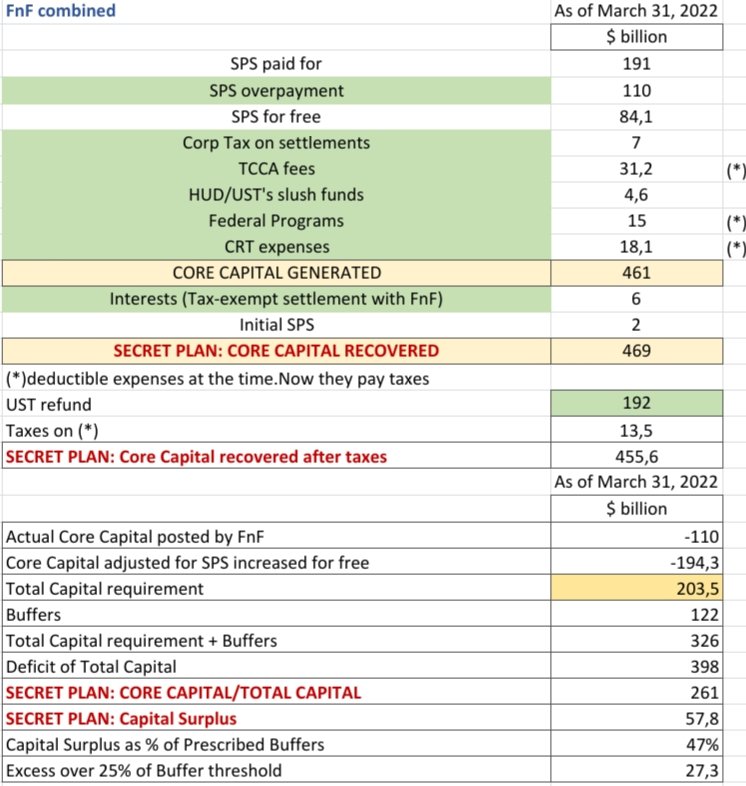

$400B CAPITAL SHORTFALL OVER 205B C.REQUIREMENT

C.covers unexpected losses.

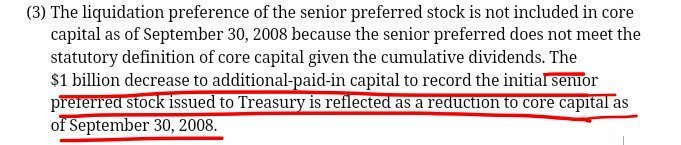

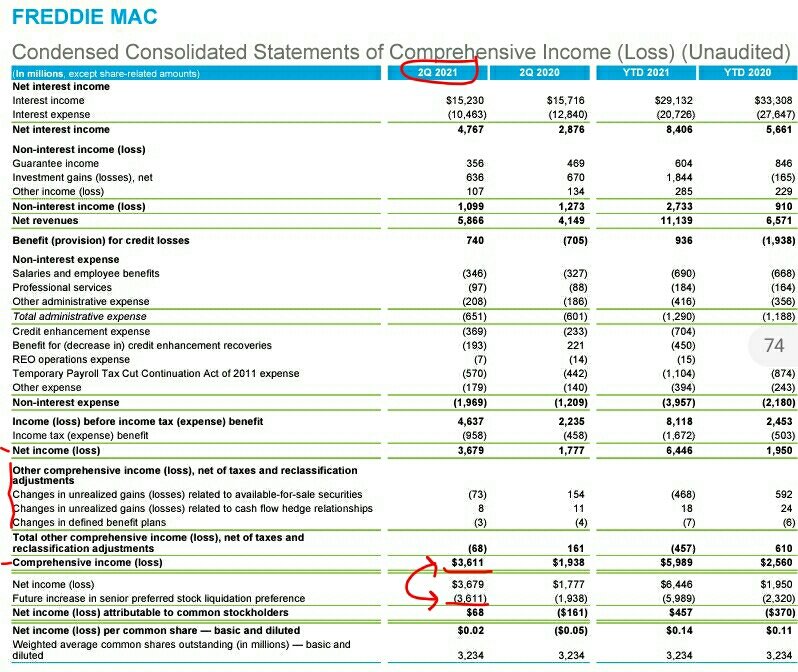

Actual C.shortfall posted=$304B,but an offset for $95B gifted SPS reduces Retained Earnings(C.C.).FnF evade it with fraud(SPS missing).Someone has to pay for it,like the initial $1B SPS👇

Joke.#Fanniegate

C.covers unexpected losses.

Actual C.shortfall posted=$304B,but an offset for $95B gifted SPS reduces Retained Earnings(C.C.).FnF evade it with fraud(SPS missing).Someone has to pay for it,like the initial $1B SPS👇

Joke.#Fanniegate

A joke is authorized in the FHFA-C's Incidental Power(FHFA's best interests) if the Common Equity is held in escrow, pursuant to the exceptions 1,2,3,4 in the CFR1237.12. I.e.,at some point, it'd be reversed(SPS cancelled)

Just like the 10%/NWS divs for SPS reduction(HERA)/Recap.

Just like the 10%/NWS divs for SPS reduction(HERA)/Recap.

Finally,Capital Reserve/Surplus (bce sheet: the portion of Equity/NW above the Capital Stock)=$0

FnF pass $94B NW off as Capital Reserve(Retained Earnings)

In truth,that NW is the $94.7B SPS missing on their bce sheets(NWS 2.0)to evade the offset and sell the "build Capital" lie.

FnF pass $94B NW off as Capital Reserve(Retained Earnings)

In truth,that NW is the $94.7B SPS missing on their bce sheets(NWS 2.0)to evade the offset and sell the "build Capital" lie.

The Conservator's Rehab power, secures that the Separate Account plan will be reversed.

@TheJusticeDept @RepFrenchHill

@TheJusticeDept @RepFrenchHill

• • •

Missing some Tweet in this thread? You can try to

force a refresh