How to earn #yield on your stables position?

A 🧵 providing all you need to know about @SperaxUSD $SPA $USDs.

(AIP-1)

Diving in! (1/19)

A 🧵 providing all you need to know about @SperaxUSD $SPA $USDs.

(AIP-1)

Diving in! (1/19)

How do stablecoin issuers makes money?

Similar to a bank.

You trust them to hold your fiat, they mint a representative token. They invest your fiat and keep the yields to themselves.

Similar to a bank.

You trust them to hold your fiat, they mint a representative token. They invest your fiat and keep the yields to themselves.

Following the "Be Your Own Bank" narrative, what if you could earn yields on stablecoins just by holding them (without locking, staking, claiming, etc.).

@SperaxUSD enables this.

@SperaxUSD enables this.

How it works.

Essentially a stablecoin index fund ($USDs), backed by a basket of stablecoins ($USDC $VST $DAI $FRAX).

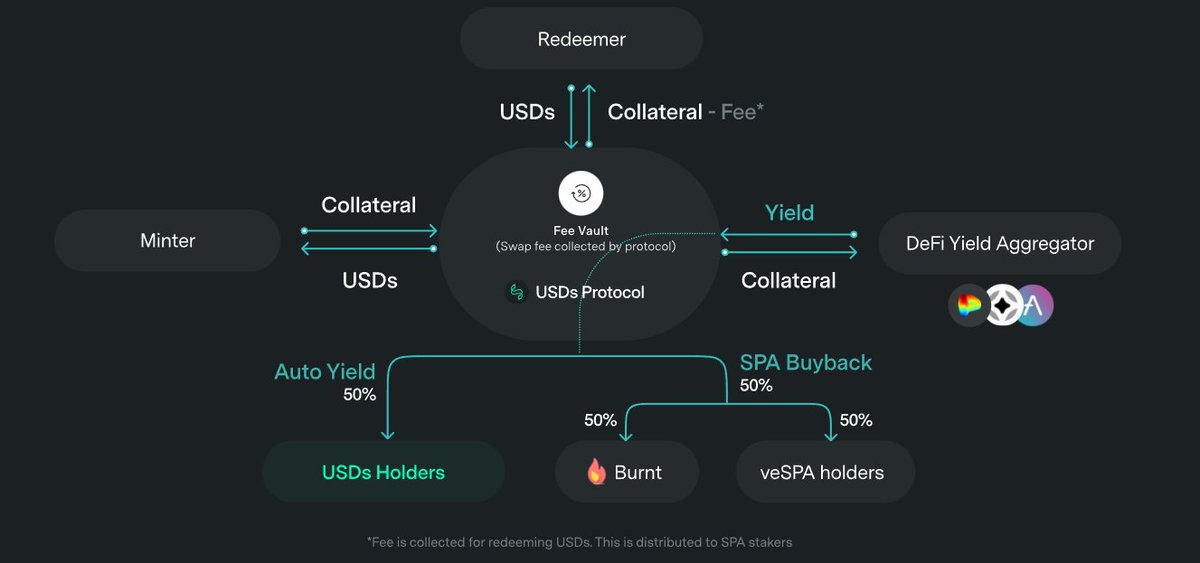

Collaterals are invested on stable yield strategies. Yields are distributed (50% to $USDs holders; 25% to buyback & burn $SPA; 25% to $SPA stakers).

Essentially a stablecoin index fund ($USDs), backed by a basket of stablecoins ($USDC $VST $DAI $FRAX).

Collaterals are invested on stable yield strategies. Yields are distributed (50% to $USDs holders; 25% to buyback & burn $SPA; 25% to $SPA stakers).

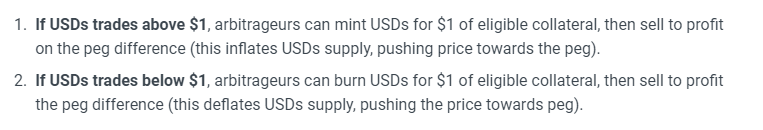

How $USDs holds its value.

For starters, it is purely backed by stables.

But should the price deviate from US$1, the design incentivize arbs to restore the value.

For starters, it is purely backed by stables.

But should the price deviate from US$1, the design incentivize arbs to restore the value.

Demeter - a SaaS expansion to increase $USDs adoption.

Demeter is a tool to help protocols and DAOs easily (w/o code) launch incentivized UniV3 farms.

Pools that are paired against $USDs or $SPA get $SPA emissions and launch fees waived (US$500 -- to burn $SPA).

Demeter is a tool to help protocols and DAOs easily (w/o code) launch incentivized UniV3 farms.

Pools that are paired against $USDs or $SPA get $SPA emissions and launch fees waived (US$500 -- to burn $SPA).

How $SPA captures value.

$SPA stakers ($veSPA) are rewarded through the following streams:

- $USDs redemption fees (0.2% of value)

- 25% of protocol investment yield

- additional protocol incentives

- potential price appreciation through buyback and burn

$SPA stakers ($veSPA) are rewarded through the following streams:

- $USDs redemption fees (0.2% of value)

- 25% of protocol investment yield

- additional protocol incentives

- potential price appreciation through buyback and burn

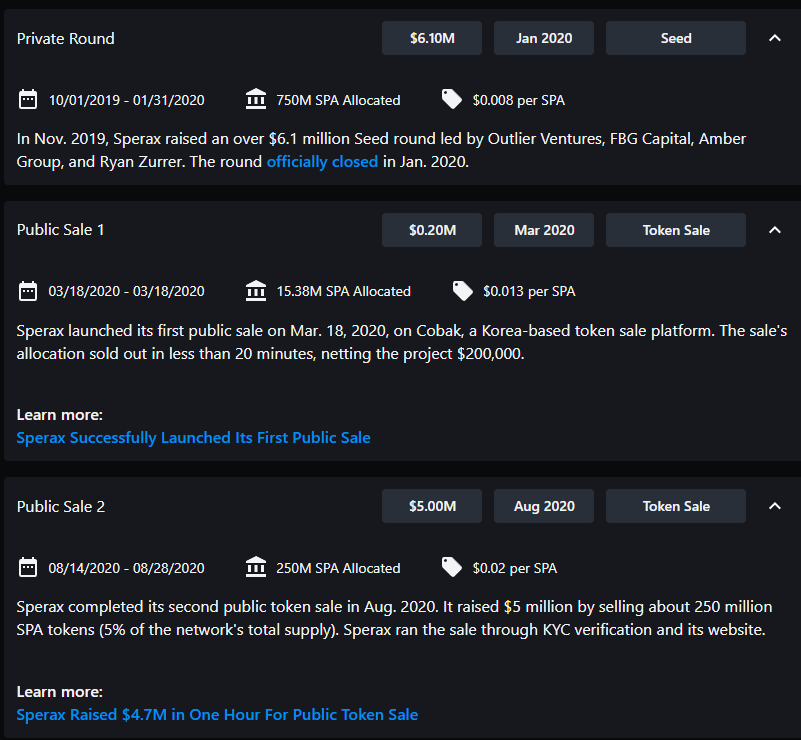

Tokenomics.

Honestly the public allocation is rather small (at least for me; but was funded 3 years ago, so yeah).

But its nice to know that private investors allocation has completed vesting on Sep 2022.

messari.io/asset/sperax/p…

Honestly the public allocation is rather small (at least for me; but was funded 3 years ago, so yeah).

But its nice to know that private investors allocation has completed vesting on Sep 2022.

messari.io/asset/sperax/p…

Done with the boring/general information on Sperax.

Here's some more exciting news/thoughts.

1) Demeter bribing gauge

2) PlutusDAO integration

3) $SPA as a backstop mechanism

4) Potential use cases

5) M. Cap to TVL

6) Personal curiosities

Here's some more exciting news/thoughts.

1) Demeter bribing gauge

2) PlutusDAO integration

3) $SPA as a backstop mechanism

4) Potential use cases

5) M. Cap to TVL

6) Personal curiosities

1) Demeter bribing gauge

Demeter's live.

With $veSPA and Demeter v2 (TBA), stakers could vote and redirect $SPA emissions to Demeter pools. Akin to @CurveFinance $veCRV.

OFC this also means that it unlocks a space for a @ConvexFinance $CVX.

Demeter's live.

With $veSPA and Demeter v2 (TBA), stakers could vote and redirect $SPA emissions to Demeter pools. Akin to @CurveFinance $veCRV.

OFC this also means that it unlocks a space for a @ConvexFinance $CVX.

2) PlutusDAO integration

In fact, @PlutusDAO_io has already filled this void, with their recent $plsSPA integration.

PlutusDAO is too exciting to cover here, will do in another thread.

TL;DR, PlutusDAO is (trying to be) the Convex for the whole Arbi ecosystem.

In fact, @PlutusDAO_io has already filled this void, with their recent $plsSPA integration.

PlutusDAO is too exciting to cover here, will do in another thread.

TL;DR, PlutusDAO is (trying to be) the Convex for the whole Arbi ecosystem.

3) $SPA as a backstop mechanism

Though not unique to Sperax, should a whitelisted stablecoin depeg, $USDs can be undercollateralized and to fulfil redemptions, $SPA will be minted to cover the disparity.

Though slim, the chances are non-zero.

Though not unique to Sperax, should a whitelisted stablecoin depeg, $USDs can be undercollateralized and to fulfil redemptions, $SPA will be minted to cover the disparity.

Though slim, the chances are non-zero.

4) Potential use cases

Currently, only non-smart contract addresses eligible to earn yield from $USDs positions.

This can be changed through governance.

Once it is enabled and widespread, the possibilities are endless.

(cont.)

Currently, only non-smart contract addresses eligible to earn yield from $USDs positions.

This can be changed through governance.

Once it is enabled and widespread, the possibilities are endless.

(cont.)

(cont.)

Similar to @AaveAave 's $aUSDC, integration with protocols would enable the following:

- Earning (additional) yield while providing LP

- Earning yield while waiting for limit orders to fill

- Earning yield while using as collateral

- and many more

Similar to @AaveAave 's $aUSDC, integration with protocols would enable the following:

- Earning (additional) yield while providing LP

- Earning yield while waiting for limit orders to fill

- Earning yield while using as collateral

- and many more

5) M. Cap to TVL

The current TVL of $USDs is US$3.67mn.

The current M. Cap. of $SPA is US$20.43mn.

Is the current premium over $SPA worth? Given that most of the value captured by $SPA is driven by $USDs adoption. 🤷♂️.

The current TVL of $USDs is US$3.67mn.

The current M. Cap. of $SPA is US$20.43mn.

Is the current premium over $SPA worth? Given that most of the value captured by $SPA is driven by $USDs adoption. 🤷♂️.

6) Personal curiosities

Why not just be a stablecoin issuer that rewards back yield? Instead of a stablecoin wrapper. Besides legality.

What about a protocol that does this but with real-world yields?

Why not just be a stablecoin issuer that rewards back yield? Instead of a stablecoin wrapper. Besides legality.

What about a protocol that does this but with real-world yields?

Good readings on the protocol:

Most of the features are already covered by the quoted Tweet.

docs.sperax.io

Most of the features are already covered by the quoted Tweet.

docs.sperax.io

https://twitter.com/BillyBobBaghold/status/1559560230027026434

https://twitter.com/BillyBobBaghold/status/1566795842941501440

That's it for now. Looking forward to further discussions.

Hopefully I can keep my motivation going and post regularly.

Unrolled version:

typefully.com/archipelabro/s…

If you liked the thread, I'd appreciate a follow/like/rt!

Have a nice day fren!

Hopefully I can keep my motivation going and post regularly.

Unrolled version:

typefully.com/archipelabro/s…

If you liked the thread, I'd appreciate a follow/like/rt!

Have a nice day fren!

• • •

Missing some Tweet in this thread? You can try to

force a refresh