#nifty50

Position sizing techniques to level up your trading game ❤️

// Risk Management //

Must watch my personal favourite

🧵🧵🧵🧵🧵🧵🧵🧵🧵

Position sizing techniques to level up your trading game ❤️

// Risk Management //

Must watch my personal favourite

🧵🧵🧵🧵🧵🧵🧵🧵🧵

A good trader is also a good risk manager. And position sizing is the bedrock of good risk management

What is position sizing?

It refers to the technique of determining the size of your trade. The size of a trade could be in terms of

the amount of capital to be used in one trade or the quantity i.e. the number of shares to buy or sell in a trade.

It refers to the technique of determining the size of your trade. The size of a trade could be in terms of

the amount of capital to be used in one trade or the quantity i.e. the number of shares to buy or sell in a trade.

1. KYC - Know your capital

The math behind position sizing hinges on the amount of trading capital. So knowing how much capital you are willing to deploy is a critical first step.

The math behind position sizing hinges on the amount of trading capital. So knowing how much capital you are willing to deploy is a critical first step.

You could decide that you want to trade with a capital of ₹5 lakh but may transfer only ₹2 lakh to your trading wallet, initially. You can then transfer the remaining amount as required. In such a case, consider a total corpus of ₹5 lakh for position sizing purposes.

2. Choose the position sizing method

Once the capital amount is well defined, you could choose a position sizing method from those listed below. While there is no ‘one size fits all’ solution, choose a method that suits your risk appetite and comfort.

Once the capital amount is well defined, you could choose a position sizing method from those listed below. While there is no ‘one size fits all’ solution, choose a method that suits your risk appetite and comfort.

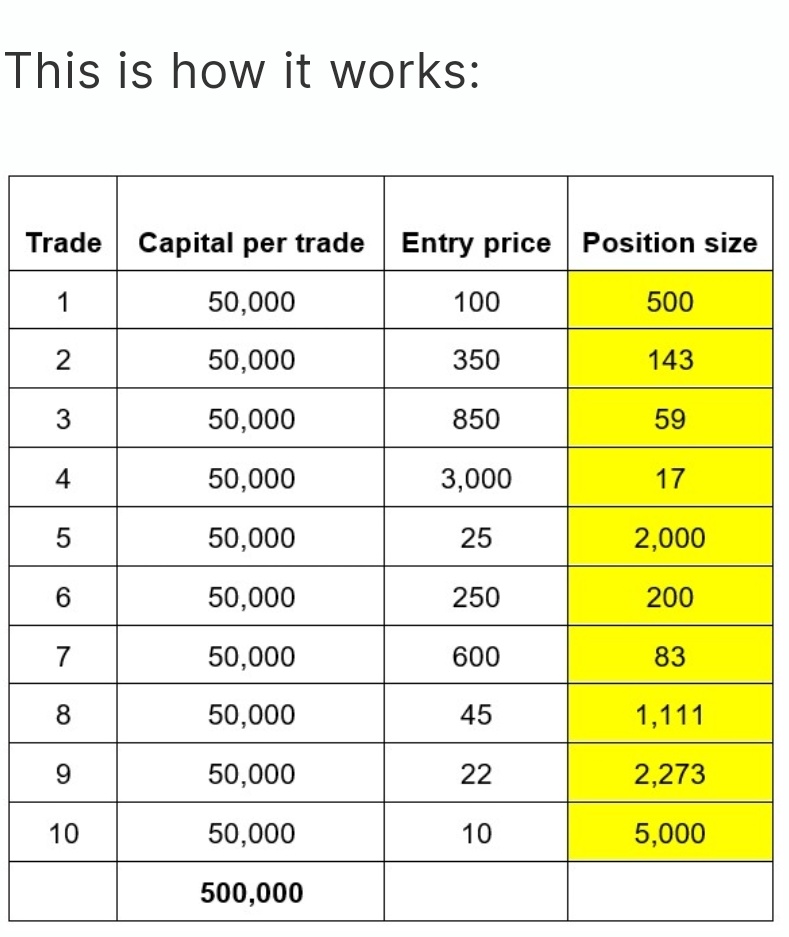

A. Capital-based

This is a very straightforward method where the capital is equally distributed in each trade. For example, if your capital is ₹5 lakh, you may want to allocate 10% (or ₹50,000) to each trade. 10 trades instead of putting the entire capital in one trade.

This is a very straightforward method where the capital is equally distributed in each trade. For example, if your capital is ₹5 lakh, you may want to allocate 10% (or ₹50,000) to each trade. 10 trades instead of putting the entire capital in one trade.

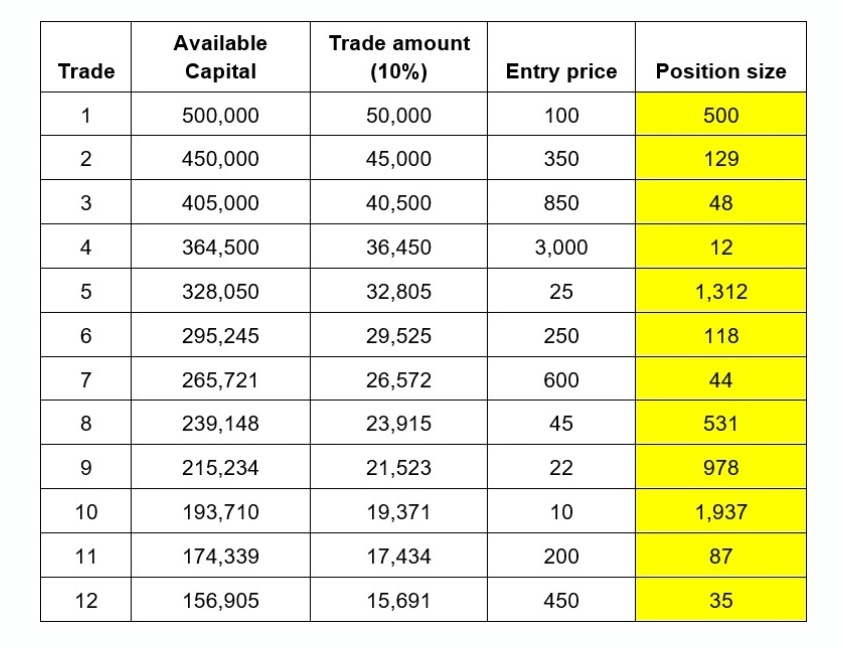

Alternatively, a conservative trader could apply a fixed percentage (say 10%) to a reducing capital balance. Here is how:

This method is conservative because you could execute more than 10 trades (compared to the previous method) and thus distribute risk.

This method is conservative because you could execute more than 10 trades (compared to the previous method) and thus distribute risk.

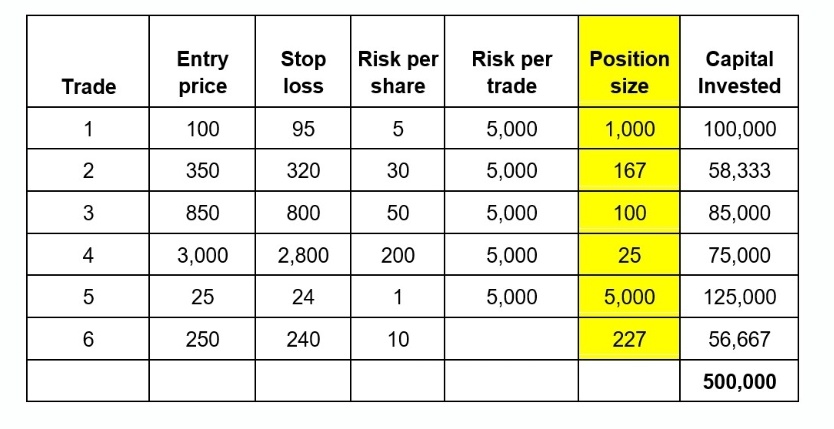

B. Risk-based - This is what I use

Here you risk a small percentage of your total capital on each trade and decide the position size based on the risk amount.

Here you risk a small percentage of your total capital on each trade and decide the position size based on the risk amount.

A simple way to calculate risk is entry price minus stop loss. In the below trade, the risk is calculated as:

Entry price: ₹100

Stop loss: ₹95

Risk = ₹5

Let’s say you decide to risk 1% per trade. So based on your capital of ₹5 lakh, 1% comes to ₹5,000.

Entry price: ₹100

Stop loss: ₹95

Risk = ₹5

Let’s say you decide to risk 1% per trade. So based on your capital of ₹5 lakh, 1% comes to ₹5,000.

The position size will be calculated as:

Position size = Risk per trade / Risk per share

So the quantity for each trade would be as below:

Position size = Risk per trade / Risk per share

So the quantity for each trade would be as below:

The 1% risk rule helps to stay in the game for a long time, because only if you lose in 100 consecutive trades, will the entire capital be wiped off.

That's practically impossible..

You can change the 1% risk to 2% or whichever number you are comfortable with

That's practically impossible..

You can change the 1% risk to 2% or whichever number you are comfortable with

Join the 1% Club

• • •

Missing some Tweet in this thread? You can try to

force a refresh