1/ I found evidence that FTX might have provided a massive bailout for Alameda in Q2 which now came back to haunt them.

40 days ago, 173 million FTT tokens worth over 4B USD became active on-chain.

A rabbit hole appeared 🧵👇

40 days ago, 173 million FTT tokens worth over 4B USD became active on-chain.

A rabbit hole appeared 🧵👇

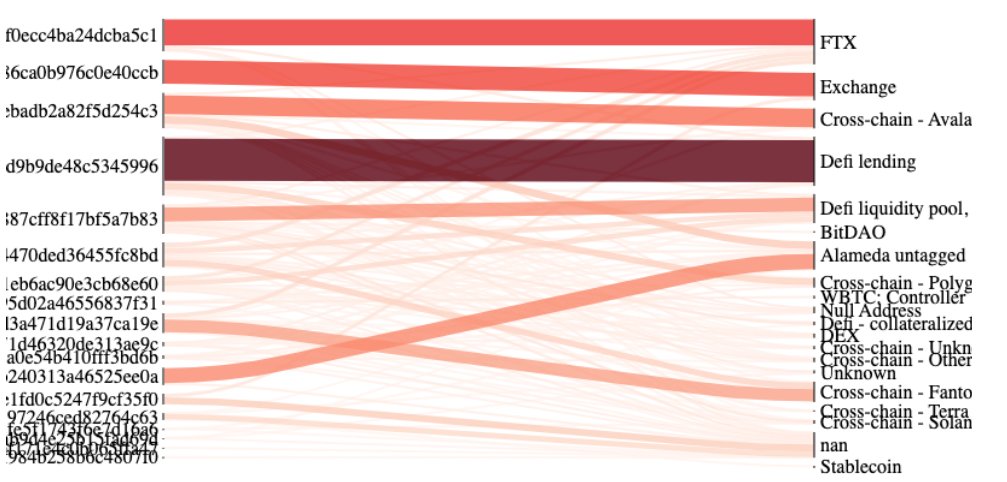

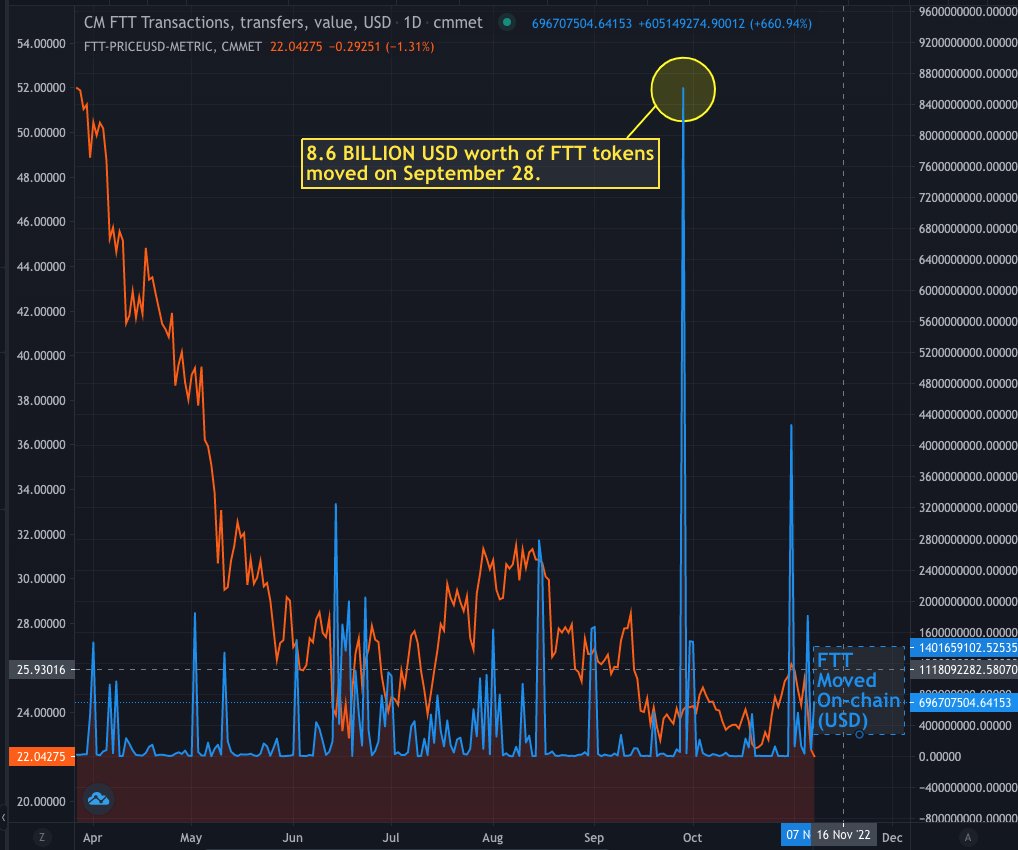

2/ That day, September 28, over 8.6 Billion USD worth of FTT was moved on-chain.

That was by far the largest daily move of FTT in the token's existence and one of the largest ERC20 daily moves we ever recorded at Coin Metrics.

That was by far the largest daily move of FTT in the token's existence and one of the largest ERC20 daily moves we ever recorded at Coin Metrics.

3/ I went through all transfers that happened that day using CM ATLAS and ranked them.

I found a peculiar transaction that interacted with a contract from the FTT ICO.

This 2019 contract *automatically* released 173 Million FTT from the token's ICO.

etherscan.io/tx/0x975d62232…

I found a peculiar transaction that interacted with a contract from the FTT ICO.

This 2019 contract *automatically* released 173 Million FTT from the token's ICO.

etherscan.io/tx/0x975d62232…

4/ The recipient of the $4.19 B USD worth of FTT tokens was no one but Alameda Research!

So what? Alameda and FTX were intrinsically connected from day 1 and Alameda obviously participated in the FTX ICO.

But what happened next was interesting...

So what? Alameda and FTX were intrinsically connected from day 1 and Alameda obviously participated in the FTX ICO.

But what happened next was interesting...

5/ Alameda then sent that *entire* balance to the address of the deployer (creator) of the FTT ERC20, which is controlled by someone at FTX.

In other words, Alameda auto-vested $4.19 billion dollars worth of FTT just to send it immediately back to FTX.

etherscan.io/tx/0x8c7cf8d16…

In other words, Alameda auto-vested $4.19 billion dollars worth of FTT just to send it immediately back to FTX.

etherscan.io/tx/0x8c7cf8d16…

5/ Here's what I think happened:

- Alameda blew up in Q2 along with 3AC+ others.

- It ONLY survived because it was able to secure funding from FTX using as "collateral" the 172M FTT that was guaranteed to vest 4 months later.

Once vested, all tokens were sent back as repayment.

- Alameda blew up in Q2 along with 3AC+ others.

- It ONLY survived because it was able to secure funding from FTX using as "collateral" the 172M FTT that was guaranteed to vest 4 months later.

Once vested, all tokens were sent back as repayment.

6/ Remember, the FTT ICO contract vests automatically.

Had FTX let Alameda implode in May, their collapse would have ensured the subsequent liquidation of all FTT tokens vested in September.

It would have been terrible for FTX, so they had to find a way to avoid this scenario.

Had FTX let Alameda implode in May, their collapse would have ensured the subsequent liquidation of all FTT tokens vested in September.

It would have been terrible for FTX, so they had to find a way to avoid this scenario.

7/ The timing makes sense.

Alameda and FTX essentially put all chips on the table in Q2 and used that cash to bail others out.

This solidified FTXs image as a solvent and responsible institution, which helped FTT's price.

So did SBFs political moves.

cryptobriefing.com/voyager-tumble…

Alameda and FTX essentially put all chips on the table in Q2 and used that cash to bail others out.

This solidified FTXs image as a solvent and responsible institution, which helped FTT's price.

So did SBFs political moves.

cryptobriefing.com/voyager-tumble…

8/ The Alameda bailout likely put a dent on FTXs balance sheet to the point where it was no longer solvent.

This would have been fine if the price of FTT didn't collapse and a bank run ensued

This is why Alameda tried their best to protect FTT's price.

cointelegraph.com/news/binance-c…

This would have been fine if the price of FTT didn't collapse and a bank run ensued

This is why Alameda tried their best to protect FTT's price.

cointelegraph.com/news/binance-c…

9/ Here's where I think it gets crazier.

There is a chance the folks from Binance knew about this arrangement between FTX and Alameda.

An opportunity emerged.

As large holders of FTT, they could start deliberately tanking that market to force FTX to face a liquidity crunch.

There is a chance the folks from Binance knew about this arrangement between FTX and Alameda.

An opportunity emerged.

As large holders of FTT, they could start deliberately tanking that market to force FTX to face a liquidity crunch.

10/ Long and behold, Binance comes to FTX's rescue.

Did CZ just walk out with one of his largest competitors at the expense of a relatively large FTT bag he was going to unwind anyways?

Huge if true™️

Did CZ just walk out with one of his largest competitors at the expense of a relatively large FTT bag he was going to unwind anyways?

Huge if true™️

11/ Important to note that this is my own personal highly-speculative take on what happened based on these on-chain artifacts.

A lot more is likely going to come out in the following days.

A lot more is likely going to come out in the following days.

12/ Evidence that supports this hypothesis keeps coming out.

FTX-US President Brett Harrison stepped down a day before Sept 28. transfer.

Maybe he wasn't on-board with a transaction that looked like outright fraud?

coindesk.com/business/2022/…

FTX-US President Brett Harrison stepped down a day before Sept 28. transfer.

Maybe he wasn't on-board with a transaction that looked like outright fraud?

coindesk.com/business/2022/…

13/ Voyager had 4,650,000 FTT and 63,750,000 SRM (Serum) tokens.

Just like Alameda, SBF might have had no other option but to bail them out.

fortune.com/crypto/2022/09…

Just like Alameda, SBF might have had no other option but to bail them out.

fortune.com/crypto/2022/09…

14/ SBF tried to contain any FUD saying the transfer was "rotating" a few wallets and that they do this "periodically"

Both are lies: the FTT transfer was between 2 entities, not "rotation"

I wouldnt call the largest FTT transfer ever "periodical"

Both are lies: the FTT transfer was between 2 entities, not "rotation"

I wouldnt call the largest FTT transfer ever "periodical"

https://twitter.com/hype_eth/status/1590254430837800960?s=20&t=W1TAyY6hhzK4HsJJ7FWamQ

15/ Reuters internal FTX source:

"Seeking to prop up Alameda, which held almost $15 billion in assets, Bankman-Fried transferred at least $4 billion in FTX funds, secured by assets including FTT and shares in trading platform Robinhood Markets Inc,"

reuters.com/technology/exc…

"Seeking to prop up Alameda, which held almost $15 billion in assets, Bankman-Fried transferred at least $4 billion in FTX funds, secured by assets including FTT and shares in trading platform Robinhood Markets Inc,"

reuters.com/technology/exc…

• • •

Missing some Tweet in this thread? You can try to

force a refresh