I have been investing in the Stock Markets for over 6 years now,

Apart from direct stocks, Smallcase has been a great WealthTech platform for me.

Backed by strong FinTech e.g. Zerodha, Let’s understand how you can leverage smallcase for Investing this Diwali Muhurat 🧵

Apart from direct stocks, Smallcase has been a great WealthTech platform for me.

Backed by strong FinTech e.g. Zerodha, Let’s understand how you can leverage smallcase for Investing this Diwali Muhurat 🧵

Disclosure - I have been using smallcase for a long time now, subscribed to their Windmill Capital smallcases in May 2022. So far the experience and return both has been good

But before this, let’s understand what is smallcase and how it is different from Mutual Funds?

But before this, let’s understand what is smallcase and how it is different from Mutual Funds?

smallcase is basically curated and tailored baskets of stocks that lets you invest based on idea or strategy in one or more sector

It gives us flexibility to choose from professionally selected stock baskets so we can make better investment decisions.

It lets you buy and sell tradable securities based on predefined combinations.

It lets you buy and sell tradable securities based on predefined combinations.

Given that Gold is one of the most preferred investment choices for Indians.

Equity & Gold smallcase could be an interesting addition to portfolio for Muhurat Investing this Diwali

Equity & Gold smallcase could be an interesting addition to portfolio for Muhurat Investing this Diwali

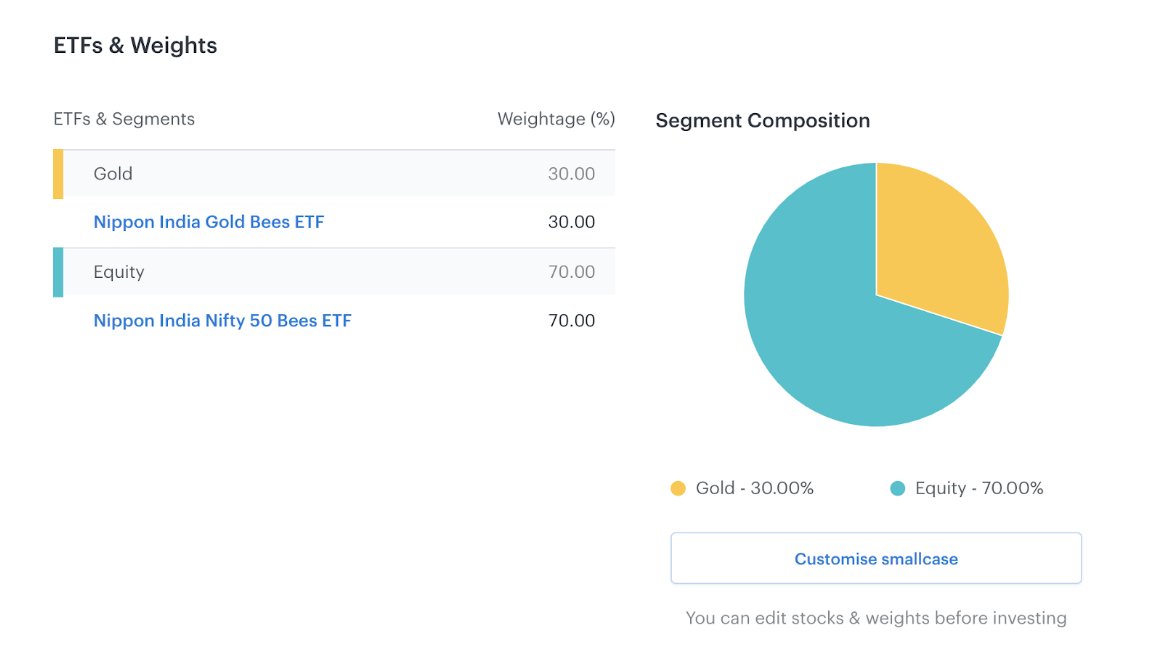

The Equity & Gold Basket is managed by Windmill Capital, it lets you invest in Nippon Nifty50 Bees and Gold Bees ETFs.

An ideal balance between Index Fund and Gold. You can customize it given your choices.

An ideal balance between Index Fund and Gold. You can customize it given your choices.

Here are 3 of my favorite smallcase baskets that you can also check

a) Equity & Gold

b) Top 100 Stocks

c) Value & Momentum by Windmill Capital

a) Equity & Gold

b) Top 100 Stocks

c) Value & Momentum by Windmill Capital

Apart from this, I’m also bullish on the Indian Banking & Small-Cap Sector.

There are a couple of baskets on smallcase that you might find interesting given your risk appetite and investing preferences.

There are a couple of baskets on smallcase that you might find interesting given your risk appetite and investing preferences.

While first-time investors should understand the product and the risks involved, everyone else should consult with a financial advisor before investing or making any decisions. I am sharing this Thread solely for educational purposes and hope this helps many first time investors.

I’m also adding Equity and Gold both to my portfolio this Diwali: link.smallcase.com/HNd6VAbohub

Thanks for reading, appreciate your RT to help me educate more investors so that they can also explore innovative FinTech products.

Thanks for reading, appreciate your RT to help me educate more investors so that they can also explore innovative FinTech products.

Are you a first time investor? How do you plan to start your investing journey this Diwali?

#smallcaseKaMuhurat #collab

#smallcaseKaMuhurat #collab

https://twitter.com/Ravisutanjani/status/1584431178219544576?s=20&t=P9JlMATSIyHNs8yHmC8A8A

• • •

Missing some Tweet in this thread? You can try to

force a refresh