About -

A part of the Tata Group, Tata Chemicals Limited is a sustainable chemistry solutions Company. The Company operates through two verticals - Basic Chemistry & Specialty Products.

A part of the Tata Group, Tata Chemicals Limited is a sustainable chemistry solutions Company. The Company operates through two verticals - Basic Chemistry & Specialty Products.

The Company’s product portfolio provides key ingredients to many of the world’s leading brands for glass, detergents,

pharma, food & other industries.

TCL is a global major in soda ash & sodium bicarbonate with manufacturing facilities in India, US, UK and Kenya.

pharma, food & other industries.

TCL is a global major in soda ash & sodium bicarbonate with manufacturing facilities in India, US, UK and Kenya.

Location Wise Break-up -

TCL earns (47%) of it's revenue from India, (32.1%) from USA, (15%) from Europe, (3.2%) from Asia Ex India & (2.5%) from Africa.

TCL earns (47%) of it's revenue from India, (32.1%) from USA, (15%) from Europe, (3.2%) from Asia Ex India & (2.5%) from Africa.

R&D infrastructure -

Tata Chemicals has a robust R&D set-up with three state-of-the-art R&D Centres -

1 at Pune & 2 in Bengaluru India.

Also, strengthening

R&D commitment through increased collaboration to access cutting-edge research & undertake collaborative R&D.

Tata Chemicals has a robust R&D set-up with three state-of-the-art R&D Centres -

1 at Pune & 2 in Bengaluru India.

Also, strengthening

R&D commitment through increased collaboration to access cutting-edge research & undertake collaborative R&D.

Financial Summary -

Q2FY23 (YoY)

Revenue ₹4,239 Cr vs 3,022 Cr ⬆️40%

EBITDA ₹920 Cr vs 501 Cr ⬆️84%

PBT ₹723 Cr vs 320 Cr ⬆️126%

PAT ₹685 Cr vs 248 Cr ⬆️176%

Q2FY23 (YoY)

Revenue ₹4,239 Cr vs 3,022 Cr ⬆️40%

EBITDA ₹920 Cr vs 501 Cr ⬆️84%

PBT ₹723 Cr vs 320 Cr ⬆️126%

PAT ₹685 Cr vs 248 Cr ⬆️176%

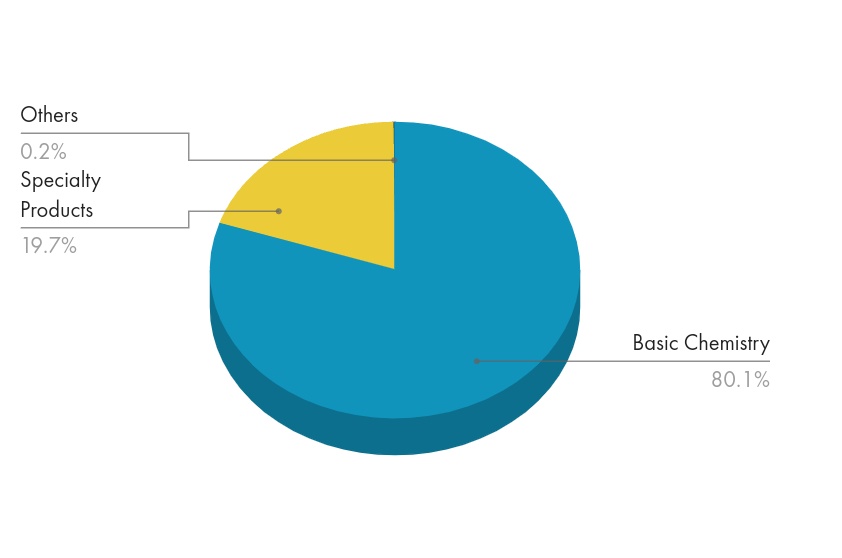

Segment Break-up -

Tata Chemicals makes 80% of it's revenue from Basic Chemicals & 19.7% from Speciality Chemicals.

Tata Chemicals makes 80% of it's revenue from Basic Chemicals & 19.7% from Speciality Chemicals.

▪️Basic Chemistry Products:

~ Alkali products: Soda Ash, Sodium Bicarbonate, Caustic Soda, Crushed Refined Soda

~ Halogen products: Chlorine-based products, Bromine-based products

~ Salt products: Industrial Salt, Livestock Salt, Animal Salt, Gypsum.

~ Alkali products: Soda Ash, Sodium Bicarbonate, Caustic Soda, Crushed Refined Soda

~ Halogen products: Chlorine-based products, Bromine-based products

~ Salt products: Industrial Salt, Livestock Salt, Animal Salt, Gypsum.

▪️Specialty Chemistry Products:

~ Agro Sciences: Cover 80% of India's districts with 13 Million farmer contacts through our subsidiary Rallis India Limited which offers crop protection & agri-input solutions.

~ Agro Sciences: Cover 80% of India's districts with 13 Million farmer contacts through our subsidiary Rallis India Limited which offers crop protection & agri-input solutions.

~ Nutritional Sciences: Offer an innovative range of nutritional solutions, prebiotics and healthier alternatives to regular sugar for consumers.

~ Material Sciences: Includes Highly Dispersible Silica & other grades of Precipitated Silica & silica dispersion - have allowed to leverage nano-chemistry & material synthesis expertise to serve needs of high performance materials across several industry segments.

With inherent strengths in chemistry, Tata Chemicals is creating a platform for electro-chemistry solutions.

CAPEX Update -

Out of project cost of ₹2,900 Cr, ₹1,850 Cr has been committed till Sept 2022. Total ₹1,050 Cr is expected to be spent till March 2024.

Further, for FY24-27 ₹2000 Cr Capex has been planned for incremental capacity (beyond ongoing expansion).

Out of project cost of ₹2,900 Cr, ₹1,850 Cr has been committed till Sept 2022. Total ₹1,050 Cr is expected to be spent till March 2024.

Further, for FY24-27 ₹2000 Cr Capex has been planned for incremental capacity (beyond ongoing expansion).

Indian Chemical Industry -

🇮🇳 chemical industry makes up ~3.4% of the global chemicals industry & is expected to grow to $300 billion by 2025.

The domestic Chemicals sector is expected to showcase high revenue & volume growth in FY2022-23,

owing to an improvement in domestic-

🇮🇳 chemical industry makes up ~3.4% of the global chemicals industry & is expected to grow to $300 billion by 2025.

The domestic Chemicals sector is expected to showcase high revenue & volume growth in FY2022-23,

owing to an improvement in domestic-

-demand, increased Government spending & better price realisation of chemicals.

Bulk chemicals (Basic Chemistry) constitute 25% of the market, while Specialty Chem, Petrochem, & Agrochem have 21%, 19% & 15% of the market, respectively.

Bulk chemicals (Basic Chemistry) constitute 25% of the market, while Specialty Chem, Petrochem, & Agrochem have 21%, 19% & 15% of the market, respectively.

Key triggers -

~ Improvement in the soda ash pricing environment bodes well for future growth outlook.

~ Revival in export demand for North America unit to sustain group performance.

~ Higher share of speciality business to command better valuations for the overall group.

~ Improvement in the soda ash pricing environment bodes well for future growth outlook.

~ Revival in export demand for North America unit to sustain group performance.

~ Higher share of speciality business to command better valuations for the overall group.

Risks -

~ High prices of energy sources like Oil, Natural Gas, Coal impacting variable costs.

~ Policy changes which could impact the Company’s operations at large.

~ Failure to address climate change related risks with an aim to reduce carbon emissions.

~ High prices of energy sources like Oil, Natural Gas, Coal impacting variable costs.

~ Policy changes which could impact the Company’s operations at large.

~ Failure to address climate change related risks with an aim to reduce carbon emissions.

Valuations -

P/E (Stock): 14.5

P/E (Industry): 18.5

P/S : 1.93

P/B : 1.49

EV/EBITDA : 9.6

P/E (Stock): 14.5

P/E (Industry): 18.5

P/S : 1.93

P/B : 1.49

EV/EBITDA : 9.6

Conclusion -

Green Chemistry & Green applications will continue to be at the heart of growth. Soda Ash is expected to remain on growth path in 🇮🇳 & around the world with increase demand for solar glass & lithium carbonate.

Green Chemistry & Green applications will continue to be at the heart of growth. Soda Ash is expected to remain on growth path in 🇮🇳 & around the world with increase demand for solar glass & lithium carbonate.

Specialty silica is an essential ingredient for the green labelling of tyres & Fermentation technology-based Prebiotics are replacing synthetic ingredients in food, feed & pharma sectors.

Tata Chemicals is well positioned to continue its growth in the comming years.

Tata Chemicals is well positioned to continue its growth in the comming years.

Please 🙏 like 👍,comment, retweet ♻️ if you find this 🧵 useful.

And follow us on @LnprCapital for more information like this.

@nid_rockz @VVVStockAnalyst @saketreddy

And follow us on @LnprCapital for more information like this.

@nid_rockz @VVVStockAnalyst @saketreddy

https://twitter.com/LnprCapital/status/1589487173312843780?t=VCAroYVB9uBbtA4SrXlm-Q&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh