#BANKNIFTY

Anticipating a 950 point move soon.

Outlook for the week Oct 17 - Oct 21, 2022.

THREAD: Deconstructing BANKNIFTY on 4 different TF's.

Anticipating a 950 point move soon.

Outlook for the week Oct 17 - Oct 21, 2022.

THREAD: Deconstructing BANKNIFTY on 4 different TF's.

#BANKNIFTY

1. Monthly TF:

• Bullish view. Erstwhile we had seen that, BNF failed to sustain > 37250-300 in monthly.

• However, now the bulls are comfortably holding up levels of 37250-39k in the past 3 months which wasn't the case since Nov 2021 till July 2022.

1. Monthly TF:

• Bullish view. Erstwhile we had seen that, BNF failed to sustain > 37250-300 in monthly.

• However, now the bulls are comfortably holding up levels of 37250-39k in the past 3 months which wasn't the case since Nov 2021 till July 2022.

#BANKNIFTY

2. Weekly TF:

• Erstwhile resistance has now turned into support, and we are still bullish on weekly as well.

•On weekly TF, currently inside bar formation, and still look positive.

2. Weekly TF:

• Erstwhile resistance has now turned into support, and we are still bullish on weekly as well.

•On weekly TF, currently inside bar formation, and still look positive.

#BANKNIFTY

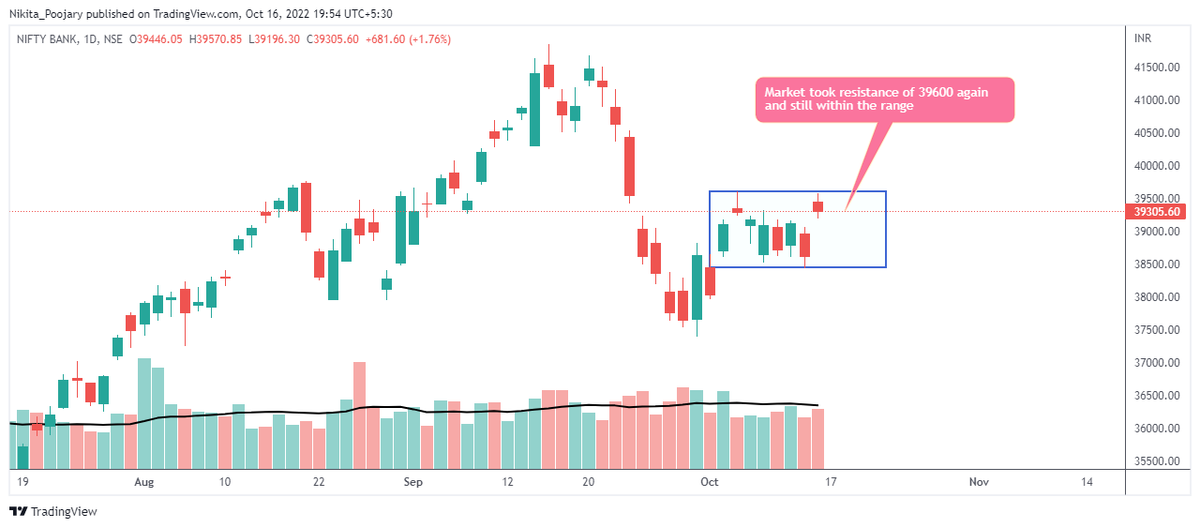

3. Daily TF:

• Consolidating within 38500-39600

• Anticipating BNF to break this consolidation soon.

3. Daily TF:

• Consolidating within 38500-39600

• Anticipating BNF to break this consolidation soon.

#BANKNIFTY

4. Hourly TF:

• S/R mentioned on the charts.

• Rectangle formation in hourly awaiting a BO or a BD.

4. Hourly TF:

• S/R mentioned on the charts.

• Rectangle formation in hourly awaiting a BO or a BD.

#BANKNIFTY

Conclusion:

• On higher TF i.e. monthly and weekly BNF is bullish.

• On daily TF looks sideways, unless 39600 is taken out, post which it will be bullish.

• Can expect a strong 950 move at the break of the rectangle.

Conclusion:

• On higher TF i.e. monthly and weekly BNF is bullish.

• On daily TF looks sideways, unless 39600 is taken out, post which it will be bullish.

• Can expect a strong 950 move at the break of the rectangle.

• • •

Missing some Tweet in this thread? You can try to

force a refresh