If you invest, you MUST learn how to read SEC filings.

Here are the 10 most useful filings, how to find them, and what they tell you:

Here are the 10 most useful filings, how to find them, and what they tell you:

1/ Filing: 10-K

The #1 go-to document to learn about a company.

Key insights:

▪️Business Overview

▪️All 3 financial statements compared to previous years

▪️Management’s discussion & analysis of the financials

▪️Risks

Here's $MDB latest 10K.

The #1 go-to document to learn about a company.

Key insights:

▪️Business Overview

▪️All 3 financial statements compared to previous years

▪️Management’s discussion & analysis of the financials

▪️Risks

Here's $MDB latest 10K.

2/ Filing: 10-Q

The backup quarterback to the 10-K. A decent go-to when a 10-K isn't available or is several quarters old.

Key insights:

▪️Income Statement

▪️Balance Sheet

▪️Cash Flow Statement

▪️Management’s discussion & analysis

▪️Notes

$MDB's latest 10-Q:

The backup quarterback to the 10-K. A decent go-to when a 10-K isn't available or is several quarters old.

Key insights:

▪️Income Statement

▪️Balance Sheet

▪️Cash Flow Statement

▪️Management’s discussion & analysis

▪️Notes

$MDB's latest 10-Q:

3/ Filing: 8-K

An important "news brief" for investors.

Key insights: Details on a “material event” such as:

▪️Acquisition

▪️Delisting

▪️Management change

▪️Public event

Here’s the 8-K when $TWLO announced its recent layoff / restructuring plan.

An important "news brief" for investors.

Key insights: Details on a “material event” such as:

▪️Acquisition

▪️Delisting

▪️Management change

▪️Public event

Here’s the 8-K when $TWLO announced its recent layoff / restructuring plan.

4/ Filing: S-1, S-1A

An information-packed document released prior to going public.

Key insights:

▪️Business Description

▪️Growth strategy

▪️Pre-IPO financials

▪️Management’s discussion

▪️Use of proceeds

▪️Biggest shareholders

▪️Risks

Here’s $LMND's S-1 table of contents

An information-packed document released prior to going public.

Key insights:

▪️Business Description

▪️Growth strategy

▪️Pre-IPO financials

▪️Management’s discussion

▪️Use of proceeds

▪️Biggest shareholders

▪️Risks

Here’s $LMND's S-1 table of contents

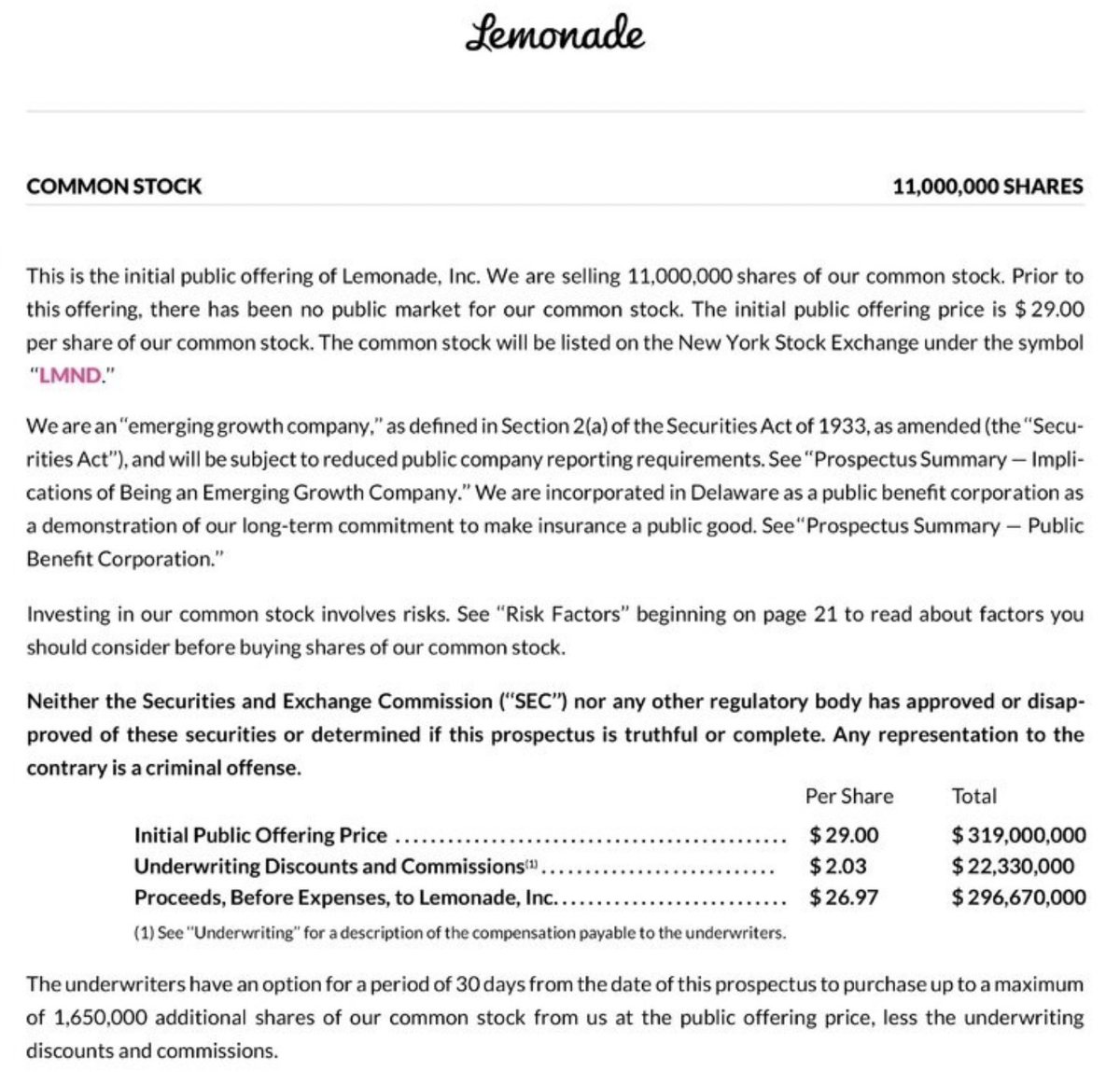

5/ Filing: 424B4, 424B7

Update on the S1 AFTER a company comes public

Key insights:

▪️How many shares were sold

▪️IPO Pricing

▪️Post-IPO balance sheet

Here’s how much $LMND raised from its IPO

Update on the S1 AFTER a company comes public

Key insights:

▪️How many shares were sold

▪️IPO Pricing

▪️Post-IPO balance sheet

Here’s how much $LMND raised from its IPO

6/ Filing: S-4, Form 425

Merge/Acquisition details

Key insights:

▪️Terms of the acquisition

▪️Risks

▪️Pro-forma financial information (what the company’s financials would look like when combined)

Here's Lemonade's and MetroMile's combined assets from its S-4.

Merge/Acquisition details

Key insights:

▪️Terms of the acquisition

▪️Risks

▪️Pro-forma financial information (what the company’s financials would look like when combined)

Here's Lemonade's and MetroMile's combined assets from its S-4.

7/ Filing: DEF 14A (Proxy Statement)

Annual meeting information

Key insights:

▪️Items of vote for shareholders

▪️Executive compensation

▪️Inside Ownership of management/board

Here’s $DDOG's top shareholders from its DEF 14A. (note co-founder's skin in the game!)

Annual meeting information

Key insights:

▪️Items of vote for shareholders

▪️Executive compensation

▪️Inside Ownership of management/board

Here’s $DDOG's top shareholders from its DEF 14A. (note co-founder's skin in the game!)

8/ Filing: SC-13G (Schedule 13G), SC-13D (Schedule 13D)

What: A person/group now owns more than 5% of the company’s stock

Key Information:

▪️Buyer name & ownership stake

Below is the 13D where Elon Musk disclosed his 9.2% position in $TWTR in March 2022.

What: A person/group now owns more than 5% of the company’s stock

Key Information:

▪️Buyer name & ownership stake

Below is the 13D where Elon Musk disclosed his 9.2% position in $TWTR in March 2022.

9/ Filing: Form 3, Form 4, Form 5

Insider ownership updates

Who:

▪️Management

▪️Board members

▪️An outside investor owns 10%+ of the company

Form 3 - Initial reporting

Form 4 - Change in ownership

Form 5 - Annual ownership statement

Insider ownership updates

Who:

▪️Management

▪️Board members

▪️An outside investor owns 10%+ of the company

Form 3 - Initial reporting

Form 4 - Change in ownership

Form 5 - Annual ownership statement

10a/ Foreign company SEC filings:

F-1 ➡️ Foreign IPO Prospectus (Like an S1)

20-F ➡️ Annual report (Like a 10k)

40-F ➡️ Annual report (Canadian company 10k)

6-k ➡️ Quarterly report, important Press release

F-1 ➡️ Foreign IPO Prospectus (Like an S1)

20-F ➡️ Annual report (Like a 10k)

40-F ➡️ Annual report (Canadian company 10k)

6-k ➡️ Quarterly report, important Press release

10b/ SPAC SEC filings

8-K ➡️ Merger details finalized

424b3 ➡️ Post SPAC registration info

S-4 ➡️ Additional details and financial info

Form 425 ➡️ Tweets, interviews

8-K ➡️ Merger details finalized

424b3 ➡️ Post SPAC registration info

S-4 ➡️ Additional details and financial info

Form 425 ➡️ Tweets, interviews

To find this information, either visit:

1️⃣ SEC EDGAR database (sec.gov/edgar/searched…)

2️⃣ or the company’s investor relations page

For EDGAR: click the link above, type in a stock symbol in the search, then click to bring up the statements you want:

1️⃣ SEC EDGAR database (sec.gov/edgar/searched…)

2️⃣ or the company’s investor relations page

For EDGAR: click the link above, type in a stock symbol in the search, then click to bring up the statements you want:

You'll also LOVE the free newsletter from The Brians

Each Wednesday, we share:

▪️ One simple graphic

▪️ One piece of timeless content

▪️ One Twitter thread

▪️ One resource

▪️ One quote

Interested? Join 40,000+ others:

getrevue.co/profile/stocks…

Each Wednesday, we share:

▪️ One simple graphic

▪️ One piece of timeless content

▪️ One Twitter thread

▪️ One resource

▪️ One quote

Interested? Join 40,000+ others:

getrevue.co/profile/stocks…

In summary; here's my go-to SEC reports:

1️⃣ 10-K (Annual Report)

2️⃣ DEF 14A (Proxy)

3️⃣ 424B4 (Post-IPO Data & Financials)

H/T to @BrianFeroldi for his cheat sheet and insights for this thread:

1️⃣ 10-K (Annual Report)

2️⃣ DEF 14A (Proxy)

3️⃣ 424B4 (Post-IPO Data & Financials)

H/T to @BrianFeroldi for his cheat sheet and insights for this thread:

• • •

Missing some Tweet in this thread? You can try to

force a refresh