How to get URL link on X (Twitter) App

https://twitter.com/pogourinchas/status/1673751747498483730?s=20

[2/6] This was viewed with some skepticism: the measures were costly, poorly targeted, could make the energy crisis worse, and could fuel aggregate demand, aggravating inflation pressures. But they could also reduce headline and the passthrough to core inflation. Did they?

[2/6] This was viewed with some skepticism: the measures were costly, poorly targeted, could make the energy crisis worse, and could fuel aggregate demand, aggravating inflation pressures. But they could also reduce headline and the passthrough to core inflation. Did they?

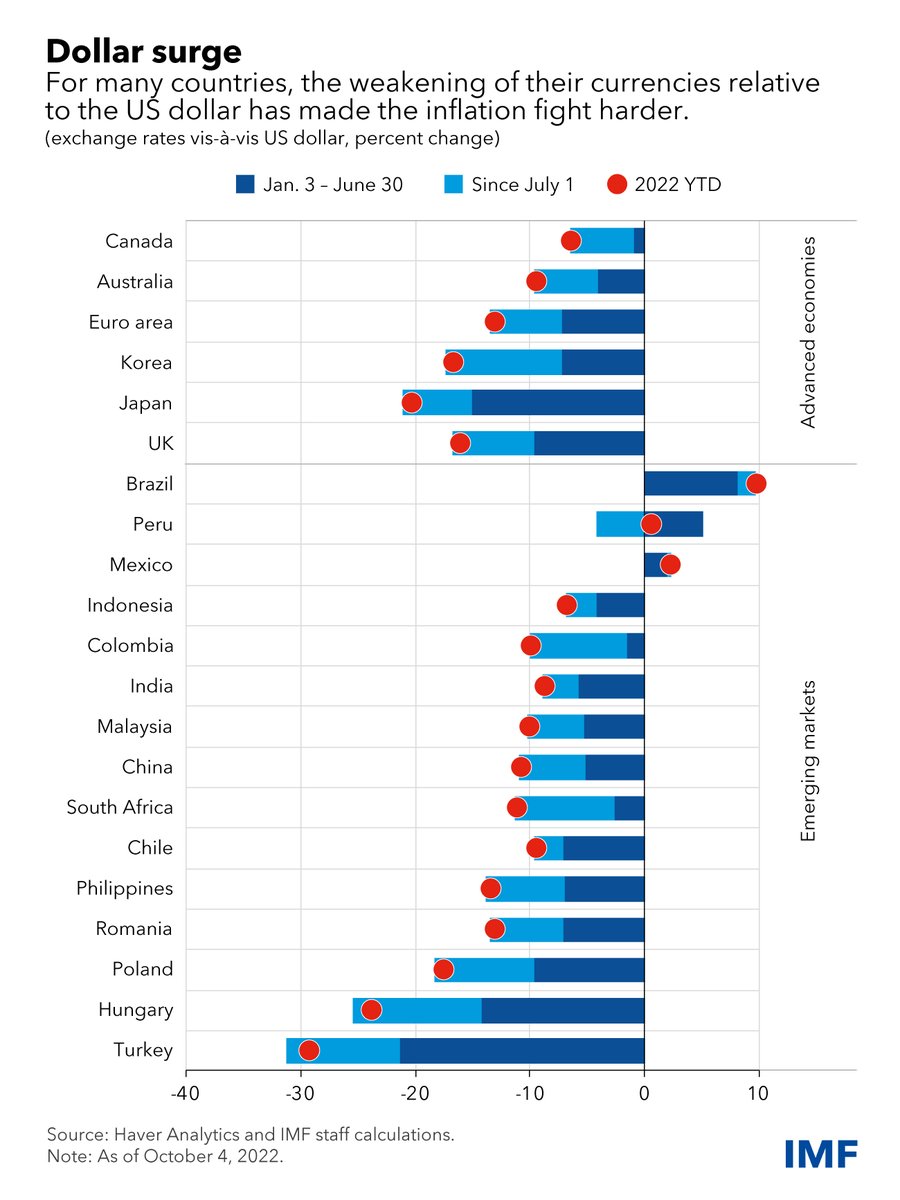

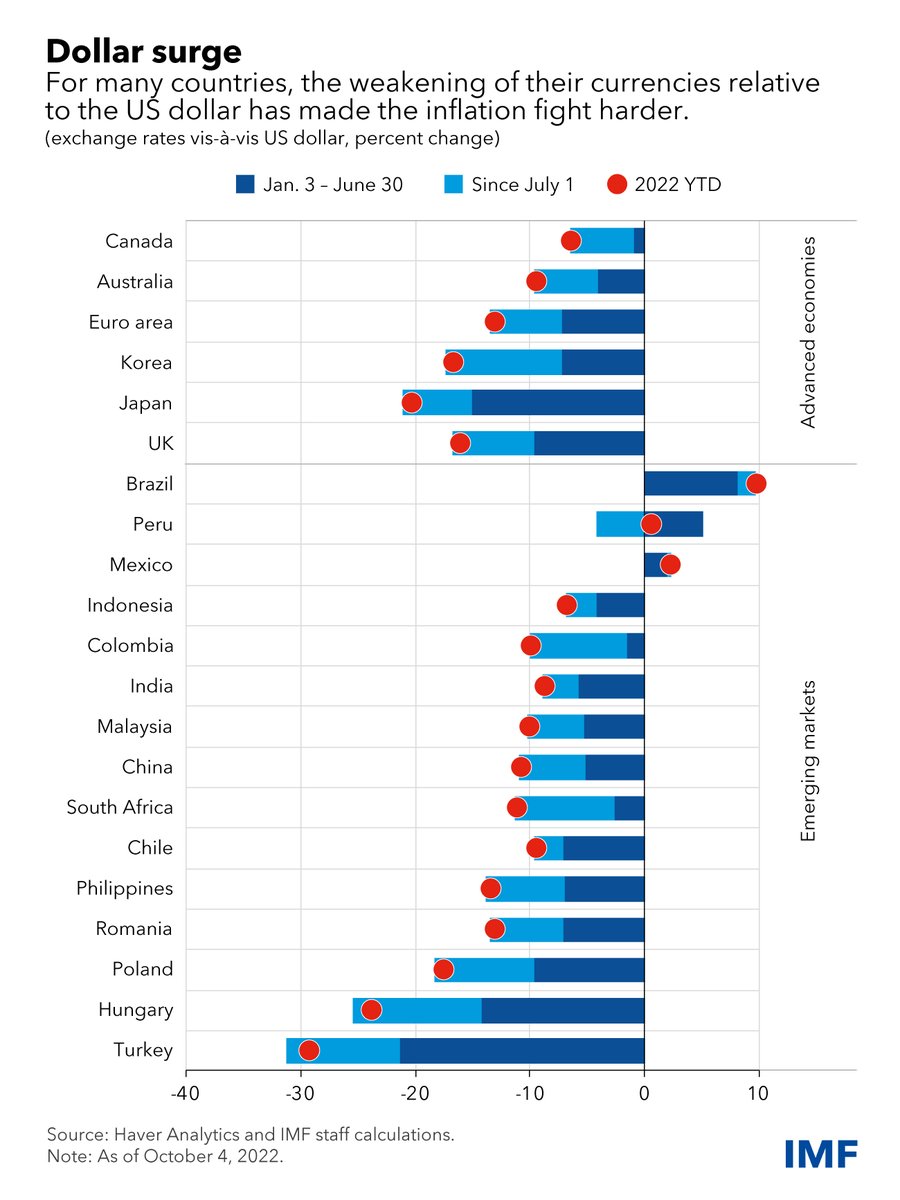

Even though the appreciation is lower in emerging markets relative to advanced economies, the impact is larger, reflecting their higher import dependency & greater share of dollar-invoiced imports. bit.ly/3yGyrCV (2/9)

Even though the appreciation is lower in emerging markets relative to advanced economies, the impact is larger, reflecting their higher import dependency & greater share of dollar-invoiced imports. bit.ly/3yGyrCV (2/9)

To put things in context, back in March 2020, I (and others) argued that we needed to act quickly, to 'flatten both the pandemic and recession curves'.

To put things in context, back in March 2020, I (and others) argued that we needed to act quickly, to 'flatten both the pandemic and recession curves'. https://twitter.com/pogourinchas/status/12385965583687065612/N

https://twitter.com/pogourinchas/status/12385965583687065612/n Financial markets are looking forward. They do not like what they see. Time is running out and the next few days are going to be critical.