About -

Tejas Networks got founded in 2000 by Sanjay Nayak is an optical, broadband & data networking products company based in 🇮🇳, designs develops & sells its products to telecom service providers, internet service providers, utilities, security & Govt entities in 75 countries

Tejas Networks got founded in 2000 by Sanjay Nayak is an optical, broadband & data networking products company based in 🇮🇳, designs develops & sells its products to telecom service providers, internet service providers, utilities, security & Govt entities in 75 countries

Global Presence -

Tejas Network earns 60% of it's revenue from India. International Revenues accounts for 40% of total revenues of the company.

Has geographical presence in USA, Mexico, Brazil, South Africa, Nigeria, Kenya, UAE, Bangladesh, Philippines, Singapore and Malaysia.

Tejas Network earns 60% of it's revenue from India. International Revenues accounts for 40% of total revenues of the company.

Has geographical presence in USA, Mexico, Brazil, South Africa, Nigeria, Kenya, UAE, Bangladesh, Philippines, Singapore and Malaysia.

Financial Summary -

Revenue at 220 Cr Vs 173 Cr (YoY); 126 Cr (QoQ)

EBITDA 21.54 Cr Vs 18.34 Cr (YoY); Loss -7.32 Cr (QoQ)

PAT 1.07 Cr Vs 3.66 Cr (YoY); Loss -6.64 Cr (QoQ)

Cash & Equivalents at: Rs 1,402 Cr

Order book at end of Q2: Rs 1,455 Cr (all-time high)

Revenue at 220 Cr Vs 173 Cr (YoY); 126 Cr (QoQ)

EBITDA 21.54 Cr Vs 18.34 Cr (YoY); Loss -7.32 Cr (QoQ)

PAT 1.07 Cr Vs 3.66 Cr (YoY); Loss -6.64 Cr (QoQ)

Cash & Equivalents at: Rs 1,402 Cr

Order book at end of Q2: Rs 1,455 Cr (all-time high)

Company’s revenue is derived from three segments:

(A) International business (contributes 36% to overall revenue),

(B) Indian private business (47%), &

(C) Indian Government business (17%) as on Q2 FY 22.

(A) International business (contributes 36% to overall revenue),

(B) Indian private business (47%), &

(C) Indian Government business (17%) as on Q2 FY 22.

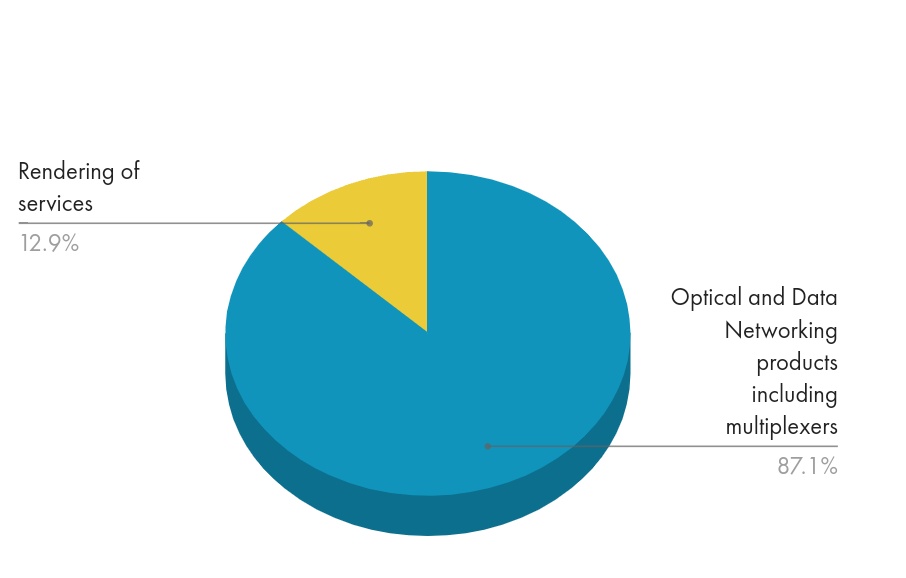

Product Offerings & Breakup -

Tejas Networks earns 87.1% from Optical & Data Networking products and 12.9% from Rendering of Services

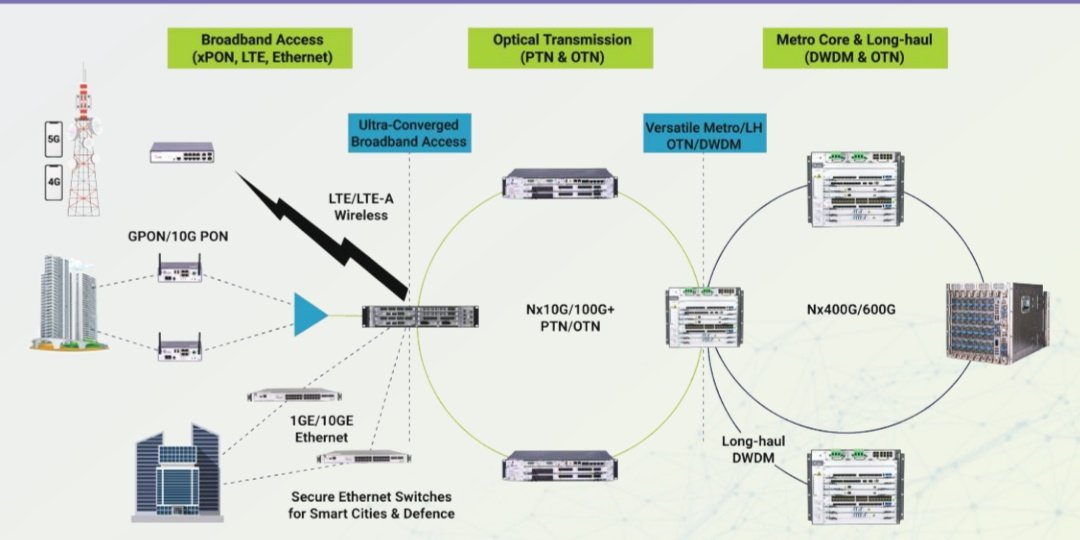

🔹Optical transmission equipment

🔹Broadband access equipment

🔹Ethernet/IP switch

🔹Network management software

🔹Lifecycle management services

Tejas Networks earns 87.1% from Optical & Data Networking products and 12.9% from Rendering of Services

🔹Optical transmission equipment

🔹Broadband access equipment

🔹Ethernet/IP switch

🔹Network management software

🔹Lifecycle management services

Tejas got a complete range of next-gen wireless, access, aggregation, metro & core switching products for realizing end-to-end optical networks with a universal network management system.

Benefit from Data & Broadband Growth in 🇮🇳 -

Over the last two decades, India has transitioned from a voice-centric telecom market to the world’s largest carrier of mobile data traffic. With a huge

pent-up demand for fiberization & home broadband,

Over the last two decades, India has transitioned from a voice-centric telecom market to the world’s largest carrier of mobile data traffic. With a huge

pent-up demand for fiberization & home broadband,

today India is one of the fastest growing optical equipment markets in the world.

Well positioned to play a key role for

Atmanirbhar Bharat -

• Preference to Make in India (PMI) : All telecom products being

mfg & sold by

Tejas are included in the PMI list.

• PLI Scheme : Tejas products approved

under PLI scheme for Telecom & Networking.

Atmanirbhar Bharat -

• Preference to Make in India (PMI) : All telecom products being

mfg & sold by

Tejas are included in the PMI list.

• PLI Scheme : Tejas products approved

under PLI scheme for Telecom & Networking.

Opportunity to leverage synergies with Tata Group -

Both Tata Group & Tejas foresee a large opportunity in telecom sector in 🇮🇳 & international markets & are planning to work together to benefit from the growth opportunity from new investment in fiber-based broadband rollouts.

Both Tata Group & Tejas foresee a large opportunity in telecom sector in 🇮🇳 & international markets & are planning to work together to benefit from the growth opportunity from new investment in fiber-based broadband rollouts.

Innovative Business Model -

• India-based

R&D :

4X R&D productivity compared to global peers by using talented yet low-cost workforce based in 🇮🇳, use of mass-

market FPGA devices with ownership of silicon IPR.

• India-based

R&D :

4X R&D productivity compared to global peers by using talented yet low-cost workforce based in 🇮🇳, use of mass-

market FPGA devices with ownership of silicon IPR.

• Asset-light

Manufacturing :

Outsourced

manufacturing to global

electronic contract manufacturers (EMS)

enabling us to scale-up manufacturing,

while making only incremental investments.

Manufacturing :

Outsourced

manufacturing to global

electronic contract manufacturers (EMS)

enabling us to scale-up manufacturing,

while making only incremental investments.

• Low Operations Cost :

SG&A and other costs are half of our global peers creating operating efficiency. Our gross margins are competitive despite lower economies of scale.

SG&A and other costs are half of our global peers creating operating efficiency. Our gross margins are competitive despite lower economies of scale.

Risks -

• Competition from international players.

• Global semiconductor supply chain challenges.

• Competition from international players.

• Global semiconductor supply chain challenges.

Aquisition of Saankhya Labs -

The acquisition is slated to boost Tejas’s wireless offerings by adding 5G ORAN, 5G cellular broadcast & satellite communication products to its product portfolio besides adding to its customer base in India and global markets.

The acquisition is slated to boost Tejas’s wireless offerings by adding 5G ORAN, 5G cellular broadcast & satellite communication products to its product portfolio besides adding to its customer base in India and global markets.

Conclusion -

The future of Tejas Networks looks positive on the capex by communications companies in India and international regions to feed the data hungry markets.

The future of Tejas Networks looks positive on the capex by communications companies in India and international regions to feed the data hungry markets.

Tejas Networks as a Tata Group company, with a widening product portfolio & an expanding array of opportunities, the company’s next phase of growth will be both exciting & rewarding.

Please 🙏 like 👍,comment, retweet ♻️ if you find this 🧵 useful.

And follow us on @LnprCapital for more information like this.

@nid_rockz @VVVStockAnalyst

And follow us on @LnprCapital for more information like this.

@nid_rockz @VVVStockAnalyst

https://twitter.com/LnprCapital/status/1588188272333062144?t=rD8IXhH-0TohyV3S64nAqw&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh