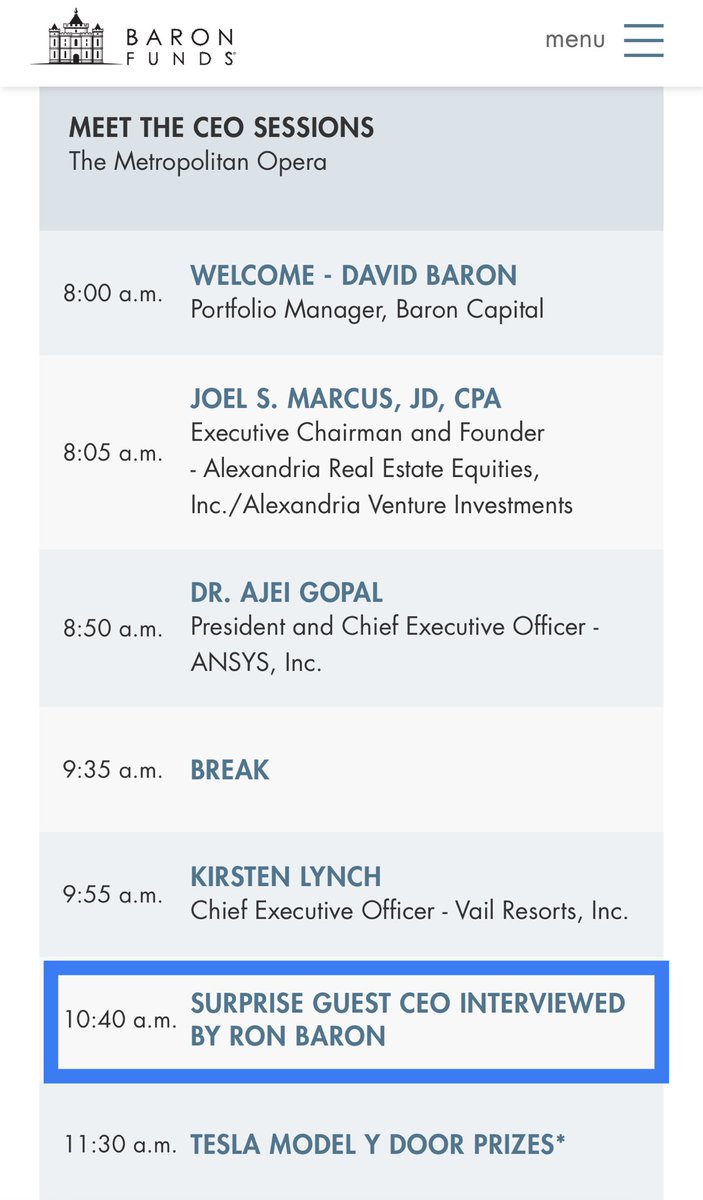

Here is the link to watch the Elon interview today. 👇

$TSLA

$TSLA

https://twitter.com/baronfunds/status/1588528670083518464

Hi Elon, please fire up the long term investor community that continue to stick w/ you through the ups and downs.

Good luck with your interview today with the investing legend Rob Baron!

@elonmusk @baronfunds

$TSLA #SpaceX $TWTR

Good luck with your interview today with the investing legend Rob Baron!

@elonmusk @baronfunds

$TSLA #SpaceX $TWTR

Elon is onstage right now. $TSLA #SpaceX

Elon just said he believes Twitter could become one of the most valuable companies in the world. $TWTR

• • •

Missing some Tweet in this thread? You can try to

force a refresh