WHY IS EVERYONE SLEEPING ON DEFI OPTIONS?

If you're not already, it's time to pay attention 🧐

A thread on DeFi Options, and 5 undervalued gems to add to your watchlist: 🧵

If you're not already, it's time to pay attention 🧐

A thread on DeFi Options, and 5 undervalued gems to add to your watchlist: 🧵

In simple terms, An options contract offers the buyer the opportunity and option to either buy or sell an asset at a pre-accorded price.

It's simple logic. You enter a contract ( not obligatory) to buy or sell a commodity at a certain rate in the future.

It's simple logic. You enter a contract ( not obligatory) to buy or sell a commodity at a certain rate in the future.

And when the time comes, you can accept to buy or decline the offer.

Investors could place long (buy) or short (sell) bets on crypto assets or commodities with a small fee (premium), even without having the full cost in possession.

Investors could place long (buy) or short (sell) bets on crypto assets or commodities with a small fee (premium), even without having the full cost in possession.

DeFi Options is simply bringing these activities on-chain.

Instead of having a broker that executes trades for you, you can have smart contracts do the work for you

In crypto, various options strategies are pre-packed as structured products, of which the most common are Vaults.

Instead of having a broker that executes trades for you, you can have smart contracts do the work for you

In crypto, various options strategies are pre-packed as structured products, of which the most common are Vaults.

I know it's a lot to digest.

Breath.

But one thing to know is that DeFi has simplified this; you need to lock your fund in a decentralized options vault (DOV), and the platform will do the work.

Every platform has its unique strategy.

Breath.

But one thing to know is that DeFi has simplified this; you need to lock your fund in a decentralized options vault (DOV), and the platform will do the work.

Every platform has its unique strategy.

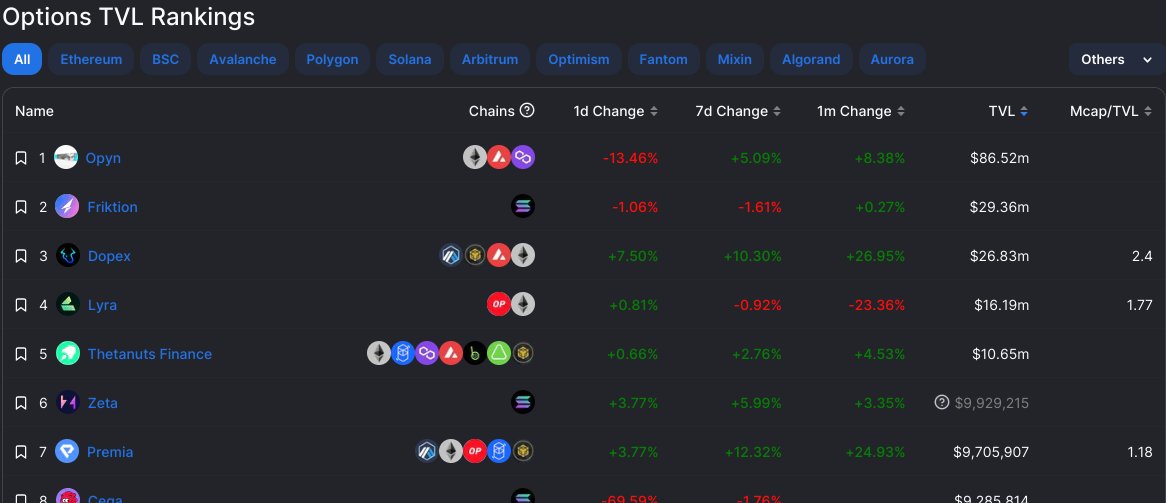

According to @DefiLlama, the DeFi options market has a combined TVL of $318M with about 43 platforms.

But today, we will look at some of the under-valued and fast-rising options platforms in different options categories. (in no particular order)

Let's get in.

But today, we will look at some of the under-valued and fast-rising options platforms in different options categories. (in no particular order)

Let's get in.

1/ Ribbon Finance - @ribbonfinance

Ribbon Finance is a suite of products that helps users access crypto-structured products.

They aim to be the one-stop solution for users who want to improve their portfolio's risk-return profile.

Ribbon Finance is a suite of products that helps users access crypto-structured products.

They aim to be the one-stop solution for users who want to improve their portfolio's risk-return profile.

Their products include Theta Vaults, Ribbon Earn, Ribbon Lend. And more recently, they introduced @aevoxyz, a DeFi options exchange.

Users can earn up to 13.12% APY on R-EARN, and some juicy rewards on their DOVs.

Users can earn up to 13.12% APY on R-EARN, and some juicy rewards on their DOVs.

2/ Polysynth - @0xPolysynth

Polysynth Protocol is a DeFi Options Vault (DOV) protocol that enables you to express your views on the market and earn in all market conditions.

With Polysynth DOVs, you can earn sustainable real yields on your investments.

Polysynth Protocol is a DeFi Options Vault (DOV) protocol that enables you to express your views on the market and earn in all market conditions.

With Polysynth DOVs, you can earn sustainable real yields on your investments.

They offer up to 51% APY on stables and structured products.

Best of all, Polysynth recently launched a Fixed Coupon Notes (FCN) that provides compounded fixed yields.

You can read it up here.

Best of all, Polysynth recently launched a Fixed Coupon Notes (FCN) that provides compounded fixed yields.

You can read it up here.

https://twitter.com/ViktorDefi/status/1578767082832809986?s=20&t=fxWdW0-4Iz2R_QUN2jOZfg

3/ Jones DAO - @DAOJonesOptions

Jones DAO is a yield, strategy, and liquidity protocol for options.

It generates yield through strategies deployed on the assets deposited in Jones Vaults.

You can get as much as 15.56% APY on their DPX vaults.

Jones DAO is a yield, strategy, and liquidity protocol for options.

It generates yield through strategies deployed on the assets deposited in Jones Vaults.

You can get as much as 15.56% APY on their DPX vaults.

With Jones Metavaults, Users can now optimally tune their LP positions to match their market outlook.

Metavaults reduce the impacts of IL, provide more opportunities for yield, and enhance the overall liquidity of the Dopex ecosystem.

Image: A new milestone of $JONES holders.

Metavaults reduce the impacts of IL, provide more opportunities for yield, and enhance the overall liquidity of the Dopex ecosystem.

Image: A new milestone of $JONES holders.

4/ Hegic - @HegicOptions

Hegic is an on-chain peer-to-pool options trading protocol built on Ethereum.

With Hegic, users can trade on-chain ETH and WBTC call/put options with no KYC or registration required for trading.

Hegic is an on-chain peer-to-pool options trading protocol built on Ethereum.

With Hegic, users can trade on-chain ETH and WBTC call/put options with no KYC or registration required for trading.

Hegic is a trading platform, unlike others that that are mainly DOVs.

If you're looking to start options trading, Hegic will give you a great start.

Hegic utilises a stake and cover model, basically a liquidity pool that acts as a counterparty to traders.

If you're looking to start options trading, Hegic will give you a great start.

Hegic utilises a stake and cover model, basically a liquidity pool that acts as a counterparty to traders.

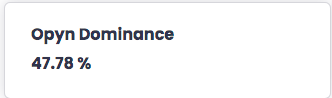

5/ Opyn - @opyn_

Opyn is a derivatives and options infrastructure in DeFi.

They currently dominate up to 47% of DeFi options market, and most DOVs of your favourite options platform are built on their infrastructure.

Opyn is a derivatives and options infrastructure in DeFi.

They currently dominate up to 47% of DeFi options market, and most DOVs of your favourite options platform are built on their infrastructure.

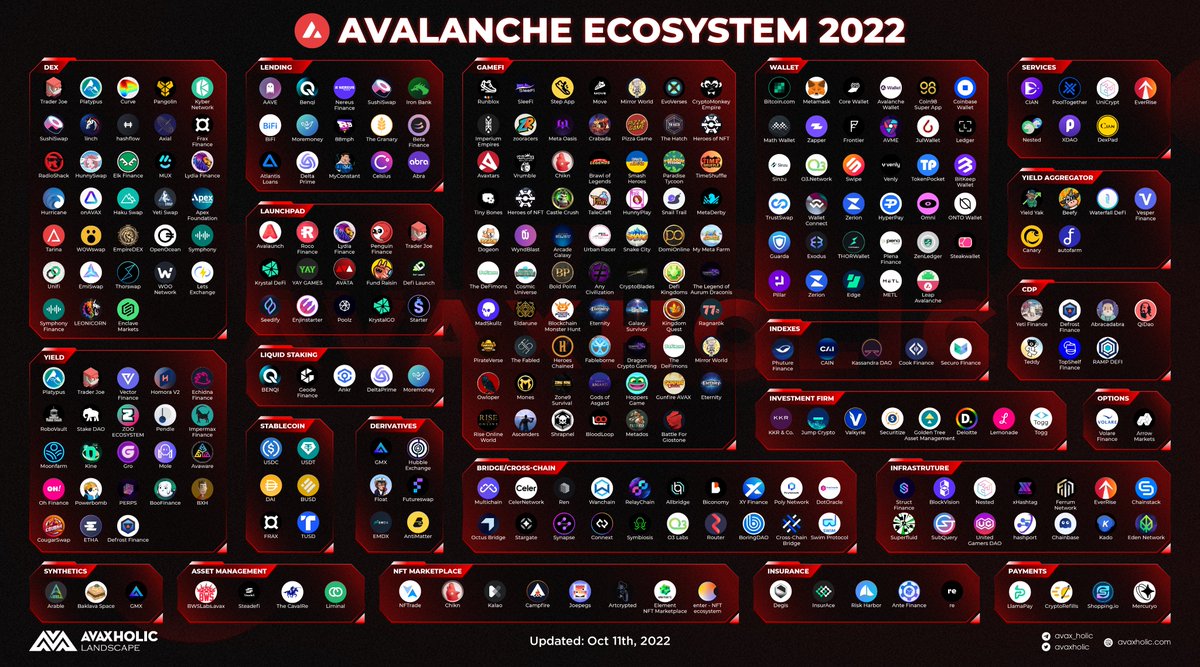

6/ Struct Finance - @StructFinance

Struct Finance is a new DeFi protocol that allow users to customize interest rate products and compose them with options available in the ecosystem.

Struct is bringing a novel innovation to DeFi options.

They are set to launch soon.

Struct Finance is a new DeFi protocol that allow users to customize interest rate products and compose them with options available in the ecosystem.

Struct is bringing a novel innovation to DeFi options.

They are set to launch soon.

That's all for today.

Follow me @ViktorDefi for more insightful defi threads.

Tagging some OG's:

@rektdiomedes

@DAdvisoor

@NDIDI_GRAM

@crypthoem

@0xtypejohnny

@dennis_qia

@defiprincess_

@TheDeFinvestor

Follow me @ViktorDefi for more insightful defi threads.

Tagging some OG's:

@rektdiomedes

@DAdvisoor

@NDIDI_GRAM

@crypthoem

@0xtypejohnny

@dennis_qia

@defiprincess_

@TheDeFinvestor

Kindly retweet

https://twitter.com/ViktorDefi/status/1588592701917696001?t=70FjeThosagDpcn2yXX-hg&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh