What creates opportunities for investors?

“There are three ways to make a living in this business: be first, be smarter, or cheat.”

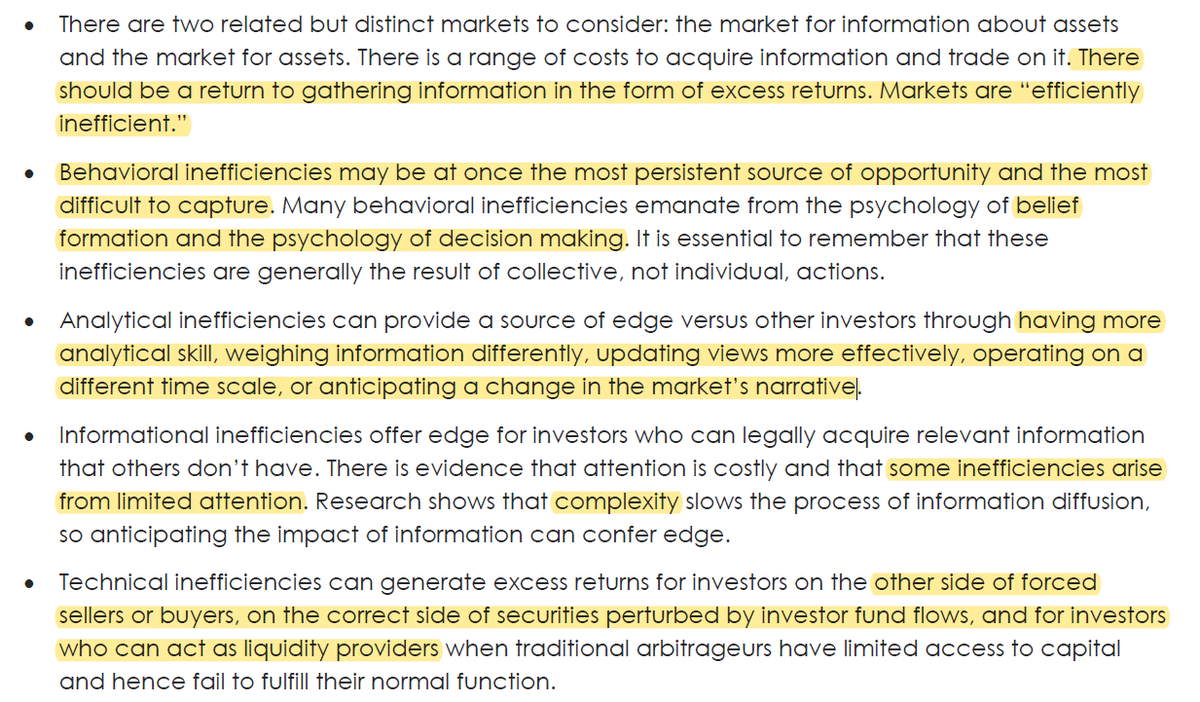

Okay.. Let's ask @mjmauboussin for a more robust framework of inefficiencies. It's called BAIT: behavioral, analytical, informational, technical.

“There are three ways to make a living in this business: be first, be smarter, or cheat.”

Okay.. Let's ask @mjmauboussin for a more robust framework of inefficiencies. It's called BAIT: behavioral, analytical, informational, technical.

“You should have a good answer to: “Who is on the other side?” You are specifying the source of your advantage, or edge."

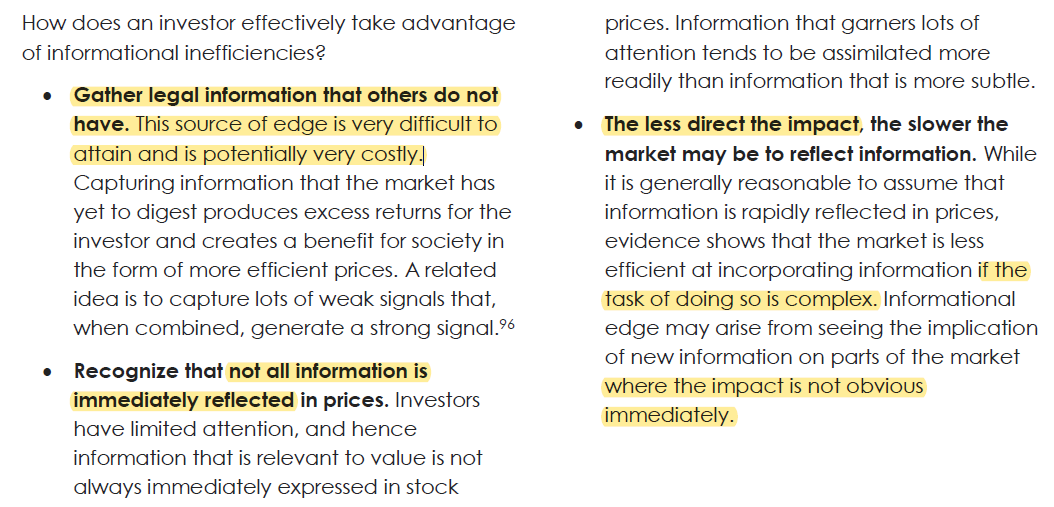

Informational: “arises when some market participants have different information than others and can trade profitably on that asymmetry.”

Possible but market has become a lot more efficient since the internet and Reg FD.

Possible but market has become a lot more efficient since the internet and Reg FD.

Analytical: "one investor can analyze it better than the others can."

Possible but also much more challenging in a market dominated by pros.

Pick a game where you stand out. Recognize biases that wreck analysis (confirmation, recency). Consider time arbitrage.

Possible but also much more challenging in a market dominated by pros.

Pick a game where you stand out. Recognize biases that wreck analysis (confirmation, recency). Consider time arbitrage.

Behavioral: a source of inefficiency as long as there are humans in markets. Unfortunately also where you can become the source of opportunity for others.

Separate facts from opinions. What does the price imply? Be mindful of sentiment, overextrapolation, pressure to conform.

Separate facts from opinions. What does the price imply? Be mindful of sentiment, overextrapolation, pressure to conform.

Technical: "when some market participants have to buy or sell for reasons are unrelated to fundamental value."

The one area in which inefficiency might actually be *increasing* as the market becomes dominated non-fundamental players and institutional mandates.

The one area in which inefficiency might actually be *increasing* as the market becomes dominated non-fundamental players and institutional mandates.

Spin-offs were a classic example of forced or disinterested sellers. Joel Greenblatt and Seth Klarman wrote about them. This created a cottage industry of people exploiting the opportunity, making the market more efficient.

Look for odd securities that people didn't ask for. Sometimes created in mergers or reorganizations.

But also, Buffett and Munger scooped up Blue Chip shares when the Justice Department forced a sale of stock to many small retailers.

But also, Buffett and Munger scooped up Blue Chip shares when the Justice Department forced a sale of stock to many small retailers.

Demutualizations/thrift conversions offered opportunities for decades. How many depositors were really interested in exercising their right to become shareholders of their bank? How many knew how to value a bank?

Sometimes it's about buying from an inflexible institution. Bonds that lost their investment grade rating used to be dropped like hot potatoes. Milken and the early generations of distressed investors built their careers around this inefficiency.

It's not complicated. Savvy traders start to embody this mindset.

In HBO's Industry, Harper encounters Rishi in the garage. After parking his new Ferrari, he comments: “I bought my motor off a recently divorced dad in Chingford. Distressed seller is key.”

That's the mentality.

In HBO's Industry, Harper encounters Rishi in the garage. After parking his new Ferrari, he comments: “I bought my motor off a recently divorced dad in Chingford. Distressed seller is key.”

That's the mentality.

Instead of a large group of small and unsophisticated owners, how about one large corporation?

Private equity has long loved to buy small divisions, fixing incentives, underperformance, and removing layers of bureaucracy and internal politics.

Private equity has long loved to buy small divisions, fixing incentives, underperformance, and removing layers of bureaucracy and internal politics.

If you like that idea, pay close attention when the government unloads assets (privatizations, merchandise acquired during bailouts..).

Some investors like @DanielSLoeb1 connect the event-driven style to macro.

"In a QE-driven world government intervention was itself an ‘event’ and this insight led us to new and profitable opportunities."

"In a QE-driven world government intervention was itself an ‘event’ and this insight led us to new and profitable opportunities."

It's not a novel idea. Macro funds love to hunt for policy mistakes. @scmallaby covered it well in More Money Than God.

"Macro trading exploited a prime example of this insight: Governments and central banks were clearly not trying to maximize profits."

"Macro trading exploited a prime example of this insight: Governments and central banks were clearly not trying to maximize profits."

Paul Tudor Jones knew from the trading pit to pay attention to positioning. In the final years of the Japanese bubble, he paid close attention to the behavior of local institutional investors. Once they started shifting out of the market, it was over.

This doesn't mean everyone should try to become an event-driven investor. Complexity can be a trap with “low return on brain damage” as @BillAckman would say.

It's easy for the motivated analyst to gravitate to this because solving the puzzle is intellectually satisfying.

It's easy for the motivated analyst to gravitate to this because solving the puzzle is intellectually satisfying.

But in a market dominated by passive flows, factor and quant strategies, and institutional mandates, paying attention to technical inefficiencies could be a lasting edge. After all, there's a buyer of every forced ESG divestiture.

With governments and central banks very active, be mindful of their motivations, constraints, and possible mistakes.

Remember that understanding the players, most importantly the Bundesbank, was a key element of Soros's most famous trade.

Remember that understanding the players, most importantly the Bundesbank, was a key element of Soros's most famous trade.

I wrote about it on my substack.

“I have a friend who says, ‘The first rule of fishing is to fish where the fish are. And the second rule of fishing is to never forget the first rule.’” Charlie Munger

neckar.substack.com/p/what-creates…

“I have a friend who says, ‘The first rule of fishing is to fish where the fish are. And the second rule of fishing is to never forget the first rule.’” Charlie Munger

neckar.substack.com/p/what-creates…

• • •

Missing some Tweet in this thread? You can try to

force a refresh