According to extensive research from @CreditSuisse, Family-owned businesses has overperformed massively over time.

We will in this thread highlight 8 interesting family-run businesses. Let's dive in 👇

We will in this thread highlight 8 interesting family-run businesses. Let's dive in 👇

1. 🇺🇸 $BF.B (est. 1870) is the owner and manufacturer of some of the most well-known spirit brands in the world, such as Jack Daniel’s, and Old Forester.

Today’s Chairman, Campbell Brown, is a 5th generation Brown, and the family still holds a majority of the voting rights.

Today’s Chairman, Campbell Brown, is a 5th generation Brown, and the family still holds a majority of the voting rights.

2. 🇫🇮 $KONE (est. 1910) is one of the largest elevator and escalators manufacturers in the world. Ever since 1924, the Herlin family has been in control over the company, and still holds over 50% of the voting rights.

Since 1998, KONE's EBIT has jumped 12x.

Since 1998, KONE's EBIT has jumped 12x.

3. 🇮🇳 #SUNPHARMA (est. 1983) is the 4th largest Specialty Generic Pharma company in the world. Sun Pharma was founded by Dilip Shanghvi and the family still holds a controlling interest in the company.

Over the last two decades, the company has grown its revenue by 68x 👀

Over the last two decades, the company has grown its revenue by 68x 👀

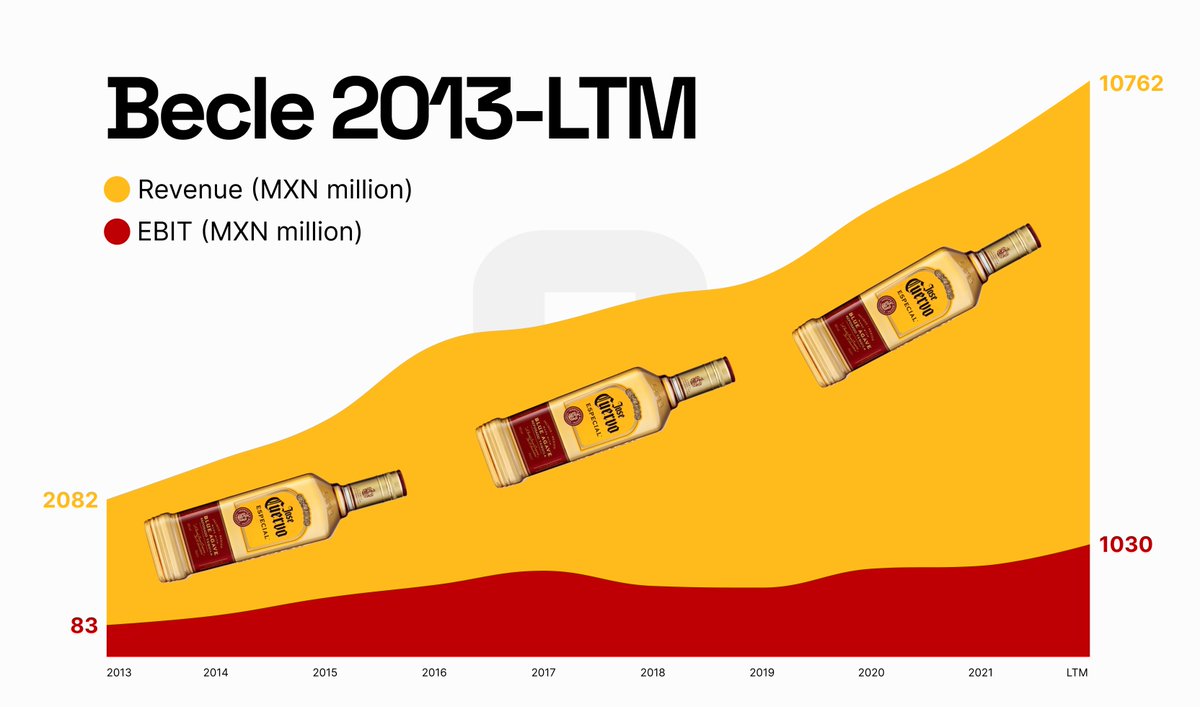

4. 🇲🇽 $CUERVO (est. 1758) is currently run by the eleventh(!) generation of the Beckmann family.

Becle is by far the largest tequila producer in the world with a ~1/3 market share. Its portfolio includes brands like Jose Cuervo, Kraken, Bushmills, and Proper Twelve.

Becle is by far the largest tequila producer in the world with a ~1/3 market share. Its portfolio includes brands like Jose Cuervo, Kraken, Bushmills, and Proper Twelve.

5. 🇫🇷 $DSY.PA was spun out from Dassault Aviation in 1981, and has a wide product portfolio of software for 3D product design, simulation, and manufacturing. The Dassault family is still the largest owner.

The performance over the last two decades has been very impressive:

The performance over the last two decades has been very impressive:

6. 🇫🇷 $BIM.PA (est. 1963) was founded by Alain Mérieux in the early 1960s, and the Mérieux still control over 50% of the shares.

Since its founding, bioMérieux has acquired several companies and is now a major player in the global Diagnostics solutions space.

Since its founding, bioMérieux has acquired several companies and is now a major player in the global Diagnostics solutions space.

7. 🇺🇸 $BIO (est. 1952) was founded by David & Alice Schwartz. Bio-Rad operates in the Life Science and Clinical Diagnostics space, and has has been run by Norman Schwartz, David's son, since 2003.

Judging only by this chart, Norman has done a good job as CEO:

Judging only by this chart, Norman has done a good job as CEO:

8. 🇺🇸 $COLM (est. 1938) actually started out as a hat manufacturer back in the 1930s, but has since then grown to be one of the largest outdoor apparel brands in the world.

Tim Boyle is a third-generation member of the founding Boyle family, and has been CEO since 1988 (!).

Tim Boyle is a third-generation member of the founding Boyle family, and has been CEO since 1988 (!).

• • •

Missing some Tweet in this thread? You can try to

force a refresh