About -

Harsha Engineers International Ltd (HEIL), incorporated in 2010, is the largest manufacturer of precision bearing cages, in organised sector in India in terms of capacity & operations and amongst the leading manufacturers of precision bearing cages in the world.

Harsha Engineers International Ltd (HEIL), incorporated in 2010, is the largest manufacturer of precision bearing cages, in organised sector in India in terms of capacity & operations and amongst the leading manufacturers of precision bearing cages in the world.

It manufactures brass, steel & polyamide cages & stamped components with production facilities in Asia (India & China) & Europe (Romania).

It has market share of approximately 5-6% in the organized segment of the global brass, steel, polyamide bearing cages in terms of revenue.

It has market share of approximately 5-6% in the organized segment of the global brass, steel, polyamide bearing cages in terms of revenue.

Presence -

Harsha supply products to customers in over 25 countries covering 5 continents i.e. North America, Europe, Asia, South America & Africa.

Harsha supply products to customers in over 25 countries covering 5 continents i.e. North America, Europe, Asia, South America & Africa.

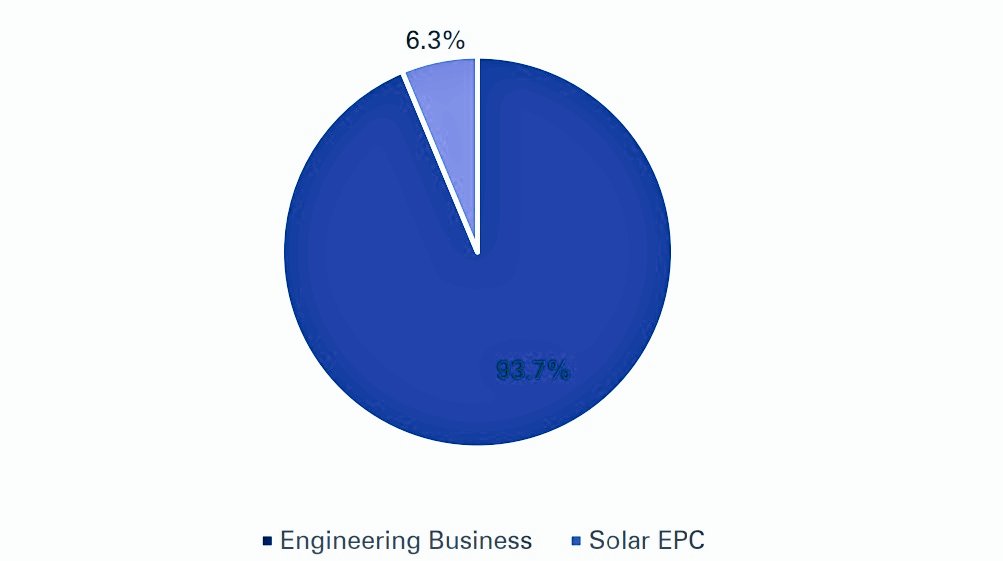

Revenue Breakup -

Harsha earns 93.7% of revenues from the Engineering Business & the rest 6.3% comes from Solar EPC Business.

Harsha earns 93.7% of revenues from the Engineering Business & the rest 6.3% comes from Solar EPC Business.

▪️Engineering Business:

The company has 50-60% market share in organised segment of the Indian bearing cages market & 6.5% market share in the global organised bearing cages market for brass, steel & polyamide cages.

The company has 50-60% market share in organised segment of the Indian bearing cages market & 6.5% market share in the global organised bearing cages market for brass, steel & polyamide cages.

▪️Solar EPC Business:

EPC service provider in the solar photovoltaic industry & also

provides operations and maintenance services in the solar sector. Harsha has over 10yrs of operating history in the solar EPC business.

EPC service provider in the solar photovoltaic industry & also

provides operations and maintenance services in the solar sector. Harsha has over 10yrs of operating history in the solar EPC business.

Manufacturing Capabilities -

HEIL has 4 strategically located manufacturing facilities for engineering

business one of the principal mfg facilities 2 near Ahmedabad in Gujarat, 1 mfg unit each at China & in Romania.

HEIL has 4 strategically located manufacturing facilities for engineering

business one of the principal mfg facilities 2 near Ahmedabad in Gujarat, 1 mfg unit each at China & in Romania.

Presence in these strategic locations helps the company to penetrate global markets more efficiently, in a cost

effective manner & allows better access to customers.

To meet ‘just in time’ requirements of the customers, they have entered into arrangements to stock inventory in

effective manner & allows better access to customers.

To meet ‘just in time’ requirements of the customers, they have entered into arrangements to stock inventory in

warehouses spread across more than 20 locations across the world including in Europe, US, China and South America.

Their multinational presence has also allowed them to diversify their revenue geographically.

Their multinational presence has also allowed them to diversify their revenue geographically.

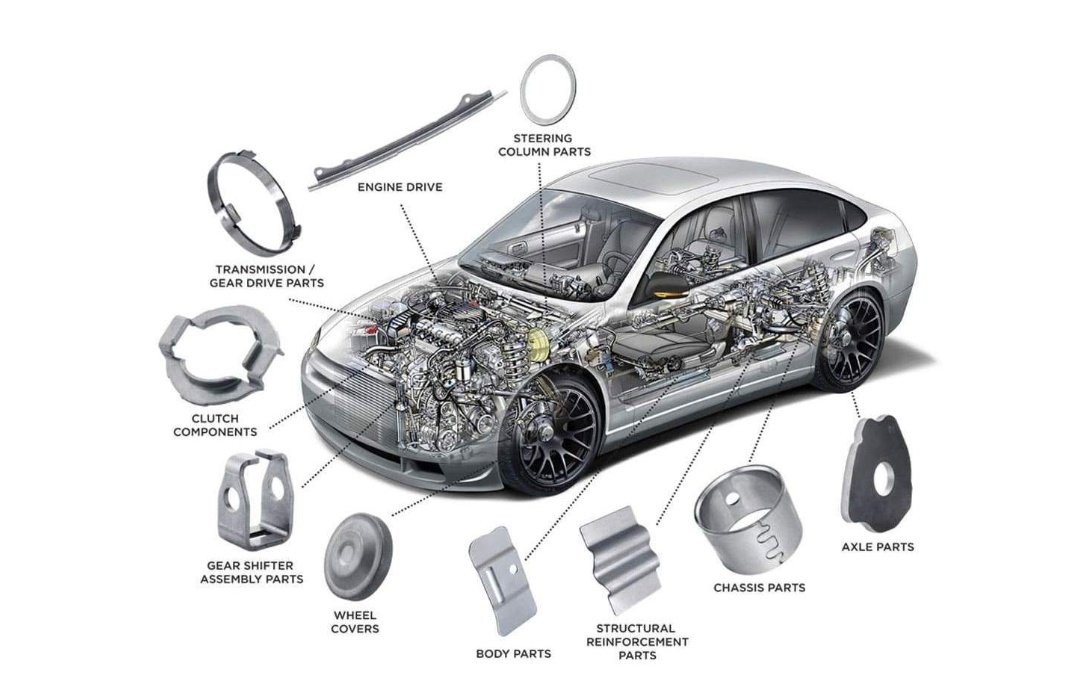

Product -

Bearing cage category comprises roller cages & ball bearing cages. HEIL primarily

manufactures bearing cages out of brass, steel and polyamide.

Bearing cage category comprises roller cages & ball bearing cages. HEIL primarily

manufactures bearing cages out of brass, steel and polyamide.

▪️Steel cages:

HEIL offers various grades of steel cages as per the requirements of its

customers. Owing to the lightweight nature, frictionless wear & high strength, such steel cages are widely in demand. HEIL manufactures more than 3,700 types of steel cages.

HEIL offers various grades of steel cages as per the requirements of its

customers. Owing to the lightweight nature, frictionless wear & high strength, such steel cages are widely in demand. HEIL manufactures more than 3,700 types of steel cages.

▪️Brass Cages:

It has salient characteristics of high rigidity, high strength & is suitable for high temperature operation conditions. HEIL produces more than 3500 types of brass cages.

It has salient characteristics of high rigidity, high strength & is suitable for high temperature operation conditions. HEIL produces more than 3500 types of brass cages.

▪️Polyamide Cages:

HEIL offers injection moulded polyamide cages. Features of such cages include being corrosion resistant & light in weight owing to presence of high polymers materials. HEIL manufactures more than 80 types of polyamide cages.

HEIL offers injection moulded polyamide cages. Features of such cages include being corrosion resistant & light in weight owing to presence of high polymers materials. HEIL manufactures more than 80 types of polyamide cages.

▪️Stamped Components:

In recent years, automotive & industrial stamping has emerged as a key market segment, wherein Harsha provides metal stamping solutions ranging from simple to complex designs and geometries.

In recent years, automotive & industrial stamping has emerged as a key market segment, wherein Harsha provides metal stamping solutions ranging from simple to complex designs and geometries.

Another business segment of Harsha is Solar EPC Business

Provide services to solar photovoltaic industry & also provides operations & maintenance services in the solar sector.

Provide services to solar photovoltaic industry & also provides operations & maintenance services in the solar sector.

Harsha has in-house design,

engineering, procurement, project management & O&M team which has a combined experience of installing at least 500MW & more than 60MW commissioning experience in roof top.

engineering, procurement, project management & O&M team which has a combined experience of installing at least 500MW & more than 60MW commissioning experience in roof top.

Industry Overview -

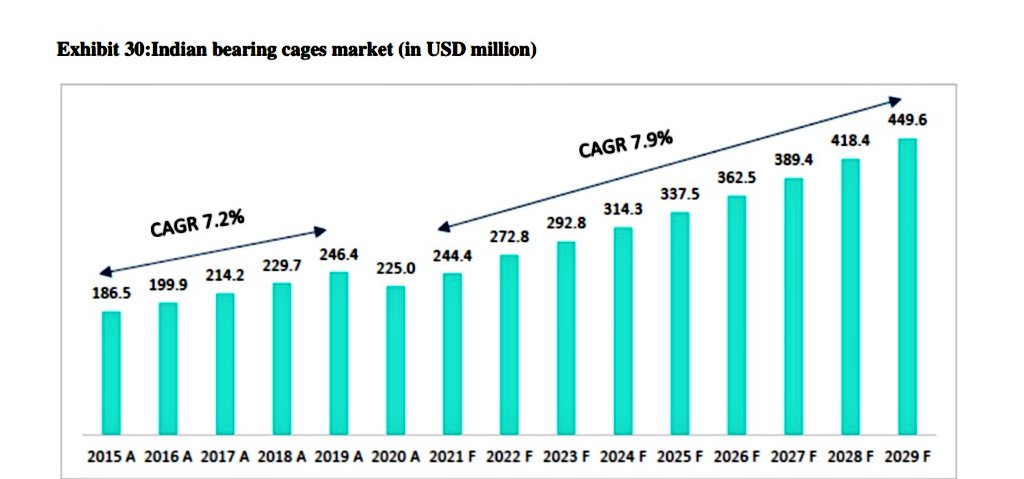

▪️Bearing Cages Market:

In terms of revenue, the bearing cages market in 🇮🇳 accounted for about 5% share of the global bearings market in 2021.

The Indian bearing cages market was at $186.5 Million in 2015 & grew at 7.2% CAGR in 2015-19.

▪️Bearing Cages Market:

In terms of revenue, the bearing cages market in 🇮🇳 accounted for about 5% share of the global bearings market in 2021.

The Indian bearing cages market was at $186.5 Million in 2015 & grew at 7.2% CAGR in 2015-19.

Expected growth in usage of bearings in applications such as mining, auto, heavy machinery, infra, etc, is forecast to drive demand.

🇮🇳 bearing cages market is expected to grow at CAGR

of 8.3% among countries within Asia Pacific region in 2021-29 & est. to valued at $516Million.

🇮🇳 bearing cages market is expected to grow at CAGR

of 8.3% among countries within Asia Pacific region in 2021-29 & est. to valued at $516Million.

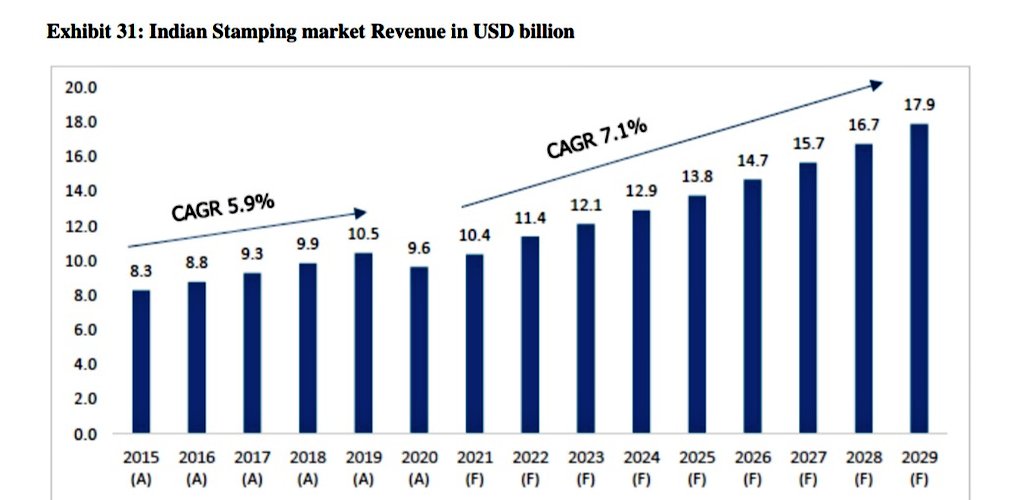

▪️Stamping Market:

The Indian stampings market grew at 5.9% CAGR between 2015-19 & was valued at $11.4 Bill in 2019. It is forecast to grow at 7.4% CAGR in 2021-29 to reach $20 Bill by 2029.

Within the Asia Pacific region, India is one of the fastest growing regions.

The Indian stampings market grew at 5.9% CAGR between 2015-19 & was valued at $11.4 Bill in 2019. It is forecast to grow at 7.4% CAGR in 2021-29 to reach $20 Bill by 2029.

Within the Asia Pacific region, India is one of the fastest growing regions.

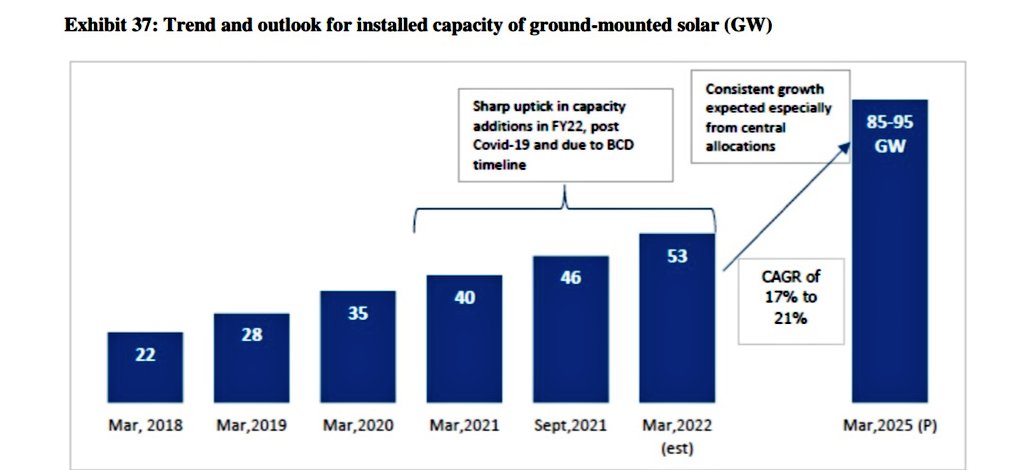

▪️Overview of Solar Industry:

Approx 5,000 trillion kWh of energy is incident over India’s geographical area each year. Solar photovoltaic electricity can be successfully harvested, allowing for massive scalability in India.

Approx 5,000 trillion kWh of energy is incident over India’s geographical area each year. Solar photovoltaic electricity can be successfully harvested, allowing for massive scalability in India.

India's Solar Energy Sector has emerged as a key participant in grid-connected

power generation capacity. It contributes to the government's objective of sustainable growth while emerging as a

key anchor in meeting the nation's energy demands and ensuring energy security.

power generation capacity. It contributes to the government's objective of sustainable growth while emerging as a

key anchor in meeting the nation's energy demands and ensuring energy security.

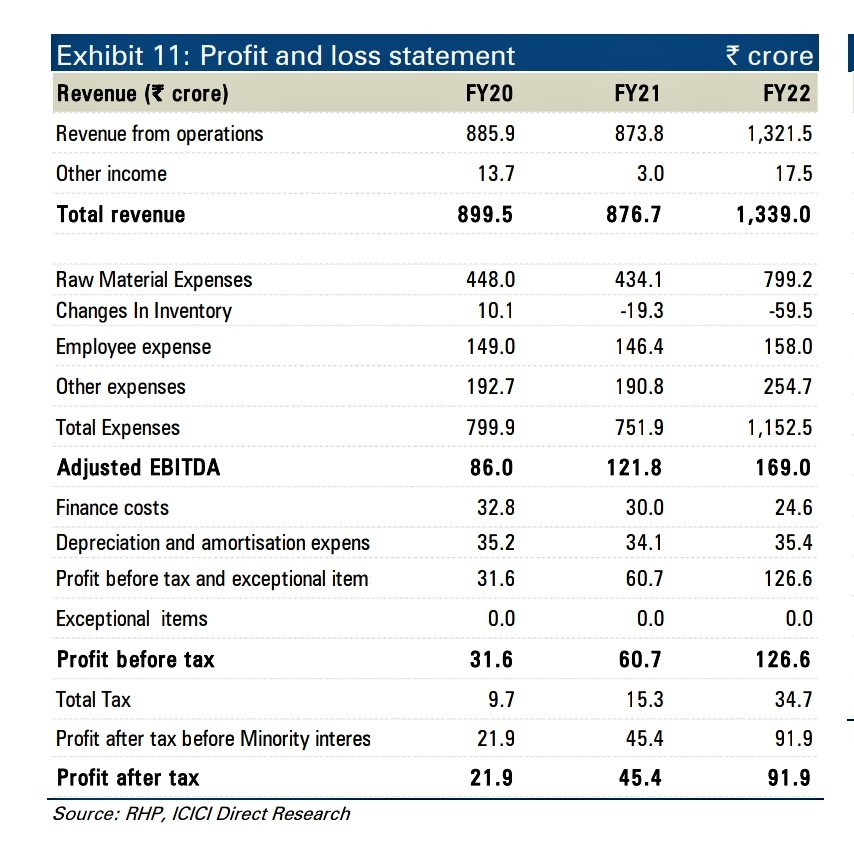

Financial Summary -

During FY20-22, HEIL registered CAGR Revenue,

EBITDA & PAT growth of 22.1%, 40.2% & 104.9%, respectively.

Looking at the current economic scenario & demand in bearing space it's expected to perform on similar lines.

During FY20-22, HEIL registered CAGR Revenue,

EBITDA & PAT growth of 22.1%, 40.2% & 104.9%, respectively.

Looking at the current economic scenario & demand in bearing space it's expected to perform on similar lines.

Key risks -

🛑Limited customers groups for a significant portion of its revenue from engineering business, loss of any major customer groups due to any adverse development/significant reduction in business from major customer groups may adversely affect its business.

🛑Limited customers groups for a significant portion of its revenue from engineering business, loss of any major customer groups due to any adverse development/significant reduction in business from major customer groups may adversely affect its business.

🛑Majority of revenue from operations is contributed by engineering business. Inability to successfully diversify product offerings of engineering business may adversely affect growth, negatively impact profitability.

🛑 Around 38% of Harsha's revenue comes from Europe, which is undergoing several issues at the moment due to high energy costs and facing a recessionary environment. Any kind of degrowth in the bearing industry in Europe may impact the business of the company.

Conclusion -

In recent years, manufacturers have started outsourcing of bearing components from emerging regions due to low cost manufacturing advantage. This is likely to positively impact the bearing cages manufacturers.

In recent years, manufacturers have started outsourcing of bearing components from emerging regions due to low cost manufacturing advantage. This is likely to positively impact the bearing cages manufacturers.

While China is considered as global mfg. hub, recent industry developments such as US China trade war & global outbreak of COVID led to manufacturers setting up manufacturing units in regions other than China to emerging economies like India.

Please 🙏 like 👍,comment, retweet ♻️ if you find this 🧵 useful.

And follow us on @LnprCapital for more information like this.

@Jitendra_stock @NeerajCNBC @nid_rockz @sahil_vi @varinder_bansal

And follow us on @LnprCapital for more information like this.

@Jitendra_stock @NeerajCNBC @nid_rockz @sahil_vi @varinder_bansal

• • •

Missing some Tweet in this thread? You can try to

force a refresh