Here is my latest Tesla earnings forecast. Anybody knocking their forecast way down as a result of numerous recent apparent headwinds may be in for a big earnings surprise.

After including those, my current Non-GAAP EPS forecast is $1.27. In August, it was $1.36. 👀

1/30 $TSLA

After including those, my current Non-GAAP EPS forecast is $1.27. In August, it was $1.36. 👀

1/30 $TSLA

Q3 deliveries missed many analyst expectations due to higher-than-typical ending inventory levels.

Tesla explained that this resulted from "ending the wave". I made videos explaining that here:

... and here:

2/30

Tesla explained that this resulted from "ending the wave". I made videos explaining that here:

... and here:

2/30

So Tesla earnings will be lower in Q3 than they otherwise would have been, by maybe...

22K deliveries

~$50K Model 3/Y ASP

~30% variable gross margin

~$0.33B

... but those deliveries and earnings are still going to happen-- they'll just happen in Q4 instead of Q3.

3/30

22K deliveries

~$50K Model 3/Y ASP

~30% variable gross margin

~$0.33B

... but those deliveries and earnings are still going to happen-- they'll just happen in Q4 instead of Q3.

3/30

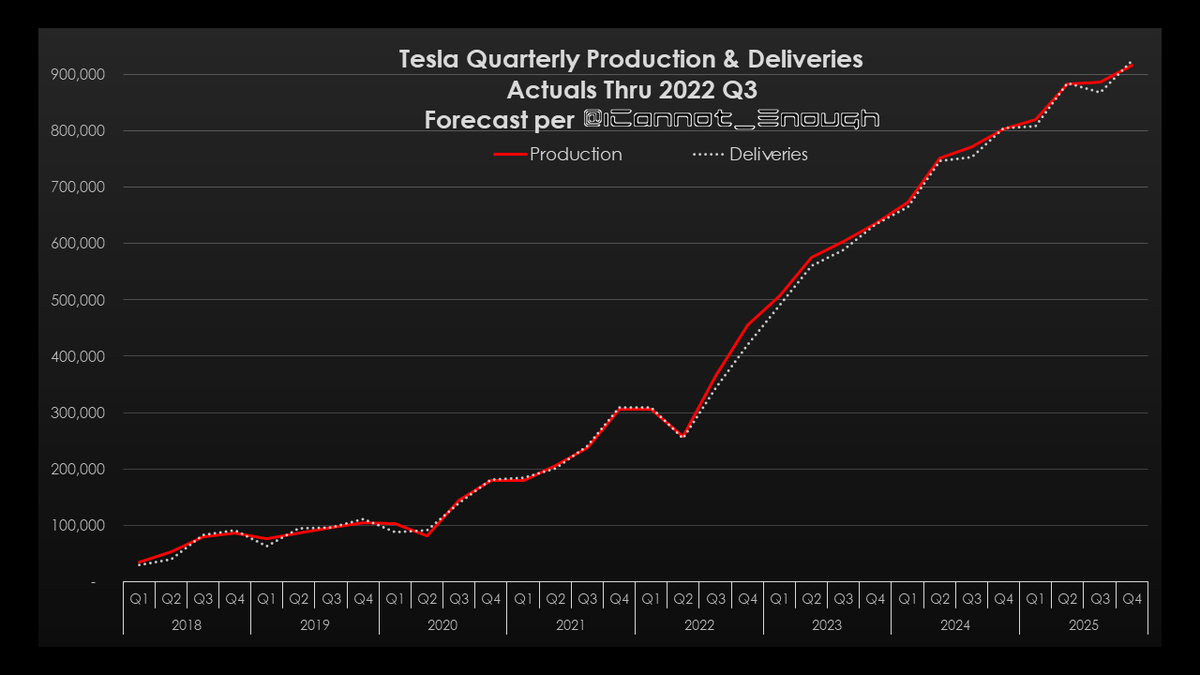

You can see the ending inventory build clearly on this quarterly chart, with production exceeding deliveries as a result of ending the wave.

This is good for Tesla's profitability over the long term because it optimizes profit per vehicle rather than ending inventory. 🤓

4/30

This is good for Tesla's profitability over the long term because it optimizes profit per vehicle rather than ending inventory. 🤓

4/30

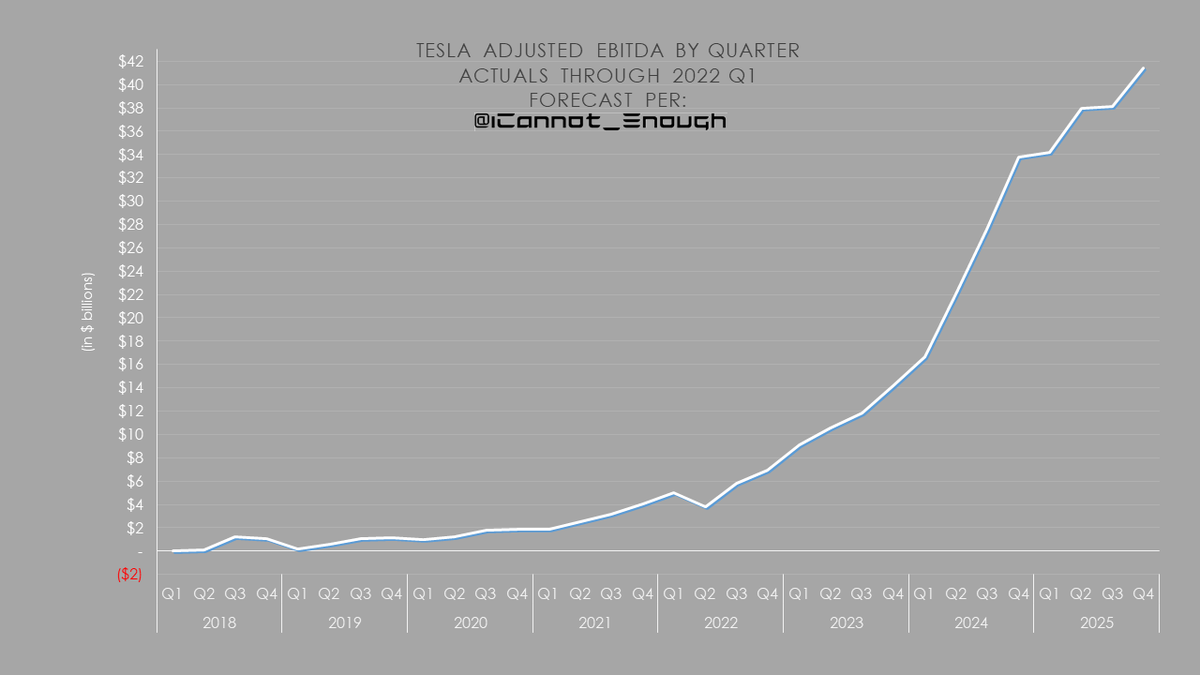

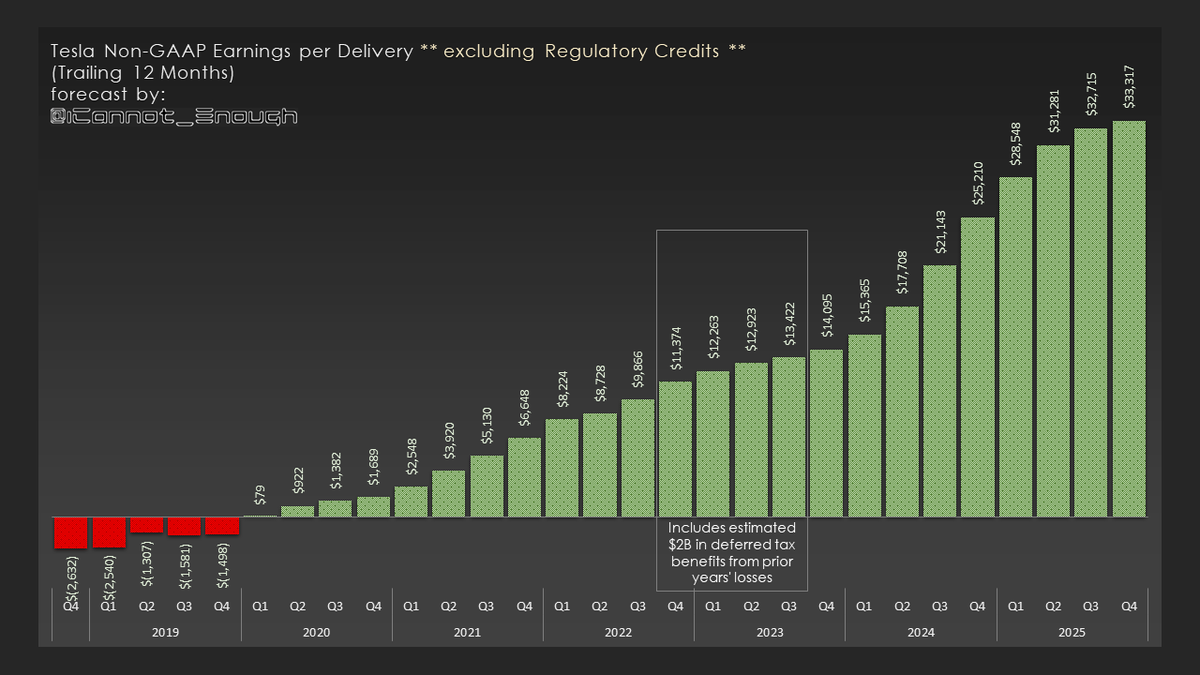

What matters to investors isn't inventory counts, it's *earnings growth*, and Tesla has that covered (see chart).

I am still forecasting lots of future earnings growth as FSD becomes more valuable, which I explain thoroughly in this video:

5/30

I am still forecasting lots of future earnings growth as FSD becomes more valuable, which I explain thoroughly in this video:

5/30

Here's an updated chart showing where Tesla's average dollar of revenue comes from.

You will still see uninformed people who read FUD years ago tweeting that Tesla revenue comes mostly from EV regulatory credit sales, but this chart illustrates the truth.

6/30

You will still see uninformed people who read FUD years ago tweeting that Tesla revenue comes mostly from EV regulatory credit sales, but this chart illustrates the truth.

6/30

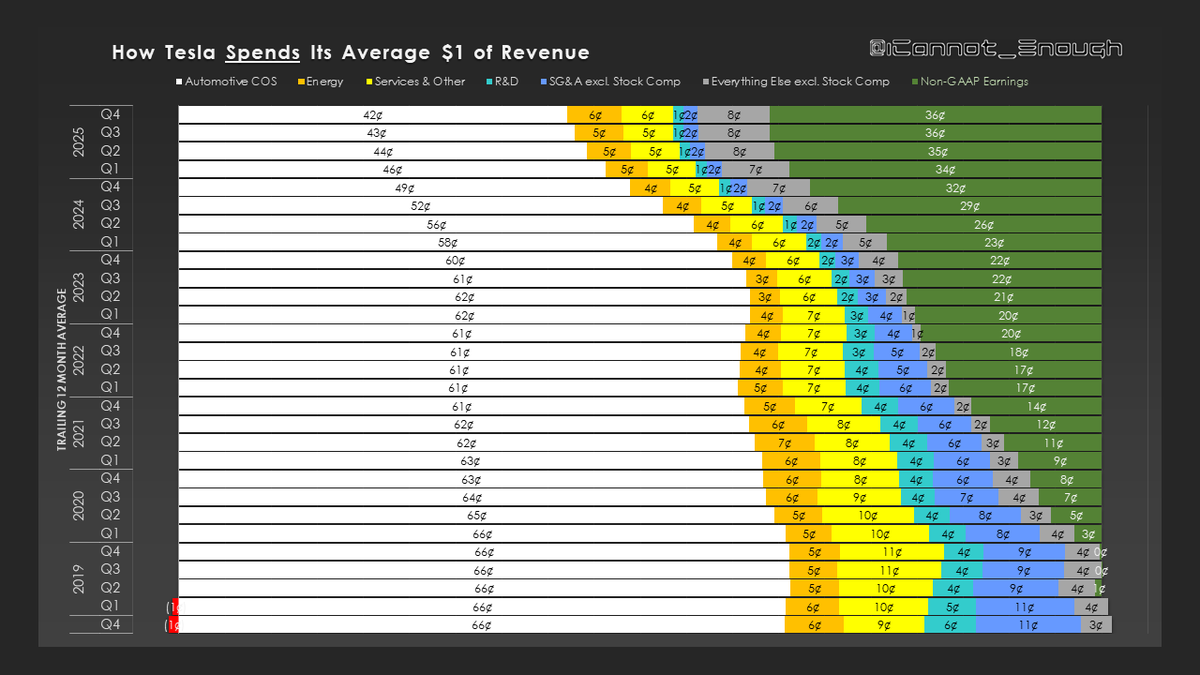

This sister chart shows how Tesla *spends* its average dollar of revenue, with unspent money shown in green, as Non-GAAP Earnings.

These charts are shown on a trailing 12-month basis to smooth out seasonality.

7/30

These charts are shown on a trailing 12-month basis to smooth out seasonality.

7/30

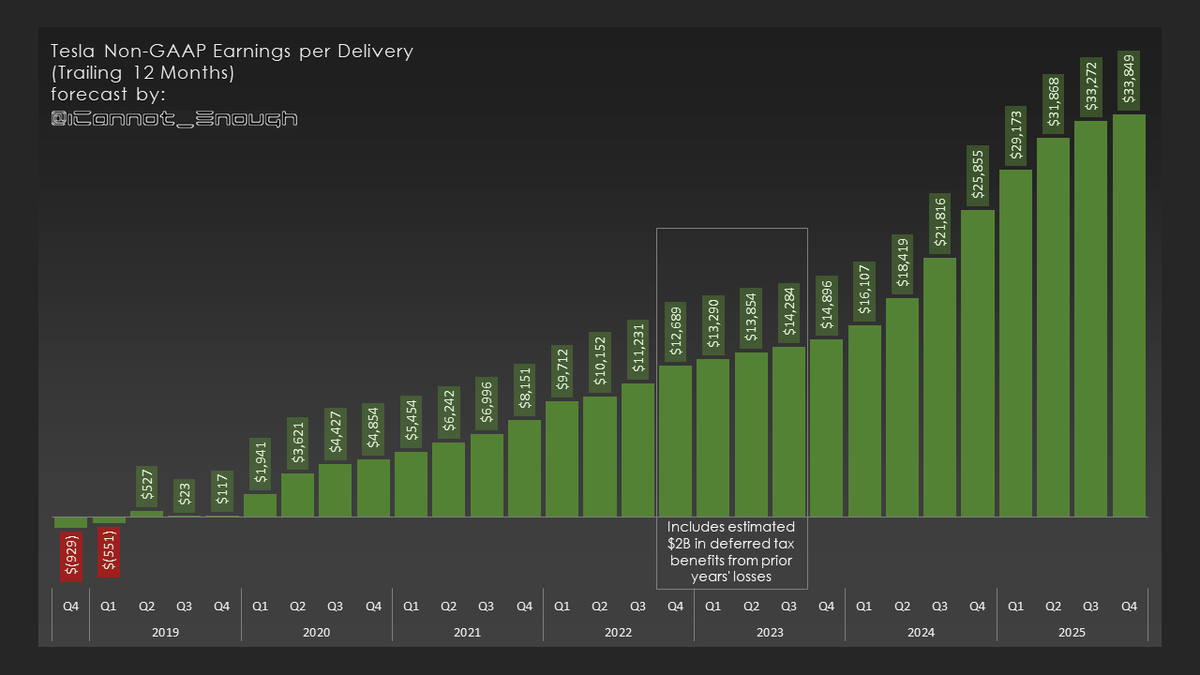

Tesla's earnings per delivery are world-class for any automaker- let alone an EV maker.

Even with some modest strategic price reductions (I do forecast those over the next year, especially in China), Tesla earnings per delivery will grow as global production ramps up.

8/30

Even with some modest strategic price reductions (I do forecast those over the next year, especially in China), Tesla earnings per delivery will grow as global production ramps up.

8/30

Here's the same chart except with regulatory credit sales thrown out.

Why strategic price reductions "especially in China"?

To qualify Model Y SR for a new buyer incentive in China. I explained in greater detail in this video:

9/30

Why strategic price reductions "especially in China"?

To qualify Model Y SR for a new buyer incentive in China. I explained in greater detail in this video:

9/30

This chart illustrates how "ending the wave" effects Tesla's quarterly finished goods inventory level.

The more vehicles you produce per week, the harder it gets to deliver all of them by the end of each quarter.

Here's the explainer video again:

10/30

The more vehicles you produce per week, the harder it gets to deliver all of them by the end of each quarter.

Here's the explainer video again:

10/30

This chart shows how much expense hits the income statement per quarter related to the performance plan Elon Musk has been working under as CEO since 2018.

Almost all of the maximum $2.283B expense that can hit under this stock compensation plan already has hit.

11/30

Almost all of the maximum $2.283B expense that can hit under this stock compensation plan already has hit.

11/30

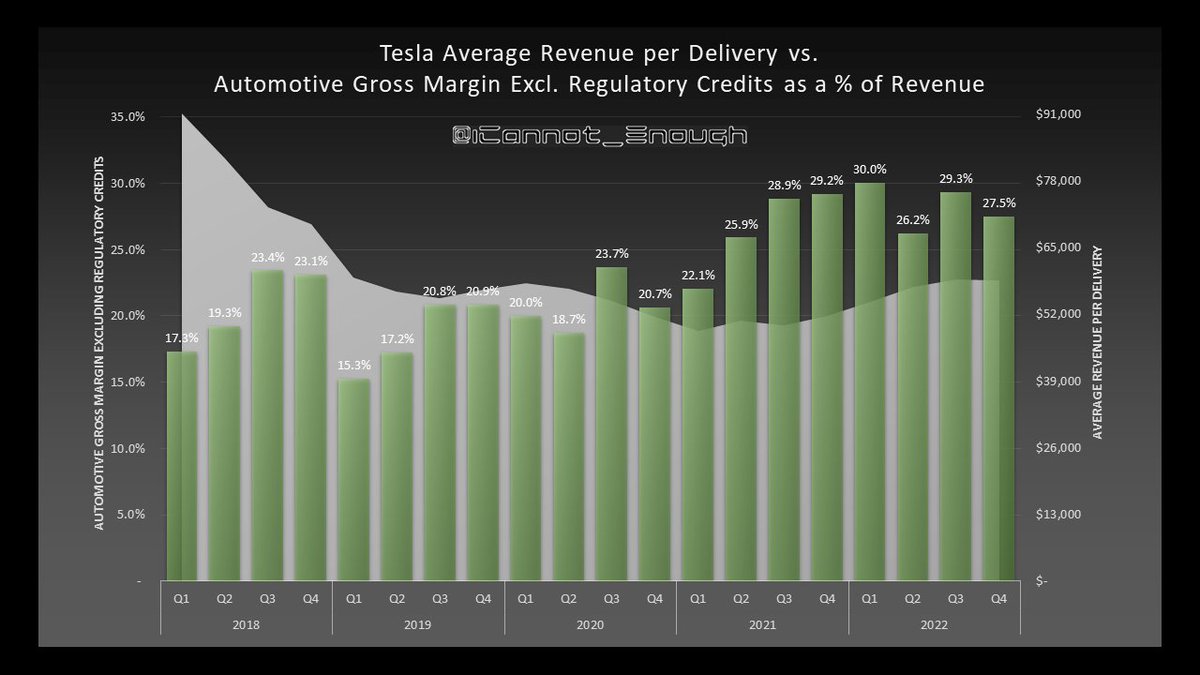

Tesla's automotive gross margin has been improving for years- even if you throw out reg. credits- and even though revenue per vehicle was decreasing for most of those years. That's hard to do.

I explain more in this video (showing my Aug forecast):

12/30

I explain more in this video (showing my Aug forecast):

12/30

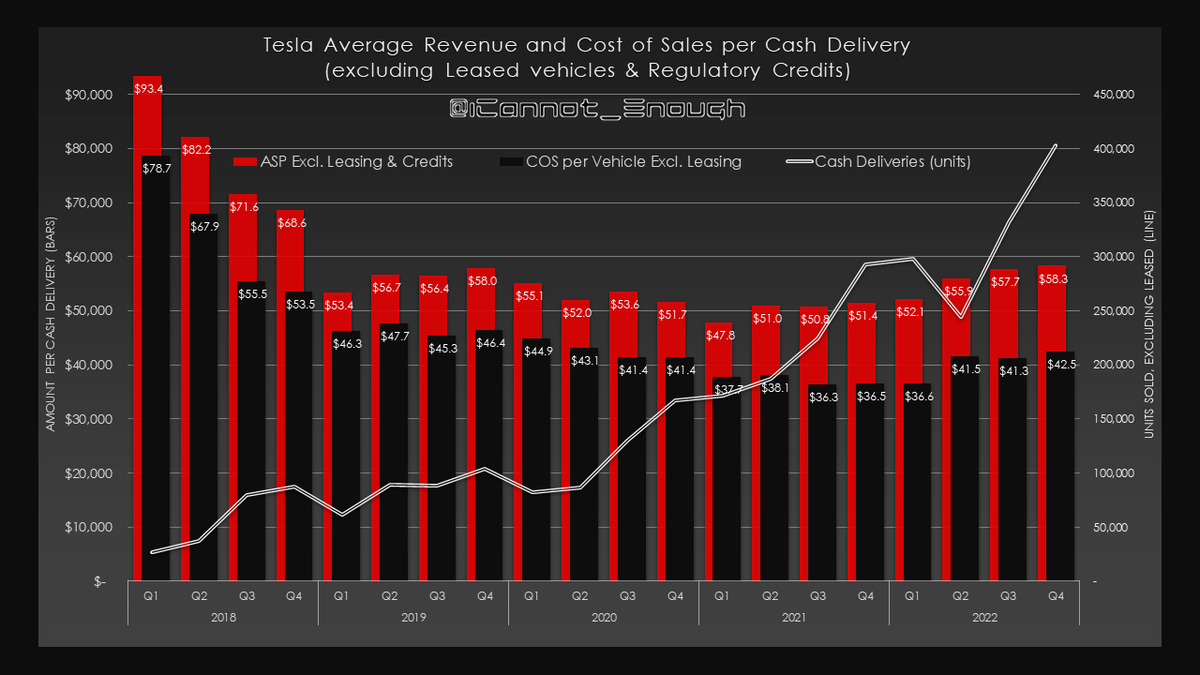

This chart excludes reg. credits and leased deliveries, revenue, and cost of sales.

So what you see reflects what "cash buyers" are paying to purchase the average car and how much that car cost Tesla to build, over time.

Volume and rate improving at the same time. 📈

13/30

So what you see reflects what "cash buyers" are paying to purchase the average car and how much that car cost Tesla to build, over time.

Volume and rate improving at the same time. 📈

13/30

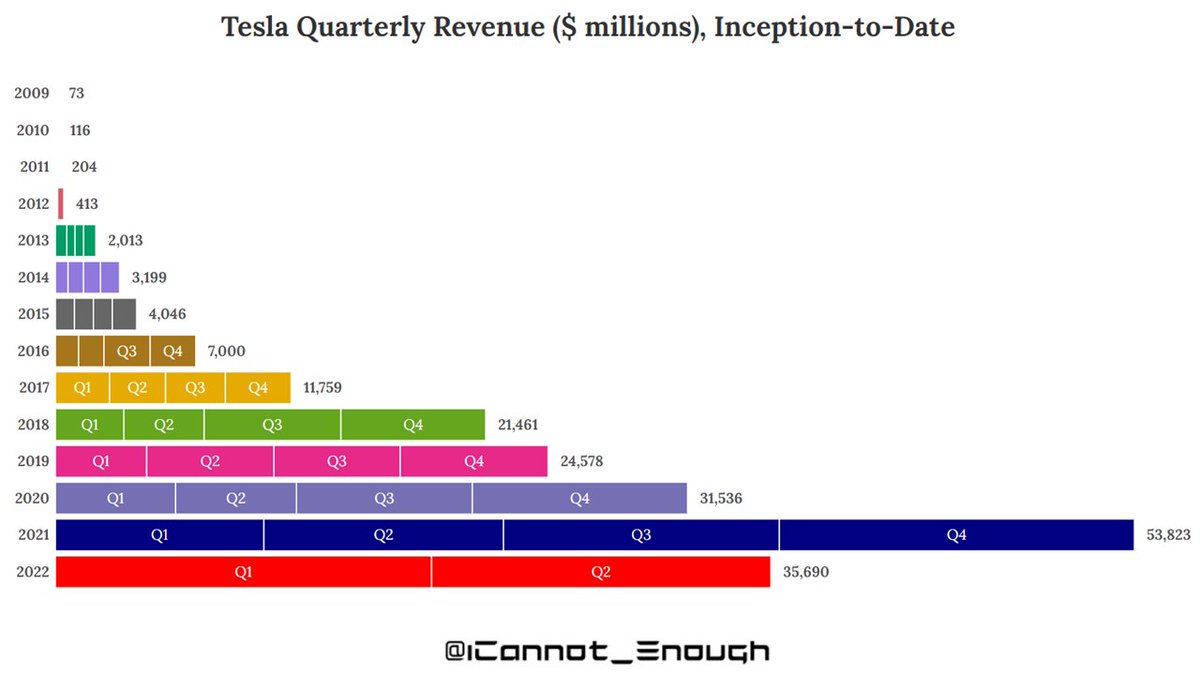

Here's how Tesla's revenue has grown over time. When the Q3 number hits, I'm gonna need a bigger chart.

... and then Q4 will hit... likely with all-time high quarterly revenue. 🍿

14/30 $TSLA

... and then Q4 will hit... likely with all-time high quarterly revenue. 🍿

14/30 $TSLA

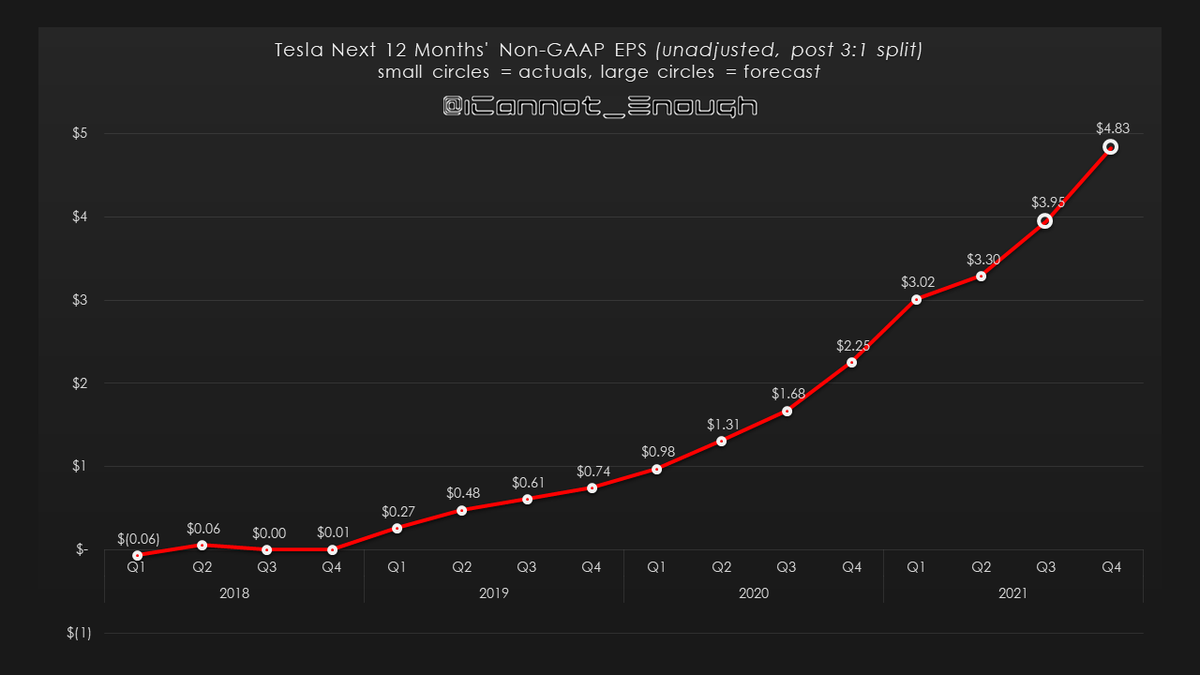

And here's my most confusing chart. Why confusing?

"Next 12 Months" = the sum of the 4 quarters that follow

15/30

"Next 12 Months" = the sum of the 4 quarters that follow

15/30

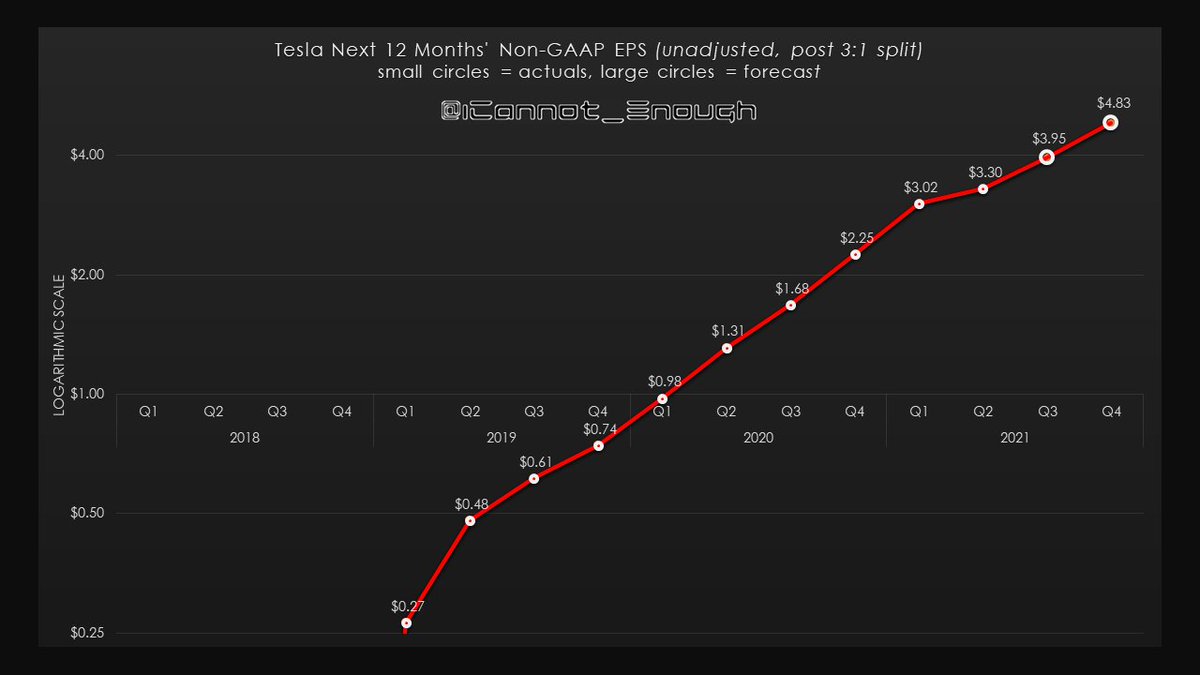

Here's the same chart except with a logarithmic y-axis so that you can see the consistent growth rate, with the exception of the Q2 2022 hiccup, when lockdowns in Shanghai limited production output from Tesla's most profitable factory.

16/30

16/30

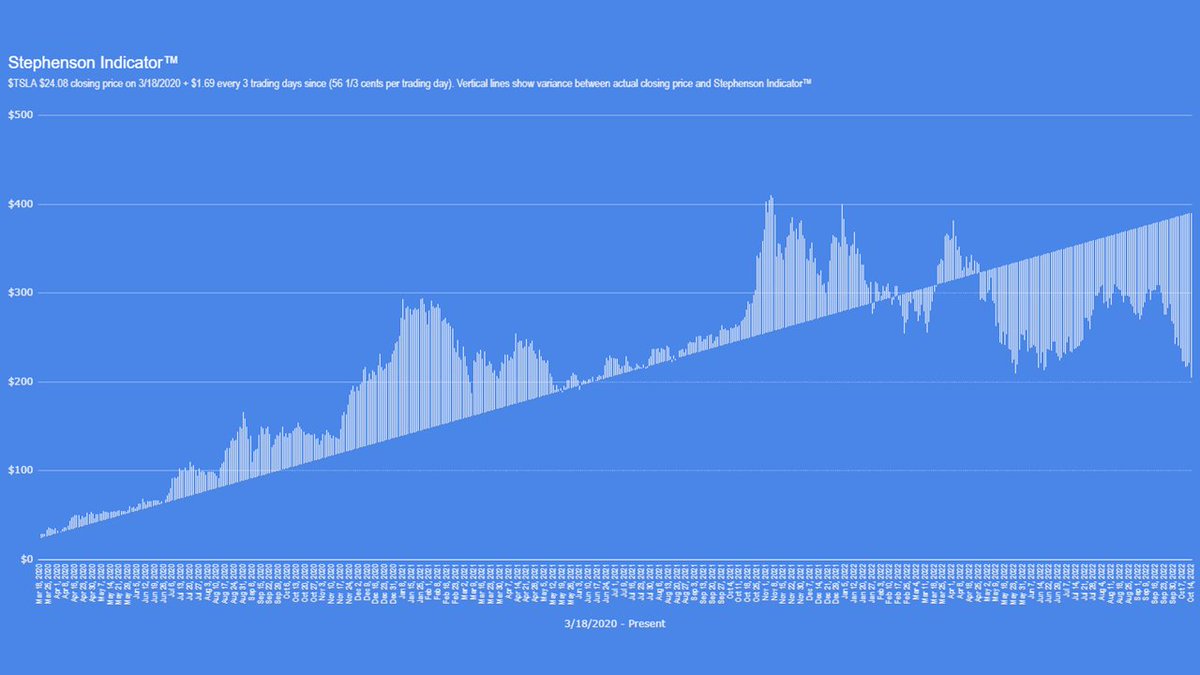

Here's a Stephenson Indicator™️ chart update. With $TSLA at 52-week lows, there has never been a bigger discount.

Here's a video that explains the last 3 charts more fully:

... and here's a Stephenson Indicator™️ playlist:

youtube.com/playlist?list=…

17/30

Here's a video that explains the last 3 charts more fully:

... and here's a Stephenson Indicator™️ playlist:

youtube.com/playlist?list=…

17/30

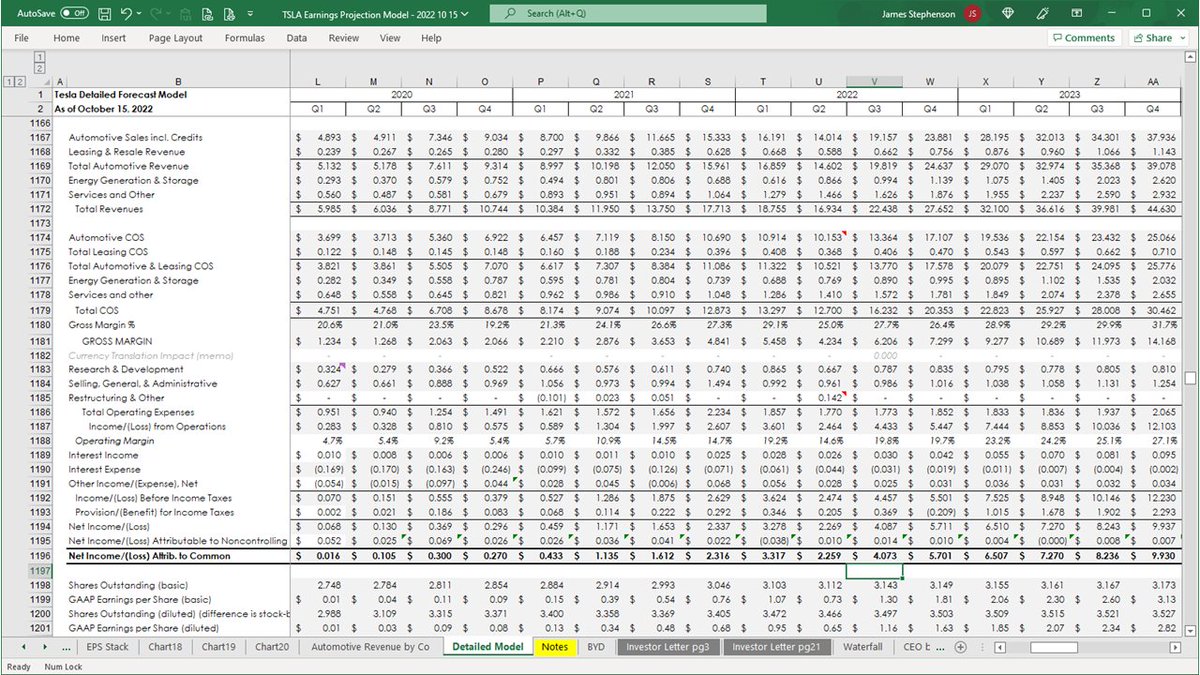

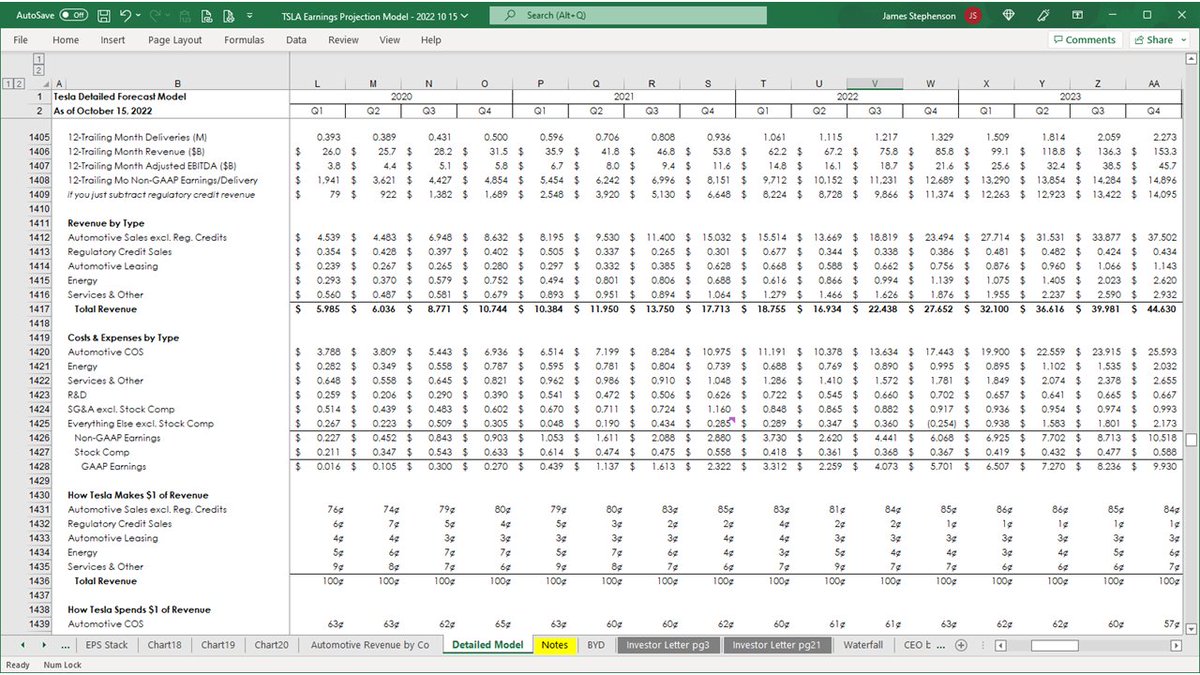

That's all of the pretty charts.

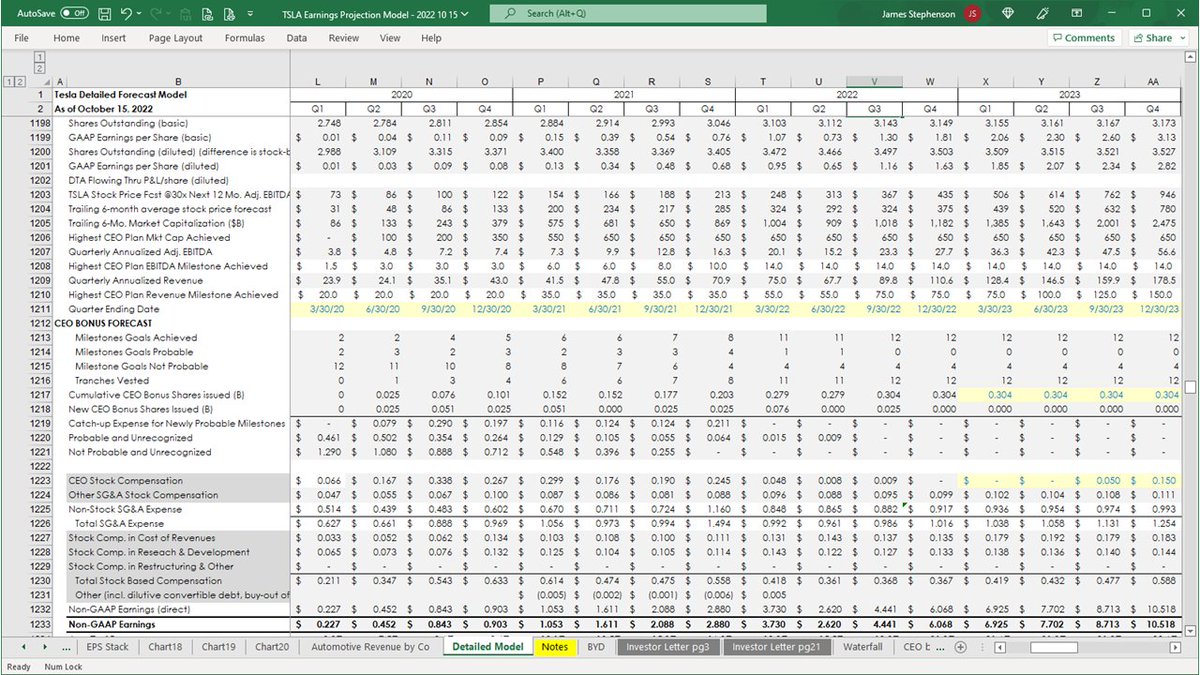

From here, it's just fascinating numbers in black font on a white background showing screenshots of my detailed forecast model (skipping rows 1 through 1,165), beginning with the Income Statement summary (GAAP), as Tesla will report it:

18/30

From here, it's just fascinating numbers in black font on a white background showing screenshots of my detailed forecast model (skipping rows 1 through 1,165), beginning with the Income Statement summary (GAAP), as Tesla will report it:

18/30

This slide shows GAAP EPS, the trailing 6-month average stock price, a few alternative methodologies for stock price forecasts 🤓 (not trading advice), some rows I use to forecast stock compensation expense, and Non-GAAP Earnings at the bottom.

19/30

19/30

I'm forecasting Non-GAAP EPS of:

$1.27 in Q3

$1.73 in Q4 (includes 45 cents of one-time tax favorability that Wall St. will back out no matter when it hits- rightly- as non-sustainable), so

$1.28 Q4 Adjusted

$4.83 Full year 2022

$4.38 Full Year 2022 Adjusted

20/30

$1.27 in Q3

$1.73 in Q4 (includes 45 cents of one-time tax favorability that Wall St. will back out no matter when it hits- rightly- as non-sustainable), so

$1.28 Q4 Adjusted

$4.83 Full year 2022

$4.38 Full Year 2022 Adjusted

20/30

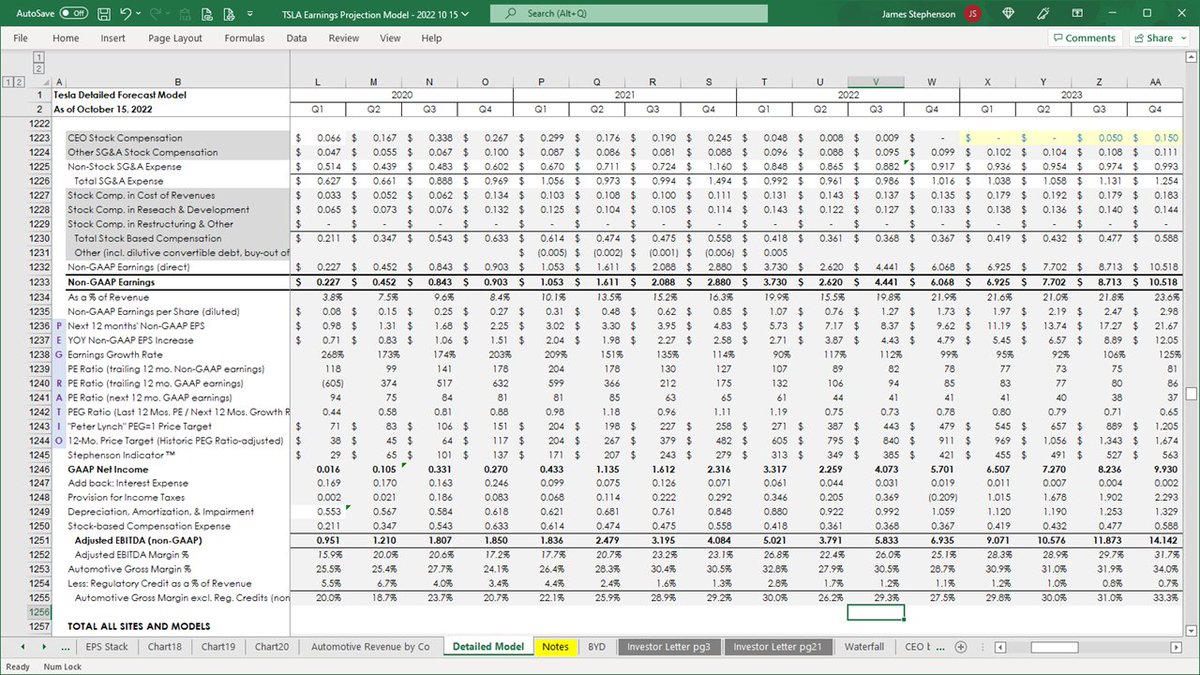

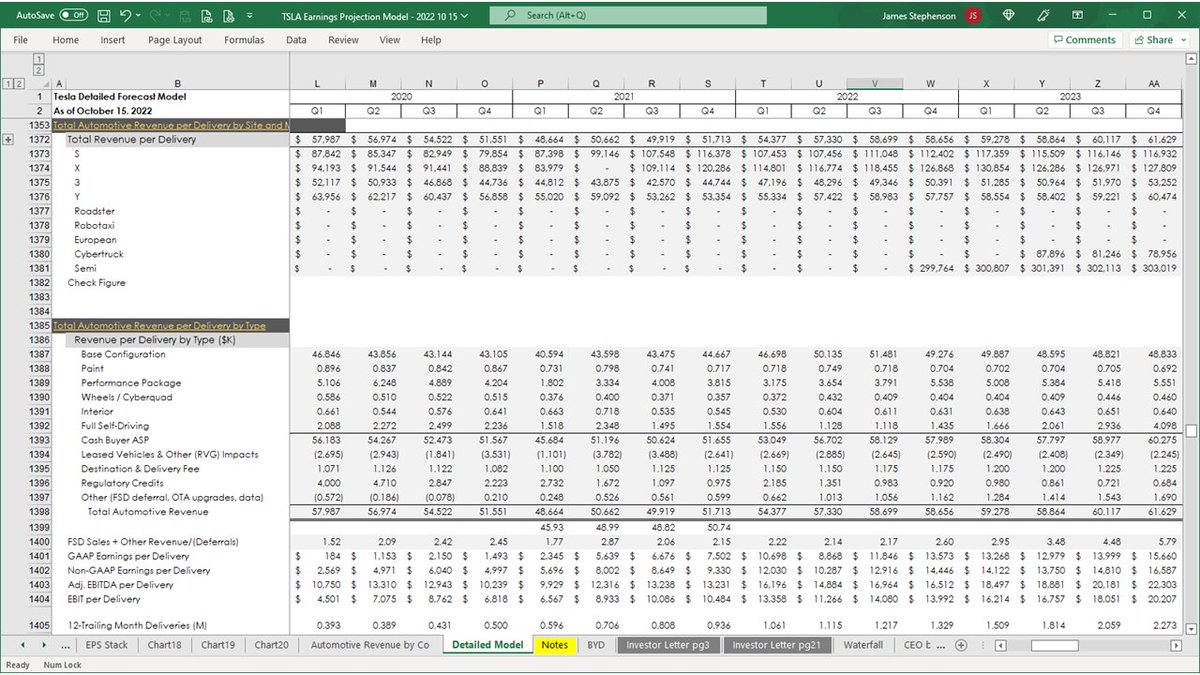

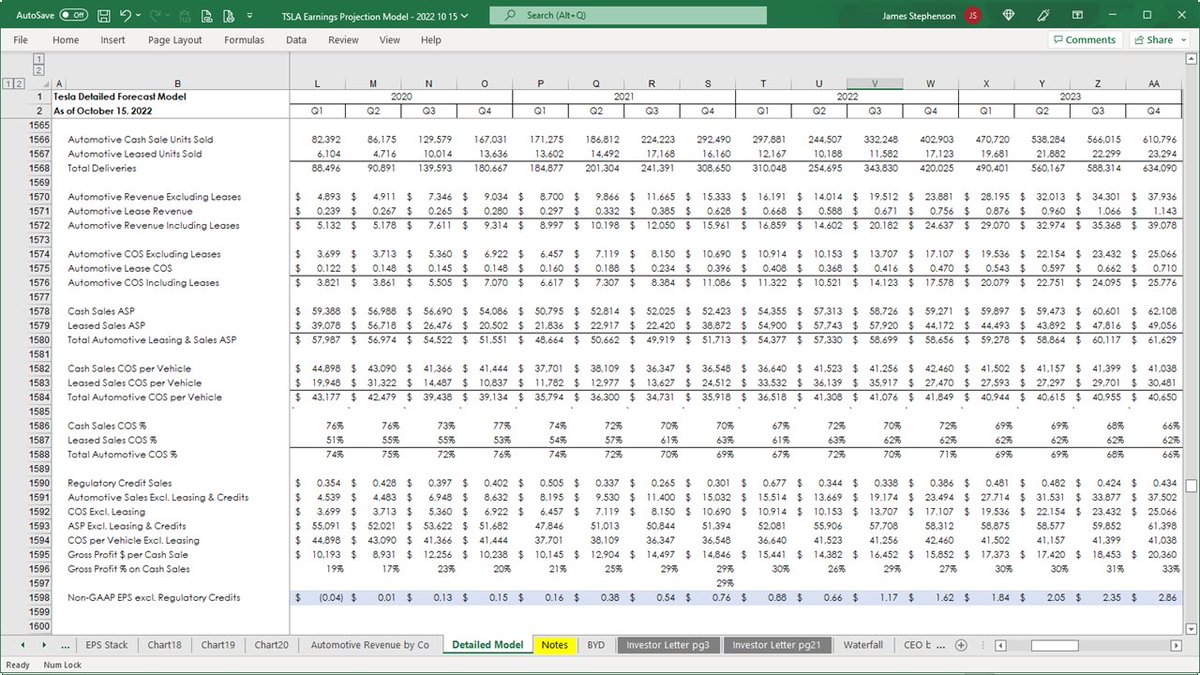

Here are some revenue and cost of sales forecast breakdowns and a few other metrics.

Tesla reports these numbers in total but not at this detailed level, so I have to guess how the totals are composed and never find out how close or far off it is. 😢

21/30

Tesla reports these numbers in total but not at this detailed level, so I have to guess how the totals are composed and never find out how close or far off it is. 😢

21/30

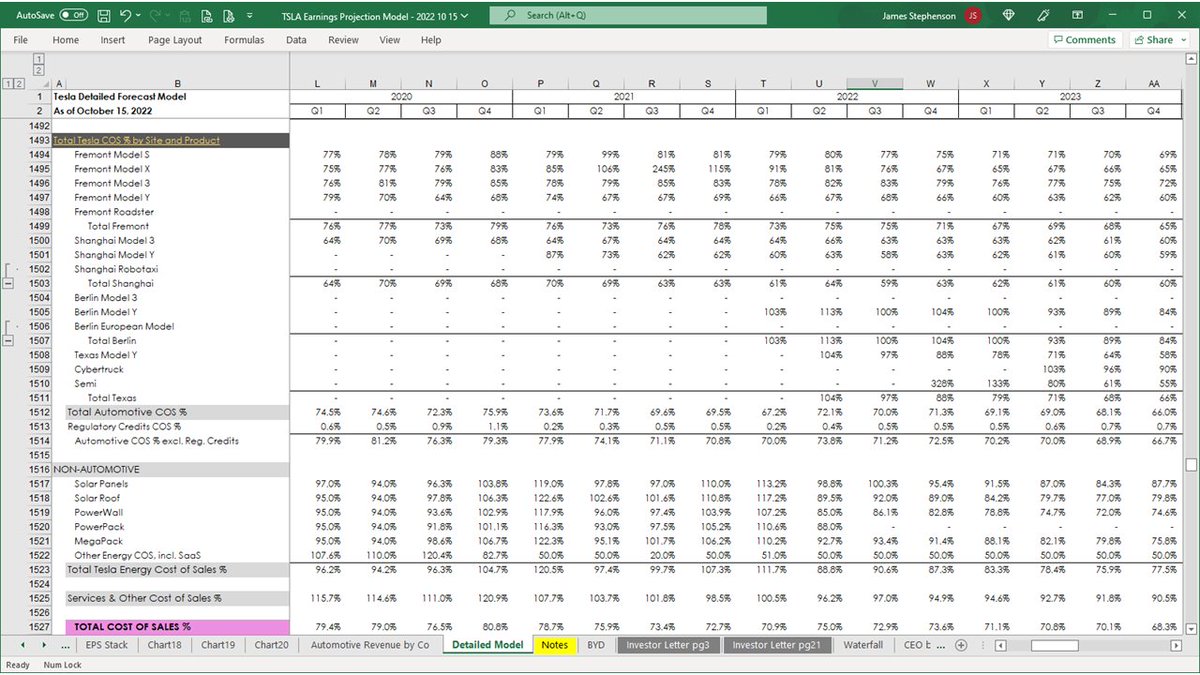

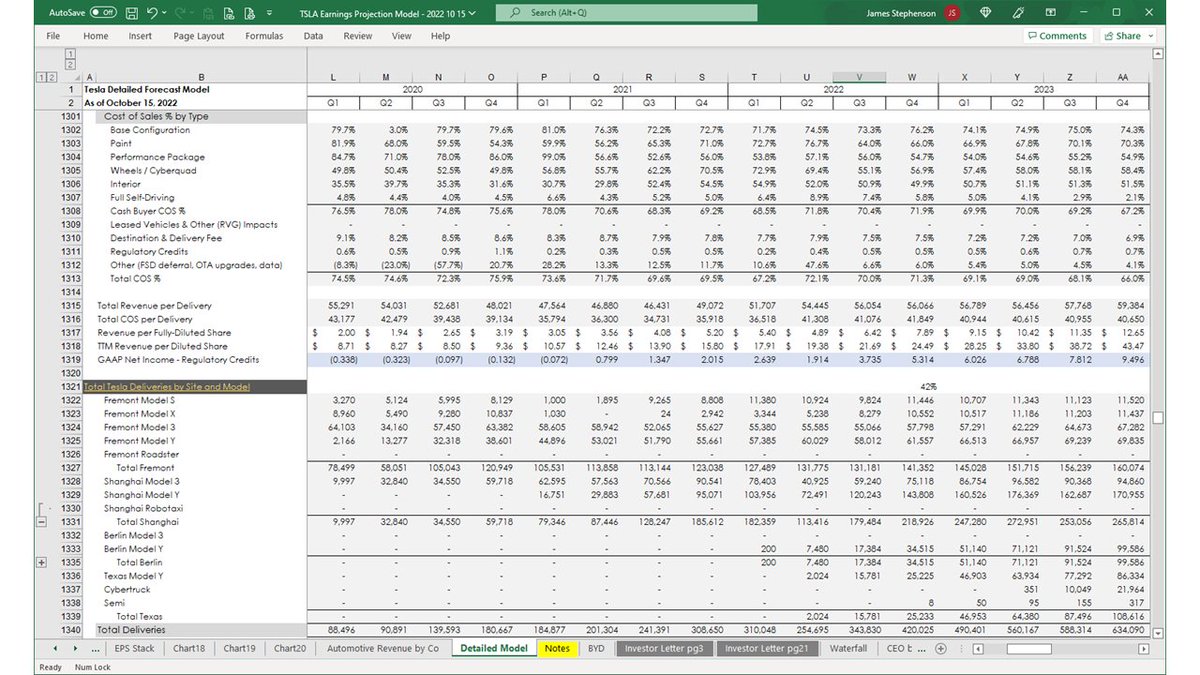

Here's a detailed breakdown of my forecast for cost of sales % by type, some revenue and cost per delivery metrics, revenue per share, and GAAP Net Income Excluding Regulatory Credits (for anyone interested in a dumb metric made up by Tesla short sellers) 🤣 (Google it!)

22/30

22/30

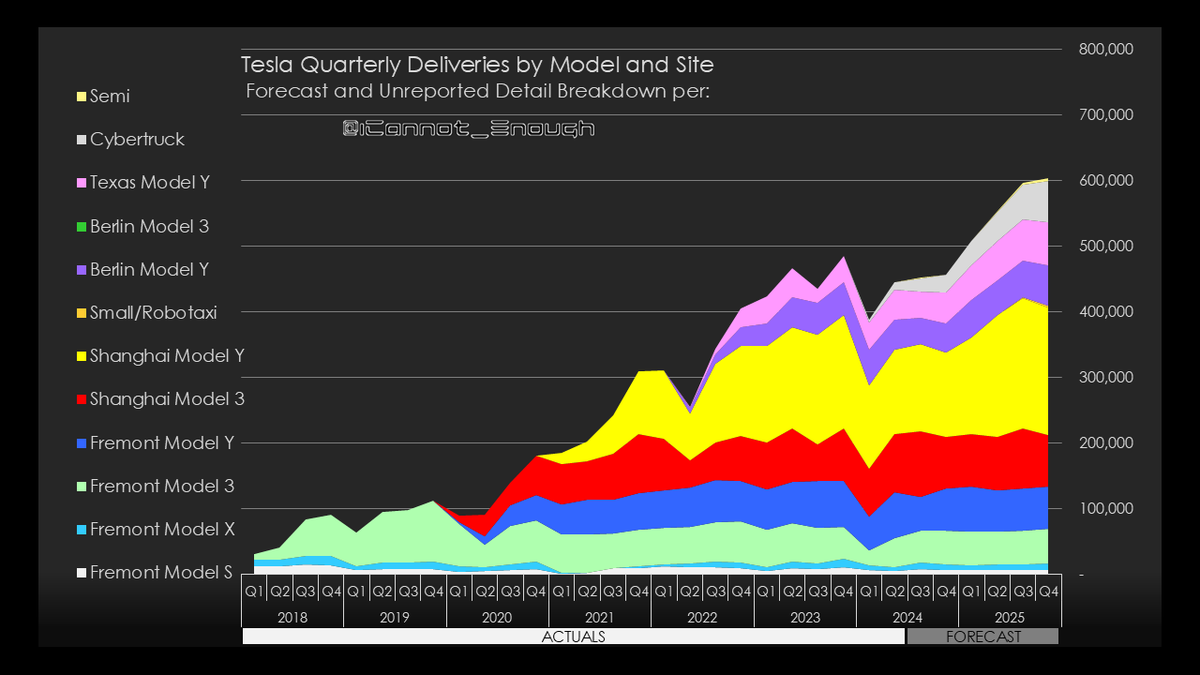

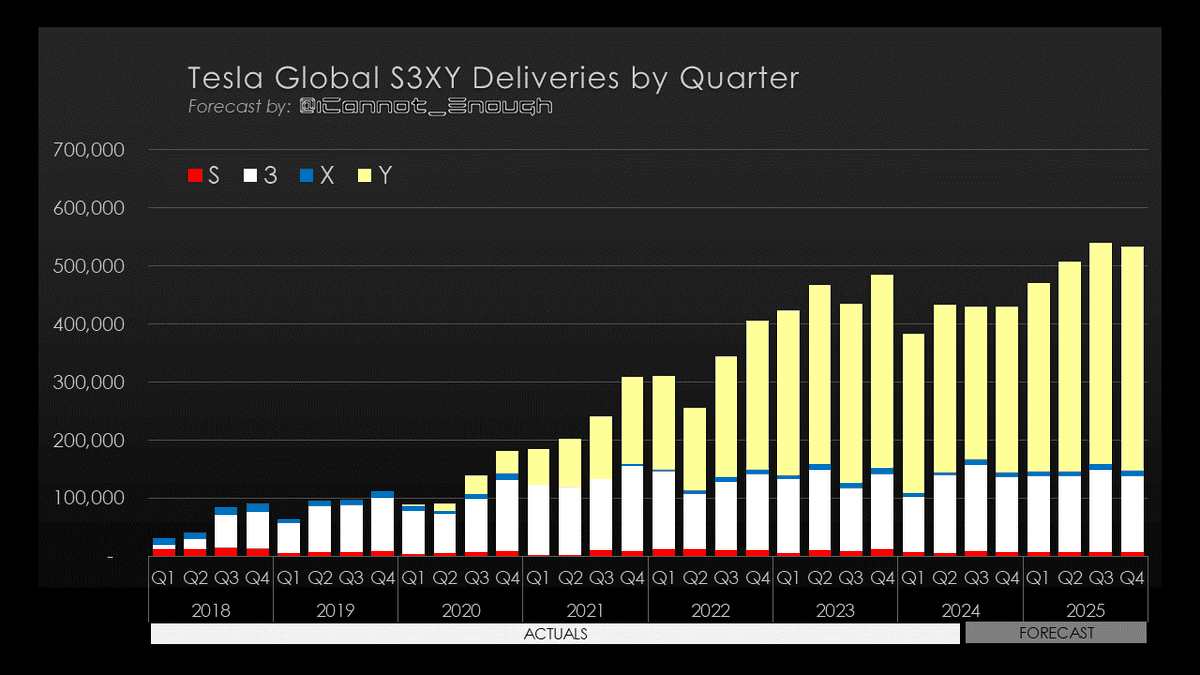

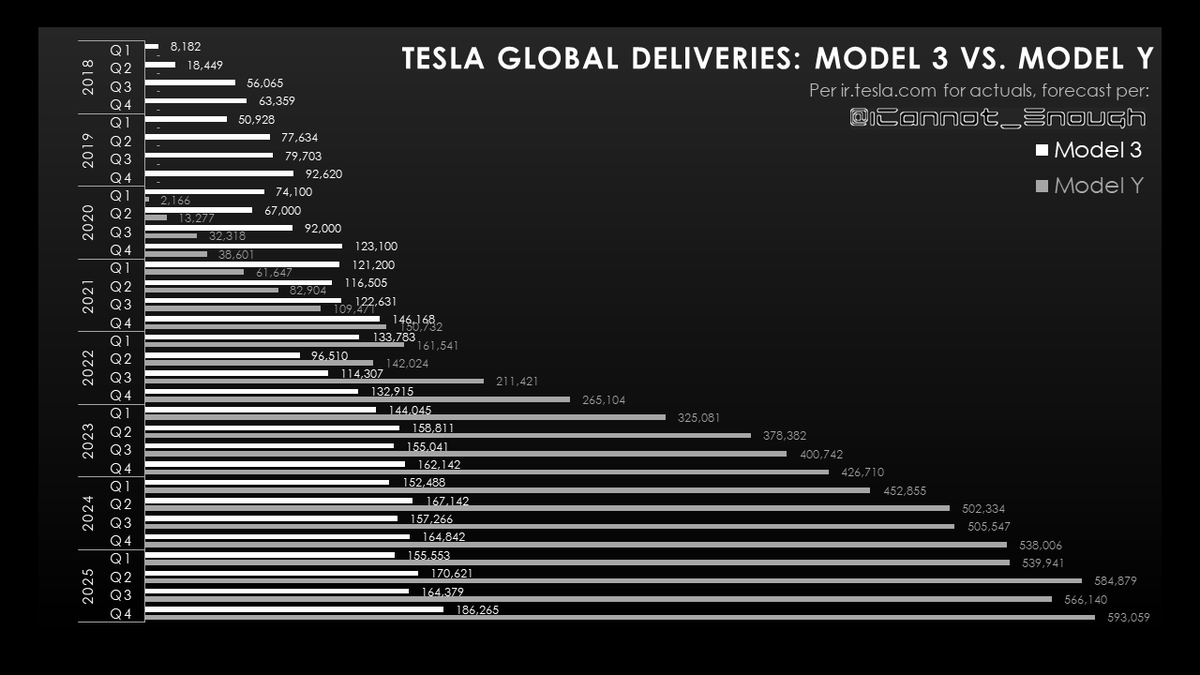

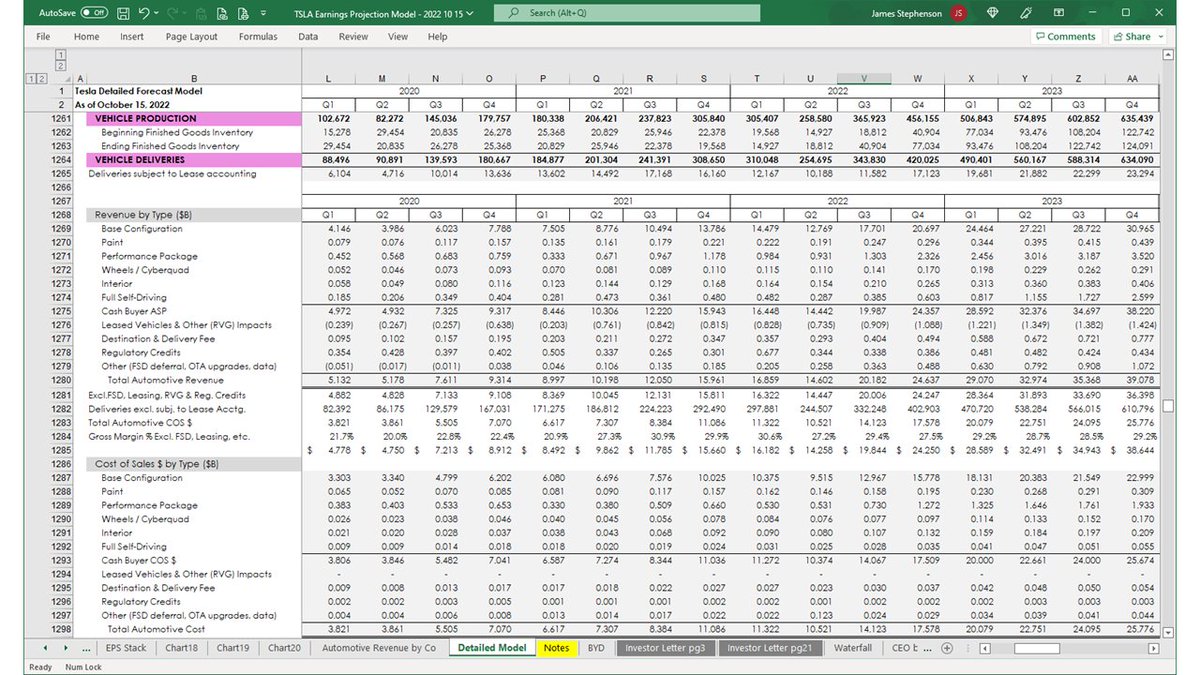

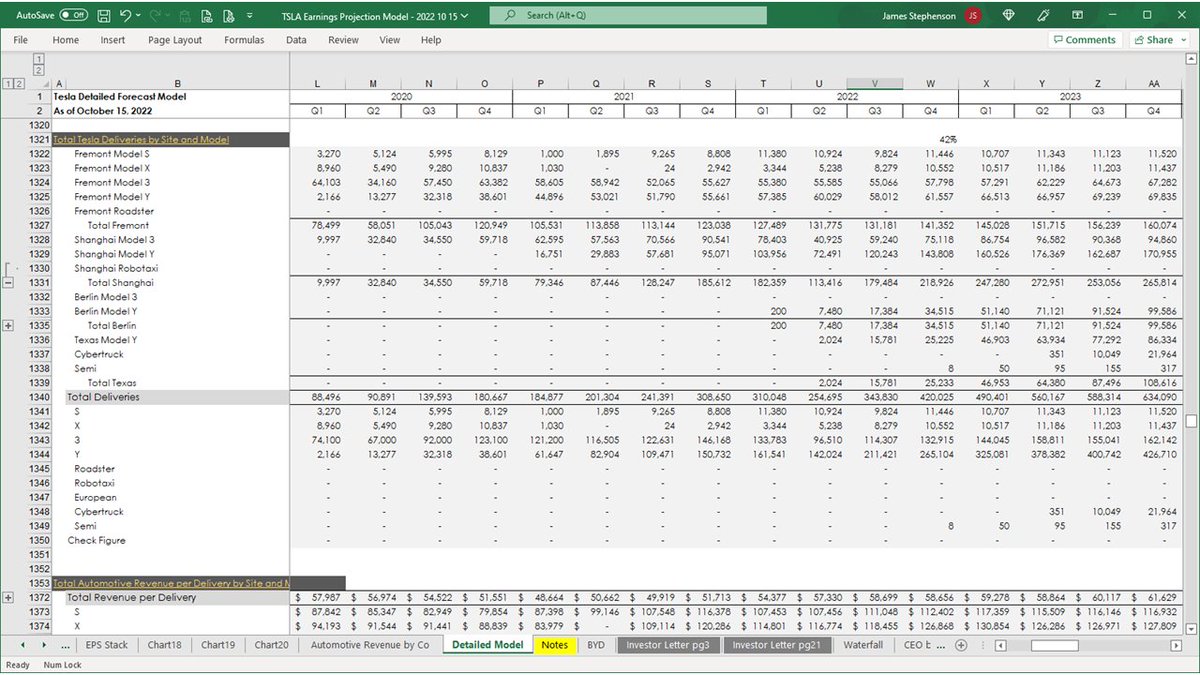

Here's a breakdown of deliveries by model, site, & quarter, with global totals by model below.

Tesla doesn't report at this level of detail either, so I leverage the work @TroyTeslike does. He's worth following & subscribing to his Patreon if you follow this info closely.

23/30

Tesla doesn't report at this level of detail either, so I leverage the work @TroyTeslike does. He's worth following & subscribing to his Patreon if you follow this info closely.

23/30

This page breaks down total Automotive Revenue by model and then by type, as I forecast it, with some earnings per delivery metrics at the bottom.

24/30

24/30

Here are some Trailing 12 Month deliveries, revenue, earnings, and earnings per delivery metrics.

This begins the section where I did the math for the charts showing how Tesla makes (slide 6) and then spends (slide 7) its average dollar of revenue.

25/30

This begins the section where I did the math for the charts showing how Tesla makes (slide 6) and then spends (slide 7) its average dollar of revenue.

25/30

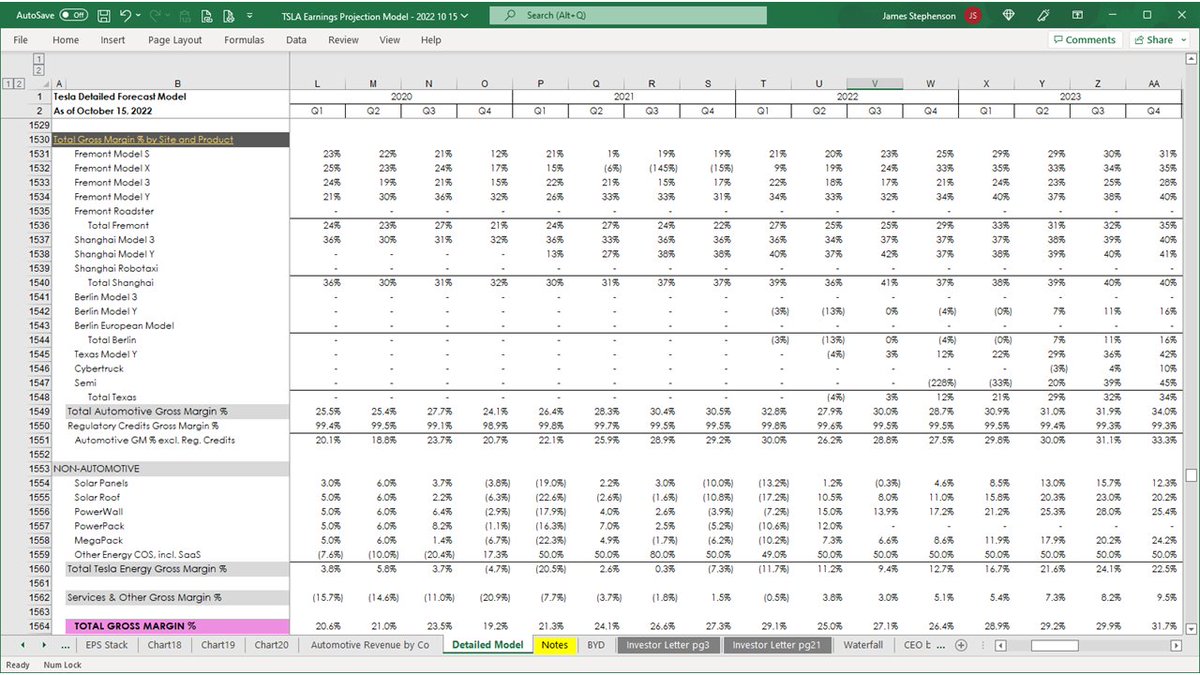

Here's a slide showing exactly the same information as the one above, except the flip side of the coin:

Gross margin % is just 1 - the cost of sales %.

27/30

Gross margin % is just 1 - the cost of sales %.

27/30

Here is a section showing breakdowns of the Automotive division into:

Cash vs. Leased

(units sold, revenue, and cost of sales that I used to make the slide 13 chart)

... and some related metrics at the bottom.

28/30

Cash vs. Leased

(units sold, revenue, and cost of sales that I used to make the slide 13 chart)

... and some related metrics at the bottom.

28/30

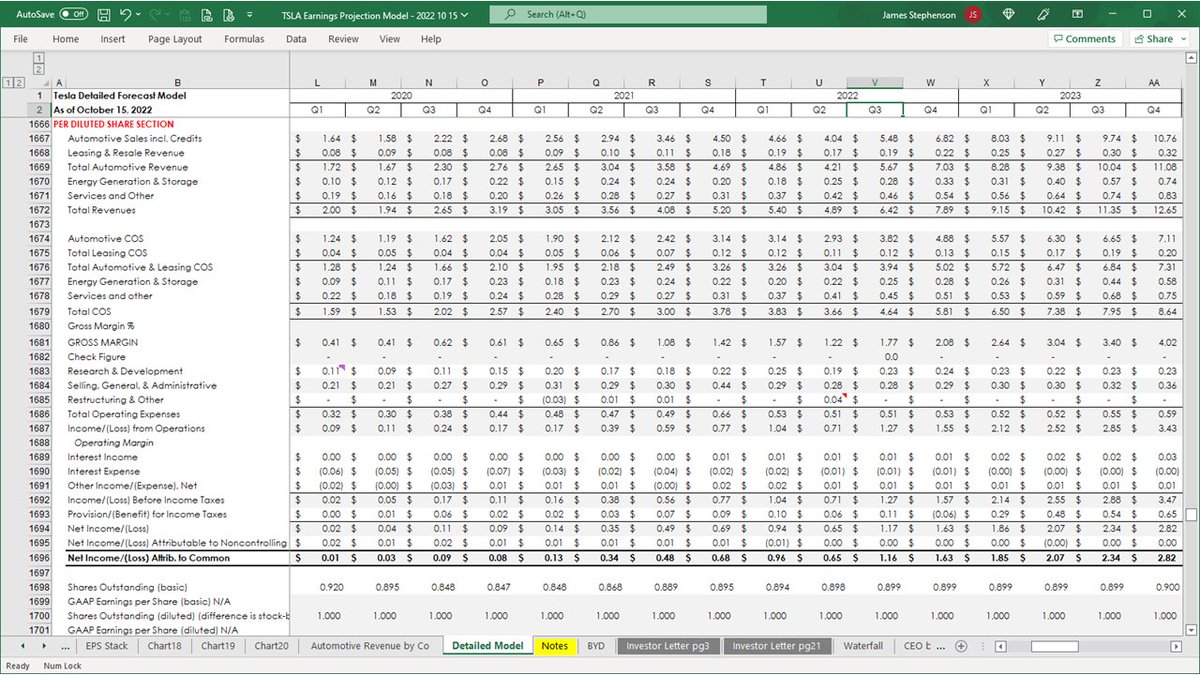

Here's a table that shows every dollar amount on the Income Statement on a Per Diluted Share basis.

Why do only "earnings per share" when you could do "everything per share"?

I used this table and the one on tweet 30 to create a grouped EPS stacked bar chart.

29/30

Why do only "earnings per share" when you could do "everything per share"?

I used this table and the one on tweet 30 to create a grouped EPS stacked bar chart.

29/30

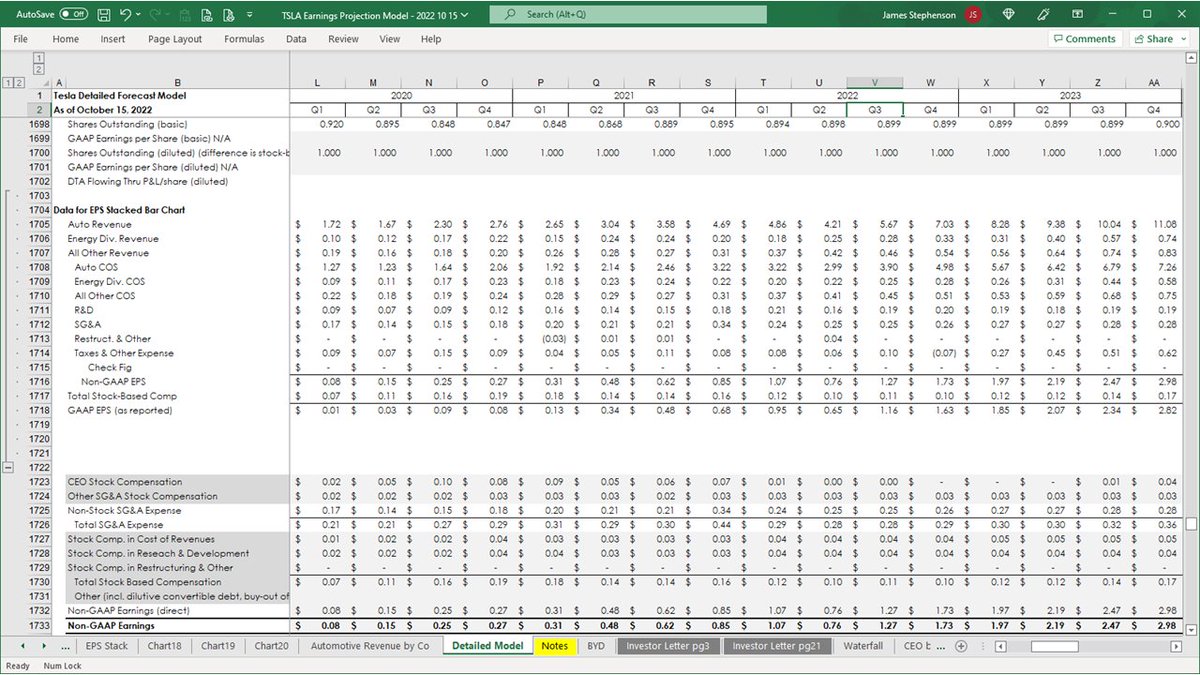

This final table shows an SBC breakdown and GAAP vs. Non-GAAP EPS.

For even more info, here's a playlist where I give you the full tour of my detailed $TSLA earnings projection model:

youtube.com/playlist?list=…

Congratulations! You made it to the end of the 🧵!

🥂🥳🕺

30/30

For even more info, here's a playlist where I give you the full tour of my detailed $TSLA earnings projection model:

youtube.com/playlist?list=…

Congratulations! You made it to the end of the 🧵!

🥂🥳🕺

30/30

Bonus Content! 🤓

If you’d rather have a video, here’s a quick guided tour of this 30-tweet thread, if you missed it when I tweeted it separately yesterday:

$TSLA

If you’d rather have a video, here’s a quick guided tour of this 30-tweet thread, if you missed it when I tweeted it separately yesterday:

$TSLA

• • •

Missing some Tweet in this thread? You can try to

force a refresh