🔥 Insurance is the Achilles heel of the fossil fuel industry. A new #InsureOurFuture report published today finds that new coal power plants have become near uninsurable and that insurers have finally started to move away from oil and gas. A short 🧵 on leaders and laggards! 🔥

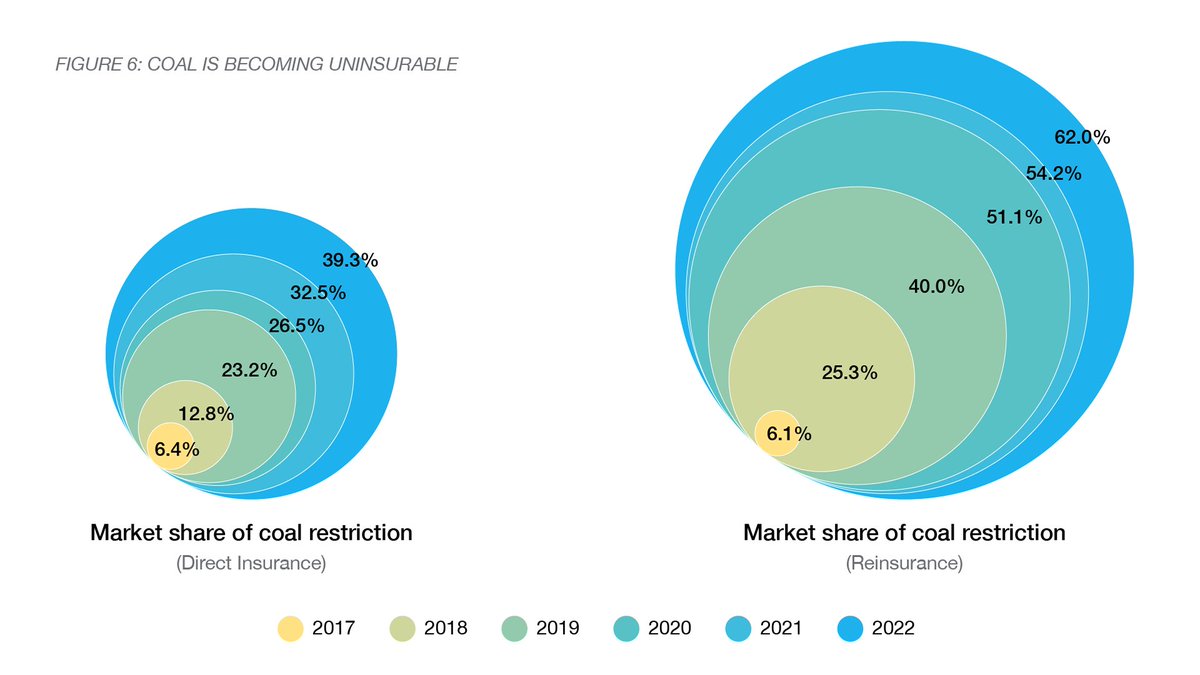

So far 41 insurers, up from 36 last year, have adopted coal restrictions. 📈 Their share of the reinsurance market has grown to 62% and much of the rest isn’t insuring coal anyway. Insurance capacity for coal has dwindled to $250m – 1/10 of the capacity for other power projects!

And 13 insurers, up from only 3 last year, have adopted restrictions on oil and gas. Their share of the reinsurance market has grown to 38%, up from 3% last year. 18 insurers have pledged not to insure the Trans Mountain pipeline and 18 have done the same for EACOP.

The quality of the new oil and gas restrictions is however uneven. 👏 @Swiss Re, @Allianz and @MunichRe will stop insuring all or most new oil and gas production projects while ❓ @AXA and @Zurich will only restrict support for new exploration but not for increased extraction.

And in spite of their climate rhetoric, 🛢️ major oil and gas insurers like @AIGinsurance, @Chubb, @LloydsofLondon and @TokioMarine have not adopted any restrictions on their support for climate wrecking conventional oil and gas projects at all!

Our new report scores and ranks 30 major fossil fuel insurers on their climate policies. 👍 #1 for insurance restrictions is @Allianz, followed by @AXA, @Avivaplc and @SwissRe. @SCOR_SE is #1 for fossil fuel divestment, followed by @AXA, @Generali and @Allianz. Congrats!

At the bottom of the list 👎 are #BerkshireHathaway, @EverestRe, China’s #PICC and #Sinosure, and @StarrCompanies with a flat 0 out of 10. @Chubb, @LibertyMutual and @LloydsofLondon also score very low.

As @ESulakshana says, “is unacceptable that insurance companies are abandoning climate-affected communities while continuing to fuel the climate emergency by underwriting the expansion of fossil fuel production".

Next year it will be 50 years since insurers started warning about climate risks. They need to immediately stop insuring any new fossil fuel projects and phase out their support for existing coal, oil and gas operations in line with a 1.5C pathway. #InsureOurFuture

The climate buck stops with the CEOs. Some have taken action even while their management is dragging their feet. Others’ legacy will be utter climate destruction. An @InsOurFuture thread calls out the leaders and laggards among the insurance CEOs at bit.ly/3CMw8zs.

The climate buck stops with the CEOs. Some have taken action even while their management is dragging their feet. Others’ legacy will be utter climate destruction. An @InsOurFuture thread calls out the leaders and laggards among the insurance CEOs at bit.ly/3CMw8zs.

You will find the 2022 fossil fuel insurance scorecard report at insure-our-future.com/scorecard. Our best insurance is to keep fossil fuels in the ground. Follow @InsOurFuture and join the campaign!

For some great early coverage of the new report, check out the Guardian bit.ly/3D6roGi, Washington Post wapo.st/3TsMR1w and SCMP bit.ly/3gijtwG.

• • •

Missing some Tweet in this thread? You can try to

force a refresh