1. About Company

Raunaq Automotive Components Limited(RACL) was incorporated in 1983 and is engaged in manufacturing transmission gears and shafts for automotive and industrial applications.

Raunaq Automotive Components Limited(RACL) was incorporated in 1983 and is engaged in manufacturing transmission gears and shafts for automotive and industrial applications.

It had a solid vision to create a diverse customer base ranging from two-wheelers to Heavy Commercial vehicles, a 100 CC commuter bike to a 1200 CC Sports Motorcycle, a 150 cc Premium Scooter to a 1500 CC bike.

RACL Geartech has one subsidiary, RACL Geartech GmbH which was incorporated in Austria in February 2019 which functions as a sales office for Europe.

2. Segment

RACL manufactures components for Tractors, Two Wheelers, Electric cars, Three Wheelers, Cargo Vehicles, Light and Heavy commercial vehicles, etc.

• 2-wheelers contributed 49% of FY22 revenues

• Recreational vehicles share is 19%

RACL manufactures components for Tractors, Two Wheelers, Electric cars, Three Wheelers, Cargo Vehicles, Light and Heavy commercial vehicles, etc.

• 2-wheelers contributed 49% of FY22 revenues

• Recreational vehicles share is 19%

• Followed by tractors which contributed 18%

• Passenger cars, commercial vehicles, Industrial gears, etc constitute the remaining 14%

• Passenger cars, commercial vehicles, Industrial gears, etc constitute the remaining 14%

3. Products

RACL is engaged in the Business of manufacturing automotive components Transmission Gears and Shafts and other types of gears related to power transmission to the engine

It started as a small auto component supplier in the aftermarket,

RACL is engaged in the Business of manufacturing automotive components Transmission Gears and Shafts and other types of gears related to power transmission to the engine

It started as a small auto component supplier in the aftermarket,

Today it makes gears like transmission gears, timing gears, ring gears, lock wheels, drivetrain drive shafts, etc which are complex and tech-driven creating a high entry barrier.

The major raw materials used by the company are steel and forgings

For product diversification, it is entering into chassis and suspension components used in EV, ICE, and hybrid vehicles.

For product diversification, it is entering into chassis and suspension components used in EV, ICE, and hybrid vehicles.

4. Clients :

Over the years RACL has developed relations with marquee clients like BMW Motorrad, TM, Kubota, Piaggio, MAN trucks, etc

They have also recently started supplying to ZF which is the largest auto component manufacturer in the world.

Over the years RACL has developed relations with marquee clients like BMW Motorrad, TM, Kubota, Piaggio, MAN trucks, etc

They have also recently started supplying to ZF which is the largest auto component manufacturer in the world.

As per Management, they have grabbed orders from clients for their electric vehicles(name not disclosed due to NDA)

5. Manufacturing:

RACL has two Manufacturing Plants one in Gajraula(UP) and the other in Noida which exclusively caters to Yamaha

The Gajraula plant is 100 km from New Delhi, while the Noida plant is 15 km away.

RACL has two Manufacturing Plants one in Gajraula(UP) and the other in Noida which exclusively caters to Yamaha

The Gajraula plant is 100 km from New Delhi, while the Noida plant is 15 km away.

Their capacities are easily fungible as per the orders

The company has a large product range of more than 500 products and has to maintain an inventory of around 3.5 months.

Current capacity utilization is about 70% to 75%

6. Financials

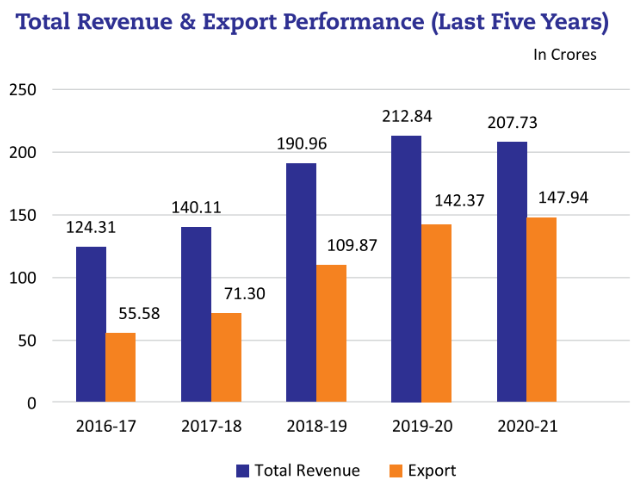

RACL derives 70% of its revenue from exports. It majorly supplies in Europe which constitutes 57% of its export revenue followed by Asia accounting for 39% and the rest from America.

RACL derives 70% of its revenue from exports. It majorly supplies in Europe which constitutes 57% of its export revenue followed by Asia accounting for 39% and the rest from America.

About 75% to 80% of the revenue comes from premium products and 20% to 25% from commodities due to which its top line does not get much affected because of economic downturns, and inflation volatility in raw materials.

Operating profit is ~20%

PAT stands at ~8%

Operating profit is ~20%

PAT stands at ~8%

ROCE and ROE are 18% at 20% and respectively

7. CAPEX

For FY23, the company will be undertaking CAPEX of ₹60cr which will be used for creating capacities for new products in lieu of nomination letters received from customers and modernization of the existing facility.

For FY23, the company will be undertaking CAPEX of ₹60cr which will be used for creating capacities for new products in lieu of nomination letters received from customers and modernization of the existing facility.

8. Management Guidance

The management has given guidance to reach a revenue of ₹500 Cr by 2025, from ₹245 Cr at present.

The management has given guidance to reach a revenue of ₹500 Cr by 2025, from ₹245 Cr at present.

Micro Cap Club : bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh