The Glasgow Financial Alliance for Net Zero has announced it will encourage but no longer require its members to join Race to Zero. Notably, the 7 GFANZ alliances remain committed to R2Z. Some thoughts on where this leaves the push for integrity. assets.bbhub.io/company/sites/…

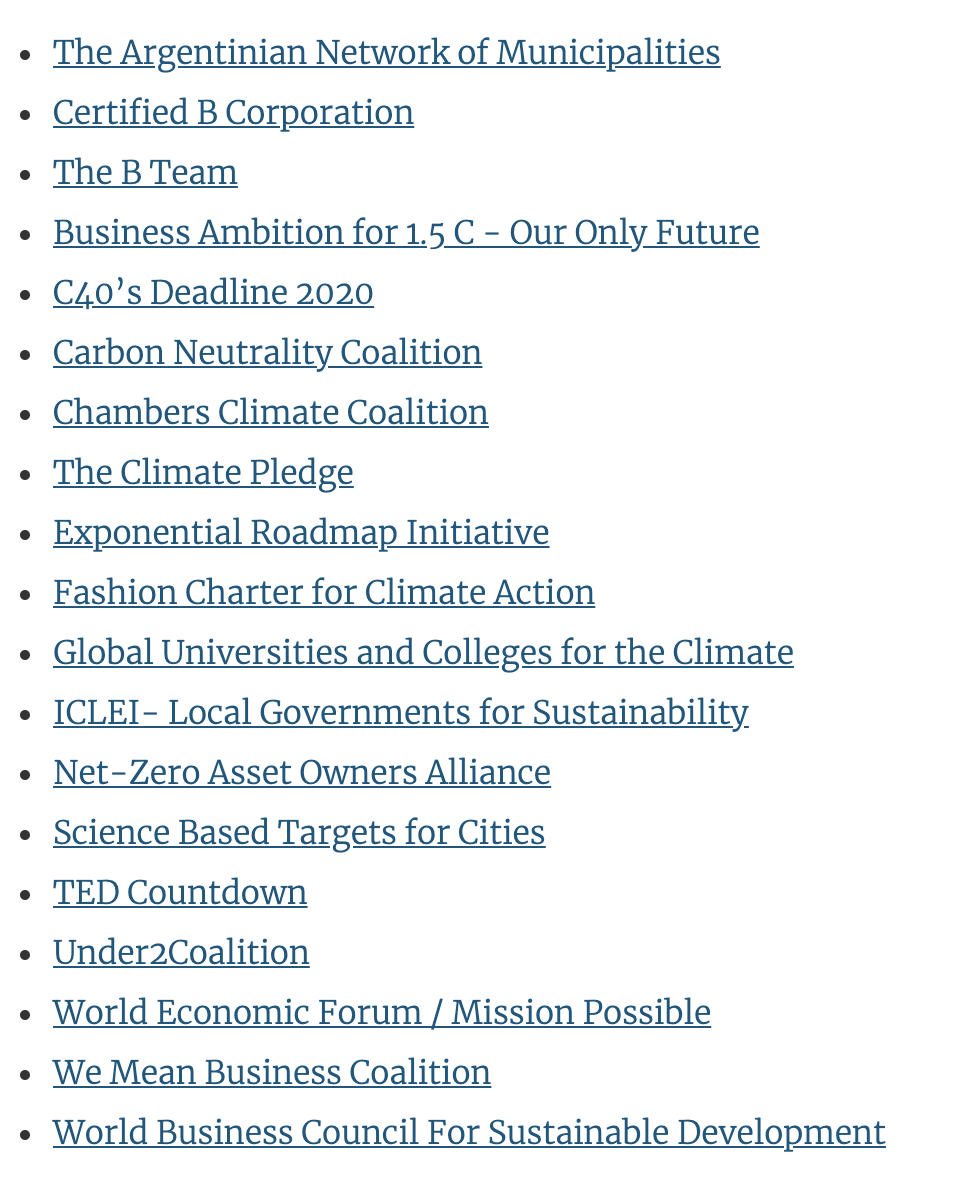

First, what was the situation before? GFANZ has never itself been a standard-setter/verifier. It has instead said that members need to align to the general Race to Zero criteria, which also cover non-financial businesses, cities, regions, etc.

GFANZ is made up of 7 industry-specific alliances (asset owners, asset managers, banks, etc.), which set the specific commitments that financial institutions follow. These 7 are all part of Race to Zero, having been approved by the R2Z expert peer review group, which I co-chair.

The GFANZ secretariat supports these alliances on implementation of their goals.

Second, what has changed? All of the 7 alliances remain part of Race to Zero. None has changed their commitment frameworks. None of them have said they want to leave it, and none have been asked to leave.

So the announcement does not change the current status quo, but it creates the possibility that in the future alliances may join GFANZ that do not meet the Race to Zero criteria, or alliances could remain in GFANZ even if they are shown to fall short of those criteria.

Notably, GFANZ continues to encourage its members to align to the Race to Zero criteria. It but it doesn’t require it.

Third, what are the implications? I see two: the value of focusing on implementation, and the value of having rigorous criteria embedded across all parts of the net zero ‘ecosystem’ – including in regulation.

Signing up to the right criteria shows the right intent. But what ultimately matters is results. GFANZ has always seen its role as implementation, not standards. That’s a key function.

For this reason, no one should consider GFANZ membership alone as a badge of “quality.” Indeed, the progress report out today shows substantial room for improvement. assets.bbhub.io/company/sites/… Even Race to Zero membership just requires an entity to meet the “starting line” criteria.

So alliances and entities that are not even at the level of the R2Z starting line have a huge amount of work to do. To the extent GFANZ gets them to do that work, it is serving a valuable function.

At the same time, if institutions can’t get to even the minimum level, that is a pretty dire indictment of their commitment. Consumers, investors, and regulators should react accordingly. GFANZ, the alliances, and R2Z will ultimately be judged by how much they shift the dial.

The reality is that having clear criteria and the expectation to meet them are not going away. Financial institutions that think they can continue to fudge their net zero commitments should probably think harder. See for example climatechangenews.com/2022/09/28/cor…

Criteria exist because they’re useful. They help organizations and their stakeholders navigate this extraordinarily complex and difficult transition by creating focal points around what “good” looks like.

For organizations struggling to figure this out, that’s hugely helpful. That’s why we see so many efforts to define standards and criteria around net zero, and why we can expect all serious organizations to continue to adhere to such criteria. netzeroclimate.org/oxford-net-zer…

In other words, organizations need benchmarks. Going it alone, or just saying “trust us” is very risky.

For the same reason we see a growing push for putting net zero alignment into regulation. Done well, regulation can help the private sector do this by establishing a clear and level playing field.

https://twitter.com/thomasnhale/status/1572645713695363073?s=20&t=QYXSzjmGX5RVzR_-d2OQXA

Voluntary commitments, orchestration efforts like Race to Zero, and the proliferation of standards on net zero are all building a "conveyor belt" to net zero regulation. Organizations can be part of developing those criteria, or they can be rule-takers. bsg.ox.ac.uk/sites/default/…

Of course, there are plenty of groups pushing against criteria because they want to block or delay climate action (e.g. texasattorneygeneral.gov/news/releases/…). Some will see GFANZ's decision as a victory, and if it slows or blocks the work of the net zero financial alliances, it would be.

The proof will be in what happens next. Will the financial alliances and their members deliver on their commitments and stay in Race to Zero? Or will they reverse their commitments?

• • •

Missing some Tweet in this thread? You can try to

force a refresh