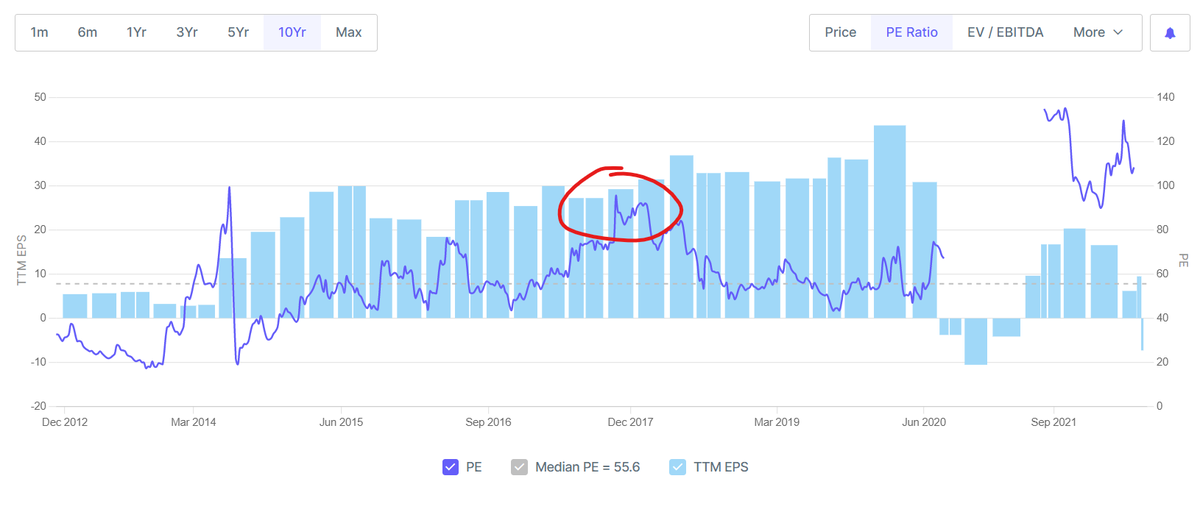

AC was megatrend 5-8 years back with 10% penetration story n high double digit market growth rate like we had platform companies last year, right? Lesson remains same - Never overpay to stories. Even if, do not overexpose mistakes (we all do, quantum is key) #respectvaluation

symphony - of course , it is not as easy as it is, growth, margins n lot of things baked behind these charts

• • •

Missing some Tweet in this thread? You can try to

force a refresh