Campaign adviser and blogger. Retired campaigner with the Sunrise Project, Insure Our Future, International Rivers and Public Eye. Now only posting on Bluesky.

How to get URL link on X (Twitter) App

Zurich is the 6th biggest fossil fuel insurer with annual premiums from oil and gas of an estimated $510 mn. With Zurich, ALL big European insurers have now stopped insuring the expansion of oil and gas.

Zurich is the 6th biggest fossil fuel insurer with annual premiums from oil and gas of an estimated $510 mn. With Zurich, ALL big European insurers have now stopped insuring the expansion of oil and gas.

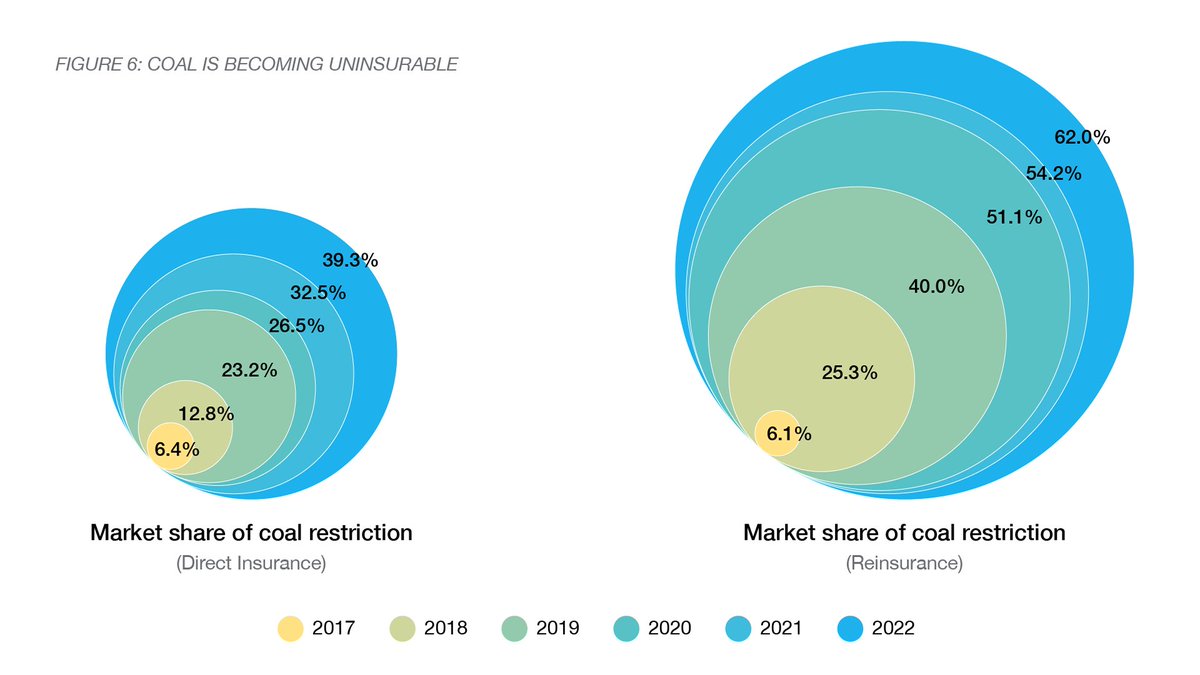

👍 According to the new #InsureOurFuture scorecard published today, the number of coal exit policies has increased from 41 to 45 last year. Oil & gas restrictions are up from 13 to 18, and tar sands restrictions from 21 to 26. That’s the good news.

👍 According to the new #InsureOurFuture scorecard published today, the number of coal exit policies has increased from 41 to 45 last year. Oil & gas restrictions are up from 13 to 18, and tar sands restrictions from 21 to 26. That’s the good news.

The Greenpeace report identified 69 insurers offering cover for the 21 oil and gas companies with massive expansion plans in the North Sea. Most of them are syndicates of @LloydsofLondon such as @BeazleyGroup, @britinsurance and @HiscoxComms.

The Greenpeace report identified 69 insurers offering cover for the 21 oil and gas companies with massive expansion plans in the North Sea. Most of them are syndicates of @LloydsofLondon such as @BeazleyGroup, @britinsurance and @HiscoxComms.

So far 41 insurers, up from 36 last year, have adopted coal restrictions. 📈 Their share of the reinsurance market has grown to 62% and much of the rest isn’t insuring coal anyway. Insurance capacity for coal has dwindled to $250m – 1/10 of the capacity for other power projects!

So far 41 insurers, up from 36 last year, have adopted coal restrictions. 📈 Their share of the reinsurance market has grown to 62% and much of the rest isn’t insuring coal anyway. Insurance capacity for coal has dwindled to $250m – 1/10 of the capacity for other power projects!

As climate change spirals out of control, (un)natural disasters are becoming more frequent and expensive. 📈 Munich Re reports that they caused losses of $280 bn last year, up from $166 bn in 2019 and $210 bn in 2020. Insurers’ business models are now stretching at the seams.

As climate change spirals out of control, (un)natural disasters are becoming more frequent and expensive. 📈 Munich Re reports that they caused losses of $280 bn last year, up from $166 bn in 2019 and $210 bn in 2020. Insurers’ business models are now stretching at the seams.

👍 Under the new policy, Munich Re will no longer insure or invest in new oil and gas fields, new oil midstream projects and new oil power plants from April 2023. This applies to Munich Re’s primary, facultative and direct reinsurance.

👍 Under the new policy, Munich Re will no longer insure or invest in new oil and gas fields, new oil midstream projects and new oil power plants from April 2023. This applies to Munich Re’s primary, facultative and direct reinsurance.

Under the new policy, Allianz will to stop insuring and investing in new oil and gas fields, new oil power plants, new midstream oil infrastructure, and practices relating to the Arctic from January 2023, and will not renew existing contracts for such projects from July 2023.

Under the new policy, Allianz will to stop insuring and investing in new oil and gas fields, new oil power plants, new midstream oil infrastructure, and practices relating to the Arctic from January 2023, and will not renew existing contracts for such projects from July 2023.

The new policy presents some major breakthroughs: Swiss Re is the first major oil and gas insurer to rule out support for almost all new oil and gas projects. More importantly, it plans to phase out support for any oil and gas companies without credible net-zero plans by 2030.

The new policy presents some major breakthroughs: Swiss Re is the first major oil and gas insurer to rule out support for almost all new oil and gas projects. More importantly, it plans to phase out support for any oil and gas companies without credible net-zero plans by 2030.

Ending exposure to fossil fuels is seen as a sign of forward-looking management. As @MoodysInvSvc has found it also reduces the risk that insurers have to pay out massive damages for climate lawsuits against fossil fuel companies. bit.ly/3khIV3M

Ending exposure to fossil fuels is seen as a sign of forward-looking management. As @MoodysInvSvc has found it also reduces the risk that insurers have to pay out massive damages for climate lawsuits against fossil fuel companies. bit.ly/3khIV3M

The IEA finds that reducing carbon emissions to net zero calls for “a complete transformation of how we produce, transport and consume energy”. This transformation will create 30 million jobs and result in at least 2 million fewer premature deaths per year from air pollution.

The IEA finds that reducing carbon emissions to net zero calls for “a complete transformation of how we produce, transport and consume energy”. This transformation will create 30 million jobs and result in at least 2 million fewer premature deaths per year from air pollution.

👍Since 2017, 23 major insurers have stopped insuring coal projects. Premiums for coal companies have gone up by up to 40% this year, and “businesses with exposure to coal are being punished as many insurers withdraw their support”, an insurance broker warns.

👍Since 2017, 23 major insurers have stopped insuring coal projects. Premiums for coal companies have gone up by up to 40% this year, and “businesses with exposure to coal are being punished as many insurers withdraw their support”, an insurance broker warns.

The world’s biggest oil and gas insurers are @AIGinsurance, @Travelers, @Zurich and @LloydsofLondon, a new #InsureOurFuture report reveals. (2/8) unfriendcoal.com/insurers-must-…

The world’s biggest oil and gas insurers are @AIGinsurance, @Travelers, @Zurich and @LloydsofLondon, a new #InsureOurFuture report reveals. (2/8) unfriendcoal.com/insurers-must-…