1/19 The @osmosiszone "Master Plan"

Liquidity 🔁 Connectivity 🔁 Security

A breakdown of the past, present and future for the Liquidity Hub of the #Cosmos. 🧵👇

Liquidity 🔁 Connectivity 🔁 Security

A breakdown of the past, present and future for the Liquidity Hub of the #Cosmos. 🧵👇

2/19 In order to help explain the Master Plan, we need to understand what @osmosiszone is.

Osmosis is a Layer 1 on the Cosmos.

Built on it, is the Osmosis DEX, an interchain DEX which allows users to:

👉Swap IBC enabled tokens

👉Provide Liquidity to Yield Farm

Osmosis is a Layer 1 on the Cosmos.

Built on it, is the Osmosis DEX, an interchain DEX which allows users to:

👉Swap IBC enabled tokens

👉Provide Liquidity to Yield Farm

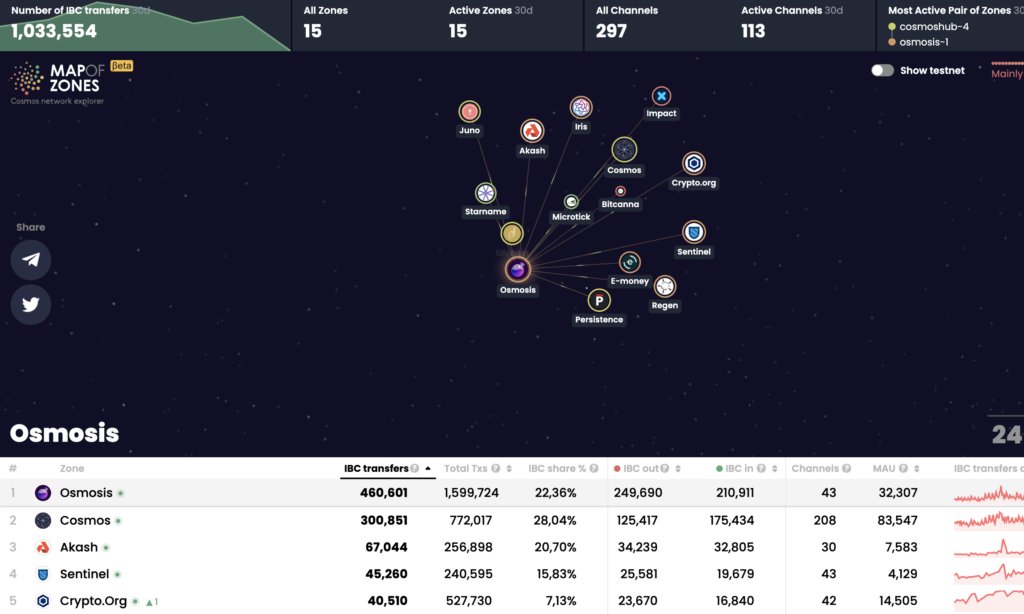

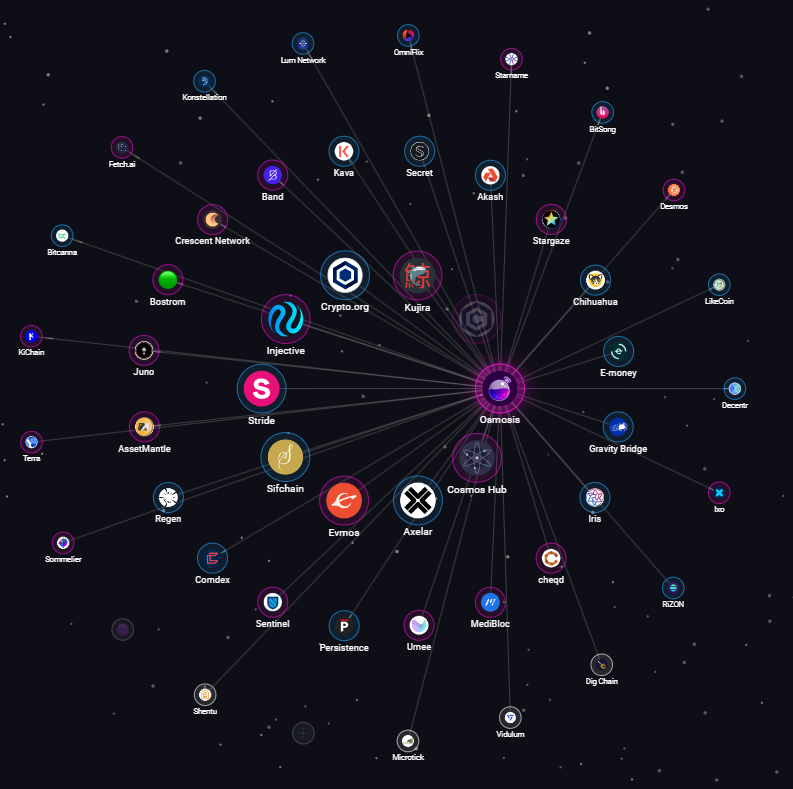

3/19 @osmosiszone is the Liquidity Hub of the Cosmos

✔$201M in TVL

✔$384M in IBC Volume

✔47 IBC connections

✔139,260 Monthly Users

✔$201M in TVL

✔$384M in IBC Volume

✔47 IBC connections

✔139,260 Monthly Users

4/19 It is this position in the ecosystem which will enable the @osmosiszone Master Plan

Liquidity 🔁 Connectivity 🔁 Security

Let's break down each of the components and put the pieces together.

Liquidity 🔁 Connectivity 🔁 Security

Let's break down each of the components and put the pieces together.

5/19 1️⃣Proof of Stake

Osmosis is Layer-1, Proof-of-Stake (PoS) blockchain built using the Cosmos SDK.

The $OSMO token serves 3 purposes

👉pay fees

👉make governance changes

👉Secure the Chain

It holds the heaviest Economic value on chain.

Osmosis is Layer-1, Proof-of-Stake (PoS) blockchain built using the Cosmos SDK.

The $OSMO token serves 3 purposes

👉pay fees

👉make governance changes

👉Secure the Chain

It holds the heaviest Economic value on chain.

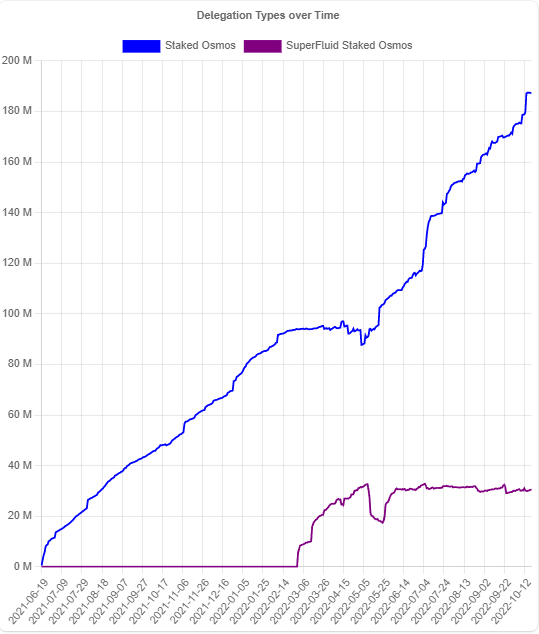

6/19 46% of all $OSMO tokens are staked securing the network.

It is important to make the distinction of @osmosiszone not only allows users to stake their tokens but also enabled

"Superfluid Staking"

It is important to make the distinction of @osmosiszone not only allows users to stake their tokens but also enabled

"Superfluid Staking"

7/19 What is Superfluid Staking? An evolution of the POS staking model of securing the network.

@osmosiszone enables Liquidity Providers the ability secure the chain with the $OSMO in these pools.

The result?

✔More Security for the Network

✔More Rewards for users

@osmosiszone enables Liquidity Providers the ability secure the chain with the $OSMO in these pools.

The result?

✔More Security for the Network

✔More Rewards for users

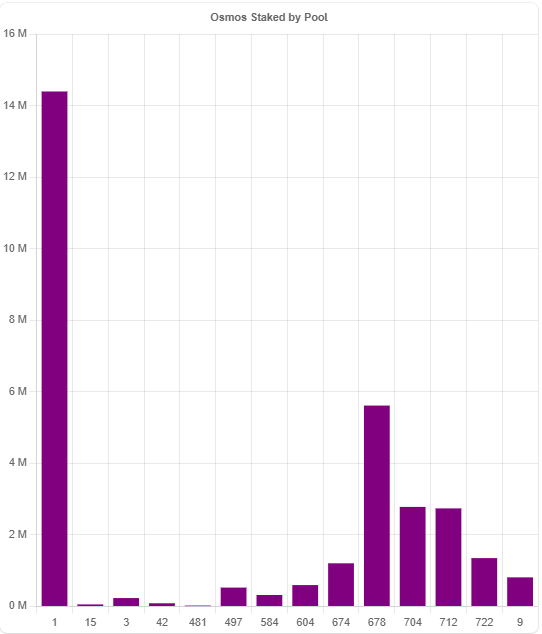

8/19 How successful has Superfluid Staking been?

👉 14 Pools enabled

👉 $30M $OSMO Super Fluid Staked

Bridging DeFi (Liquidity Farming) 🤝 Providing Security (POS)

👉 14 Pools enabled

👉 $30M $OSMO Super Fluid Staked

Bridging DeFi (Liquidity Farming) 🤝 Providing Security (POS)

9/19 2️⃣ DeFi

@osmosiszone is the largest DEX in the Cosmos by TVL

As a result of this deep connection with every IBC enabled chain in the Cosmos, it has been able to birth Cosmos Defi.

In just a year IBC connectivity and liquidity have expanded from this in 2021 👇

@osmosiszone is the largest DEX in the Cosmos by TVL

As a result of this deep connection with every IBC enabled chain in the Cosmos, it has been able to birth Cosmos Defi.

In just a year IBC connectivity and liquidity have expanded from this in 2021 👇

10/19 @osmosiszone has enabled tremendous growth in the Cosmos by introducing the ability developers to design and deploy customized AMMs and Liquidity pairings.

This injection of Liquidity has further solidified Osmosis place in the ecosystem, leveraging an IBC economy.

This injection of Liquidity has further solidified Osmosis place in the ecosystem, leveraging an IBC economy.

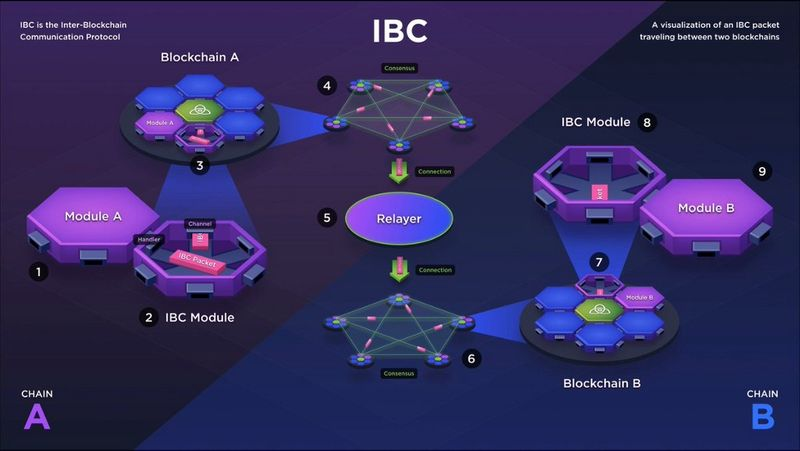

11/19 3️⃣ IBC

In order to create the vision of "The Internet of Blockchains" chains in the #Cosmos are able to communicate via the Inter Blockchain Communication protocol.

The roads paving the first step into a #Mesh of economically tied ecosystems.

In order to create the vision of "The Internet of Blockchains" chains in the #Cosmos are able to communicate via the Inter Blockchain Communication protocol.

The roads paving the first step into a #Mesh of economically tied ecosystems.

12/19 This IBC economy sprouted from the deep liquidity on @osmosiszone has paved the way for:

"Interchain Defi"

Enables the Cosmos to leverage liquidity already on Osmosis to connect via BC.

👉Imagine having $JUNO on a Margin Loan on Osmosis thanks to Interchain Accounts.

"Interchain Defi"

Enables the Cosmos to leverage liquidity already on Osmosis to connect via BC.

👉Imagine having $JUNO on a Margin Loan on Osmosis thanks to Interchain Accounts.

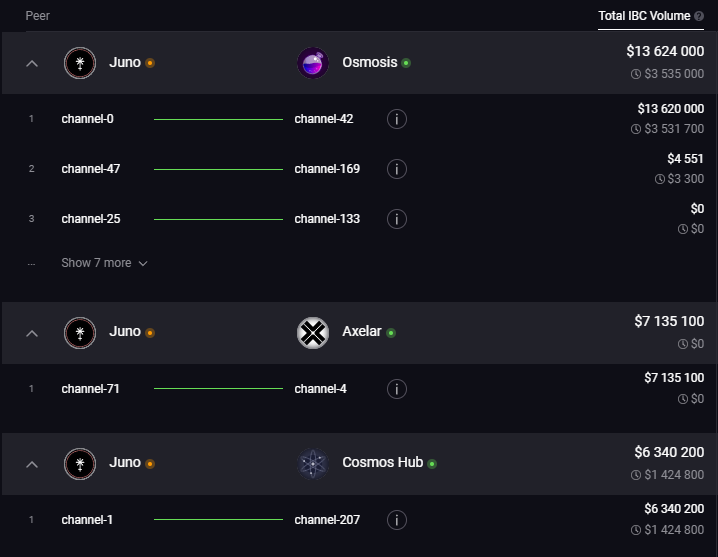

13/19 Making it possible for Ecosystems without similar goals to maintain DEEP connections.

@osmosiszone with the goal of being the Hub of liquidity across the cosmos

@JunoNetwork the hub of permissionless crosschain smart contracts.

👉Connected by Economic Interdependencies

@osmosiszone with the goal of being the Hub of liquidity across the cosmos

@JunoNetwork the hub of permissionless crosschain smart contracts.

👉Connected by Economic Interdependencies

14/19 IBC as a #Mesh of Communication secured by Proof of Stake chains.

All which are:

✅Economic Interdependent

✅Sovereign

✅Securing their Sovereignty

All which are:

✅Economic Interdependent

✅Sovereign

✅Securing their Sovereignty

15/19 #MeshSecurity leverages the Economic interdependencies amplified by IBC and Proof of stake networks.

In doing so, this bilateral model of security is economically viable.

$ATOM can secure $OSMO which can secure $JUNO and vice versa.

In doing so, this bilateral model of security is economically viable.

$ATOM can secure $OSMO which can secure $JUNO and vice versa.

16/19 A full breakdown by @JakeHartnell on the importance of #MeshSecurity to the #Comos can be found below.

https://twitter.com/JakeHartnell/status/1582067692525142016

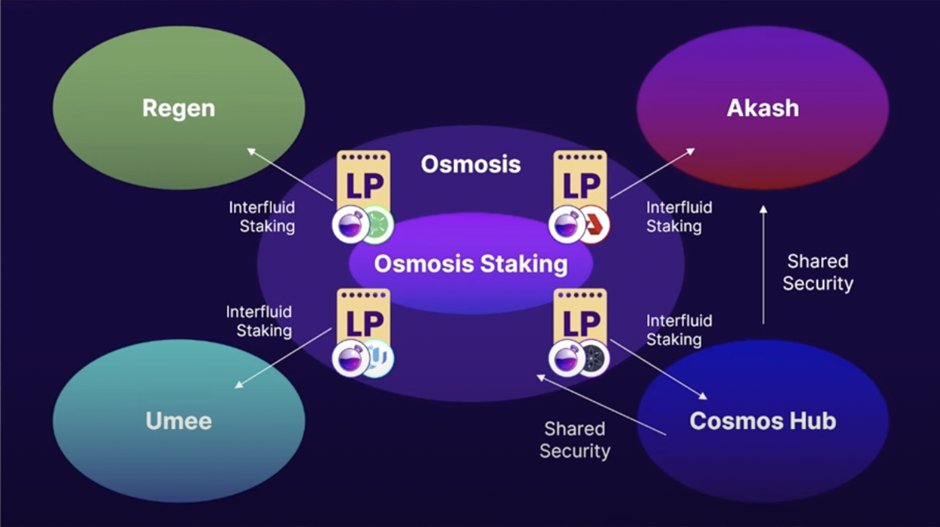

17/19 4️⃣ Interfluid Staking

✅ Defi enabled it

✅ IBC connected it

✅ Proof of Stake Secured it

Interfluid Staking combines all 3 aspects.

✅ Defi enabled it

✅ IBC connected it

✅ Proof of Stake Secured it

Interfluid Staking combines all 3 aspects.

18/19 Enabling @osmosiszone users to provide liquidity through various liquidity farms.

Superfluid Staking offered $OSMO holders security

Interfluid Staking will offer the #Cosmos security through the expansion of liquidity.

Superfluid Staking offered $OSMO holders security

Interfluid Staking will offer the #Cosmos security through the expansion of liquidity.

19/19 The @osmosiszone Master Plan

Liquidity 🔁 Connectivity 🔁 Security

⏬ More Chains Providing Liquidity to Osmosis

⏬ More Assets on Osmosis

⏬ More Security for the Cosmos

The Fly Wheel of Liquidity to benefit the Cosmos.

Liquidity 🔁 Connectivity 🔁 Security

⏬ More Chains Providing Liquidity to Osmosis

⏬ More Assets on Osmosis

⏬ More Security for the Cosmos

The Fly Wheel of Liquidity to benefit the Cosmos.

20/20 Thank you for reading!

I hope you've found this thread helpful:

Follow me @Flowslikeosmo for more.

Retweet the first tweet below 👇

I hope you've found this thread helpful:

Follow me @Flowslikeosmo for more.

Retweet the first tweet below 👇

https://twitter.com/Flowslikeosmo/status/1583261806507675649

• • •

Missing some Tweet in this thread? You can try to

force a refresh