cofounder & CEO @PortexAI | AI evals & data @ https://t.co/RXTUewIkwe

2 subscribers

How to get URL link on X (Twitter) App

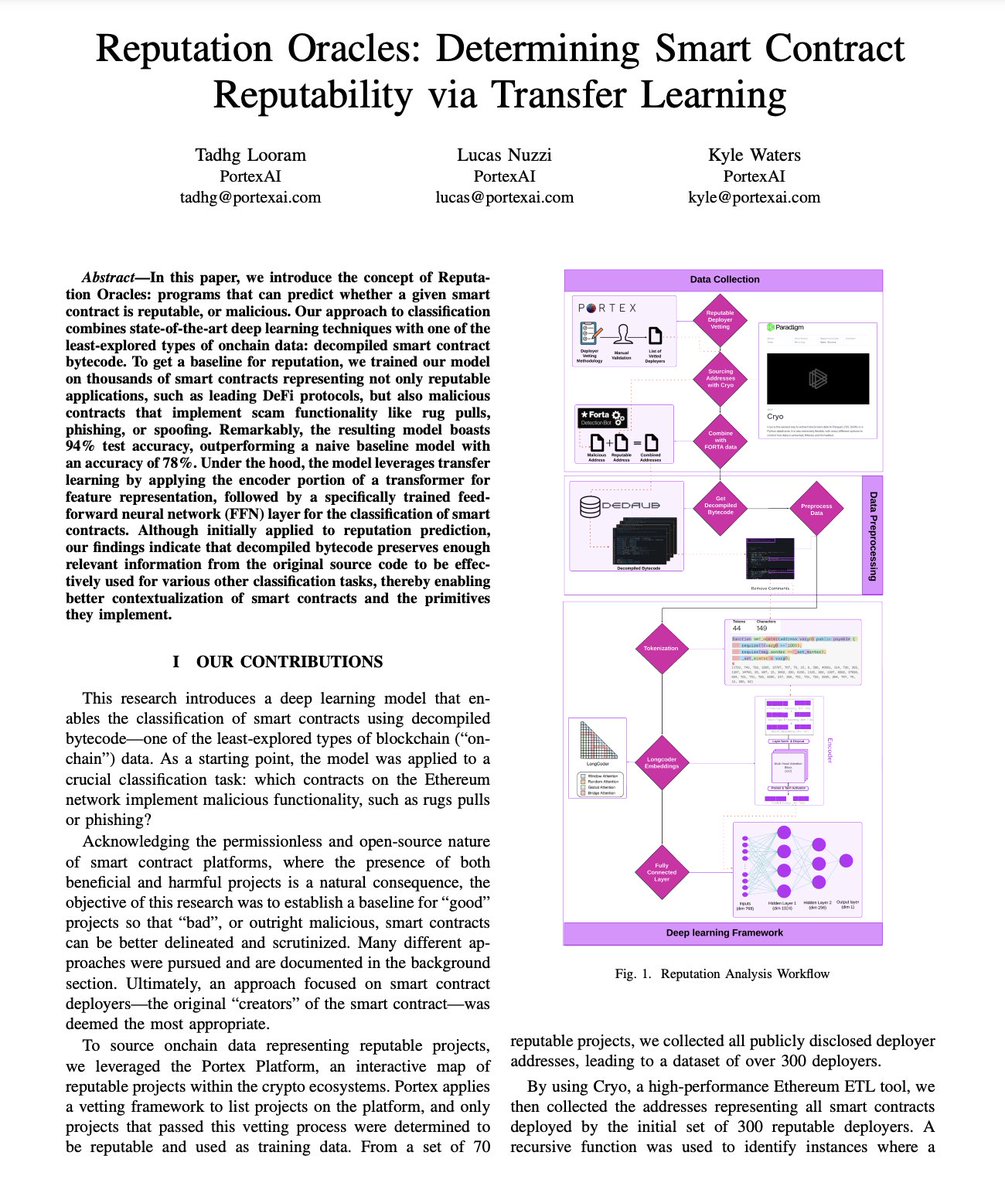

2\ We see reputation assessment as one of the most promising areas at the intersection of crypto and AI.

2\ We see reputation assessment as one of the most promising areas at the intersection of crypto and AI.

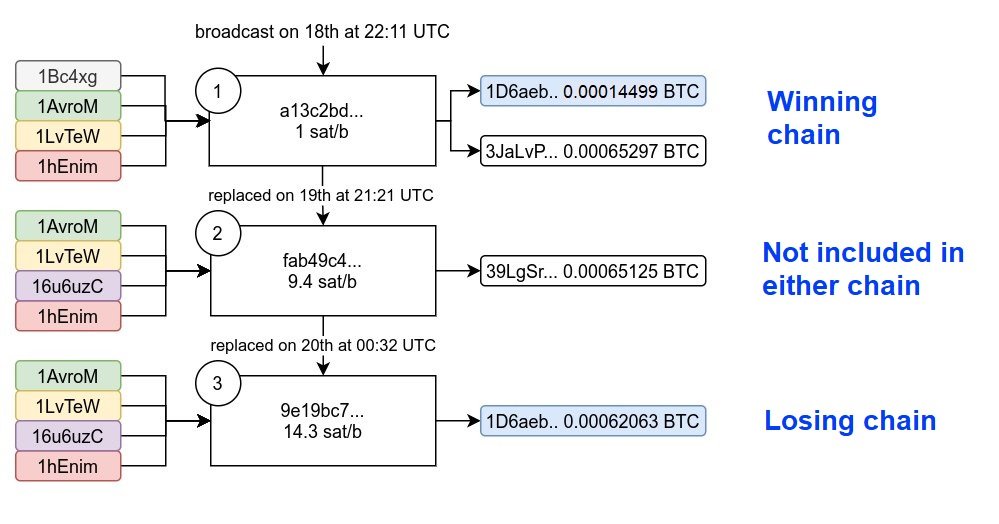

1/ The mere possibility of these types of attacks has caused significant anxiety.

1/ The mere possibility of these types of attacks has caused significant anxiety.

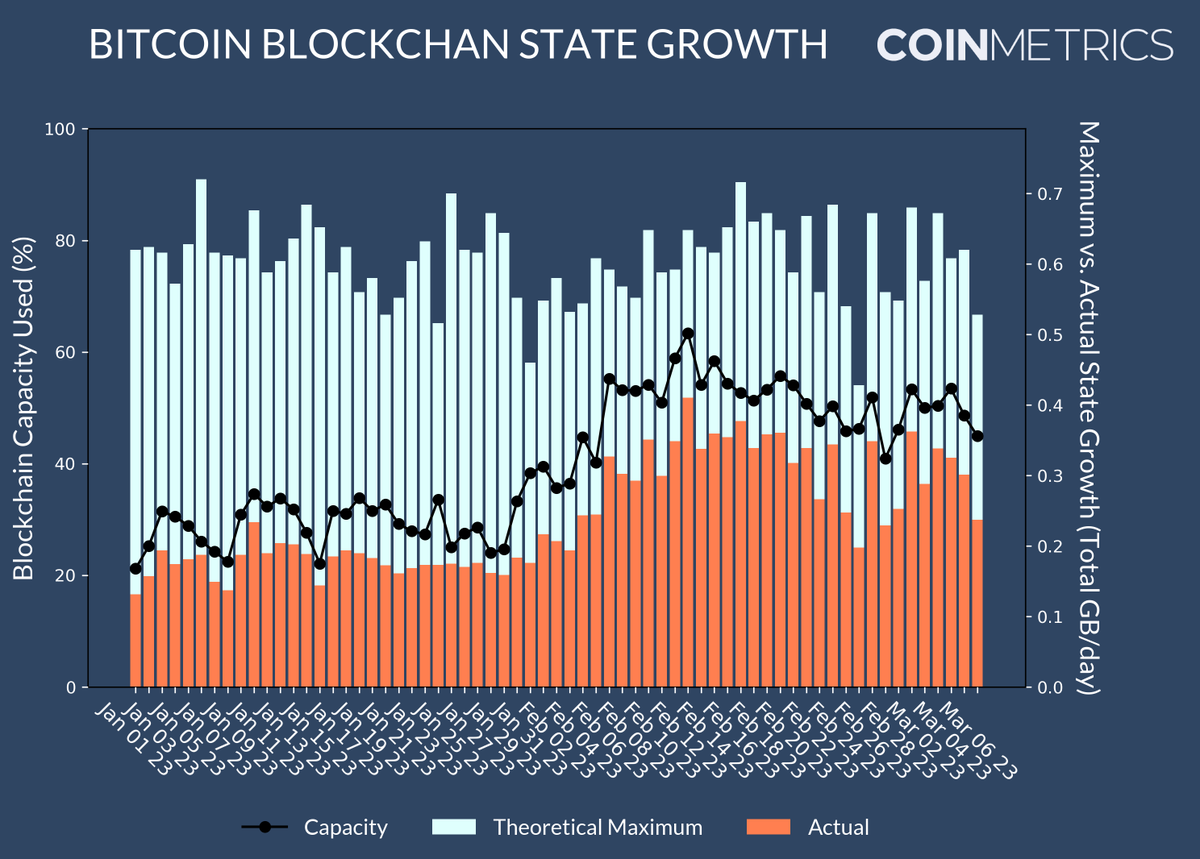

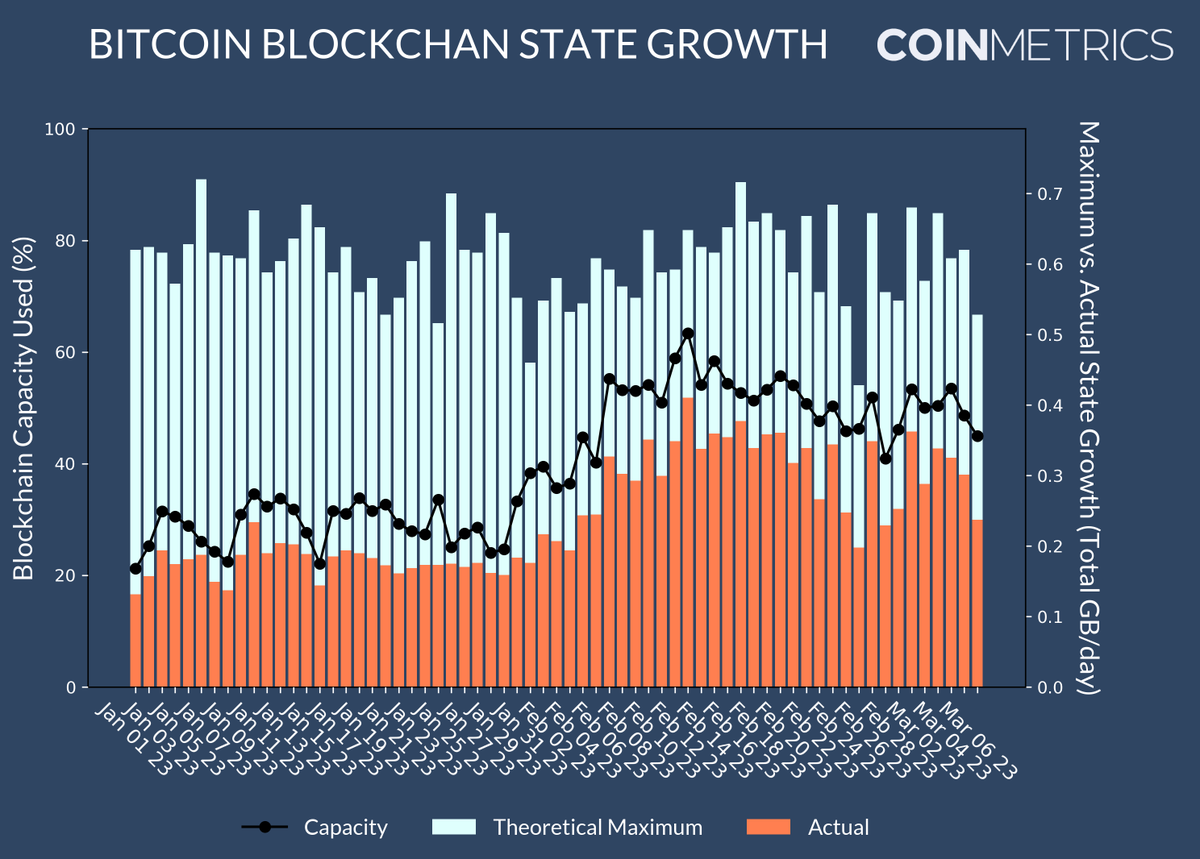

2/ Taproot has completely (and inadvertently) changed how data gets stored on the Bitcoin blockchain.

2/ Taproot has completely (and inadvertently) changed how data gets stored on the Bitcoin blockchain.

2/ First, let's get something straight:

2/ First, let's get something straight:

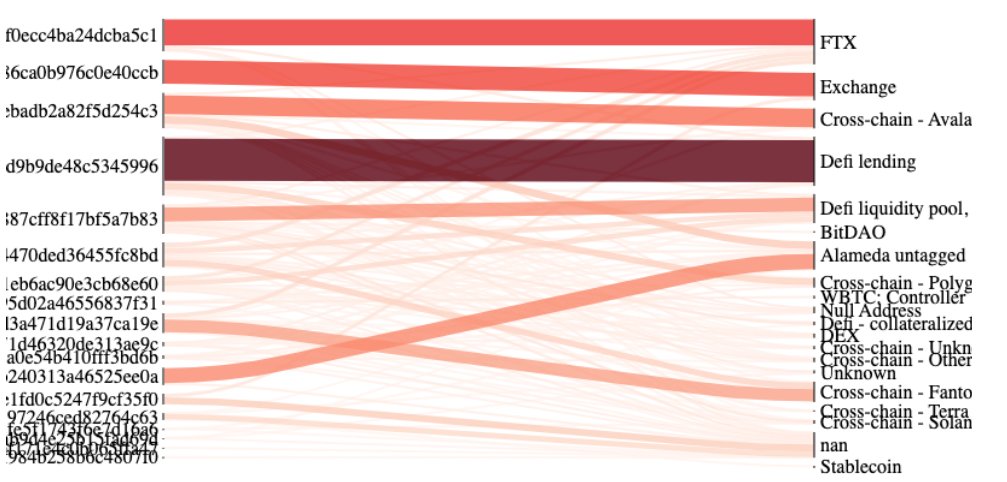

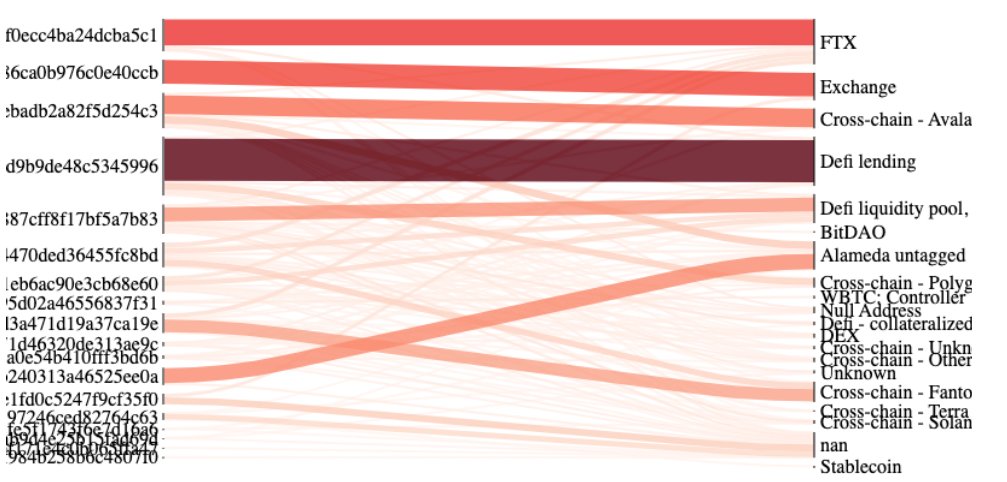

2/ Earlier today, it was reported that FTX valued its SRM position at $2.2bn USD: the largest position on its balance sheet.

2/ Earlier today, it was reported that FTX valued its SRM position at $2.2bn USD: the largest position on its balance sheet.

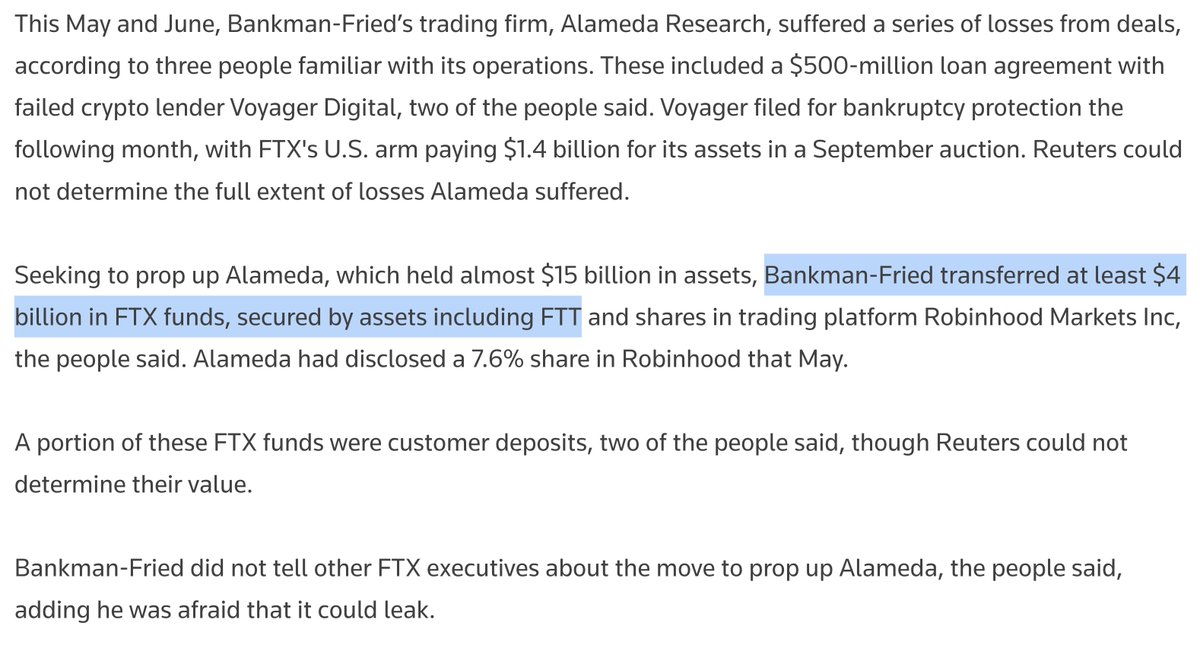

https://twitter.com/FTX_Official/status/1590763245488713729The loan that FTX made to save Alameda was likely in crypto.

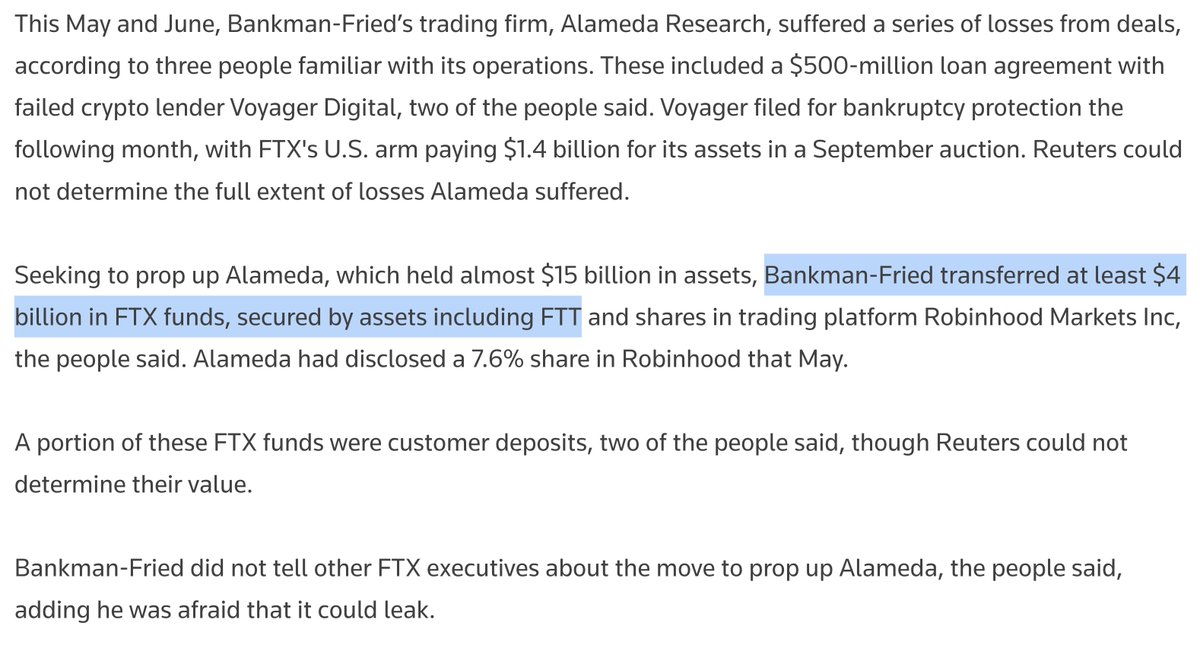

2/ That day, September 28, over 8.6 Billion USD worth of FTT was moved on-chain.

2/ That day, September 28, over 8.6 Billion USD worth of FTT was moved on-chain.

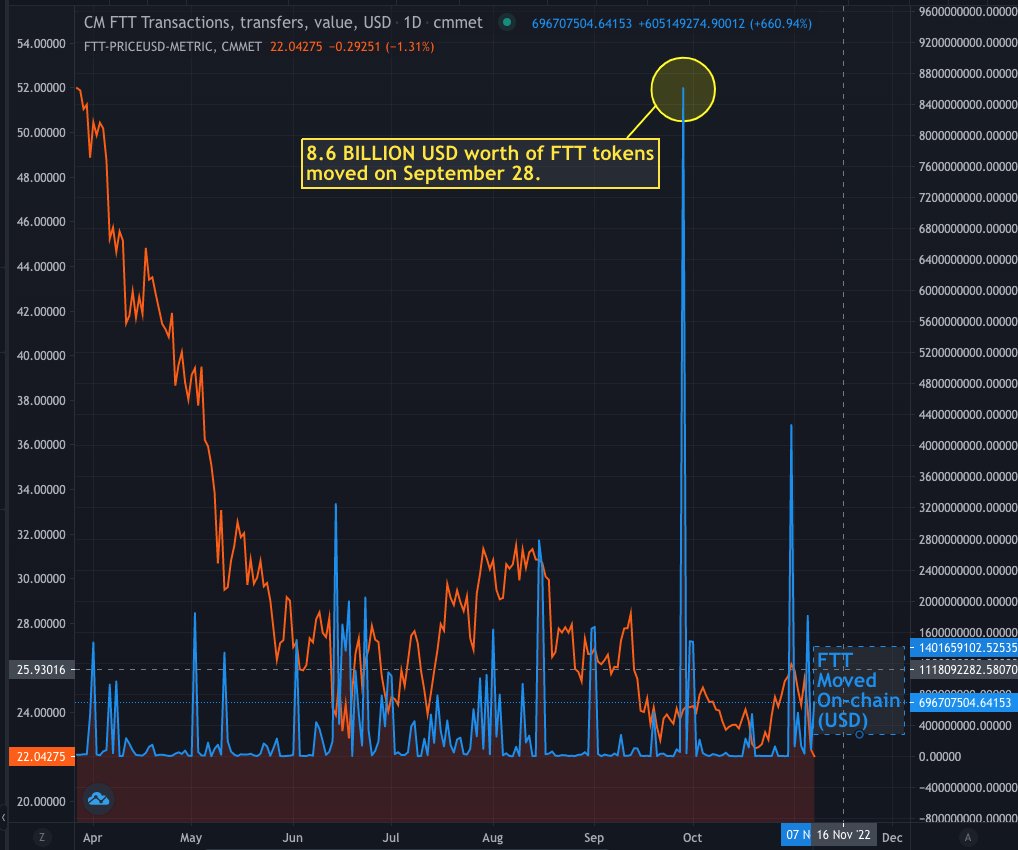

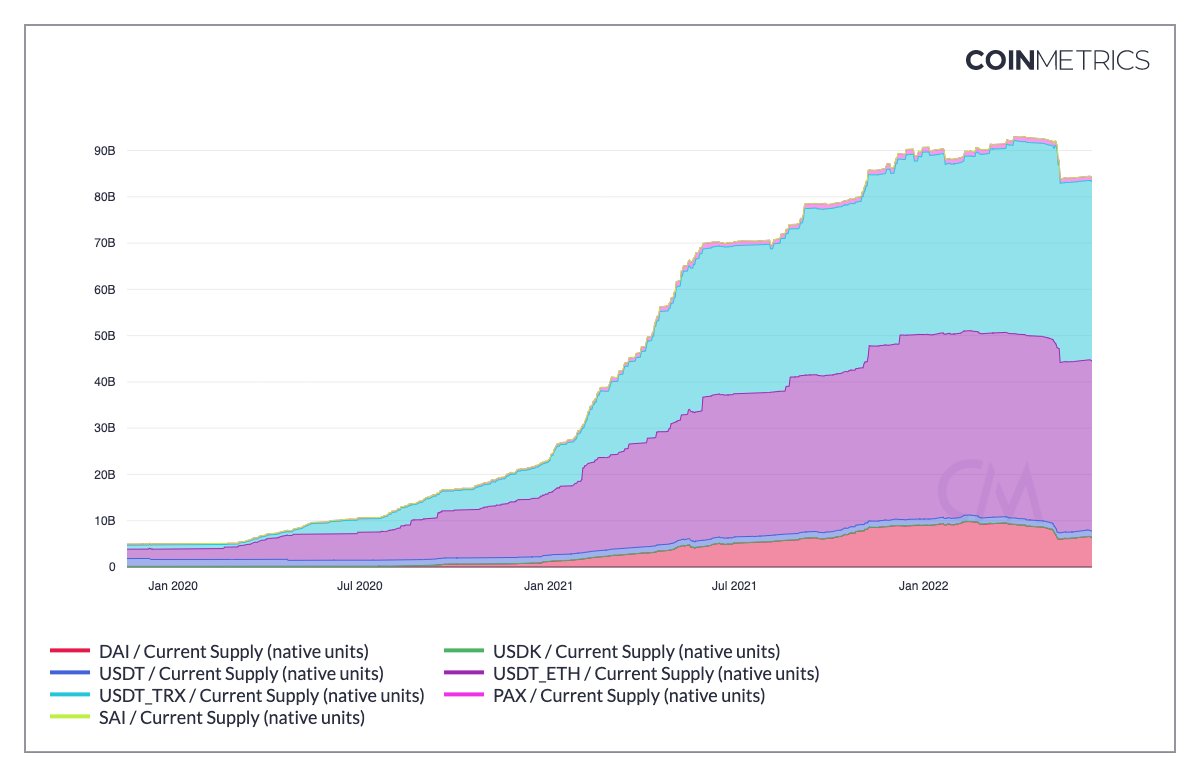

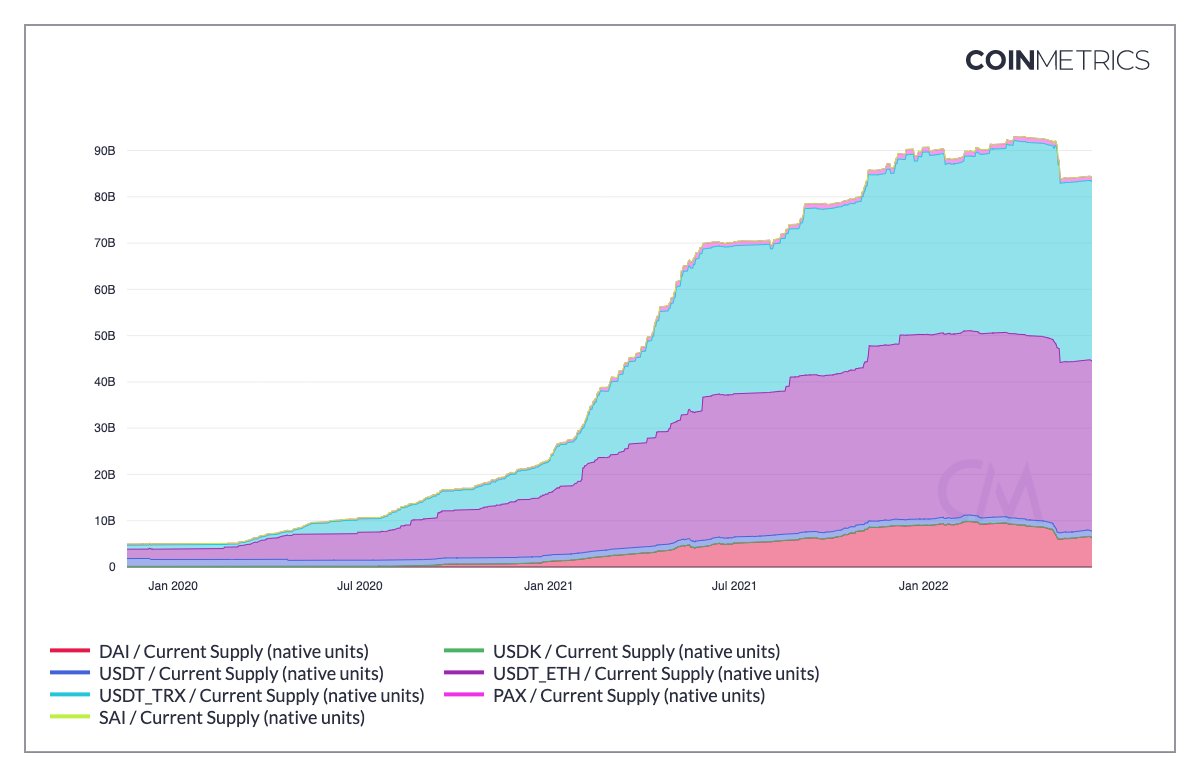

Tether has seen the most redemptions out of all centralized issuers, with a decrease of ~7B in total supply (on ERC, OMNI and TRX).

Tether has seen the most redemptions out of all centralized issuers, with a decrease of ~7B in total supply (on ERC, OMNI and TRX).

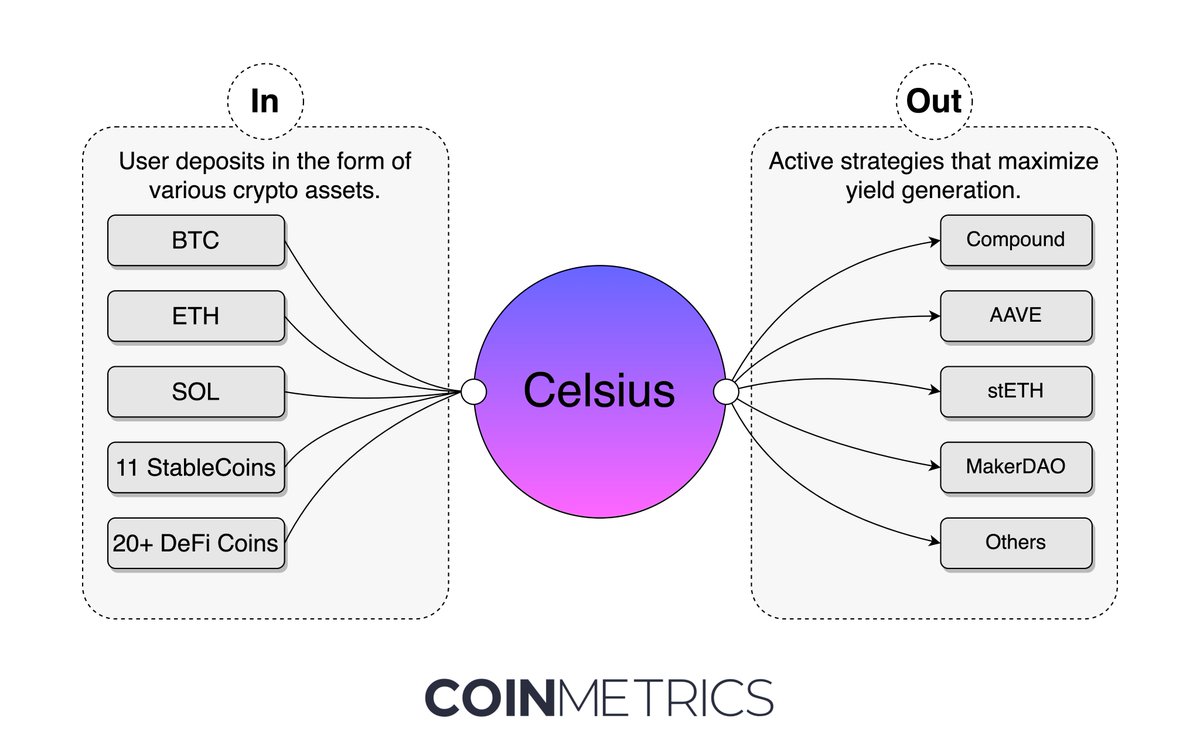

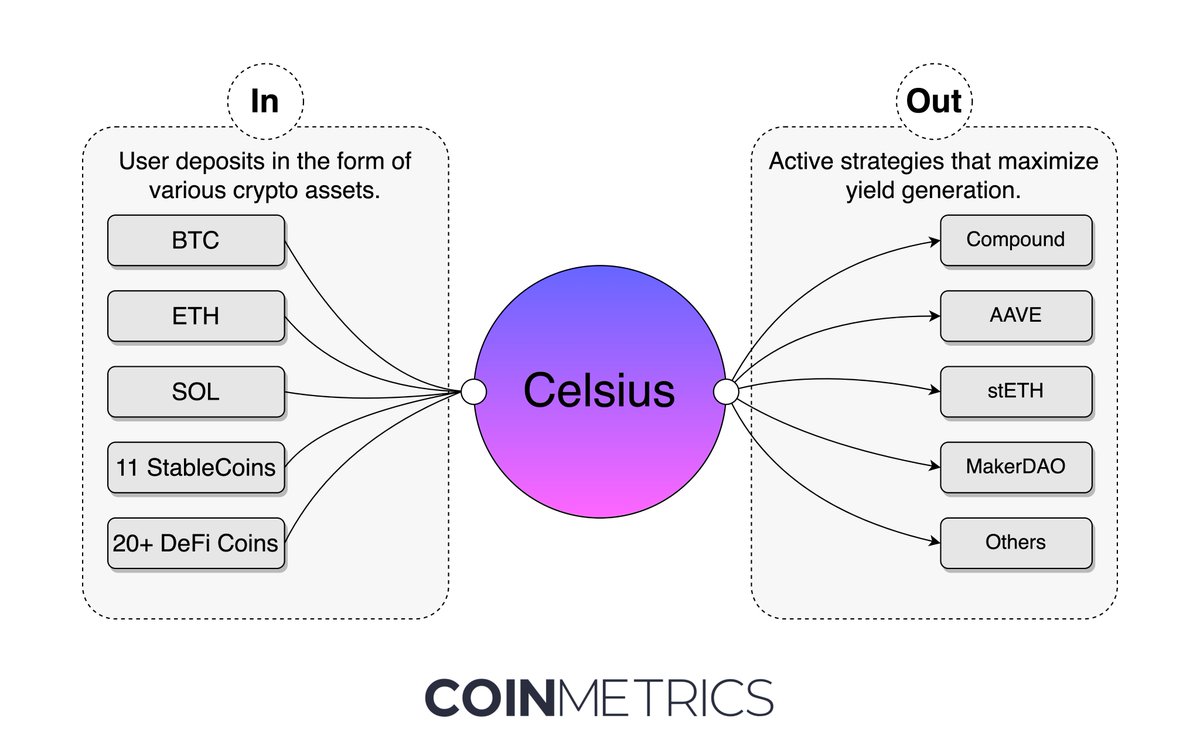

2\ Fundamentally, when the ultimate goal of your product is to maximize yield, you need to have a solid risk framework.

2\ Fundamentally, when the ultimate goal of your product is to maximize yield, you need to have a solid risk framework.

This is not investment advice. MVRV simply tracks how the overall market valuation (market cap) compares against everyone's "cost basis" (realized cap).

This is not investment advice. MVRV simply tracks how the overall market valuation (market cap) compares against everyone's "cost basis" (realized cap).

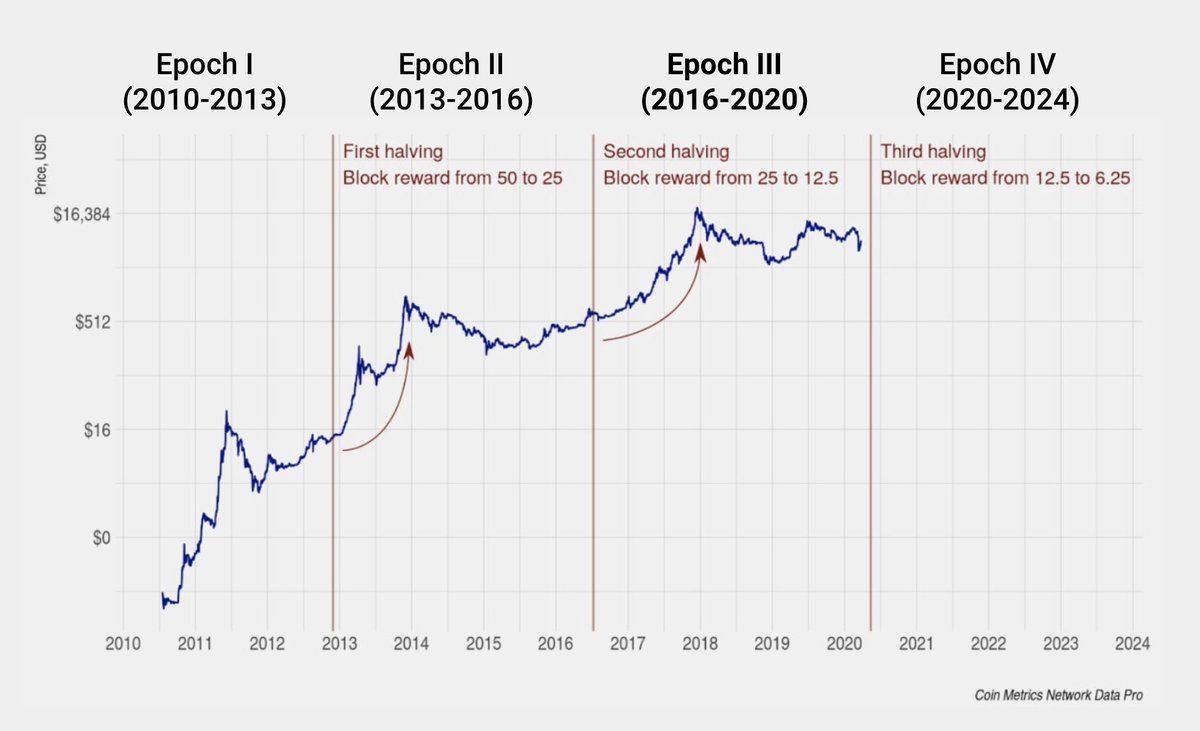

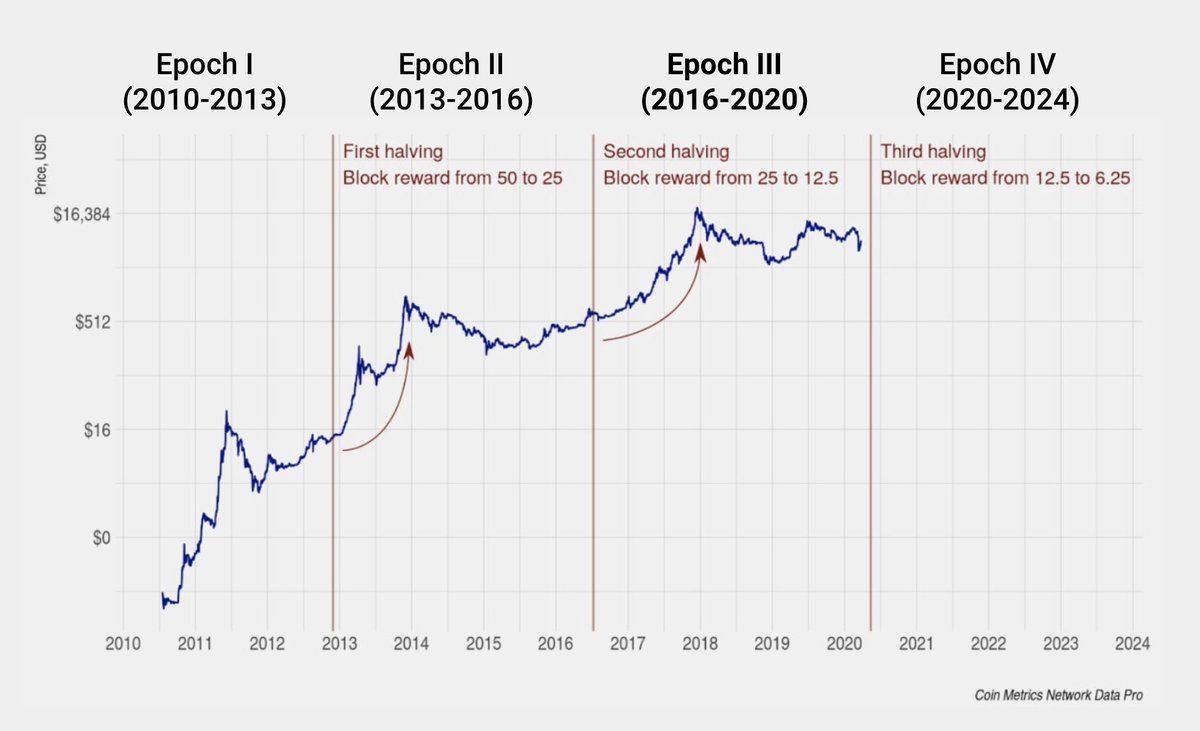

Bitcoin settled the equivalent of *2.3 trillion USD* in Epoch III

Bitcoin settled the equivalent of *2.3 trillion USD* in Epoch III

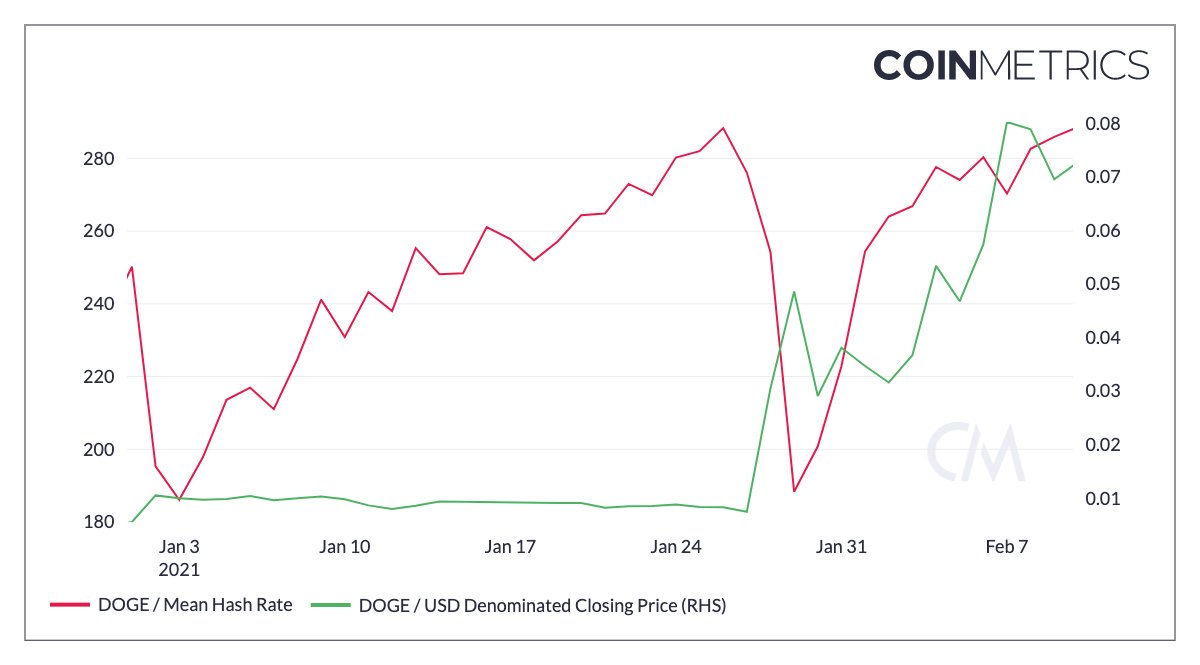

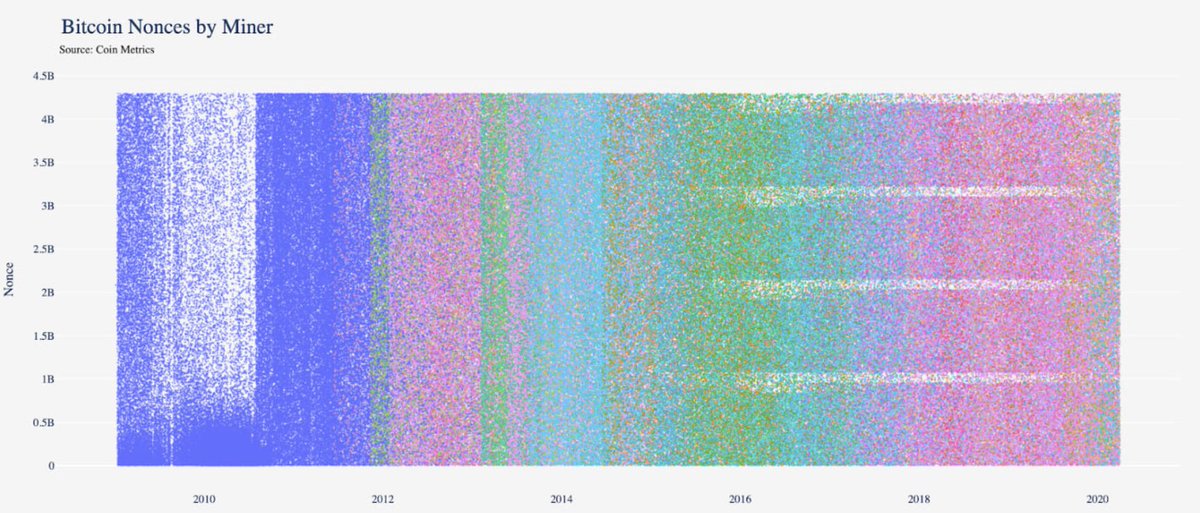

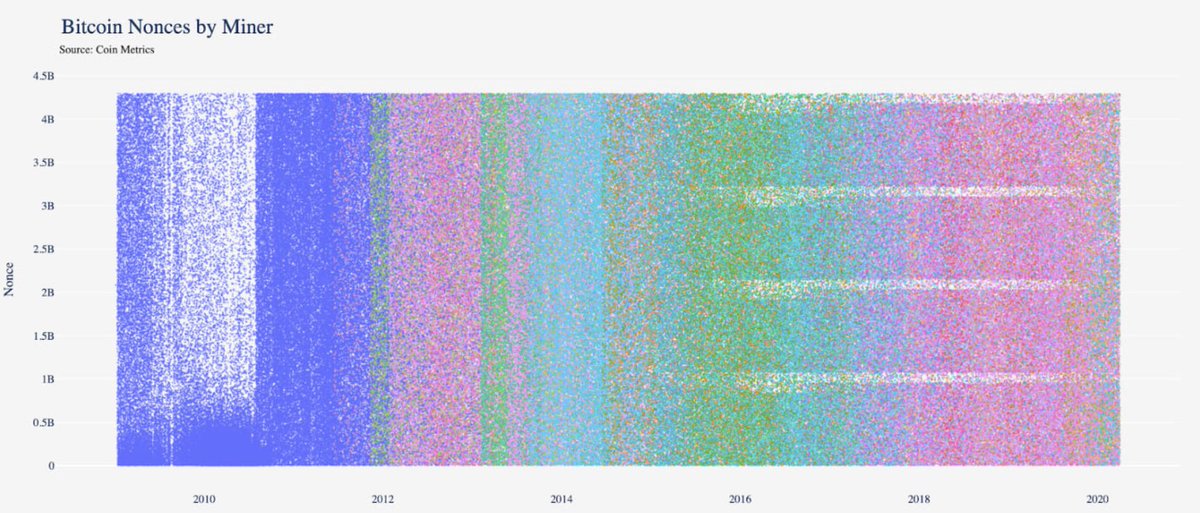

These streaks have to do with the way S7 and S9 family of ASICs sample nonces; how they approach the cryptographic puzzle in mining.

These streaks have to do with the way S7 and S9 family of ASICs sample nonces; how they approach the cryptographic puzzle in mining.https://twitter.com/soonaorlater/status/12026580196763197442010 - Satoshi decentralizes Bitcoin by leaving his leadership role as its creator, and never again commenting on its development.