1/ 🧵Everyone who thinks VCs are cold-blooded has never met an activist public markets investor. I worked on “activism defense” for tech companies during my tenure at Goldman. #StarboardValue took stakes in $WIX, $SPLK & $CRM this week - quick take below:

bit.ly/3FxtMaN

bit.ly/3FxtMaN

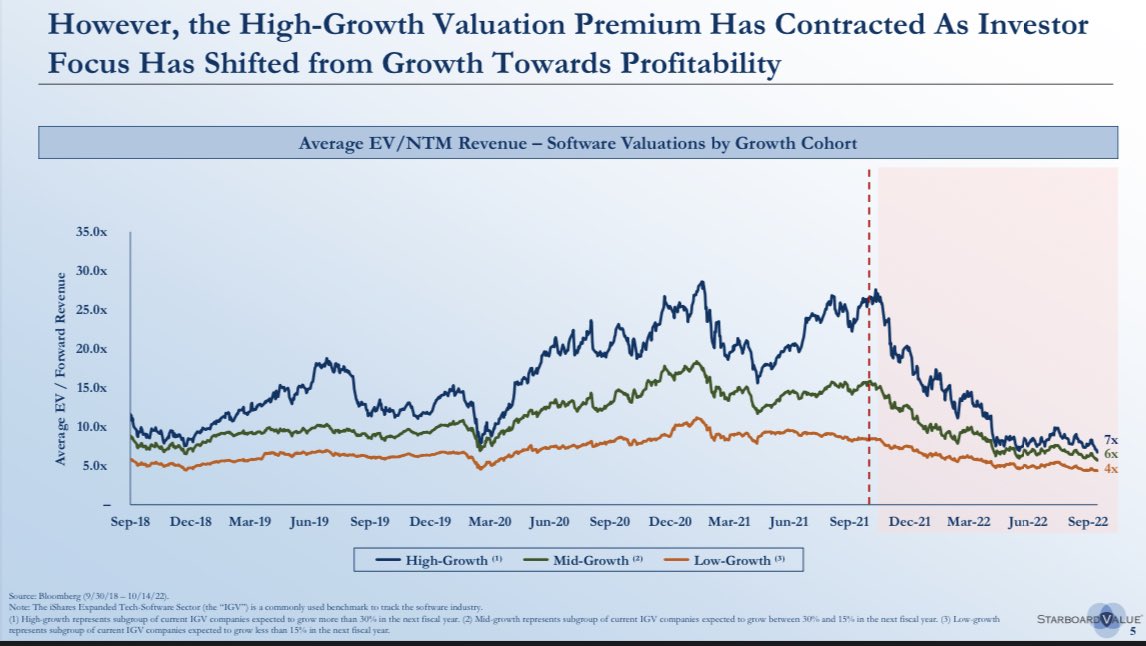

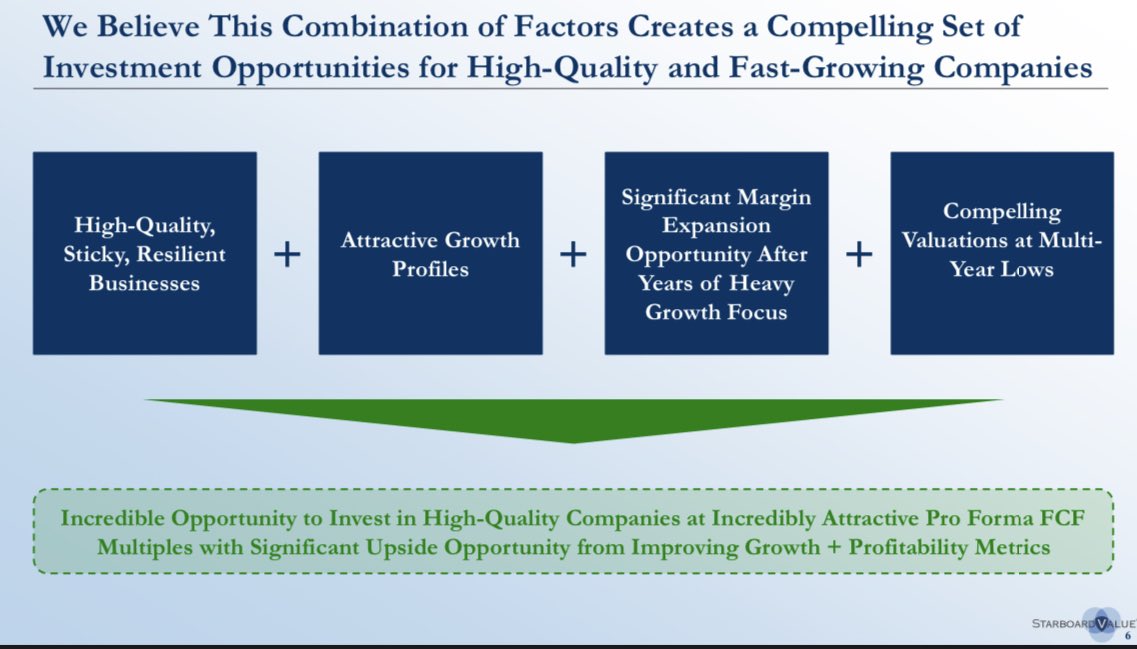

2/ They see an opportunity to buy strong growth at less premium, as well as reap the cash flow benefits of increased focus on profitability

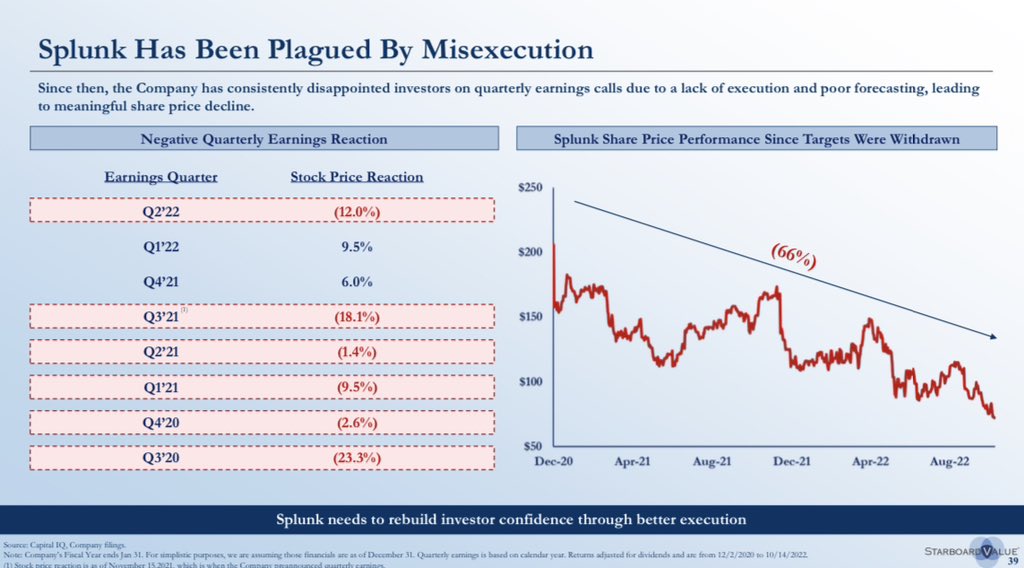

3/ Their thesis on all 3 companies: they trade at below-market multiples due to below-peer margin performance (fat)

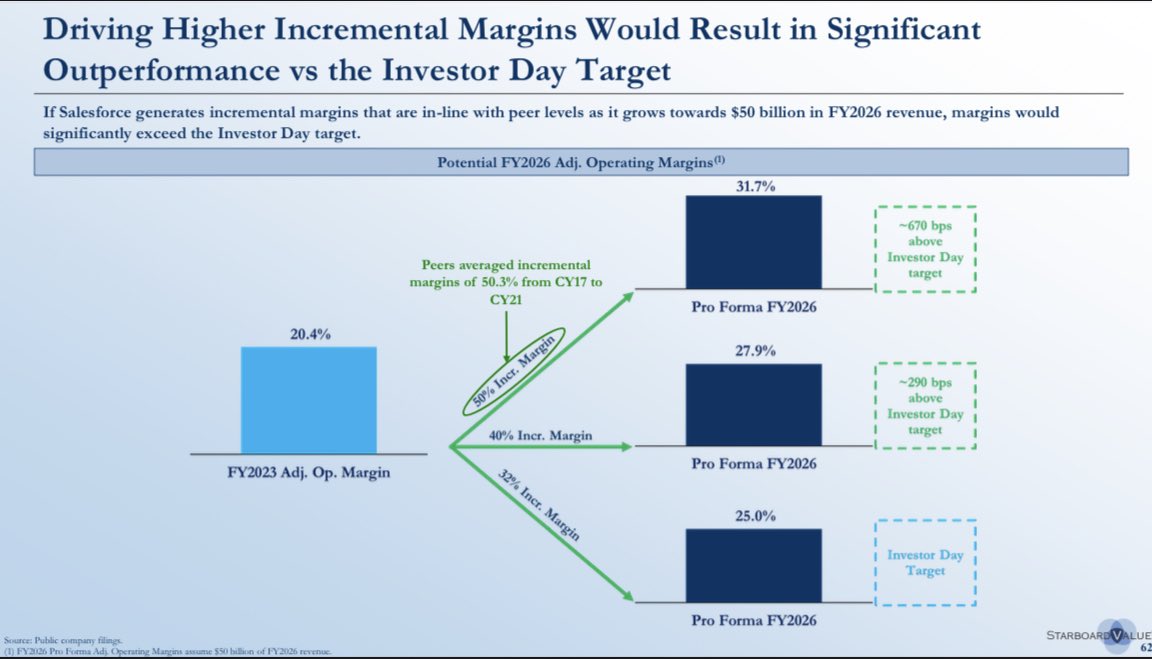

4/ And that each company can execute to improved profitability in line with peers (or in Salesforce’s case, higher than peers as it is growing relatively slower)

WIX: 9% ➡️ 40%

SPLK: 11% ➡️ 26%

CRM: 20.4% ➡️ 31.7%

WIX: 9% ➡️ 40%

SPLK: 11% ➡️ 26%

CRM: 20.4% ➡️ 31.7%

5/ There’s barely a mention of product, strategy. Just a simple assertion: you can do better with less cost. In tech companies, cost = people.

Lesson for the startup people: the public markets are the final arbiter for any company, and they see companies as financial statements.

Lesson for the startup people: the public markets are the final arbiter for any company, and they see companies as financial statements.

6/ It’s much easier to improve the quality of a business that is small and private (funded by investors that you choose) than one undergoing a financial dissection every quarter by every onlooker, with valuation (and stock based comp) changing every hour.

7/ The very smartest companies didn’t allow capital availability to create bad habits, and were capital efficient even during the easy times - they created internal discipline. They tried to build better (profitable, efficient) companies, not just bigger ones.

8/ Medium-smart companies will use this macro to dramatically change the way they operate. For many who have a big war chest even today, this still requires the leadership team to generate internal urgency/discipline.

9/ The companies in denial will let their remaining 2, 3, 4 years of runway guide them, refusing to make hard performance and focus decisions before they are forced to, hoping the environment improves.

10/ A friend of mine recently said about layoffs at his very loved and respected large ecommerce software employer, “lovely people, but 80% don’t do anything crucial for the business. people just don’t do performance management if they have no incentive.”

11/11 Uncle Starboard won’t accept that anymore. He and his friends will ask two very interesting questions about every software company: how many people do you really need to run this place? And do you really need to spend that much money to grow? Better to get ahead of him.

• • •

Missing some Tweet in this thread? You can try to

force a refresh