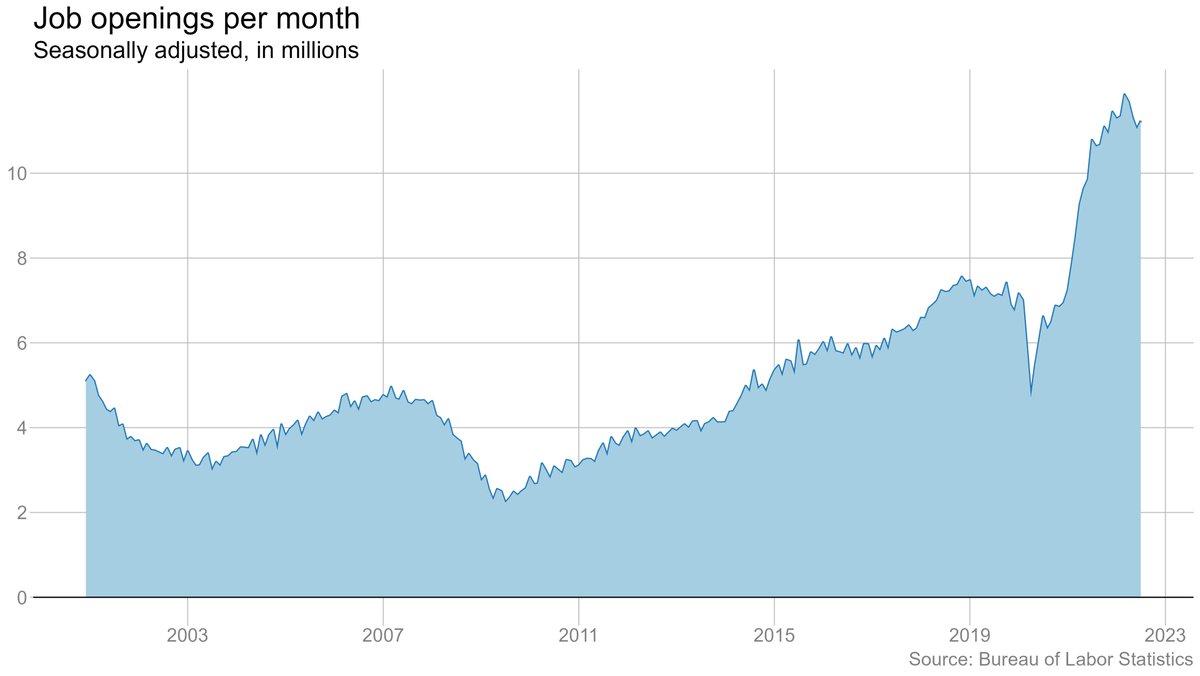

Job openings rose in September, to 10.7 million. Still only partly offsets the big drop in August.

Quits rate held steady at 2.7%.

Layoffs remain very low (and dipped back down slightly).

#JOLTS

bls.gov/news.release/j…

Quits rate held steady at 2.7%.

Layoffs remain very low (and dipped back down slightly).

#JOLTS

bls.gov/news.release/j…

Job openings edged back up in September, which isn't a big surprise given the huge drop in August. (Aug. also revised up, but only slightly.)

Basic story seems unchanged: Openings are falling, but from a *very* high level.

Basic story seems unchanged: Openings are falling, but from a *very* high level.

The uptick in job openings pushed back up the ratio of openings per unemployed worker, though it remains a bit below the 2:1 ratio we saw at the peak. Still lots of jobs out there!

Voluntary quits continue to edge down, though they remain high. Quits are key both as a sign of worker confidence and as a source of wage growth. (Remember: Most people quit to take another job.)

It's notable that while quits are elevated, they are not NEARLY as elevated as openings, relative to their historical levels. Quits say the labor market is exceptionally strong. Openings say it is blazingly hot. Which one is right has big implications for appropriate Fed policy.

Layoffs remain extraordinarily low -- well below any prepandemic level. (Note I'm showing this chart two ways -- one with the raw data and the other without the extreme pandemic levels, which obscure what's been happening recently.)

• • •

Missing some Tweet in this thread? You can try to

force a refresh