How to get URL link on X (Twitter) App

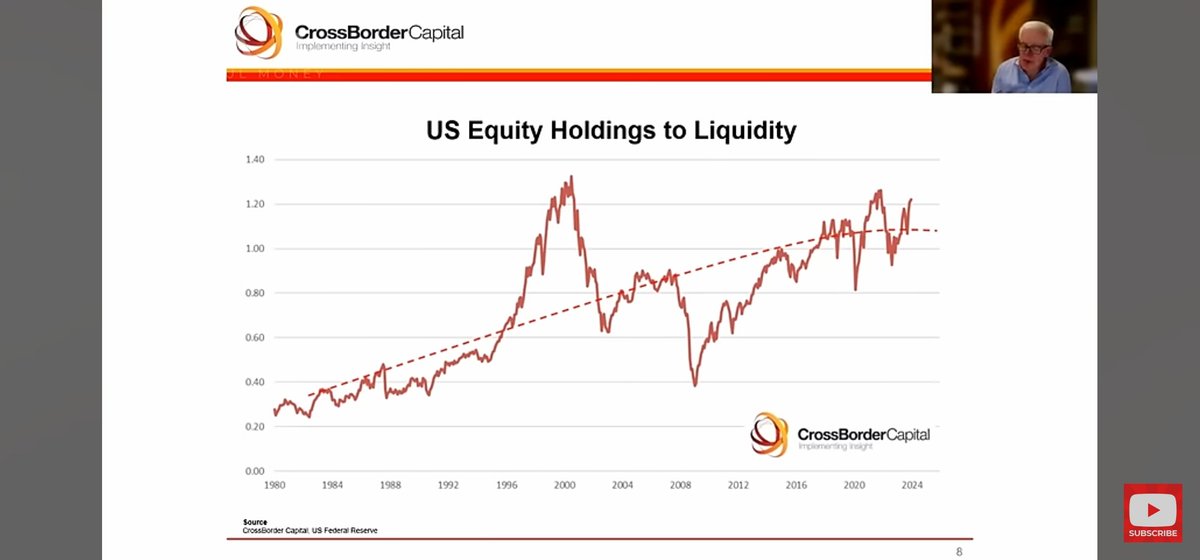

The interview, which I highly recommend is here:

The interview, which I highly recommend is here:

The indicator is signaling bearish today on $NVDA.

The indicator is signaling bearish today on $NVDA.

The formula would be:

The formula would be:

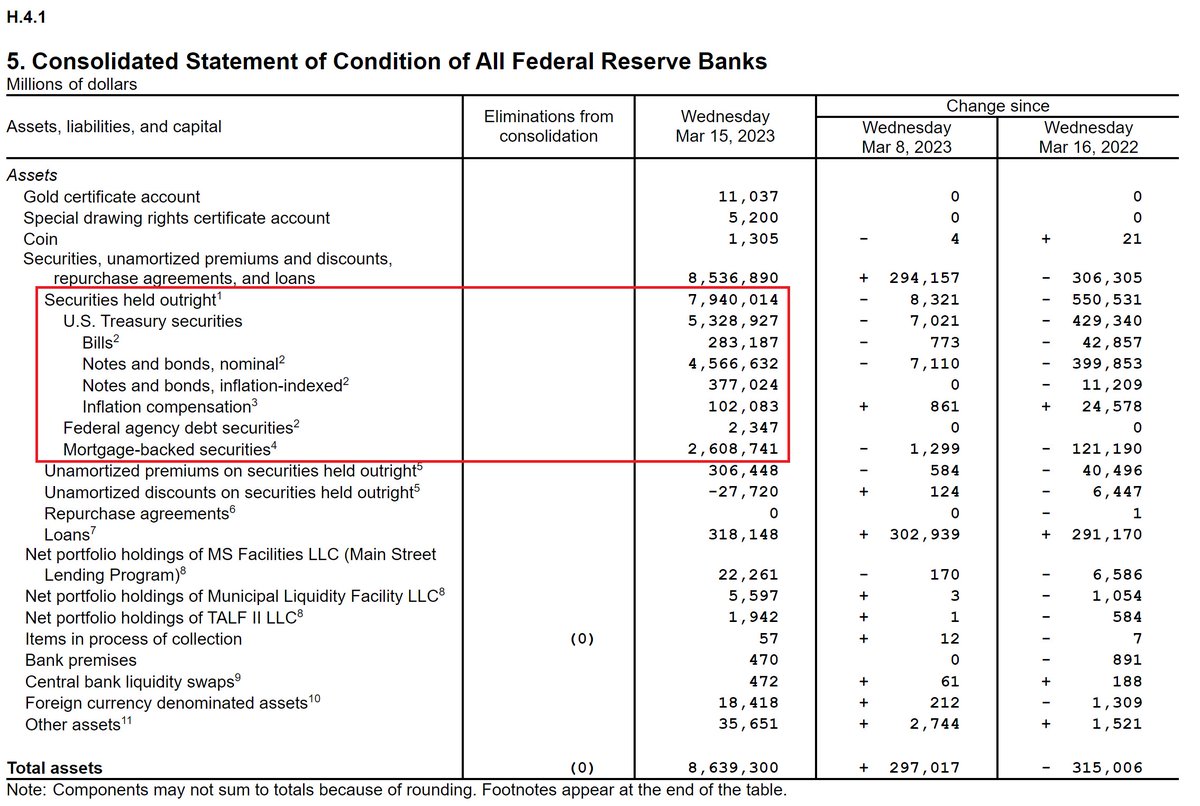

Towards the bottom of that page is a link to the following 'release table'.

Towards the bottom of that page is a link to the following 'release table'.

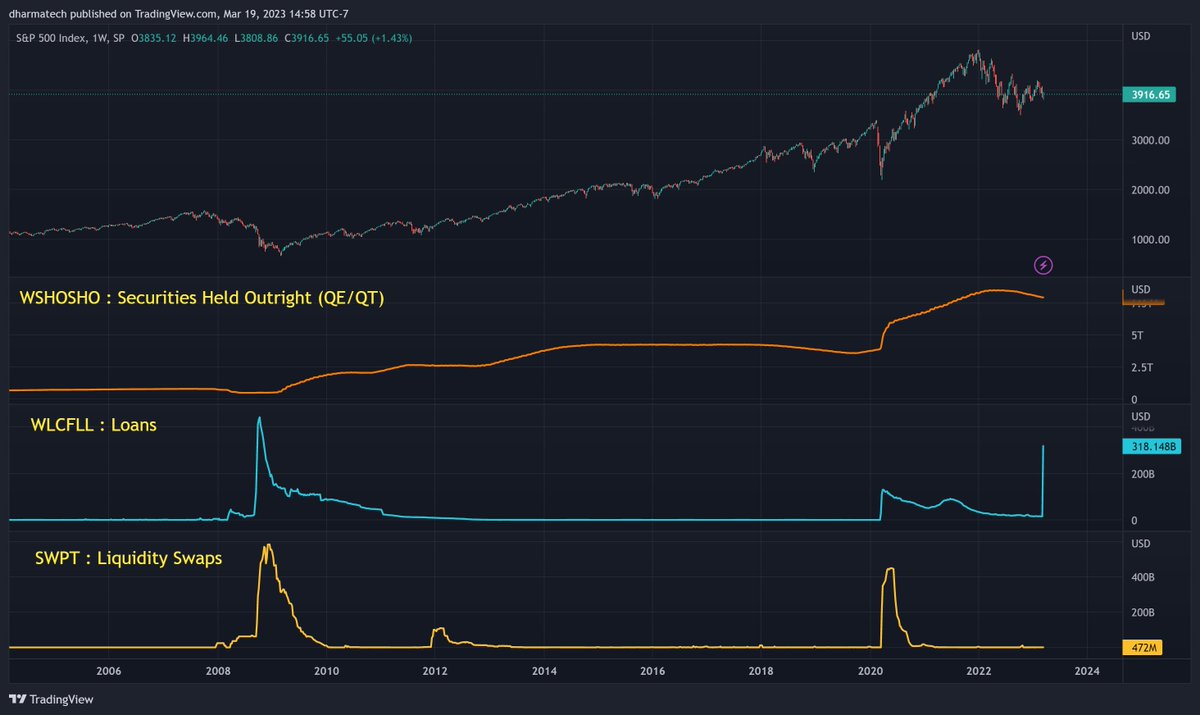

2008 - Great Financial Crisis

2008 - Great Financial Crisis

And here's an SPX Fair Value Bands indicator which uses WSHOSHO instead of WALCL.

And here's an SPX Fair Value Bands indicator which uses WSHOSHO instead of WALCL.

Messing around with an SPX Fair Value formula which incorporates JPNASSETS.

Messing around with an SPX Fair Value formula which incorporates JPNASSETS.

Projected TGA change in tomorrow's report:

Projected TGA change in tomorrow's report:https://twitter.com/Johncomiskey77/status/1668237556071235585

https://twitter.com/maxjanderson/status/1546472693234470912Net Liquidity can be plotted on TradingView

https://twitter.com/dharmatrade/status/1576915018439749632

https://twitter.com/UrbanKaoboy/status/1561061498323345408

More annotations on the chart from @UrbanKaoboy's thread

More annotations on the chart from @UrbanKaoboy's threadhttps://twitter.com/UrbanKaoboy/status/1561065890627473408