Increasing efficiency and precision in qualitative public market research.

14 subscribers

How to get URL link on X (Twitter) App

1/10 Early KPI signals

1/10 Early KPI signals

This is the biggest collaboration project on the planet. All supplier and customer relationships are built to last in good times and bad.

This is the biggest collaboration project on the planet. All supplier and customer relationships are built to last in good times and bad.

Starbucks (with Howard Schultz) by @AcquiredFM

Starbucks (with Howard Schultz) by @AcquiredFM

1. The Gambling Man: The Wild Ride of Japan's Masayoshi Son

1. The Gambling Man: The Wild Ride of Japan's Masayoshi Son

"Family businesses generally tend to be more courageous in investing because they have longer time horizon: that makes the difference over time."

"Family businesses generally tend to be more courageous in investing because they have longer time horizon: that makes the difference over time."

In 2005, the family holding company Porsche SE began quietly acquiring Volkswagen shares.

In 2005, the family holding company Porsche SE began quietly acquiring Volkswagen shares.

2. Serial acquirer $LIFCO demonstrating strong FCF per share development:

2. Serial acquirer $LIFCO demonstrating strong FCF per share development:

2. The energy drink category has been slowing, but management is optimistic for a good summer:

2. The energy drink category has been slowing, but management is optimistic for a good summer:

1. A concise breakdown of the business and the factors making it high-quality:

1. A concise breakdown of the business and the factors making it high-quality:

2. The world's largest single-brand luxury company, $RMS, is as usual trading at the highest multiples in the space:

2. The world's largest single-brand luxury company, $RMS, is as usual trading at the highest multiples in the space:

"I think the intelligent use of leverage, particularly when it's tax deductible, makes tremendous sense."

"I think the intelligent use of leverage, particularly when it's tax deductible, makes tremendous sense."

2. $BUFAB is a full-service partner for C-parts, simplifying logistics management and addressing other challenges within supply chains.

2. $BUFAB is a full-service partner for C-parts, simplifying logistics management and addressing other challenges within supply chains.

2. $TSLA released a brand-new slide explaining its ecosystem:

2. $TSLA released a brand-new slide explaining its ecosystem:

The AGM was held at the Louvre and visited by thousands of shareholders.

The AGM was held at the Louvre and visited by thousands of shareholders.

Luxury Is Independent Of Time

Luxury Is Independent Of Time

Investing can be dangerous if you don't put in the work and merely rely on the advice of experts:

Investing can be dangerous if you don't put in the work and merely rely on the advice of experts:

2. The world's largest semi manufacturing equipment supplier (by revenue), $AMAT, is expected to grow by ~10%:

2. The world's largest semi manufacturing equipment supplier (by revenue), $AMAT, is expected to grow by ~10%:

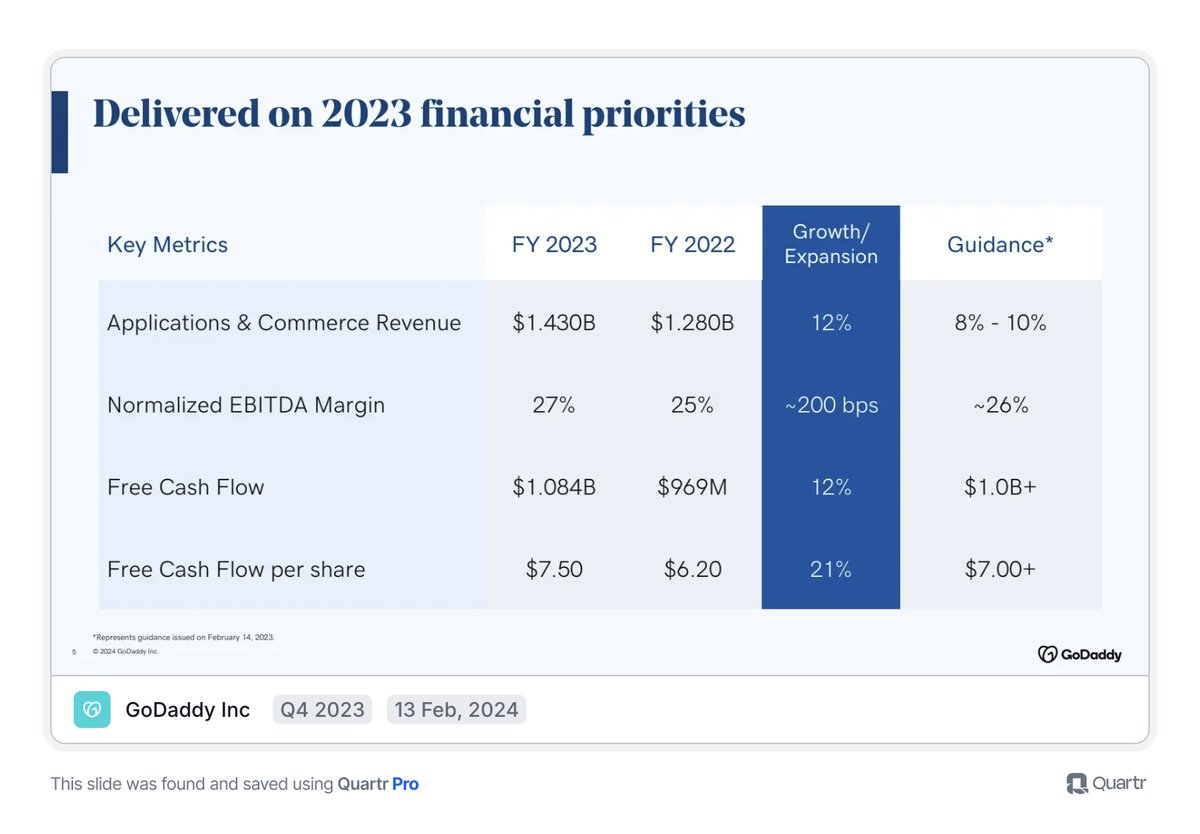

2. Another FCF per share advocate is $GDDY:

2. Another FCF per share advocate is $GDDY:

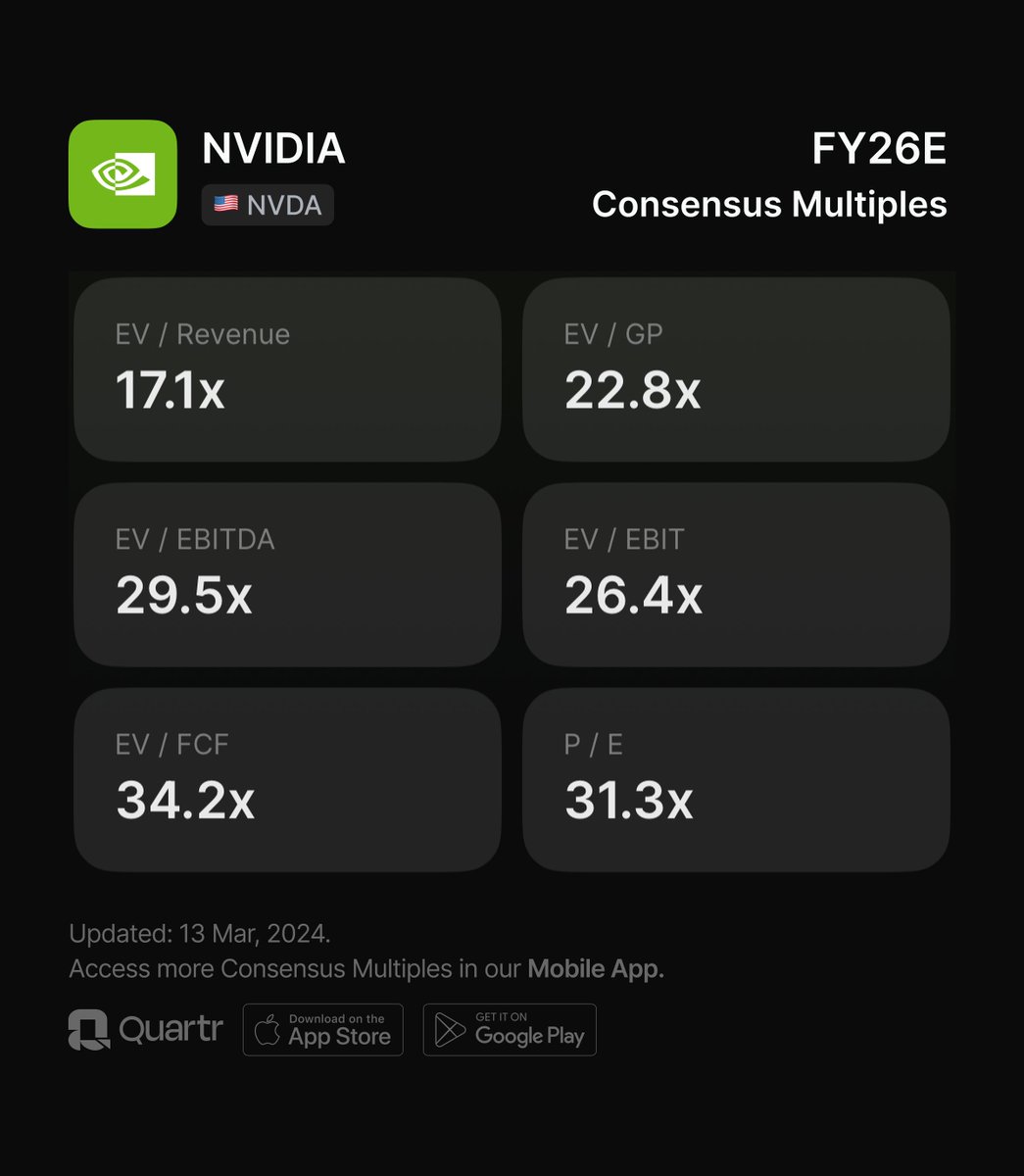

2. Fabless chip designers

2. Fabless chip designers