Holding Companies Simplified

#HoldCo

A detailed thread on Holding Companies 🧵

We’ll break it down into 4 parts:

1. What is a HoldCo

2. Types of HoldCo

3. Should you invest in HoldCo

4. Right time to invest in HoldCo

#HoldCo

A detailed thread on Holding Companies 🧵

We’ll break it down into 4 parts:

1. What is a HoldCo

2. Types of HoldCo

3. Should you invest in HoldCo

4. Right time to invest in HoldCo

To cook a meal one needs to be careful in keeping it over high flame for the right amount of time. Either way, if overcooked or under-cooked, the desired taste is not achieved and the meal is not as satisfying as it should have been.

Similarly, a half baked and hopeful investment will yield poor results. HoldCos are often seen as safe havens or sub par investment instruments by investors, both being at extremes.

Let’s dive in to understand more about HoldCos:-

Let’s dive in to understand more about HoldCos:-

1. What is a HoldCo?

If we look at the definition of a HoldCo, ‘it is the company that holds the promoter shareholding in group companies.

Sometimes promoters of a company maintain their ownership in group companies via HoldCo.

If we look at the definition of a HoldCo, ‘it is the company that holds the promoter shareholding in group companies.

Sometimes promoters of a company maintain their ownership in group companies via HoldCo.

For example, Tata Group’s major holding co Tata Sons. Tata has various business interests and a major HoldCo that houses all the assets of Tata’s is their company Tata Sons

The other possibility of company becoming a HoldCo is when a co makes investment in some other business

The other possibility of company becoming a HoldCo is when a co makes investment in some other business

This activity can make a company that has a business of its own into a HoldCo for various other businesses

Company uses its cash cow business to invest in other industries and resultantly becomes a HoldCo as well. Rel Ind has Jio & Retail built from cash flows of petrochem

Company uses its cash cow business to invest in other industries and resultantly becomes a HoldCo as well. Rel Ind has Jio & Retail built from cash flows of petrochem

2. Types of HoldCos

On broad categorisation there are 2 types of HoldCos:

1⃣ Operational Holding; &

2⃣ Pure Holding

Let’s understand both categories with examples:

On broad categorisation there are 2 types of HoldCos:

1⃣ Operational Holding; &

2⃣ Pure Holding

Let’s understand both categories with examples:

Operational HoldCo: An operational HoldCo is one which has a business of its own, however either through acquisitions or using cash flows from its main business creates more business as separate companies.

This type of HoldCo has substantial stake in the other business entities

This type of HoldCo has substantial stake in the other business entities

Info Edge is a good e.g. of an operational holdco as it had its major business of naukri.com and later invested in startups like Zomato and PolicyBazaar making it a HoldCo of these businesses as well

It has also invested in various other startups at an early stage

It has also invested in various other startups at an early stage

Pure Holding Co: A Pure Holding is a co that has no major business of its own and is a vehicle for maintaining the shareholding of group cos by promoter group

Generally the only source of income for this type of HoldCo is the Dividend it receives from the businesses it owns

Generally the only source of income for this type of HoldCo is the Dividend it receives from the businesses it owns

One classic example of a pure holding co is Bajaj Holdings. It has no operational business of its own and houses shares holding of all major Bajaj Group’s businesses

Generally these kinds of HoldCos trade at a discount to its underlying value of holding in the businesses it own

Generally these kinds of HoldCos trade at a discount to its underlying value of holding in the businesses it own

3. Should you invest in HoldCo?

Most investors who are lured towards investing in holding cos have 3 main reasons:

1⃣ Cheaper Valuations vs Underlying Investment,

2⃣ Hope of discount narrowing going ahead; &

3⃣ Dividend Yield

Most investors who are lured towards investing in holding cos have 3 main reasons:

1⃣ Cheaper Valuations vs Underlying Investment,

2⃣ Hope of discount narrowing going ahead; &

3⃣ Dividend Yield

i) Cheap Valuations: We can see across all major holding companies that the market value which is ascribed to them is at a steep discount to the value of their investment in the group businesses.

Let's see how to calculate discounts in holding companies with various examples.

Let's see how to calculate discounts in holding companies with various examples.

For example, Company A is a HoldCo with 80% stake in Company B.

Value of Company A = ₹200

Total Value of Company B = ₹1000

Discount = (Holding Value of Company B - Value of Company A) / Holding Value of Company B * 100

Discount = (800 - 200) / 800 * 100 = 75%

Value of Company A = ₹200

Total Value of Company B = ₹1000

Discount = (Holding Value of Company B - Value of Company A) / Holding Value of Company B * 100

Discount = (800 - 200) / 800 * 100 = 75%

Let's calculate discount for some live case studies:

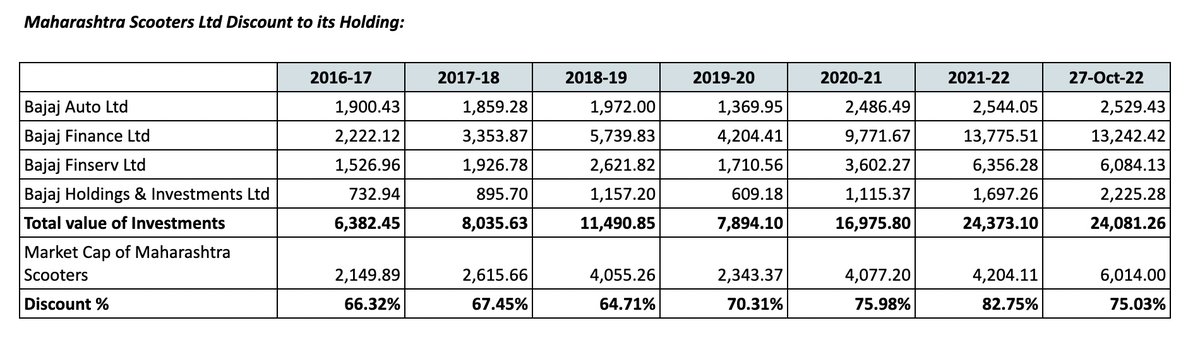

1⃣ Maharashtra Scooters: It holds Investments in Bajaj group cos like Bajaj Auto, Bajaj Finance, Bajaj Finserv, Bajaj Holding & Investment company.

It trades at a discount of ~75% to its holdings in group companies ⏬⏬

1⃣ Maharashtra Scooters: It holds Investments in Bajaj group cos like Bajaj Auto, Bajaj Finance, Bajaj Finserv, Bajaj Holding & Investment company.

It trades at a discount of ~75% to its holdings in group companies ⏬⏬

The next company is also from same Bajaj Group:

2⃣ Bajaj Holding & Investment Ltd: It holds Investments in Bajaj group cos like Bajaj Auto, Bajaj Electricals, Bajaj Finserv and Maharashtra Scooters.

Its discount has narrowed down from 62% to 49% in last few months 👇👇

2⃣ Bajaj Holding & Investment Ltd: It holds Investments in Bajaj group cos like Bajaj Auto, Bajaj Electricals, Bajaj Finserv and Maharashtra Scooters.

Its discount has narrowed down from 62% to 49% in last few months 👇👇

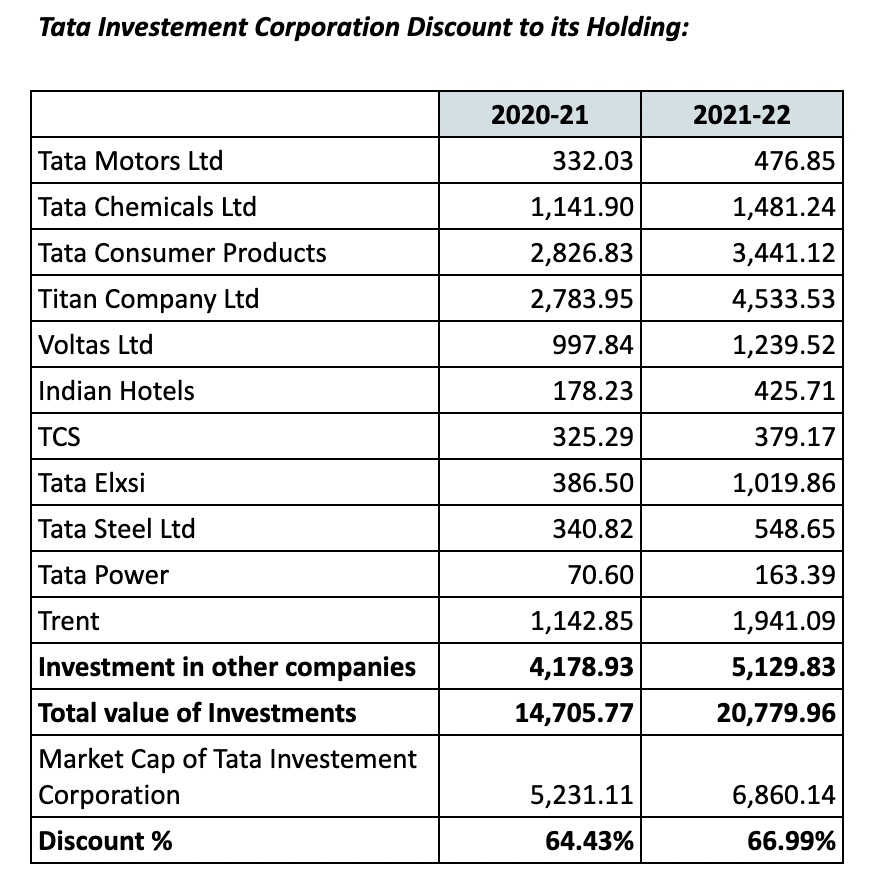

Another company is from House of Tata's which has made investments in more than 80 companies including Tata group companies as well as in other listed companies like Asian Paints, HDFC Bank, M&M, L&T

3⃣Tata Investment Corporation: It is trading at discount of 67% to its holding

3⃣Tata Investment Corporation: It is trading at discount of 67% to its holding

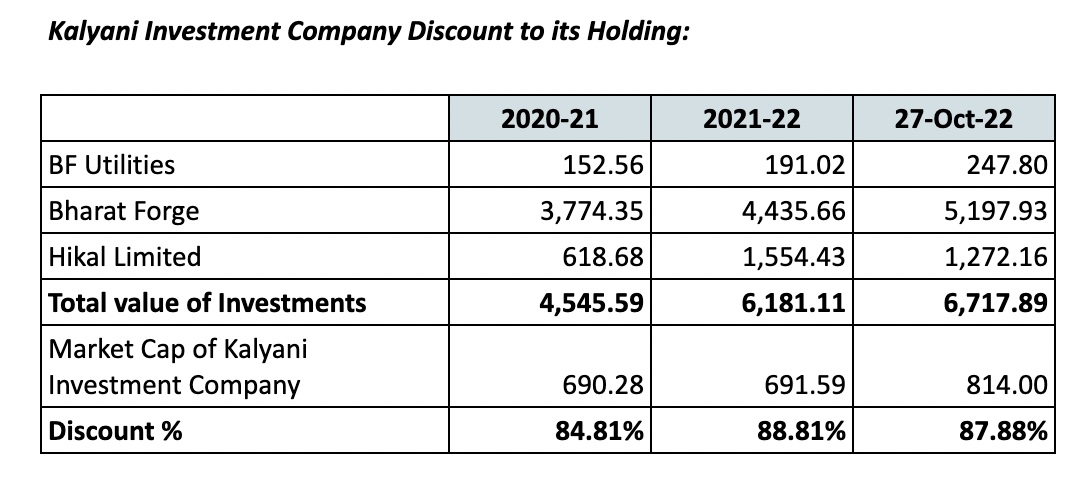

The next company is from Kalyani Group

4⃣ Kalyani Investment Company: It is holding its stake in Bharat Forge and Hikal Ltd. It is currently trading at a discount of ~88% ⏬⏬

4⃣ Kalyani Investment Company: It is holding its stake in Bharat Forge and Hikal Ltd. It is currently trading at a discount of ~88% ⏬⏬

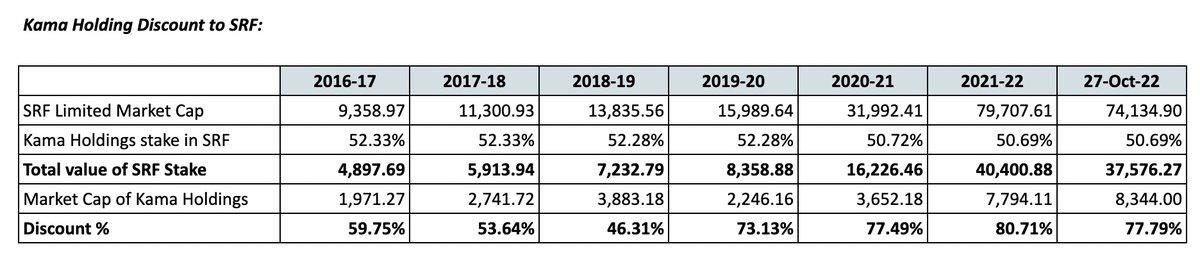

Another company is the holding company of chemical giant SRF Ltd

5⃣Kama Holding: Holding co of SRF Ltd. trades at a discount of ~55-80% at different time periods. It is currently trading at its discount which may either come down eventually or stays at the same level.

5⃣Kama Holding: Holding co of SRF Ltd. trades at a discount of ~55-80% at different time periods. It is currently trading at its discount which may either come down eventually or stays at the same level.

Another reason to invest in holding companies is

ii) Hoping of discount narrowing: Investors feel the degree of discount may narrow in the future and play it as a vehicle to invest in the underlying business. We have seen people invest in Mah Scooters to play Bajaj Finance.

ii) Hoping of discount narrowing: Investors feel the degree of discount may narrow in the future and play it as a vehicle to invest in the underlying business. We have seen people invest in Mah Scooters to play Bajaj Finance.

How much success they may be getting is a point to be analysed. You must also research well before taking such investment decisions.

Best way to do that is to calculate the disc at current levels and see the past trends at what discount it was trading and then compare the risk

Best way to do that is to calculate the disc at current levels and see the past trends at what discount it was trading and then compare the risk

iii) Dividend Yield: As a pure play holdco has no business of its own and depends upon its invested businesses for dividends as a source of income. Dividend Yields and Dividend Payout Ratio is generally high in such holdcos.

4. Right time to Invest in a Holdco

As with any investment decision, the timing and thesis ought to be right while making an investment in a HoldCo as well. Let’s explore both aspects of timing and thesis that make a case for investing in a HoldCo.

As with any investment decision, the timing and thesis ought to be right while making an investment in a HoldCo as well. Let’s explore both aspects of timing and thesis that make a case for investing in a HoldCo.

Thesis:

Strength in the underlying business - If we like a business that seems lucrative on the basis of its earning potential and sustainable growth going forward and it has a listed HoldCo. Then we may find a reason for becoming interested in such a HoldCo.

Strength in the underlying business - If we like a business that seems lucrative on the basis of its earning potential and sustainable growth going forward and it has a listed HoldCo. Then we may find a reason for becoming interested in such a HoldCo.

The discount and dividends in such a case can add more power to your thesis and eventual returns may be greater as well when compared to underlying businesses returns.

Catching the discount at far extreme - If look at variance in discount that these HoldCos trade at over a period of time. We’ll notice that the discount in some of the cases keeps fluctuating from a very deep discount to a fairly moderate level.

So it is highly beneficial if one is able to spot opportunities where the discount compared to discount earlier is at a very deep discount level. In such a case the return made in a HoldCo will be way more.

Let’s take an example: Company A is a HoldCo with 100% stake in Company B.

Price of Company A = ₹200

Price of Company B = ₹1000

Discount = 80%

Assume 25% CAGR over 3 years for Company B & Discount reduces to 50%

Price of Company A = ₹200

Price of Company B = ₹1000

Discount = 80%

Assume 25% CAGR over 3 years for Company B & Discount reduces to 50%

3 year later

Price of Company A = ₹1000

Price of Company B = ₹2000

Return from Company A = 400% or 4x

Return from Company B = 100% or 1x

So both the factors are important and must be considered.

Thank you so much for reading!

Price of Company A = ₹1000

Price of Company B = ₹2000

Return from Company A = 400% or 4x

Return from Company B = 100% or 1x

So both the factors are important and must be considered.

Thank you so much for reading!

Join us to master the A to Z of the Hot & Spicy QSR Industry in the Indian context and look at the opportunities it presents today.

Link: rzp.io/l/8q589nJpm

Topic: De-Coding the QSR Sector with Ishmohit Arora

Date & Time: 13 Nov 2022, 12 pm to 2 pm

Venue: Zoom Online

Link: rzp.io/l/8q589nJpm

Topic: De-Coding the QSR Sector with Ishmohit Arora

Date & Time: 13 Nov 2022, 12 pm to 2 pm

Venue: Zoom Online

Recording will be made available after 48-72 hours post the Webinar.

SOIC Members don’t need to register separately.

SOIC Members don’t need to register separately.

We teach Fundamental and Business analysis at SOIC :)

Be a part of our mailing list (more than 1L+ investors already benefiting) soic.in

Its free Follow us on Youtube at youtube.com/c/SOICfinance

Be a part of our mailing list (more than 1L+ investors already benefiting) soic.in

Its free Follow us on Youtube at youtube.com/c/SOICfinance

• • •

Missing some Tweet in this thread? You can try to

force a refresh