1/9. Albert Edwards @albertedwards99 has been railing against what he calls the "Davos consensus" of tight fiscal, loose monetary policy. I have some sympathy: this is the malinvestment road to hell.

https://twitter.com/albertedwards99/status/1587343751088939009?s=20&t=w8nKgP0ROb4YVBiEaQPkzw

2/9. So the alternatives are

a) loose fiscal and loose monetary.

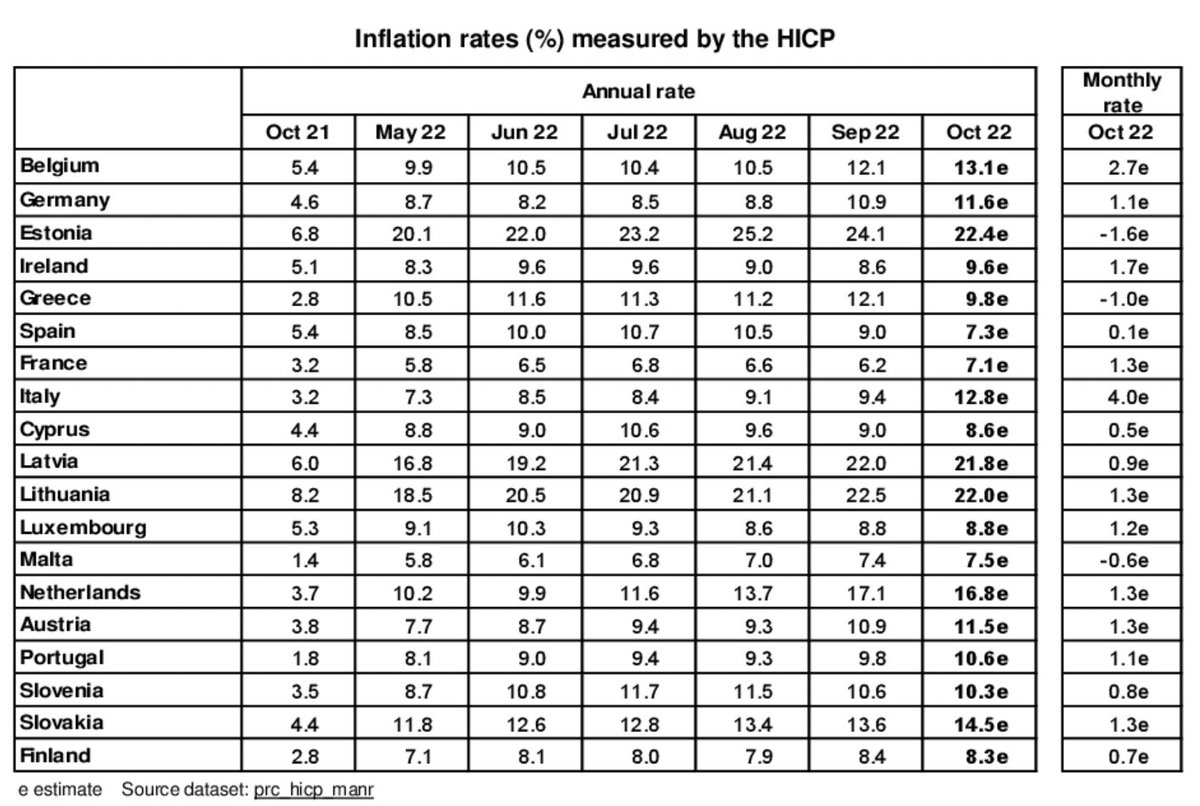

Well, we just tried that and it's given us near 10% inflation and a truly epic asset bubble.

a) loose fiscal and loose monetary.

Well, we just tried that and it's given us near 10% inflation and a truly epic asset bubble.

3/9.

b) tight fiscal and tight monetary

We have a name for that: it's called the Great Depression.

b) tight fiscal and tight monetary

We have a name for that: it's called the Great Depression.

4/9. So we end up with

c) loose fiscal and tight monetary

Here, I would add the wholly unrealistic advice-given-to-a-traveller-on-an Irish-road caveat: "better not start to from here"; but here is where we are.

c) loose fiscal and tight monetary

Here, I would add the wholly unrealistic advice-given-to-a-traveller-on-an Irish-road caveat: "better not start to from here"; but here is where we are.

5/9.

A major root of our troubles (putting the bubble boom and bust to one side) is a supply-side energy shock. Then we have to ask, "Which policy would be more focussed at solving this problem, fiscal or monetary policy?"

A major root of our troubles (putting the bubble boom and bust to one side) is a supply-side energy shock. Then we have to ask, "Which policy would be more focussed at solving this problem, fiscal or monetary policy?"

6/9.

My answer would have to be fiscal. Monetary policy as

even Ben Bernanke admitted, is a blunt tool. So, for a start, some of the billions of dollars capping energy prices in Europe would be better spent on war-time style energy-efficiency drives.

My answer would have to be fiscal. Monetary policy as

even Ben Bernanke admitted, is a blunt tool. So, for a start, some of the billions of dollars capping energy prices in Europe would be better spent on war-time style energy-efficiency drives.

7/9.

Another aspect of the debate should be that a lot of supply-side shocks can be resolved (at least to a degree) if given time. So, does Albert's "Davos consensus" (tight fiscal, loose monetary) or the alternative of 'loose fiscal, tight monetary' make better use of time?

Another aspect of the debate should be that a lot of supply-side shocks can be resolved (at least to a degree) if given time. So, does Albert's "Davos consensus" (tight fiscal, loose monetary) or the alternative of 'loose fiscal, tight monetary' make better use of time?

8/9.

In resolving supply-side shocks, kicking the can down the road for a few years is actually not a bad strategy. But if, as a teenager, you have ever kicked a can down a road, you realise that some people are better at it than others.

In resolving supply-side shocks, kicking the can down the road for a few years is actually not a bad strategy. But if, as a teenager, you have ever kicked a can down a road, you realise that some people are better at it than others.

9/9.

As can kicking goes, I would agree with Albert that tight fiscal, loose monetary is not a great way to go about it.

As can kicking goes, I would agree with Albert that tight fiscal, loose monetary is not a great way to go about it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh