BAT Option strategy has become popular now. let's decode the strategy and its variations.

BAT option Strategy Thread 🧵

Various names of BAT Option Strategy

1. BAT Strategy

2. CAT Strategy

3. BATMAN strategy

4. Double Ratio Spread

5. ‘V’ Spread

6. ‘M’ Spread

Scroll down 👇

BAT option Strategy Thread 🧵

Various names of BAT Option Strategy

1. BAT Strategy

2. CAT Strategy

3. BATMAN strategy

4. Double Ratio Spread

5. ‘V’ Spread

6. ‘M’ Spread

Scroll down 👇

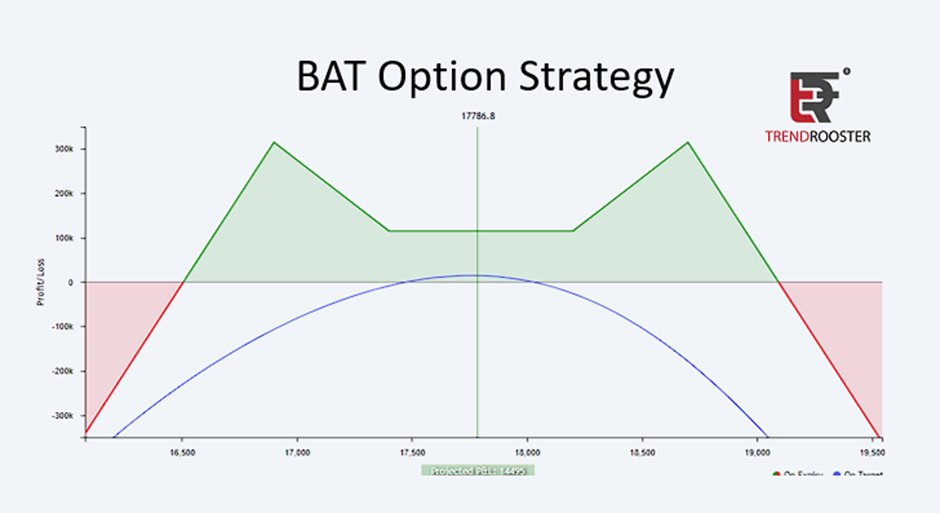

(i) BAT Strategy Construction.

The Typical construction of BAT strategy is…

Call Ratio Spread + Put Ratio Spread with same expiry

Tips: One should cover the Pay-off diagram with 1SD range to have higher probabilities of success.

Scroll down 👇

The Typical construction of BAT strategy is…

Call Ratio Spread + Put Ratio Spread with same expiry

Tips: One should cover the Pay-off diagram with 1SD range to have higher probabilities of success.

Scroll down 👇

(ii) Conservative BAT strategy

Call Ratio Spread + Put Ratio Spread + Protection on both the tail end.

Advantages of having Protected end BAT Strategy is...

1. Reduced Margin.

2. Black swan proof.

Scroll down 👇

Call Ratio Spread + Put Ratio Spread + Protection on both the tail end.

Advantages of having Protected end BAT Strategy is...

1. Reduced Margin.

2. Black swan proof.

Scroll down 👇

(iii) BAT Strategy with Ratio Variation

Typically, People will use from 2x to 5x ratio spread to make BAT strategy.

Anything beyond 5x ratio is overkill and would result in higher draw down and higher capital to manage the positions.

Scroll down 👇

Typically, People will use from 2x to 5x ratio spread to make BAT strategy.

Anything beyond 5x ratio is overkill and would result in higher draw down and higher capital to manage the positions.

Scroll down 👇

(iv)

@trendrooster

, we are more comfortable with 3x Ratio. Which is not low and not high when compared with 5x ratio.

Advantages of having Optimum ratio is…

1.T+0 slope is smoother

2.Margin friendly

3.Adjustable with less capital

Scroll down 👇

@trendrooster

, we are more comfortable with 3x Ratio. Which is not low and not high when compared with 5x ratio.

Advantages of having Optimum ratio is…

1.T+0 slope is smoother

2.Margin friendly

3.Adjustable with less capital

Scroll down 👇

(v) Can I enter BAT Strategy on Weekly / Monthly?

@trendrooster, we deploy this strategy on

Bi-Weekly

Monthly

Bi-Monthly

Result Trade

Yearly

Scroll down 👇

@trendrooster, we deploy this strategy on

Bi-Weekly

Monthly

Bi-Monthly

Result Trade

Yearly

Scroll down 👇

(vi) Can I trade BAT Strategy with stock options?

Yes. You can trade stock option with BAT option strategy. However, follow these rules to stay out of troubles.

(1) Trade only the liquid stocks.

(2) Close the trade before the expiry week.

Scroll down 👇

Yes. You can trade stock option with BAT option strategy. However, follow these rules to stay out of troubles.

(1) Trade only the liquid stocks.

(2) Close the trade before the expiry week.

Scroll down 👇

(vii) On which Volatility the BAT Strategy suites?

Well, BAT strategy is kind of allrounder except on low Volatility environment.

Ideally, Mid to High Vol

Scroll down👇

Well, BAT strategy is kind of allrounder except on low Volatility environment.

Ideally, Mid to High Vol

Scroll down👇

(Viii) How to adjust the BAT Option strategy?

Well, there is no single way to adjust the strategy, In Trendrooster we have devised 10 flavors of adjustments to any options profile.

Scroll down 👇

Well, there is no single way to adjust the strategy, In Trendrooster we have devised 10 flavors of adjustments to any options profile.

Scroll down 👇

(Viii)a

It could be short straddle / Short strangle / calendar or BAT all fits into the 10 flavors of adjustments.

To know more about the adjustments, refer our RDC video course.

trendrooster.org/Robust_Double_…

Scroll down👇

It could be short straddle / Short strangle / calendar or BAT all fits into the 10 flavors of adjustments.

To know more about the adjustments, refer our RDC video course.

trendrooster.org/Robust_Double_…

Scroll down👇

ix

If you like the content useful kindly RETWEET & LIKE the tweet to reach bigger audience.

Follow on YouTube Youtube.com/trendrooster

Follow on twitter

@trendrooster

Telegram channel t.me/TRR_Group

Check out trendrooster.org for our offerings and services.

👇

If you like the content useful kindly RETWEET & LIKE the tweet to reach bigger audience.

Follow on YouTube Youtube.com/trendrooster

Follow on twitter

@trendrooster

Telegram channel t.me/TRR_Group

Check out trendrooster.org for our offerings and services.

👇

End of this thread 🧵

Disclaimer – Do not deploy the strategy blindly without knowing the Good/bad/ugly part of the strategy.

I recommend to test the strategy for last 12months and practice them with paper trade before entering into real money.

Credit - options-decoder.truedata.in

Disclaimer – Do not deploy the strategy blindly without knowing the Good/bad/ugly part of the strategy.

I recommend to test the strategy for last 12months and practice them with paper trade before entering into real money.

Credit - options-decoder.truedata.in

• • •

Missing some Tweet in this thread? You can try to

force a refresh