Are asset managers powerful? I'm excited that my attempt at an answer is now published (open access).

Summary:

1) Exit-based power is down

2) Control-based power is up

3) ...but also more visible: AM power is constrained by politics.

More in 🧵

journals.sagepub.com/doi/10.1177/00…

Summary:

1) Exit-based power is down

2) Control-based power is up

3) ...but also more visible: AM power is constrained by politics.

More in 🧵

journals.sagepub.com/doi/10.1177/00…

We theorize the structural power of finance as being based on exit. But the primary function of finance has been shifting from financing to asset management, which reduces exit options.

-> Financialization and rising financial-sector power are *not* two sides of the same coin. /2

-> Financialization and rising financial-sector power are *not* two sides of the same coin. /2

Here's 'The end of exit', told for the US economy in three charts:

1) the declining importance of external financing for corporate investment

2) and especially of the stock market

2) the declining importance of banks & of corporate lending for banks /3

1) the declining importance of external financing for corporate investment

2) and especially of the stock market

2) the declining importance of banks & of corporate lending for banks /3

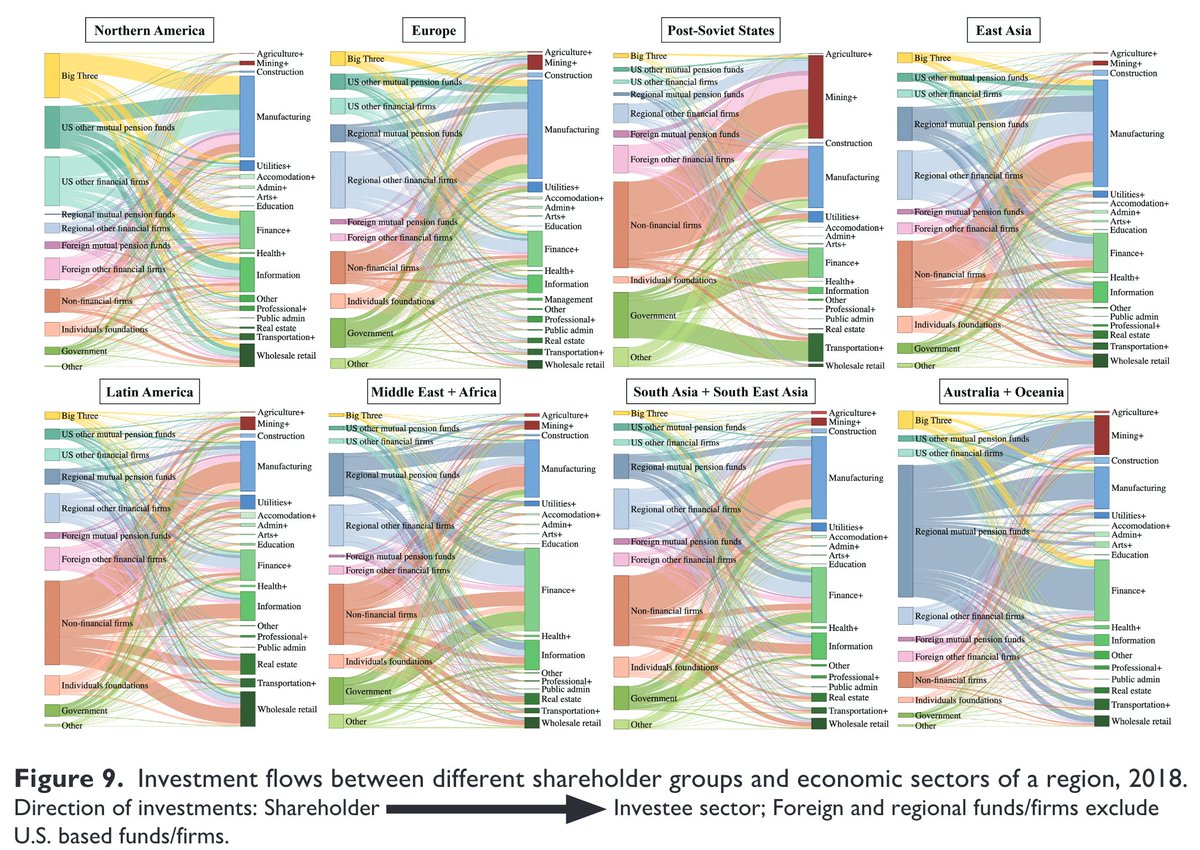

The next section charts 'The rise of control', building on my chapter on AMC as a corporate governance regime. The hallmark of that regime is the combination of weak exit options, strong control-based power, and very high diversification. /4

Now when it comes to corporate governance, the big one is the universal owner question, which @MadisonECondon and @fichtner_jan have written about.

Simply put, the question is: Will the big three push corporate behavior toward decarbonization? /5

Simply put, the question is: Will the big three push corporate behavior toward decarbonization? /5

My starting point is that the promise of universal ownership has already been broken. The big-3 could have pushed companies hard to decarbonize. They have not: Lots of evidence out there – check out @sanha926 & Baines: journals.sagepub.com/doi/10.1177/10… /6

To explain why universal owners haven't lived up to the expectations of universal owner theory we need a political economy approach – one that frees itself of the straitjacket of the #corpgov literature. /7

Assuming orderly, good-faith interactions btw shareholders and managers is to close one's eyes to the multi-level game that asset managers play. By descending priority, the goals are:

1) Maximize assets under management

2) Avoid regulatory backlash

3) Do corporate governance /8

1) Maximize assets under management

2) Avoid regulatory backlash

3) Do corporate governance /8

'Actually existing asset manager capitalism' isn't about corporate governance, it's about not being broken up.

In the US, the big-3 have found themselves between a rock—the left wants to enforce green stewardship—and a hard place—the right wants to outlaw green stewardship. /9

In the US, the big-3 have found themselves between a rock—the left wants to enforce green stewardship—and a hard place—the right wants to outlaw green stewardship. /9

BlackRock and Vanguard have been fighting a rearguard action (excuse the pun) that's been spectacular to watch. Here's a summary, based on what's in the paper. /10

To sum up, I'm arguing that besides the economic logic, there's also a political logic of universal ownership.

Economic: “Too big to not internalize external effects”

Political: “Too big to *not* internalize political conflicts”

/11

Economic: “Too big to not internalize external effects”

Political: “Too big to *not* internalize political conflicts”

/11

Upshot: private asset managers are no green deus ex machina. There's no way around thorny questions of public asset management options, public ownership, and economic democracy. Good thing @adribuller, @DantonsHead, @lenorepalladino, @its_mccarthy, among others, are on it. /12

The paper has come a long way and a lot of people have provided comments over the last three years. Special thanks to @JWMason1 for his exceptionally thoughtful comments on an early version, to Fred Block and the other editors of @pasupdates, ... /13

... and to the guest editors of the @pasupdates special issue on the structural power of finance: @florence_dafe, @sanha926, @natalyanaqvi & @LeonWansleben. Check out their excellent introductory piece. /END journals.sagepub.com/doi/10.1177/00…

• • •

Missing some Tweet in this thread? You can try to

force a refresh