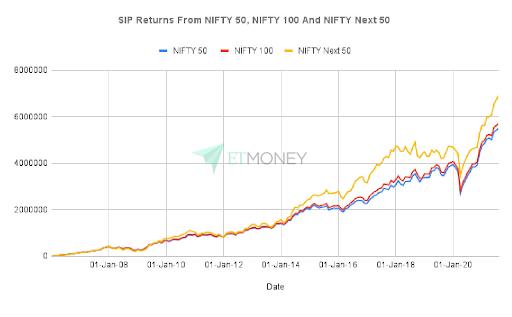

Introducing Nifty Next 50, a new investment strategy that outperforms the Nifty 50 index and large cap funds over the long term by 3-4%.

Know-it-all thread on Nifty Next 50 and how to invest in it

1/n

Know-it-all thread on Nifty Next 50 and how to invest in it

1/n

What is the Nifty Next 50 Index?

Like in cricket, we had icons like Sachin Tendulkar, Sunil Gavaskar & Don Bradman. Today we have players like Joe Root and Virat Kohli who set new standards.

2/n

Like in cricket, we had icons like Sachin Tendulkar, Sunil Gavaskar & Don Bradman. Today we have players like Joe Root and Virat Kohli who set new standards.

2/n

Similarly, the NIFTY Next 50, also known as Nifty Junior, is an index that includes a group of stocks in the stock market. These businesses aspire to be a part of the NIFTY50 stocks league

NIFTY Next 50 represents performance of 50 large cap stocks that come after NIFTY50

3/n

NIFTY Next 50 represents performance of 50 large cap stocks that come after NIFTY50

3/n

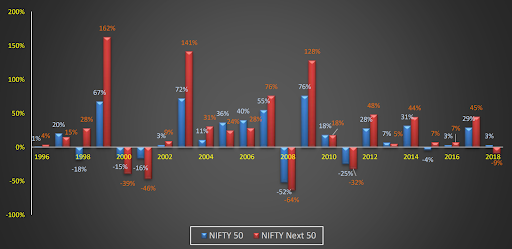

Calendar year-wise performance of NIFTY Junior vs NIFTY

When analyzing year-by-year performance, 13 out of 23 calendar years witnessed NIFTY Junior exceed the NIFTY. Particularly in the years 1999, 2003, 2009, 2012 & 2017, NIFTY Junior outperformed the market significantly

5/n

When analyzing year-by-year performance, 13 out of 23 calendar years witnessed NIFTY Junior exceed the NIFTY. Particularly in the years 1999, 2003, 2009, 2012 & 2017, NIFTY Junior outperformed the market significantly

5/n

The Junior index carries a slightly higher risk of volatility than the Nifty 50, but the Junior Nifty has generated better gains over the long run.

This is because of the outperformers in the Junior Index eventually being candidates for inclusion in the Nifty 50 index.

6/n

This is because of the outperformers in the Junior Index eventually being candidates for inclusion in the Nifty 50 index.

6/n

Additionally, the junior performs poorly in years of bear markets, but in years of bull markets, this index will outperform the Nifty by a margin of 3–5% over the long term.

7/n

7/n

Diversification & Stock Concentration

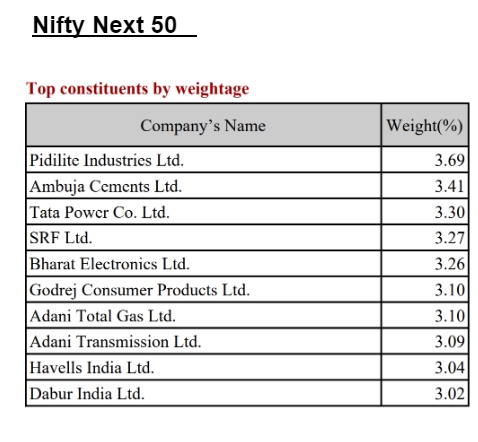

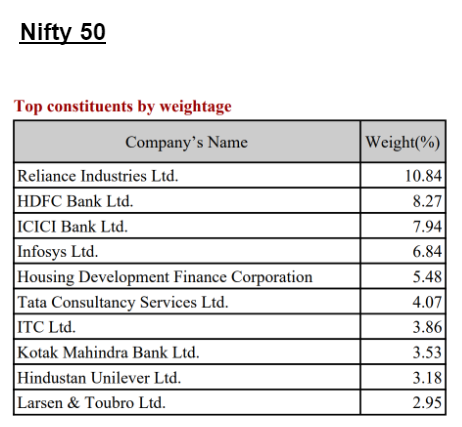

The top ten holdings of the Nifty 50 represent 57% of the index, which, in the case of Nifty Junior, is less than 33%. Junior Nifty has lower stock concentration of the two indices.

8/n

The top ten holdings of the Nifty 50 represent 57% of the index, which, in the case of Nifty Junior, is less than 33%. Junior Nifty has lower stock concentration of the two indices.

8/n

Due to Nifty's high concentration of market capitalization in sector leaders, top holdings of Nifty may exceed 10%. Top holdings in Nifty Jr. did not surpass 5%

So with broader market participation, Nifty Jr. outperforms Nifty. Nifty does well in polarized markets

9/n

So with broader market participation, Nifty Jr. outperforms Nifty. Nifty does well in polarized markets

9/n

Sectoral composition

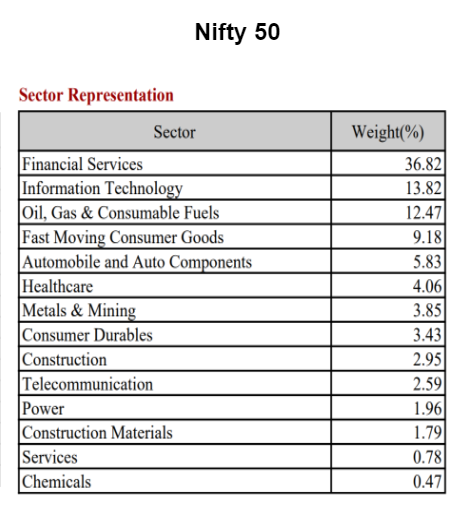

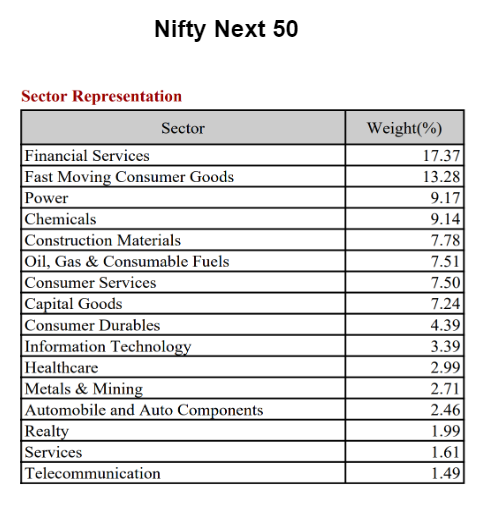

Compared to Nifty, Nifty Jr. is more diversified & has a lower sector concentration.

Nifty Jr. includes 6 sectors to make up 63% of the composition, while Nifty includes top 3 sectors to account for over 63% of its makeup.

10/n

Compared to Nifty, Nifty Jr. is more diversified & has a lower sector concentration.

Nifty Jr. includes 6 sectors to make up 63% of the composition, while Nifty includes top 3 sectors to account for over 63% of its makeup.

10/n

An imp factor is Nifty's substantial exposure - 37% to Banking & Financial services sector. It may be poised to gain due to structural factors & anticipated rerating as a result of improvement in financial performances & loan books for high-quality banks & select NBFCs

11/n

11/n

Nifty Junior index, on the other hand, is made up of developing blue chips that are often consistent steady compounders and also has a good exposure to new age sectors that are becoming more and more important in the leading indices.

12/n

12/n

Valuations : PE Multiples

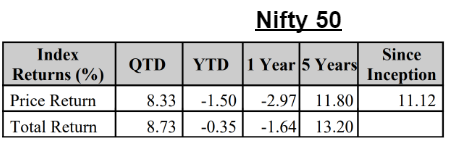

Compared to its 10-year historical average of 20.12x, Nifty Jr. is currently trading at a PE multiple of 22x

10-year average PE multiple for Nifty is roughly 18x, but it's currently trading at 21x.

13/n

Compared to its 10-year historical average of 20.12x, Nifty Jr. is currently trading at a PE multiple of 22x

10-year average PE multiple for Nifty is roughly 18x, but it's currently trading at 21x.

13/n

Both indices are currently trading at a premium above their historical mean.

But the Junior Index is trading at valuations closer to its Historic Multiples.

14/n

But the Junior Index is trading at valuations closer to its Historic Multiples.

14/n

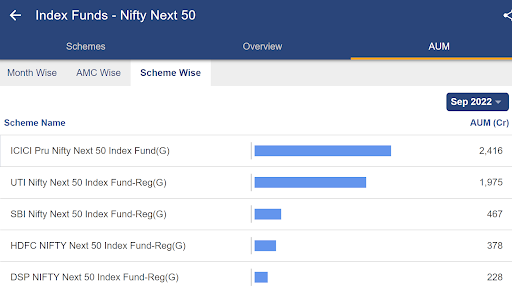

How to Invest in Nifty Jr.?

On StockEdge, you will get Index Mutual Funds that are simulating the Nifty Jr.

Alternatively, you can also invest in Nifty Jr. ETFs if you want to trade this index or invest on your days of choice.

15/n

On StockEdge, you will get Index Mutual Funds that are simulating the Nifty Jr.

Alternatively, you can also invest in Nifty Jr. ETFs if you want to trade this index or invest on your days of choice.

15/n

Few examples:

1. Nippon India Junior Bees

2. SBI ETF Next 50

3. UTI Next50 etc.

However, when it comes to ETFs, liquidity can be a problem. In case of low volumes, it may get difficult for a seller to offload large amounts of holdings leading to a high impact cost

16/n

1. Nippon India Junior Bees

2. SBI ETF Next 50

3. UTI Next50 etc.

However, when it comes to ETFs, liquidity can be a problem. In case of low volumes, it may get difficult for a seller to offload large amounts of holdings leading to a high impact cost

16/n

Which Index Should You Invest In?

The return & risk profiles of the two large cap indices vary. Your needs will determine the index you should select. To replace an actively managed Large Cap Fund, for example, you may use NIFTY 50.

17/n

The return & risk profiles of the two large cap indices vary. Your needs will determine the index you should select. To replace an actively managed Large Cap Fund, for example, you may use NIFTY 50.

17/n

If U want to take slightly higher risk than NIFTY, but don't want to invest in Mid Cap, then NIFTY Jr. is a good option. U can also invest in both. Depending on how much volatility U can handle, U might have bigger share in NIFTY & lower share in Nifty Jr., or vice versa

18/n

18/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh