Here is a basic but effective #tokenomics concept you can use to spot scammers:

--> Supply and vesting schedule

(Token distribution, Supply distribution, Token allocation - all mean the same thing)

This is post 2 of our #basicinvestormetrics (BIM) series.

--> Supply and vesting schedule

(Token distribution, Supply distribution, Token allocation - all mean the same thing)

This is post 2 of our #basicinvestormetrics (BIM) series.

These are the concepts you need to know:

- Supply distribution

- Vesting schedule

- Token emission schedule

- Supply distribution

- Vesting schedule

- Token emission schedule

Supply distribution:

Who received how many tokens when the project launched?

What are the tokens intended uses per category?

This usually looks like a pie chart. From there you can dive into the purpose of each category.

Who received how many tokens when the project launched?

What are the tokens intended uses per category?

This usually looks like a pie chart. From there you can dive into the purpose of each category.

Vesting Schedule:

This outlines how long token owners have to wait before they can spend the tokens that were allocated to them.

Often there is a cliff. This is a period at the beginning, where no tokens are available yet. "Cliff" and "lock-up" are often used interchangeably.

This outlines how long token owners have to wait before they can spend the tokens that were allocated to them.

Often there is a cliff. This is a period at the beginning, where no tokens are available yet. "Cliff" and "lock-up" are often used interchangeably.

Token emission schedule:

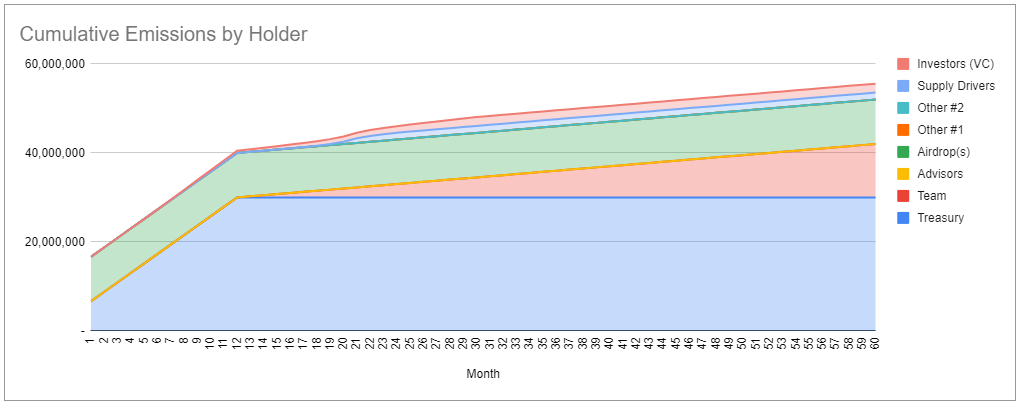

When you combine the two concepts above you receive the overall emission schedule.

It tells you when to expect tokens to enter into the circulating supply.

This can be shown as a cohort diagram.

When you combine the two concepts above you receive the overall emission schedule.

It tells you when to expect tokens to enter into the circulating supply.

This can be shown as a cohort diagram.

How can you use these simple concepts to spot a scammer?

Let's dive into a quick case study published by @cobie in his substack that we also cover in the course.

cobie.substack.com/p/incentives-s…

Let's dive into a quick case study published by @cobie in his substack that we also cover in the course.

cobie.substack.com/p/incentives-s…

Look at the supply distribution of @kasta_app token below.

Pump and Dumps schemes will try to find creative names for categories to keep you in the dark.

All the small breakdowns on the side make it look very balanced, right?

Well, let's summarize.

Pump and Dumps schemes will try to find creative names for categories to keep you in the dark.

All the small breakdowns on the side make it look very balanced, right?

Well, let's summarize.

Investors (18%)

• Seed • Private

Team/company (71.5%)

• Team • Advisors • Ecosystem referrals • Development • Marketing • Operations • General reserve • Rewards

Retail traders (2.5%)

• TGE (IDO on Bybit)

Market makers (8%)

• Exchanges & liquidity

• Seed • Private

Team/company (71.5%)

• Team • Advisors • Ecosystem referrals • Development • Marketing • Operations • General reserve • Rewards

Retail traders (2.5%)

• TGE (IDO on Bybit)

Market makers (8%)

• Exchanges & liquidity

This makes it pretty obvious that this is a money grab for the early investors and the team.

Very little is allocated to retail traders which means they will fight for scraps on launch day and run up the price.

Very little is allocated to retail traders which means they will fight for scraps on launch day and run up the price.

And that is exactly what happened:

The Price went almost to $1 upon launch.

Anyone in the seed round bought Kasta for pennies. They have been selling to capture profits ever since then.

Price will never recover because there is no reason to buy.

The Price went almost to $1 upon launch.

Anyone in the seed round bought Kasta for pennies. They have been selling to capture profits ever since then.

Price will never recover because there is no reason to buy.

This sucks!

So, what should a healthy token allocation look like, you ask?

There are resources for this!

Check out @lstephanian blog lstephanian.mirror.xyz for a breakdown of the ideal vesting schedule and token distribution.

So, what should a healthy token allocation look like, you ask?

There are resources for this!

Check out @lstephanian blog lstephanian.mirror.xyz for a breakdown of the ideal vesting schedule and token distribution.

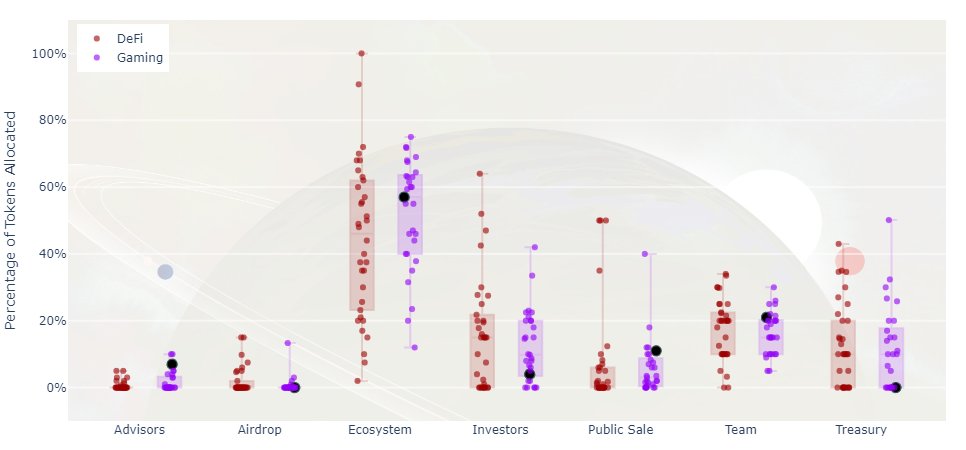

A tool we like to use is tokenomics.moonfire.com

Below you see the allocation of @AxieInfinity in contrast to other games and defi projects.

Before you buy you can use this chart to see if the allocation is in line with other projects.

Below you see the allocation of @AxieInfinity in contrast to other games and defi projects.

Before you buy you can use this chart to see if the allocation is in line with other projects.

If you read this far, you must be a tokenomics enthusiast!

We created a course to take you from tokenomics enthusiast to doing your own tokenomics-based research as quickly as possible.

Our students love it and you will too.

We created a course to take you from tokenomics enthusiast to doing your own tokenomics-based research as quickly as possible.

Our students love it and you will too.

• • •

Missing some Tweet in this thread? You can try to

force a refresh