#Cosmofirst Commodity Films Business Turning to Speciality ?

CMP - ₹ 839

Like & Retweet For better reach !

CMP - ₹ 839

Like & Retweet For better reach !

1. Company Overview

1. Cosmo Films is the pioneer of BOPP films in India

2. It is world’s largest producer of thermal lamination films and Second largest in speciality label films

3. Recently they are diversifying their business into Speciality Chemicals and Petcare (Zigly)

1. Cosmo Films is the pioneer of BOPP films in India

2. It is world’s largest producer of thermal lamination films and Second largest in speciality label films

3. Recently they are diversifying their business into Speciality Chemicals and Petcare (Zigly)

4. Company has two state of art R&D centres in Aurangabad, India and USA

2. Business Segments

Major Business segments are

○ Film Business

■ Speciality Films

■ BOPP Films (Commodity)

○ Speciality Chemicals - Started commercial production in FY22

2. Business Segments

Major Business segments are

○ Film Business

■ Speciality Films

■ BOPP Films (Commodity)

○ Speciality Chemicals - Started commercial production in FY22

■ Masterbatches

■ Textile Chemicals

■ Adhesives

○ D2C Petcare (Zigly) - Launched in Q2, FY22

■ Textile Chemicals

■ Adhesives

○ D2C Petcare (Zigly) - Launched in Q2, FY22

3. Types of Films

1. BOPP film is produced from Polypropylene which is a crude oil derivative

2. There are several types similar films like CPP, BOPP and BOPET - Down below is the properties and different applications of CPP, BOPP and BOPET

1. BOPP film is produced from Polypropylene which is a crude oil derivative

2. There are several types similar films like CPP, BOPP and BOPET - Down below is the properties and different applications of CPP, BOPP and BOPET

Global BOPP demand - 8500K MT pa

India BOPP demand - 700K MT pa

India Domestic consumption - 550K MT pa

India BOPP demand - 700K MT pa

India Domestic consumption - 550K MT pa

4. Film Business

1. Speciality Films sales have grown 18% in the last 3 years

2. Speciality Film Sales stand at 70% of Total revenues during FY22. Target to reach 80% by the end of FY23

3. Current Speciality Film volumes are 64% of total. Target to reach 80% by the end of FY24

1. Speciality Films sales have grown 18% in the last 3 years

2. Speciality Film Sales stand at 70% of Total revenues during FY22. Target to reach 80% by the end of FY23

3. Current Speciality Film volumes are 64% of total. Target to reach 80% by the end of FY24

4. Each 1% shift in speciality sales adds EBITDA between 4 to 5 Crores

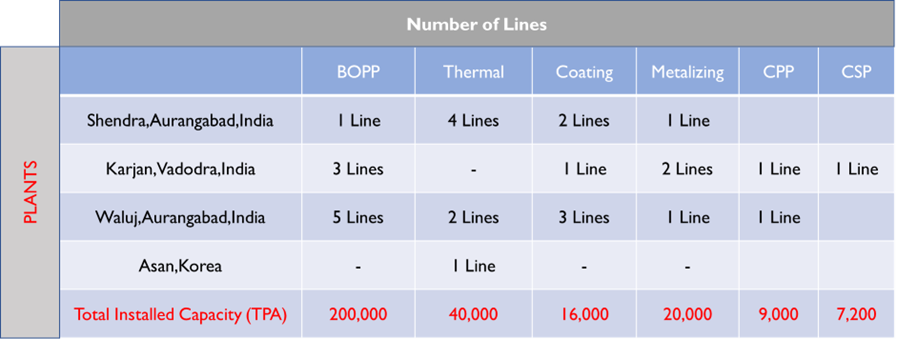

5. Total Manufacturing capacity of Cosmo is 2 Lakh MT pa and down below is the capacities of all the segments in the Film Business

5. Total Manufacturing capacity of Cosmo is 2 Lakh MT pa and down below is the capacities of all the segments in the Film Business

5. Speciality Chemicals

1. Speciality Chemicals is a very asset light business, In this business it is not about the capex, it is more about innovation

1. Speciality Chemicals is a very asset light business, In this business it is not about the capex, it is more about innovation

2. Masterbatch is a concentrated mixture of pigments and additives used for coloring or imparting specific desired properties to plastics

3. Masterbatches India Industry size is 500K MT, growing at 11% pa

3. Masterbatches India Industry size is 500K MT, growing at 11% pa

4.Textile Coating Chemicals - a type of textile chemicals which make the fabric more durable and more lavish

5. Textile coating chemicals India Industry size is USD 1.4 Billion, growing at 12% pa

5. Textile coating chemicals India Industry size is USD 1.4 Billion, growing at 12% pa

6. In phase 1, Cosmo is developing textile chemicals for cotton applications. In phase 2, they are also planning to cater to Nylon and Polyester applications

7. Adhesives Indian Industry size is USD 3.5 Billion, growing at 8 -10% pa

7. Adhesives Indian Industry size is USD 3.5 Billion, growing at 8 -10% pa

Manufacturing capacities of all the segments in Speciality Chemicals is as below

Speciality Chemicals is expected to contribute 10% -15% of revenues with 25%+ ROCE in about 5 years

Speciality Chemicals is expected to contribute 10% -15% of revenues with 25%+ ROCE in about 5 years

6. Petcare

1.Pilot launch has happened in Q2 FY22 with simultaneous launch of website, mobile van and its flagship store under brand name “Zigly” - Capex for pilot launch is Rs. 15 Crores over a period of 18 months

1.Pilot launch has happened in Q2 FY22 with simultaneous launch of website, mobile van and its flagship store under brand name “Zigly” - Capex for pilot launch is Rs. 15 Crores over a period of 18 months

2. India Petcare industry is INR 7k crores (expected to grow at 25% CAGR)

3. They Plan to launch 15 experience centers by the end of FY23, of which 5 have already started. Their Target is to launch 150 experience centers in the next couple of years

3. They Plan to launch 15 experience centers by the end of FY23, of which 5 have already started. Their Target is to launch 150 experience centers in the next couple of years

4. They are Targeting Gross Merchandise Value (GMV) of Rs. 15 Crore in FY23

7. Upcoming Capex

1. Total Upcoming Capex - 940 Crores

2. Specialized BOPET with the capacity of 30K MT can achieve revenues of 450 Crores under full capacity utilization i.e asset turnover ratio of 1

3. Payback period for BOPET line is 4 to 5 years

1. Total Upcoming Capex - 940 Crores

2. Specialized BOPET with the capacity of 30K MT can achieve revenues of 450 Crores under full capacity utilization i.e asset turnover ratio of 1

3. Payback period for BOPET line is 4 to 5 years

4. Asset Turnover Ratio

Film Business - 2

Speciality Chemicals - 10

Petcare - 5

Film Business - 2

Speciality Chemicals - 10

Petcare - 5

8. Manufacturing Facilities

Cosmo First has total 4 Manufacturing facilities, 3 plants are located in India, 1 plant is located in Korea

Cosmo First has total 4 Manufacturing facilities, 3 plants are located in India, 1 plant is located in Korea

9. Financials

1. Net Sales - INR 3038 Crores

2. EBITDA - INR 620 Crores

3. Net debt has come down to INR 303 crores from INR 438 Crores last year

4. Net debt to EBITDA is less than 0.5

5. ROCE stands at 29% and ROE at 39%

1. Net Sales - INR 3038 Crores

2. EBITDA - INR 620 Crores

3. Net debt has come down to INR 303 crores from INR 438 Crores last year

4. Net debt to EBITDA is less than 0.5

5. ROCE stands at 29% and ROE at 39%

6. Historically Revenue from Exports is around 40% of sales

7. BOPP commodity margins graph is as follows

7. BOPP commodity margins graph is as follows

10. Outlook

1. Plans to change the packaging landscape by creating sustainable and intelligent packaging solutions

2. Company’s focus is on improving the speciality films, which would further de-commoditize the present business

1. Plans to change the packaging landscape by creating sustainable and intelligent packaging solutions

2. Company’s focus is on improving the speciality films, which would further de-commoditize the present business

3. Some of the key products that will drive growth in speciality films are

1. CSP (Cosmo Synthetic Paper)

2. Direct Thermal Printable (DTP)

3. Sustainable PVC free solutions for Graphic

Applications

4. Sustainable PVC free solutions for Graphic

Applications

1. CSP (Cosmo Synthetic Paper)

2. Direct Thermal Printable (DTP)

3. Sustainable PVC free solutions for Graphic

Applications

4. Sustainable PVC free solutions for Graphic

Applications

5. Heat Control Films - Company is going to launch this product by the end of FY23

6. Sustainable PVC free solutions, Shrink Label Films,

Heat Control Films - these all are made from BOPET

which is upcoming in Q2 FY23

6. Sustainable PVC free solutions, Shrink Label Films,

Heat Control Films - these all are made from BOPET

which is upcoming in Q2 FY23

Micro Cap Club : valueeducator.com/micro-cap-club/

• • •

Missing some Tweet in this thread? You can try to

force a refresh