startup investor/helper, founder @conviction. accelerating AI adoption, interested in progress. tech podcast: @nopriorspod

How to get URL link on X (Twitter) App

AI years are like dog years: what’s changed

AI years are like dog years: what’s changed

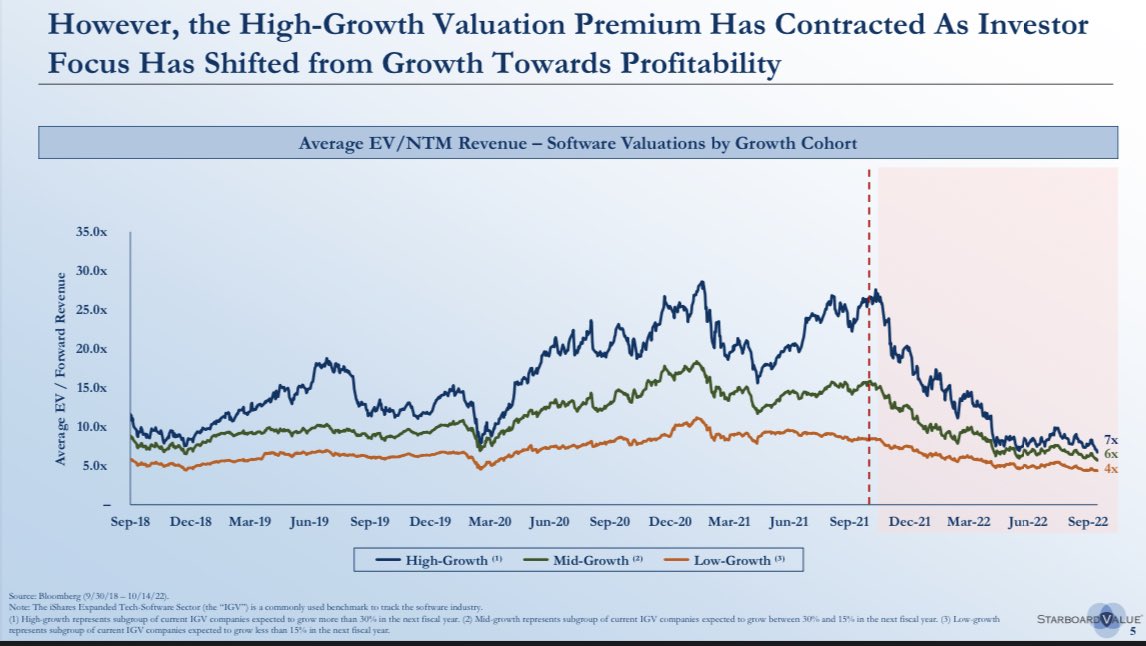

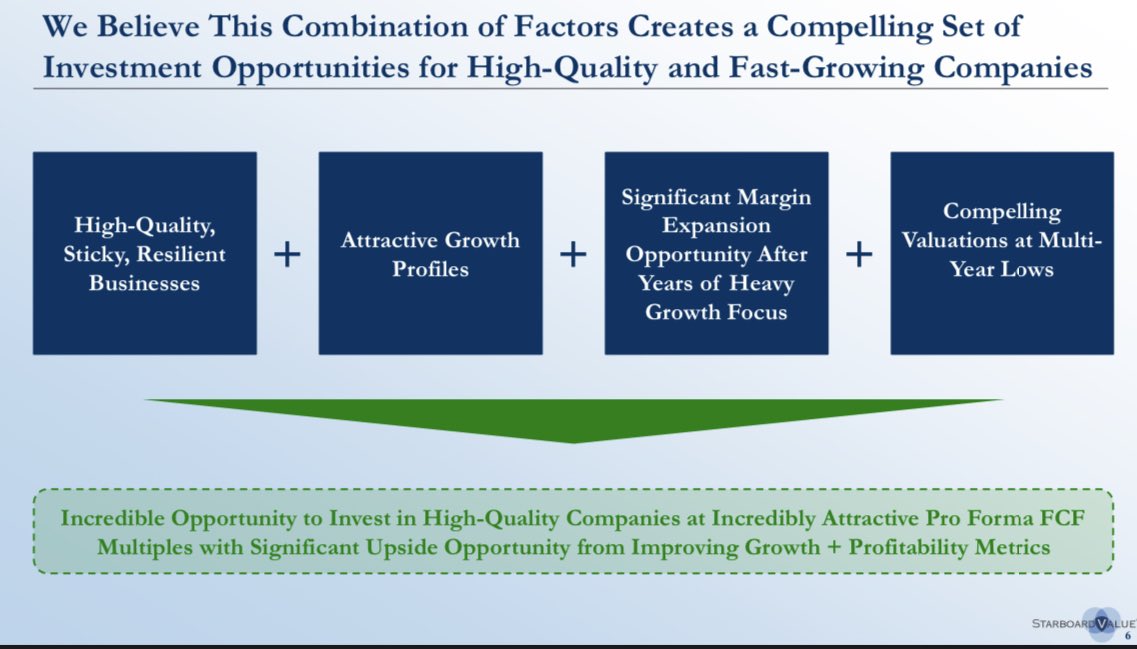

2/ They see an opportunity to buy strong growth at less premium, as well as reap the cash flow benefits of increased focus on profitability

2/ They see an opportunity to buy strong growth at less premium, as well as reap the cash flow benefits of increased focus on profitability