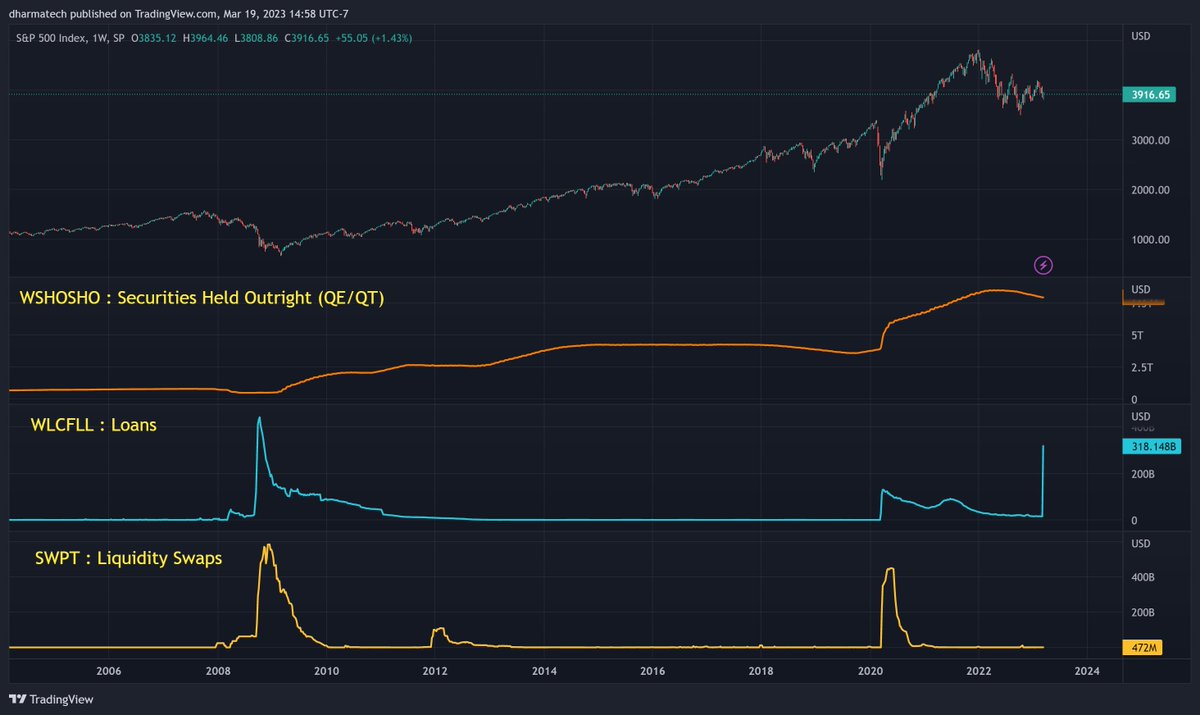

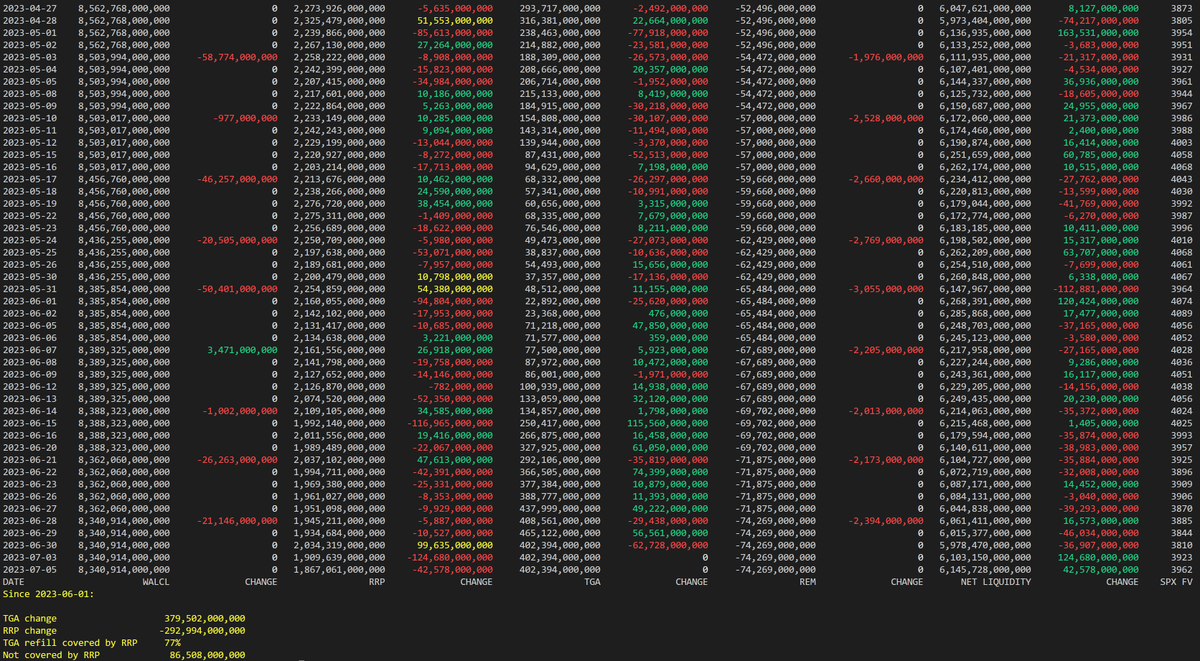

Even with the $20B drop in Fed balance sheet yesterday, #NetLiquidity is still up yesterday and today.

Projected TGA change in tomorrow's report:

+$143B

Also keep in mind the QT over the next three Thursdays:

-$19B

-$17B

-$39B

+$143B

Also keep in mind the QT over the next three Thursdays:

-$19B

-$17B

-$39B

https://twitter.com/Johncomiskey77/status/1668237556071235585

Next big TGA public debt changes according to @TreasuryDirect data:

Tue +$49B

Thu +$68B

As usual, remember that these show up in the following day's DTS.

Tue +$49B

Thu +$68B

As usual, remember that these show up in the following day's DTS.

RRP -$42B

RRP back below $2T

https://t.co/kxLWcmT02q https://t.co/FGfoz1o46bquickchart.io/chart-maker/vi…

quickchart.io/chart-maker/vi…

RRP back below $2T

https://t.co/kxLWcmT02q https://t.co/FGfoz1o46bquickchart.io/chart-maker/vi…

quickchart.io/chart-maker/vi…

Data from @TreasuryDirect is showing the following public debt changes for next week:

Tue +$59B

Thu +$59B

Fri +$31B

Tue +$59B

Thu +$59B

Fri +$31B

TGA -$35B

https://t.co/PqzvzUswF1 https://t.co/K9wKStZM0yquickchart.io/chart-maker/vi…

quickchart.io/chart-maker/vi…

https://t.co/PqzvzUswF1 https://t.co/K9wKStZM0yquickchart.io/chart-maker/vi…

quickchart.io/chart-maker/vi…

Fed balance sheet changes this week

WDTGAL +$157B (TGA)

WLRRAL -$66B (RRP)

WLODLL -$102B

While RRP dropped $66B to accommodate the $157B build in TGA, WLODLL (Other Deposits Held by Depository Institutions) fell even more, $102B.

quickchart.io/chart-maker/vi…

WDTGAL +$157B (TGA)

WLRRAL -$66B (RRP)

WLODLL -$102B

While RRP dropped $66B to accommodate the $157B build in TGA, WLODLL (Other Deposits Held by Depository Institutions) fell even more, $102B.

quickchart.io/chart-maker/vi…

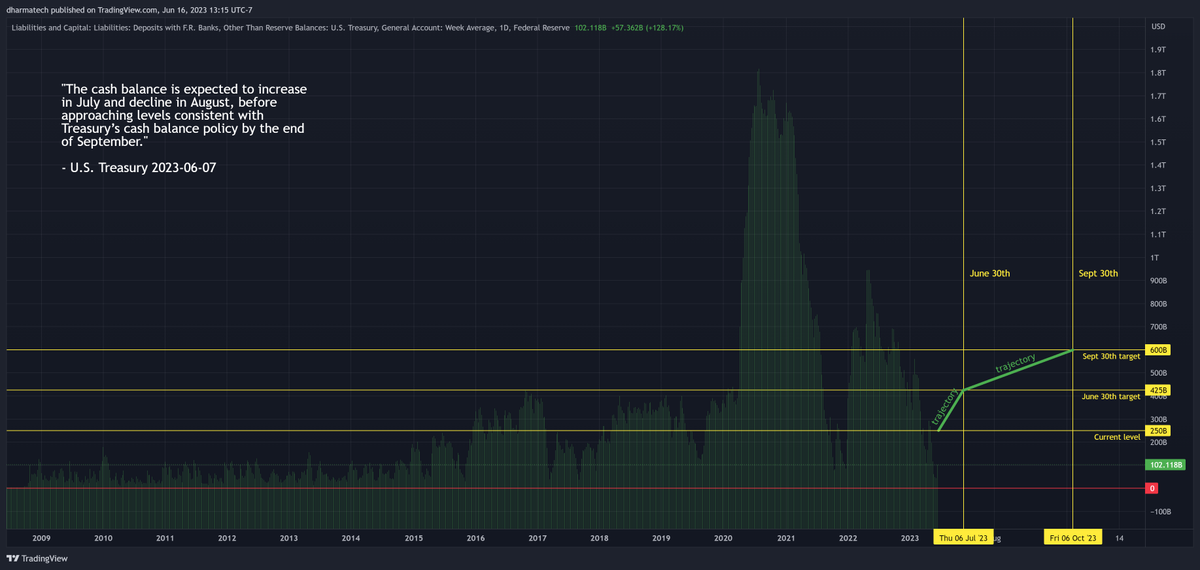

Data from @TreasuryDirect is showing the following TGA public debt increases this week:

Tue +$59B

Thu +$69B

Fri +$31B

Values expected on the following day's report.

That will wrap up June and, in theory, bring TGA up to the $425B goal of June 30th.

Then we begin the slower grind to $600B by Sept 30th.

Treasury says TGA expected to decline in Aug.

Tue +$59B

Thu +$69B

Fri +$31B

Values expected on the following day's report.

That will wrap up June and, in theory, bring TGA up to the $425B goal of June 30th.

Then we begin the slower grind to $600B by Sept 30th.

Treasury says TGA expected to decline in Aug.

Friendly reminder:

The next three days are the last days of June.

Which is month end and quarter end.

Which means, RRP is expected to rise possibly starting tomorrow and falling on the 1st due to window-dressing.

Highlighted below are the last 3 quarter ends.

Just warning everyone before people freak out about the liquidity drain. Consider it temporary until you really know the damage after the 1st.

Interesting thing is, there are @TreasuryDirect auctions today, Thu, and Fri.

It will be interesting to see if there's any contention between quarter-end window-dressing and these bill purchases.

The next three days are the last days of June.

Which is month end and quarter end.

Which means, RRP is expected to rise possibly starting tomorrow and falling on the 1st due to window-dressing.

Highlighted below are the last 3 quarter ends.

Just warning everyone before people freak out about the liquidity drain. Consider it temporary until you really know the damage after the 1st.

Interesting thing is, there are @TreasuryDirect auctions today, Thu, and Fri.

It will be interesting to see if there's any contention between quarter-end window-dressing and these bill purchases.

RRP -$10B

They're really waiting till the last minute to dress the windows.😅Tomorrow's the last day to get that done.

They're really waiting till the last minute to dress the windows.😅Tomorrow's the last day to get that done.

RRP +$99B

Above $2T again.

This is the expected end-of-quarter window-dressing.

Look for it to drop next week.

Above $2T again.

This is the expected end-of-quarter window-dressing.

Look for it to drop next week.

Data from @TreasuryDirect showing the following TGA public debt changes for next week:

Wed: +$60B

Thu: +$59B

Wed: +$60B

Thu: +$59B

TGA -$62B

Despite the +$32B in public debt, withdrawals outweighed it.

TGA is back below the $425B target for June 30th.

Despite the +$32B in public debt, withdrawals outweighed it.

TGA is back below the $425B target for June 30th.

RRP -$42B

TGA refill covered by RRP: 77%

https://t.co/oBblWvvQezquickchart.io/chart-maker/vi…

quickchart.io/chart-maker/vi…

TGA refill covered by RRP: 77%

https://t.co/oBblWvvQezquickchart.io/chart-maker/vi…

quickchart.io/chart-maker/vi…

GNL at Oct 2022 level

FRED:WALCL+FRED:JPNASSETS*FX_IDC:JPYUSD+ECONOMICS:CNCBBS*FX_IDC:CNYUSD+FRED:ECBASSETSW*FX:EURUSD-FRED:RRPONTSYD-FRED:WTREGEN

FRED:WALCL+FRED:JPNASSETS*FX_IDC:JPYUSD+ECONOMICS:CNCBBS*FX_IDC:CNYUSD+FRED:ECBASSETSW*FX:EURUSD-FRED:RRPONTSYD-FRED:WTREGEN

TGA -$7B

TGA refill covered by RRP: 79%

https://t.co/JfXyflKiv4quickchart.io/chart-maker/vi…

quickchart.io/chart-maker/vi…

TGA refill covered by RRP: 79%

https://t.co/JfXyflKiv4quickchart.io/chart-maker/vi…

quickchart.io/chart-maker/vi…

Data from @TreasuryDirect is showing these public debt changes for next week:

Tue: +$43B

Thu: +$7B

Which seems like a light week.

But $91B are maturing on Sat the 15th.

And Mon the 17th we have +$90B.

Tue: +$43B

Thu: +$7B

Which seems like a light week.

But $91B are maturing on Sat the 15th.

And Mon the 17th we have +$90B.

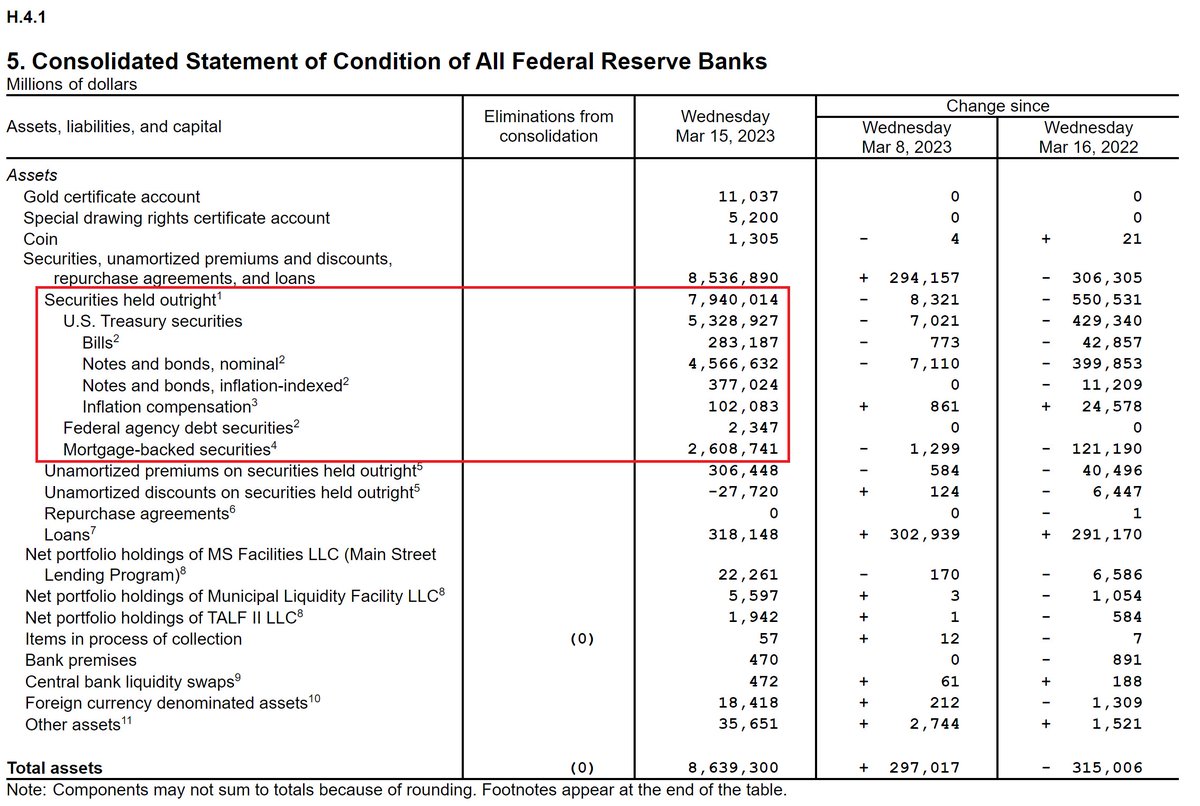

Fed balance sheet changes

Note that the large drop in RRP was not only balanced by an increase in TGA, but a drop in notes and bonds on the assets side.

https://t.co/Sdic4Fkqxxquickchart.io/chart-maker/vi…

Note that the large drop in RRP was not only balanced by an increase in TGA, but a drop in notes and bonds on the assets side.

https://t.co/Sdic4Fkqxxquickchart.io/chart-maker/vi…

RRP +$44B

TGA refill covered by RRP: 70%

First increase in RRP in 21 days.

(Excluding window-dressing.)

TGA refill covered by RRP: 70%

First increase in RRP in 21 days.

(Excluding window-dressing.)

WALCL -$1.4B

RRP -$52B

TGA -$25B

REM -$1.5B

TGA refill covered by RRP: 79%

https://t.co/skdAQ1E2KVquickchart.io/chart-maker/vi…

quickchart.io/chart-maker/vi…

RRP -$52B

TGA -$25B

REM -$1.5B

TGA refill covered by RRP: 79%

https://t.co/skdAQ1E2KVquickchart.io/chart-maker/vi…

quickchart.io/chart-maker/vi…

RRP +$49B

TGA refill covered by RRP: 76%

No idea if it's a coincidence or not but, RRP has been hanging out around that lower red line for 4 days, which is the level that was required for RRP to 100% cover TGA refill through June plus the theoretical maximum QT through June.

If Fed raises rates next week, keep a close eye on what RRP does, and also what the 1 month yield does.

SPX FV chart:

TGA refill covered by RRP: 76%

No idea if it's a coincidence or not but, RRP has been hanging out around that lower red line for 4 days, which is the level that was required for RRP to 100% cover TGA refill through June plus the theoretical maximum QT through June.

If Fed raises rates next week, keep a close eye on what RRP does, and also what the 1 month yield does.

SPX FV chart:

RRP has remained above $1.71T for around 10 days now.

As I mentioned previously, this just happens to be the level that RRP would have to drop to to cover TGA refill through June plus the theoretical maximum QT through June.

It fell continuously and dramatically for 40 days before arriving here.

There doesn't appear to be any large TGA public debt changes through next Thursday. (-43B on Mon, but then +$35B Tue.) This could be a slow drain of TGA for Aug that the treasury referred to.

Let's see if $1.71T holds for RRP.

As I mentioned previously, this just happens to be the level that RRP would have to drop to to cover TGA refill through June plus the theoretical maximum QT through June.

It fell continuously and dramatically for 40 days before arriving here.

There doesn't appear to be any large TGA public debt changes through next Thursday. (-43B on Mon, but then +$35B Tue.) This could be a slow drain of TGA for Aug that the treasury referred to.

Let's see if $1.71T holds for RRP.

Reminder:

RRP is likely to increase today due to end-of-month window-dressing. Look for it to drop back down on Tue.

RRP is likely to increase today due to end-of-month window-dressing. Look for it to drop back down on Tue.

https://twitter.com/dharmatrade/status/1598140777280180224

RRP +$90B (EOM window-dressing)

Let's see what it falls back down to tomorrow.

At EOQ in June, it went up $99B.

EOQ is usually higher than EOM, so this is relatively high for EOM.

Let's see what it falls back down to tomorrow.

At EOQ in June, it went up $99B.

EOQ is usually higher than EOM, so this is relatively high for EOM.

The @USTreasury published their TGA targets for 3rd and 4th quarters.

Sept 30st: $650B

Dec 31st: $750B

They plan to borrow as follows:

3rd quarter: $1.007T

4th quarter: $852B

As of today, TGA balance is at $501B.

Sept 30st: $650B

Dec 31st: $750B

They plan to borrow as follows:

3rd quarter: $1.007T

4th quarter: $852B

As of today, TGA balance is at $501B.

And thanks to @Entertained_1 and @ScapeTheMatrix for bringing the press release to my attention yesterday! 👍

Fed assets: -$36B

I added more stats related to the TGA refill to net-liquidity.ps1. See console output below.

TGA change needed to hit targets:

Sept 30th: $189 B days: 57 amount per day: $3.3 B

Oct 31th: $289 B days: 88 amount per day: $3.3 B

Script:

I added more stats related to the TGA refill to net-liquidity.ps1. See console output below.

TGA change needed to hit targets:

Sept 30th: $189 B days: 57 amount per day: $3.3 B

Oct 31th: $289 B days: 88 amount per day: $3.3 B

Script:

RRP +$16B

Up 4 days in a row now.

Hasn't done that 3 months (since May).

Up +$70B in these 4 days.

Back above $1.8T.

But remember, TGA expected to fall this Month.

So they're offsetting each other to some degree.

NL moving sideways-ish for around 46 days.

TGA refill expected to continue in 4 weeks.

Up 4 days in a row now.

Hasn't done that 3 months (since May).

Up +$70B in these 4 days.

Back above $1.8T.

But remember, TGA expected to fall this Month.

So they're offsetting each other to some degree.

NL moving sideways-ish for around 46 days.

TGA refill expected to continue in 4 weeks.

$DXY causing GNL to test $24.6T

I'll be extremely surprised if GNL manages to fall through here.

Something has to give. If it doesn't, and GNL does fall through, I suspect it'll mean something has broken.

TradingView expression:

FRED:WALCL+FRED:JPNASSETS*FX_IDC:JPYUSD+ECONOMICS:CNCBBS*FX_IDC:CNYUSD+FRED:ECBASSETSW*FX:EURUSD-FRED:RRPONTSYD-FRED:WTREGEN

I'll be extremely surprised if GNL manages to fall through here.

Something has to give. If it doesn't, and GNL does fall through, I suspect it'll mean something has broken.

TradingView expression:

FRED:WALCL+FRED:JPNASSETS*FX_IDC:JPYUSD+ECONOMICS:CNCBBS*FX_IDC:CNYUSD+FRED:ECBASSETSW*FX:EURUSD-FRED:RRPONTSYD-FRED:WTREGEN

Net Liquidity has remained relatively flat for over a month now.

We have two more weeks before TGA begins to refill again. We'll then have to watch RRP to see if it drops to compensate.

TGA needs to grow at a rate of $4.2B per day to hit it's Sept 30th target.

SPX FV chart:

NL table:

https://t.co/eZt1zXuIP2

We have two more weeks before TGA begins to refill again. We'll then have to watch RRP to see if it drops to compensate.

TGA needs to grow at a rate of $4.2B per day to hit it's Sept 30th target.

SPX FV chart:

NL table:

https://t.co/eZt1zXuIP2

Huge drop in TGA: -$64B

Primarily due to 'Interest on Treasury Securities'.

Although, this isn't unexpected.

Every 3 months on the 15th,

there's a large withdrawal for

'Interest on Treasury Securities'.

See chart.

https://t.co/fxzh5Lpmzc

https://t.co/lcQfaLcRmPdharmatech.dev/data/reports/n…

dharmatech.dev/data/reports/t…

Primarily due to 'Interest on Treasury Securities'.

Although, this isn't unexpected.

Every 3 months on the 15th,

there's a large withdrawal for

'Interest on Treasury Securities'.

See chart.

https://t.co/fxzh5Lpmzc

https://t.co/lcQfaLcRmPdharmatech.dev/data/reports/n…

dharmatech.dev/data/reports/t…

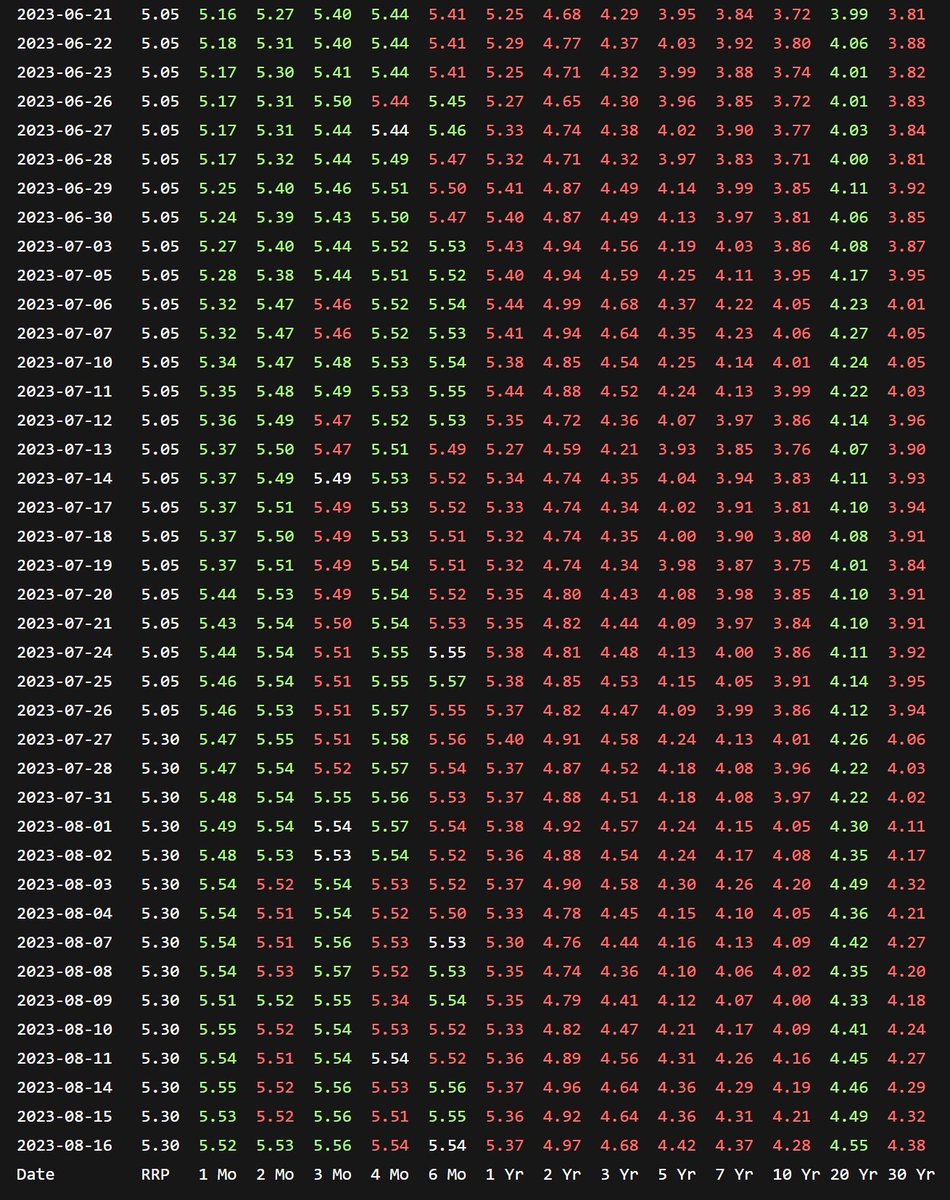

US Treasury Securities Yield Curve

Purple: today

Yellow: yesterday

Green: month ago

Chart:

Table:

https://t.co/vOpfBGKl3kdharmatech.dev/data/reports/u…

dharmatech.dev/data/reports/u…

Purple: today

Yellow: yesterday

Green: month ago

Chart:

Table:

https://t.co/vOpfBGKl3kdharmatech.dev/data/reports/u…

dharmatech.dev/data/reports/u…

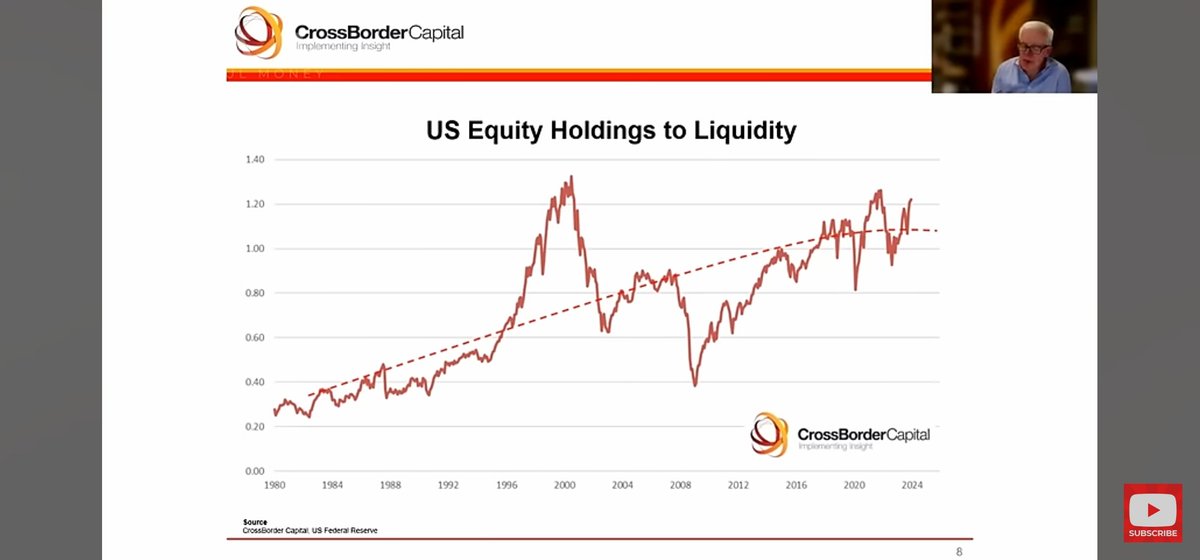

The Jaws of Liquidity are closing

Specifically, the upper jaw of $SPX is falling.

The bottom jaw of NL is still moving sideways.

SPX FV chart:

The NL table report now includes some data related to the Sep and Oct TGA refill targets, including what RRP would have to fall to in order to 100% cover the TGA refill.

NL table report:

https://t.co/eZt1zXuIP2

But wait, there's more...

The NL chart visually shows what RRP will have to fall to in order to 100% cover the TGA refill (yellow and purple lines). You'll have to toggle the 'RRP' chart on via the legend to get this view.

NL chart:

https://t.co/vkWIJ80jCi

The charts linked above are scheduled to update twice daily after the RRP and TGA numbers are available.

OK, onto the data:

TGA has to grow $6.2B per day to hit the Sep 30th target.

RRP would have to drop to $1.529T to offset this.

If there's not another banking crisis that causes the Fed to pump its assets with loans, it will be up to the RRP alone to offset the TGA build. So... watch the RRP closely, especially starting Sep 1st.

Please note: I'm not saying SPX has any guarantee or hope of hitting any of the FV lines. I just think it's interesting to note how far above these levels SPX has moved. It'll take some time to sort out what the "new normal" is.dharmatech.dev/data/reports/s…

Specifically, the upper jaw of $SPX is falling.

The bottom jaw of NL is still moving sideways.

SPX FV chart:

The NL table report now includes some data related to the Sep and Oct TGA refill targets, including what RRP would have to fall to in order to 100% cover the TGA refill.

NL table report:

https://t.co/eZt1zXuIP2

But wait, there's more...

The NL chart visually shows what RRP will have to fall to in order to 100% cover the TGA refill (yellow and purple lines). You'll have to toggle the 'RRP' chart on via the legend to get this view.

NL chart:

https://t.co/vkWIJ80jCi

The charts linked above are scheduled to update twice daily after the RRP and TGA numbers are available.

OK, onto the data:

TGA has to grow $6.2B per day to hit the Sep 30th target.

RRP would have to drop to $1.529T to offset this.

If there's not another banking crisis that causes the Fed to pump its assets with loans, it will be up to the RRP alone to offset the TGA build. So... watch the RRP closely, especially starting Sep 1st.

Please note: I'm not saying SPX has any guarantee or hope of hitting any of the FV lines. I just think it's interesting to note how far above these levels SPX has moved. It'll take some time to sort out what the "new normal" is.dharmatech.dev/data/reports/s…

• • •

Missing some Tweet in this thread? You can try to

force a refresh