1/ On How To Effectively End Crypto (for decades)

A short thread

Simultaneously ban all fiat-to-crypto exchanges in USA and EU because (pick your excuse):

a) money laundering

b) terrorism

c) sanctions busting

d) inequality

A short thread

Simultaneously ban all fiat-to-crypto exchanges in USA and EU because (pick your excuse):

a) money laundering

b) terrorism

c) sanctions busting

d) inequality

2/ Something like this would do the trick:

✅fiat-to-crypto exchanges will terminate operations in 30 days

✅holding on-chain crypto is illegal in 30 days in US/EU, punishable with $100,000 fine and 5 years in jail

✅no transfers from exchanges to on-chain wallets

✅fiat-to-crypto exchanges will terminate operations in 30 days

✅holding on-chain crypto is illegal in 30 days in US/EU, punishable with $100,000 fine and 5 years in jail

✅no transfers from exchanges to on-chain wallets

3/ What do you think would happen next?

✅ everyone sends to exchanges

✅ proceeds to sell

✅ who is the buyer in this case?

✅ price collapses

✅ more panic

✅ repeat cycle

✅ everyone sends to exchanges

✅ proceeds to sell

✅ who is the buyer in this case?

✅ price collapses

✅ more panic

✅ repeat cycle

4/ "No, 6529, not everyone would sell"

Sure, not literally everyone. maybe @lopp would not sell.

But what % of you would risk jail, fines and potential complete loss of the value of your crypto assets for decentralization.

My guess is close to zero.

Sure, not literally everyone. maybe @lopp would not sell.

But what % of you would risk jail, fines and potential complete loss of the value of your crypto assets for decentralization.

My guess is close to zero.

5/ Let's take the first test, the first heuristic.

If you hold your crypto on an exchange or a centralized custodian as opposed to running your own node, your own wallet, well you are in the "sell category"

Actually, you are in the "you have no choice" category

If you hold your crypto on an exchange or a centralized custodian as opposed to running your own node, your own wallet, well you are in the "sell category"

Actually, you are in the "you have no choice" category

6/ Anyway who has their coins on an exchange will have them frozen overnight and "what they want to do" is completely irrelevant.

Or, let me state it differently, if today, with no crisis, no risk, you can't be bothered to run decentralized, you won't fight the state.

Or, let me state it differently, if today, with no crisis, no risk, you can't be bothered to run decentralized, you won't fight the state.

7/ Most people, even big thinkers, thought influencers, whales have their coins in exchanges or custodians.

It is frankly somewhere between bizarre and amusing that the average class of 2021 NFT holder is somehow more on-chain than the class of [2012+] BTC holder.

It is frankly somewhere between bizarre and amusing that the average class of 2021 NFT holder is somehow more on-chain than the class of [2012+] BTC holder.

8/ "but 6529, this will never happen"

Why are you so sure it won't? The USA banned private gold ownership for nearly 40 years.

GOLD! the "it is Lindy because we have used it for thousands of years" tech.

FFS, it was illegal in all boomer's lifetimes.

Why are you so sure it won't? The USA banned private gold ownership for nearly 40 years.

GOLD! the "it is Lindy because we have used it for thousands of years" tech.

FFS, it was illegal in all boomer's lifetimes.

9/ In a serious actual or engineered financial or security crisis, I dunno, I think it can happen.

Nuclear or bio attack "funded by crypto"

Currency crisis/hyperbitcoinization

In this type of situation, the off-chain centers of power will not go quietly

Nuclear or bio attack "funded by crypto"

Currency crisis/hyperbitcoinization

In this type of situation, the off-chain centers of power will not go quietly

10/ It could also happen progressively as is happening now @EpsilonTheory - Eye of Sauron style

As things stand, it will be illegal on 1/1/2024 to conduct a transaction on-chain for more than $10K without sending KYC information within 10 days to Treasury

As things stand, it will be illegal on 1/1/2024 to conduct a transaction on-chain for more than $10K without sending KYC information within 10 days to Treasury

11/ I am not sure how DeFi/AMMs are supposed to work in that model.

It would literally be the end of defi for US persons (defi would become centralized basically).

And NFTs will be traded only through KYC-ed marketplace for everyone's "don't break the law" convenience

It would literally be the end of defi for US persons (defi would become centralized basically).

And NFTs will be traded only through KYC-ed marketplace for everyone's "don't break the law" convenience

12/ NFTs are a bit more protected than DeFi.

You would still have a token that you could move permissionlessly at the end (you would just be afraid to do so).

DeFi, though, I dunno how it survives.

You would still have a token that you could move permissionlessly at the end (you would just be afraid to do so).

DeFi, though, I dunno how it survives.

13/ "Market competition from other countries will save us!"

Who? Russia? China? India? Nigeria?

All of these countries are currently stricter than the USA and if they ran crypto-busting, might get sanctioned.

Are you going to risk jail for it?

Who? Russia? China? India? Nigeria?

All of these countries are currently stricter than the USA and if they ran crypto-busting, might get sanctioned.

Are you going to risk jail for it?

14/ Does this make you uncomfortable?

Good!

If it does it means you have not been thinking seriously enough about what decentralization means at a system level.

Crypto security assurances really do have external dependencies.

Good!

If it does it means you have not been thinking seriously enough about what decentralization means at a system level.

Crypto security assurances really do have external dependencies.

15/ I am not saying that, say, the BTC blockchain will not work in this scenario.

BTC will work fine at $100/BTC like it did before.

But hash rate will flee, people will be rekt and nobody will trust BTC for a generation or ever.

BTC will work fine at $100/BTC like it did before.

But hash rate will flee, people will be rekt and nobody will trust BTC for a generation or ever.

16/ "No 6529, state competition and self interest will prevent this"

MAYBE. Maybe. But are you 100% sure? What if you are wrong?

The point of adverserial thinking is to think about if bad people are your counterparty.

MAYBE. Maybe. But are you 100% sure? What if you are wrong?

The point of adverserial thinking is to think about if bad people are your counterparty.

17/ In 2022, we have mild people in charge, pro-innovation, not dictators and so on and soon it will be illegal to swap 9 ETH on uniswap without filling out a bunch of forms.

Canada (Canada!) froze all types of financial accounts.

Is it that hard to imagine worse? Is it? Why?

Canada (Canada!) froze all types of financial accounts.

Is it that hard to imagine worse? Is it? Why?

18/ So, what do we do? For me, it is three things.

#1 adoption - we live in democracies, politicians are sortof responsive to voters.

It makes a difference if 5% vs 50% of people have some experience with crypto, with the power of digital ownership, ideally on-chain

#1 adoption - we live in democracies, politicians are sortof responsive to voters.

It makes a difference if 5% vs 50% of people have some experience with crypto, with the power of digital ownership, ideally on-chain

19/ #2 is continuing the grind of explaining to politicians why crypto is broadly good for our countries.

Why innovation is good for our countries.

Why rent-seeking big tech oligopolies is NOT the perfect end-state for society.

The USA version is here

Why innovation is good for our countries.

Why rent-seeking big tech oligopolies is NOT the perfect end-state for society.

The USA version is here

https://twitter.com/punk6529/status/1457278102405623811

20/ The EU version of this argument is here:

https://twitter.com/punk6529/status/1457370810679808006

21/ #3 Put another layer of defense, a free speech layer of defense, a memetic layer of defense, a first amendment protected layer of defense, in place.

Something that can bridge chains, float through social media, live off-chain, show up in rallies.

Memes

Something that can bridge chains, float through social media, live off-chain, show up in rallies.

Memes

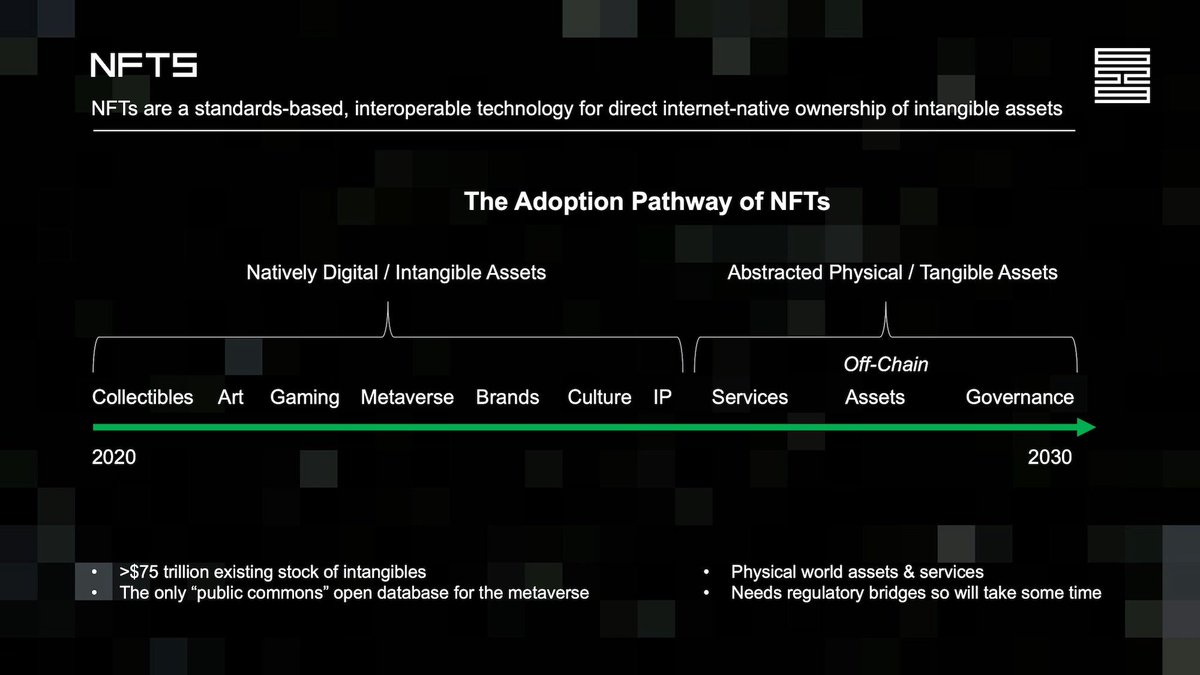

22/ #1 adoption and #3 memes are what NFTs are going to do for decentralization.

They are the best technology to get people to transact on-chain by a factor of infinity.

And memes (myths) are what drive society and politics. They are the apex objects of society.

They are the best technology to get people to transact on-chain by a factor of infinity.

And memes (myths) are what drive society and politics. They are the apex objects of society.

23/ The hardcore fungible coins crowd is immensely dense on this topic.

"har har har, can't believe people are putting JPGs on a blockchain while we are doing fancy math on AMM v5"

My brothers and sisters, your AMM is dead meat with one stroke of a legislative pen

"har har har, can't believe people are putting JPGs on a blockchain while we are doing fancy math on AMM v5"

My brothers and sisters, your AMM is dead meat with one stroke of a legislative pen

24/ "AMMs on ETH are dead meat, but my BTC is hardened state resistant money"

The industrial mining facilities will be shut down the same day as the CEXes. Easy to find!

And with price collapses, the hidden Asian ones will bleed hash rate. BTC will live, but in the shadows.

The industrial mining facilities will be shut down the same day as the CEXes. Easy to find!

And with price collapses, the hidden Asian ones will bleed hash rate. BTC will live, but in the shadows.

25/ "no, no, this will only prove the BTC case, people will flock to it"

I dunno. Maybe. It is a big gamble to take. as @NeerajKA says "maybe we can survive being banned, but isn't it better if we are not?"

I dunno. Maybe. It is a big gamble to take. as @NeerajKA says "maybe we can survive being banned, but isn't it better if we are not?"

26/ What odds do I put on this adverserial case?

I dunno, I have no idea, say 25%.

I don't think it is 2% or 1% or 0.1%. I don't think it is a number we can ignore

Be wary of "normalcy bias" - that things will continue tomorrow as they did today. Things change sometimes.

I dunno, I have no idea, say 25%.

I don't think it is 2% or 1% or 0.1%. I don't think it is a number we can ignore

Be wary of "normalcy bias" - that things will continue tomorrow as they did today. Things change sometimes.

27/ Humor me and say the chance is 25% or 40% or 10%. Just not that it is not 0.001% or something.

And if the chance is in my range, well that is a lot.

Decentralized databases are really important to the future of our digital lives.

The alternative is digital serfdom.

And if the chance is in my range, well that is a lot.

Decentralized databases are really important to the future of our digital lives.

The alternative is digital serfdom.

28/ So it is worth a lot of effort, even at a 25% risk.

CBDCs are coming for sure. AIs are coming for sure. Closed metaverses are coming for sure, along with closed VR/AR.

We need to preserve some space for freedom, some space to breathe, an exit valve for society.

CBDCs are coming for sure. AIs are coming for sure. Closed metaverses are coming for sure, along with closed VR/AR.

We need to preserve some space for freedom, some space to breathe, an exit valve for society.

29/ So keep going, keep building, keep pushing culture into decentralized containers and keep expanding its scope.

There is a pathway to a better place, but it is not easy, it is not simple, it is not 'repeating some slogans', it needs IRL engagement too

There is a pathway to a better place, but it is not easy, it is not simple, it is not 'repeating some slogans', it needs IRL engagement too

30/ If you are new around here, we like JPGs and we like open metaverses and it seems we are going to have to figure it ourselves bc the people in charge are asleep at the wheel

https://twitter.com/punk6529/status/1448399827054833668

• • •

Missing some Tweet in this thread? You can try to

force a refresh