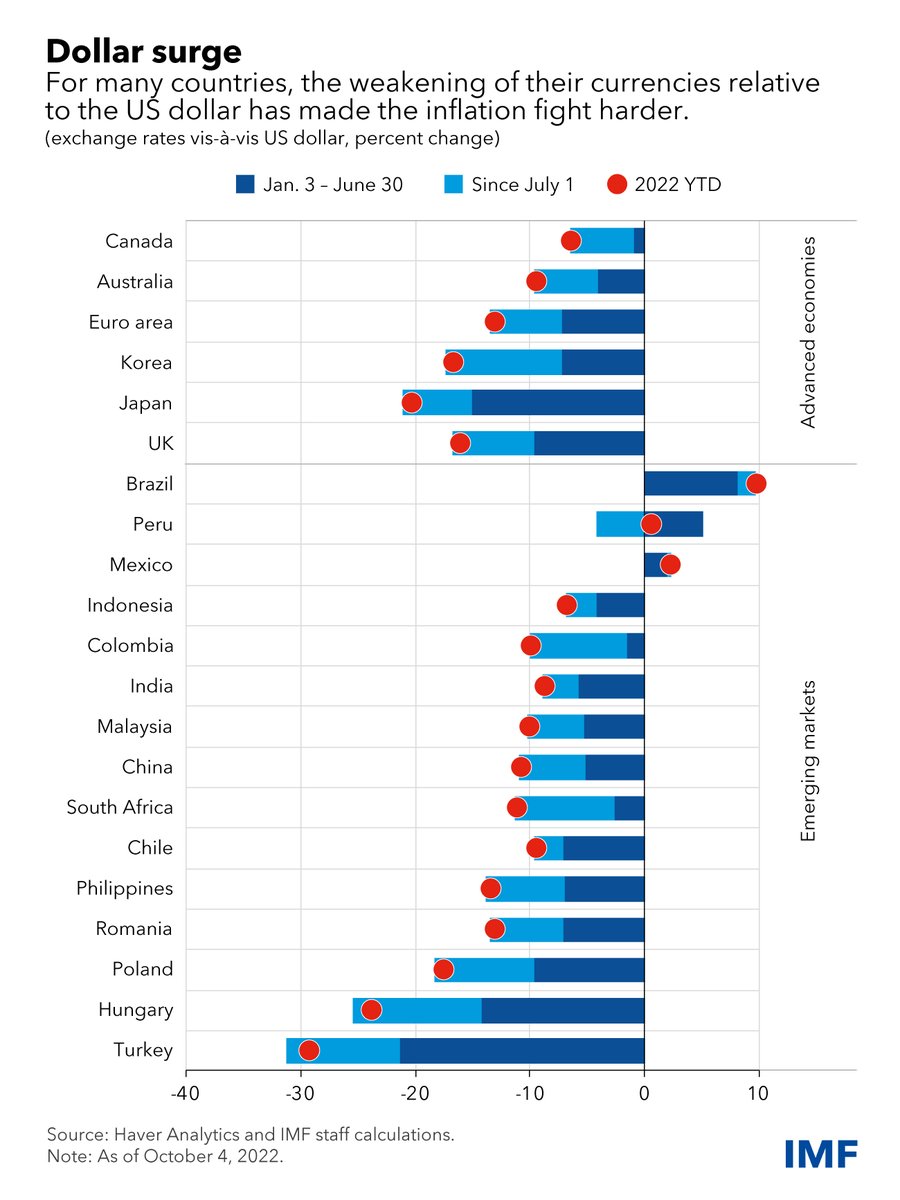

The dollar’s value is at its highest level since 2000. It has appreciated 22% against the yen, 13% against the euro & 6% against emerging market currencies since January. @GitaGopinath & I just published a #IMFBlog on how countries should respond. bit.ly/3yGyrCV (1/9)

Even though the appreciation is lower in emerging markets relative to advanced economies, the impact is larger, reflecting their higher import dependency & greater share of dollar-invoiced imports. bit.ly/3yGyrCV (2/9)

Several emerging markets and developing economies resorted to foreign exchange interventions to limit the depreciation of their currency.

bit.ly/3yGyrCV (3/9)

bit.ly/3yGyrCV (3/9)

Our advice to policymakers: focus on the drivers of the exchange rate change & look for signs of market disruptions. Foreign exchange intervention should not substitute for needed adjustment to macroeconomic policies. bit.ly/3yGyrCV (4/9)

At the current juncture, there are two main fundamental drivers. First, the stance of monetary policy, with a sharp tightening in the U.S. and in many emerging markets, less so in the euro area, the U.K. or Japan. bit.ly/3yGyrCV (5/9)

Second: the terms-of-trade shock caused by the Russian invasion of Ukraine and the energy crisis. It is very large and negative for the euro area, positive for the U.S. and mixed for EMs bit.ly/3yGyrCV (6/9)

Given these two fundamental forces, the appropriate response is to allow the exchange rate to adjust & use monetary policy to keep inflation close to its target. bit.ly/3yGyrCV (7/9)

But the environment is fragile, and interventions could be useful in the future to deal with financial turmoil for countries with shallow FX markets. Key message: Keep your FX reserve powder dry and improve resilience. bit.ly/3yGyrCV (8/9)

For the US, monetary tightening remains the appropriate policy to bring inflation close to target, while watching out for large spillovers. Among other measures, the Fed could reactivate currency swap lines. bit.ly/3yGyrCV (9/9)

• • •

Missing some Tweet in this thread? You can try to

force a refresh