Stock investor since 1998 | I tweet about investing, business, and stocks. Join 90,000+ subscribers:

5 subscribers

How to get URL link on X (Twitter) App

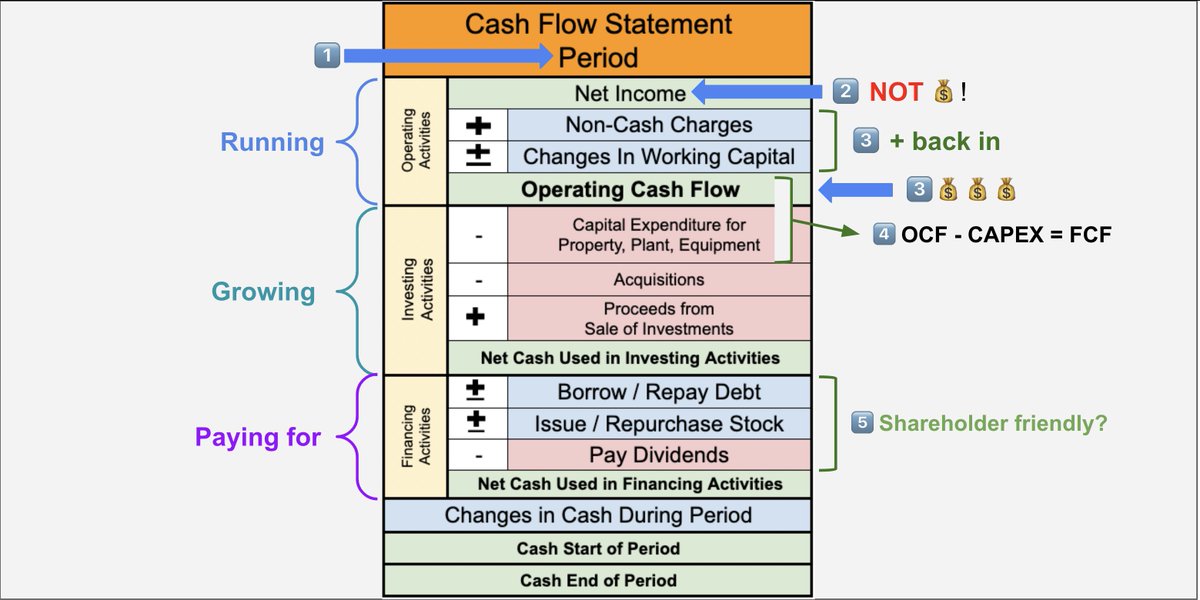

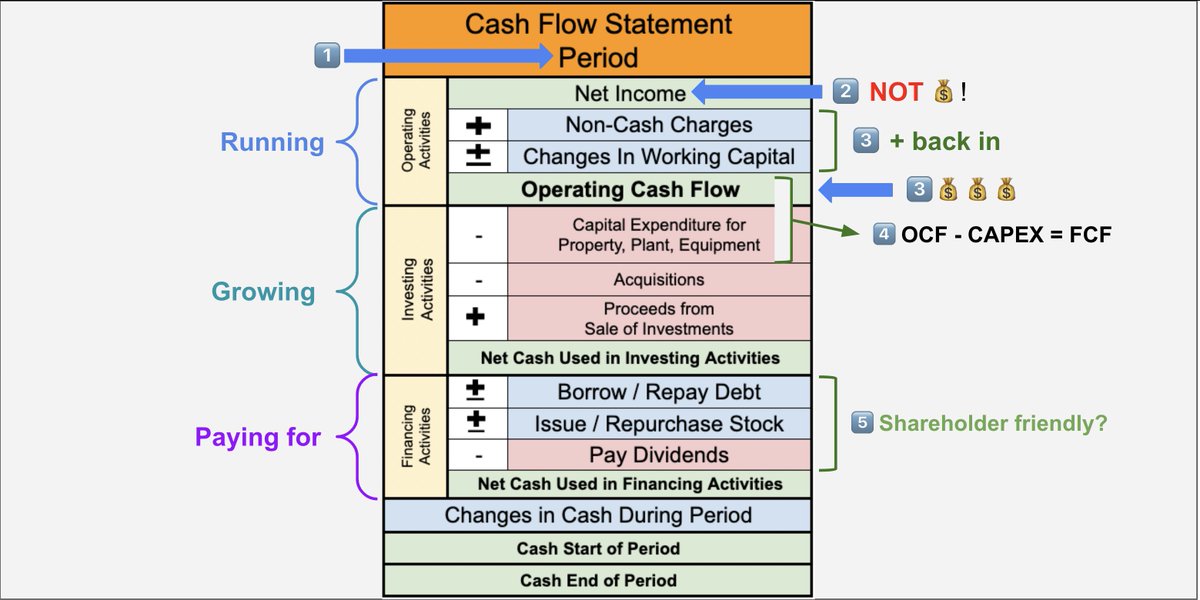

The cash flow statement shows cash moving in and out of a company over specific time periods.

The cash flow statement shows cash moving in and out of a company over specific time periods.

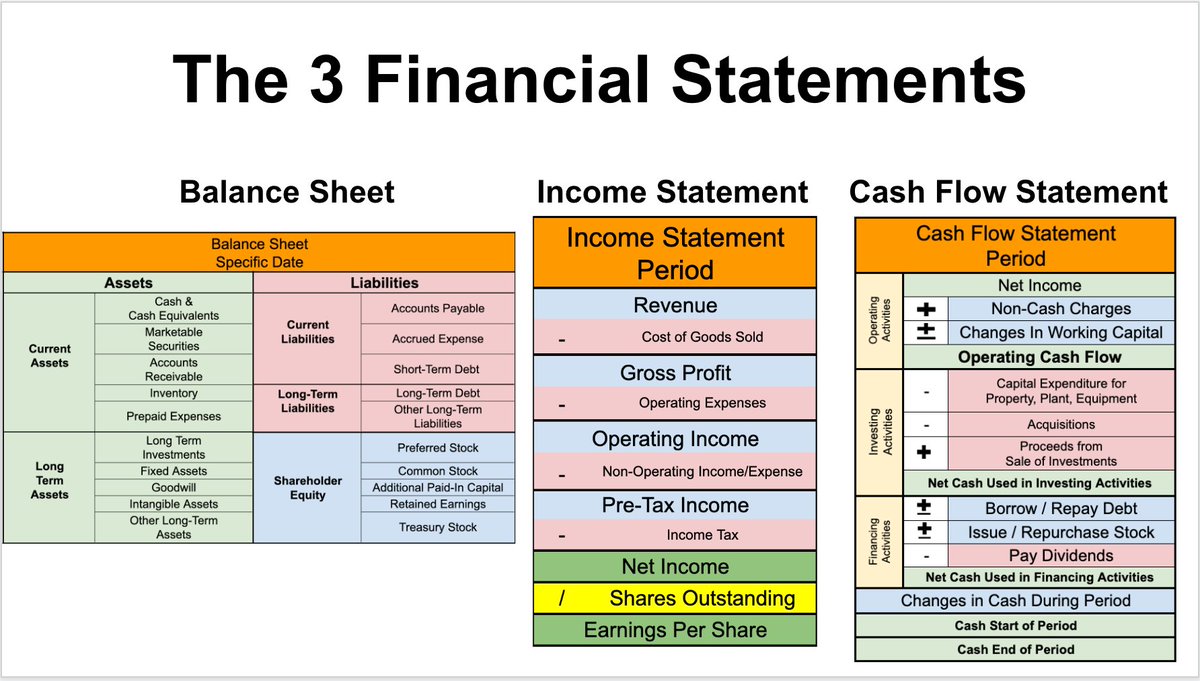

The balance sheet is one of the 3 major financial statements.

The balance sheet is one of the 3 major financial statements.

Every company has 3 financial statements.

Every company has 3 financial statements.

1. $MELI - MercadoLibre

1. $MELI - MercadoLibre