NEW

Morning from DC where Chancellor arrived a few hours ago…

- 20Y gilt yields (effective Govt borrowing costs) just topped 5% again 5.02 for first time since Bank of England first intervened after mini Budget…after Bailey hard line message

- shock August GDP fall

Morning from DC where Chancellor arrived a few hours ago…

- 20Y gilt yields (effective Govt borrowing costs) just topped 5% again 5.02 for first time since Bank of England first intervened after mini Budget…after Bailey hard line message

- shock August GDP fall

Not sure I buy the idea that there’s private reassurance the bond buying programme will prolong. Bailey not only volunteered the “you have 3 days” comments, he then when asked for reassurance by the BBC outside, reiterated it unprompted, on camera…

BUT..

BUT..

What there is into next week is a Temporary Expanded Collateral Repo Facility (TECRF)… which will help banks to help those LDI funds with liquidity, which many in the market thought was the appropriate tool to deal with this anyway…

What there isnt - and tried to make this clear in every bit of reporting - is a threat to DB pensioners…

Their pensions are guaranteed in law by the sponsoring company.

rise in interest rates actually helps long term position, but post mini budget stresses are s-term challenge

Their pensions are guaranteed in law by the sponsoring company.

rise in interest rates actually helps long term position, but post mini budget stresses are s-term challenge

So there is a Mexican stand off as I see it between these funds that chose to indulge in some leveraged wizardry in the gilt market, and suffered when gilt yields surged so fast, at record speed after mini budget, and BoE, over selling now at losses

🚨 Bank of England confirm in a statement what I said above and on air yesterday…

Gilt purchases “will end on 14th October” as “has been made absolutely clear in contact with the banks at senior levels”.

New repo facility in place to help with liquidity pressures for the LDIs

Gilt purchases “will end on 14th October” as “has been made absolutely clear in contact with the banks at senior levels”.

New repo facility in place to help with liquidity pressures for the LDIs

NEW Twenty year gilt just reached 5.036% - so now above effective borrowing cost reached in aftermath of mini budget, highest level since June 2008

NEW

this 20 year gilt was one type of Government borrowing the BoE was willing to buy (up until Friday) as part of its emergency operations… its now at 5.07% - highest level since May 2004, ie for over 18 years

this 20 year gilt was one type of Government borrowing the BoE was willing to buy (up until Friday) as part of its emergency operations… its now at 5.07% - highest level since May 2004, ie for over 18 years

NEW

30 year gilt now also above 5% again for first time since post mini budget BoE intervention. A little lower than the high then..

30 year gilt now also above 5% again for first time since post mini budget BoE intervention. A little lower than the high then..

NEW:

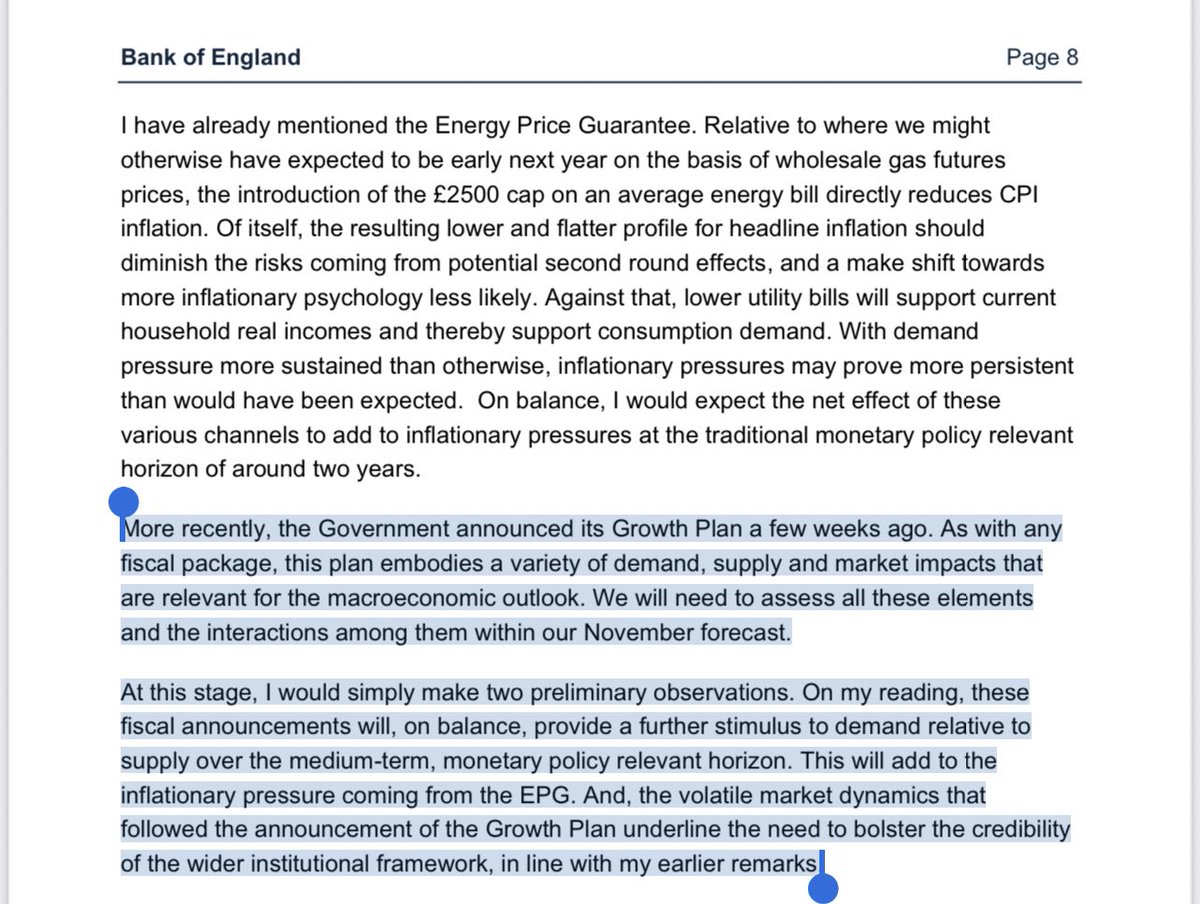

Bank of England chief economist Huw Pill:

Mini Budget “will add to inflationary pressure coming from energy guarantee”and

“volatile market dynamics that followed announcement of Growth Plan underline the need to bolster the credibility of wider institutional framework”

Bank of England chief economist Huw Pill:

Mini Budget “will add to inflationary pressure coming from energy guarantee”and

“volatile market dynamics that followed announcement of Growth Plan underline the need to bolster the credibility of wider institutional framework”

think that’s the seventh time the Bank of England has clearly linked the mini budget or UK specific factors to the bond market turmoil, including the Governor on camera to a room full of the world’s top banking CEOs, whose chair thanked Bailey for his leadership in this “crisis”

🚨

Bank of England warns on Govt fiscal policy…

chief economist Huw Pill:

“Main macroeconomic risk” from energy surge is now not inflation but “greater pressure on the fiscal deficit and ultimately the public finances more widely”

Bank of England warns on Govt fiscal policy…

chief economist Huw Pill:

“Main macroeconomic risk” from energy surge is now not inflation but “greater pressure on the fiscal deficit and ultimately the public finances more widely”

“Key” that policy “does not bring longer-term sustainability of the public finances or respect for wider institutional framework for macroeconomic policy into question both in & of itself, but also because maintaining credibility & integrity of framework supports monetary policy”

And Pill refers to my story from before mini budget about OBR offer to do forecast with it being turned down:

“It is welcome that role played by the OBR in scrutinising the Governments fiscal plans will be resumed in the forthcoming Budget statement” will help “add stability”

“It is welcome that role played by the OBR in scrutinising the Governments fiscal plans will be resumed in the forthcoming Budget statement” will help “add stability”

NEW

UK 30 year yields - have now gone above the post mini budget high, which triggered the Bank’s emergency action - at 5.095% looks to me like the highest level since August 1998, since the creation of Bank independence and the golden fiscal rules under Blair/Brown

UK 30 year yields - have now gone above the post mini budget high, which triggered the Bank’s emergency action - at 5.095% looks to me like the highest level since August 1998, since the creation of Bank independence and the golden fiscal rules under Blair/Brown

Fallen back now below 5% after the Bank of England bought £2bn of bonds in its auction.

My blog from the IMF in Washington where the Chancellor Kwasi Kwarteng has just gone into a meeting with G7 finance minister meeting. There will be questions, around the table, I’m told. bbc.co.uk/news/business-…

NEW

On #BBCNewsTen coming up live from the G7 finance ministers, the Chancellor’s debut on world stage, and I speak to both Mark Carney and Eurogroup President Paschal Donohoe

On #BBCNewsTen coming up live from the G7 finance ministers, the Chancellor’s debut on world stage, and I speak to both Mark Carney and Eurogroup President Paschal Donohoe

• • •

Missing some Tweet in this thread? You can try to

force a refresh