Milliardærklubben - På afgrundens rand? UDE NU!

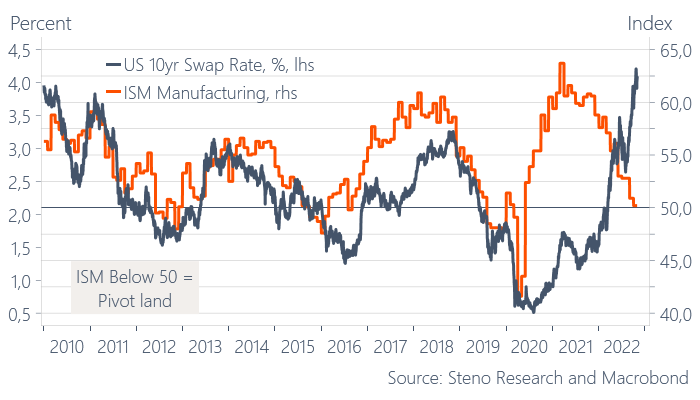

Recessionen står for døren, markederne er blodrøde verden over, men hvordan recessionsbeskytter man sig som privatperson? Dette er ugens tema i Milliardærklubben

Find podcasten på alle platforme

1/n

#DKPOL #DKMEDIER #DKBIZ

Recessionen står for døren, markederne er blodrøde verden over, men hvordan recessionsbeskytter man sig som privatperson? Dette er ugens tema i Milliardærklubben

Find podcasten på alle platforme

1/n

#DKPOL #DKMEDIER #DKBIZ

Hver uge vil vi levere ugens tip, som hjælper dig i din dialog med din bankrådgiver.

I denne uge spørger vi: Hvad har din bank gjort for at hjælpe med dig med at inflations -og recessionsbeskytte din privatøkonomi?

2/n

I denne uge spørger vi: Hvad har din bank gjort for at hjælpe med dig med at inflations -og recessionsbeskytte din privatøkonomi?

2/n

Herudover går vi bag om matematikken omkring det danske -og amerikanske valg. Bliver USA blodrødt rent politisk efter midtvejsvalget? Og hvilke konsekvenser kan det have for markedet?

3/n

3/n

Alt sammen tilsættes god jovial underholdning - vi skal have kigget på ugens kuriosum, ugens skamstøtte og andre faste programpunkter.

Vi håber, at i vil lytte med.

For kommentarer +45 31129636 eller andreassteno@stenoresearch.dk

4/n

Vi håber, at i vil lytte med.

For kommentarer +45 31129636 eller andreassteno@stenoresearch.dk

4/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh