I am disappointed by the tendentious & selective analysis of team transitory acolytes who keep finding new arguments for their conclusion that inflation is @ to subside & policy should be dovish. I focus on @paulkrugman because he is so clear & smart. 1/N nytimes.com/2022/10/14/opi…

.@paulkrugman now focuses on housing and the well-known point that government indices lag private sector indices of newly leased residences. Therefore, he argues one should not worry about projected high inflation rates because they are driven by housing. 2/N

.@paulkrugman would be more convincing if he had focused on the housing distortion when it was holding overall inflation down in 2021. He would be more credible if he acknowledged that new rental price inflation of his cited measure (Zillow) is still running at 6 percent. 3/N

He would also be more credible if he pointed out that lags apart there was a large gap between the level of residential prices measured by the private sector and government. These have historically moved together, and I’d guess the official indices will catch up. 4/N

.@paulkrugman would also be more convincing if he acknowledged that dropping out the median observation in a group of observations does not change its median. 5/N

In the @nytimes op-ed, @paulkrugman then shifts his attention to the labor market as a guide to underlying inflation. I agree that wages are a kind of super core measure of inflation. 6/N

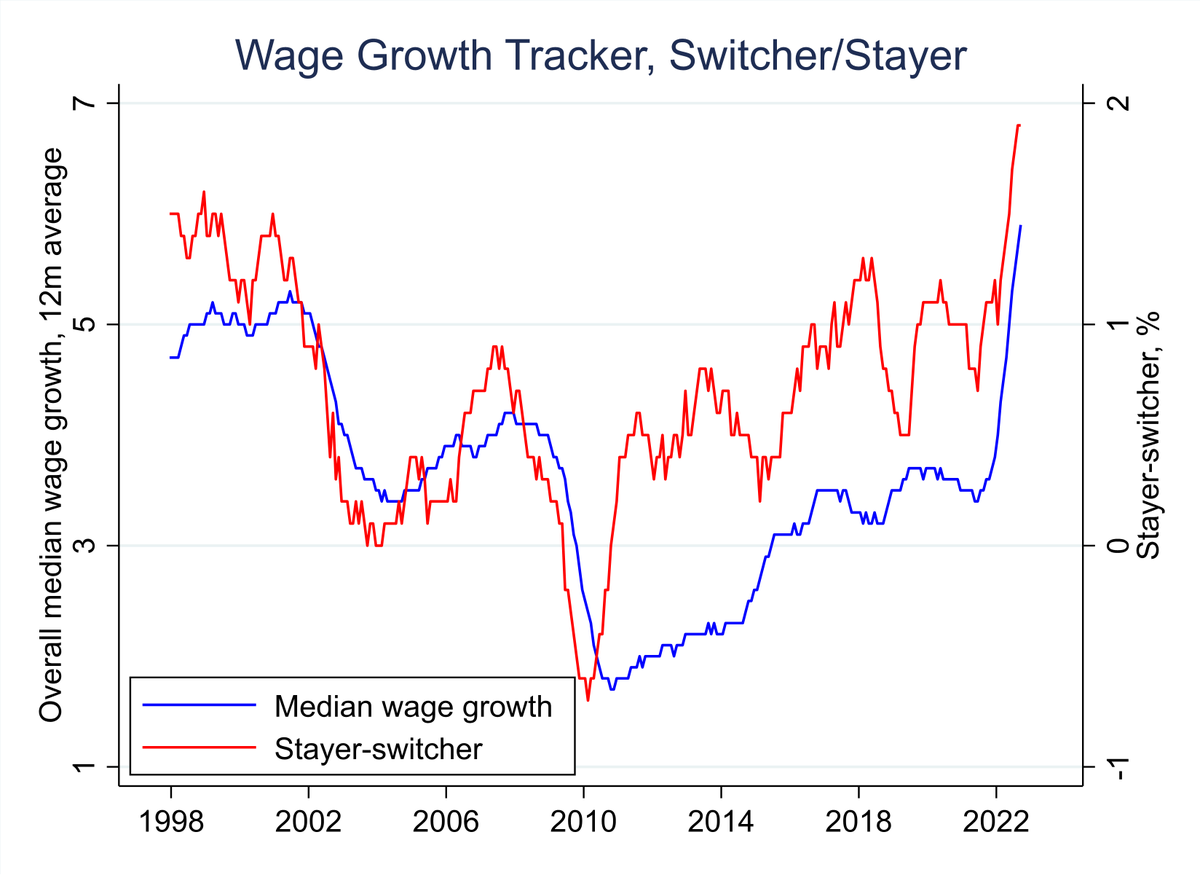

Paul focuses on average hourly earnings in the employment survey. He neglects to point out that it is badly flawed by composition effects. Nor does he observe that better indices like the Wage Growth Tracker and the ECI suggest a much less benign picture of wage inflation. 7/N

Having stressed the distinction between new and continuing prices in the context of housing where it works to allay inflation concerns, Paul neglects it in the context of wage inflation. 8/N

The gap between wage gains for those changing jobs and those staying in jobs is at record levels. This suggests accelerating wage inflation. 9/N

Given dismal productivity growth, likely caused by quiet quitting, wage inflation will have to come down significantly if sustained months near 2 percent inflation is to be attained. I do not understand the basis for believing this is likely without a meaningful recession. 10/10

• • •

Missing some Tweet in this thread? You can try to

force a refresh