Laurus Labs has been a big wealth creator over the last 3 years

The stock has taken some correction over the last 1 year

The management has downgraded the growth guidance!

A thread🧵on the business performance of Laurus Labs

Lets go👇

(1/24)

The stock has taken some correction over the last 1 year

The management has downgraded the growth guidance!

A thread🧵on the business performance of Laurus Labs

Lets go👇

(1/24)

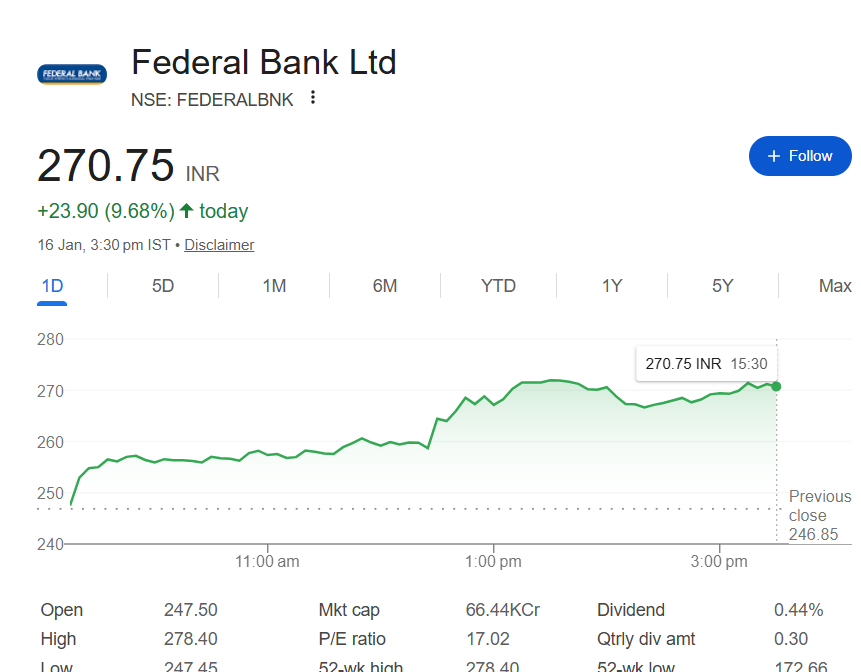

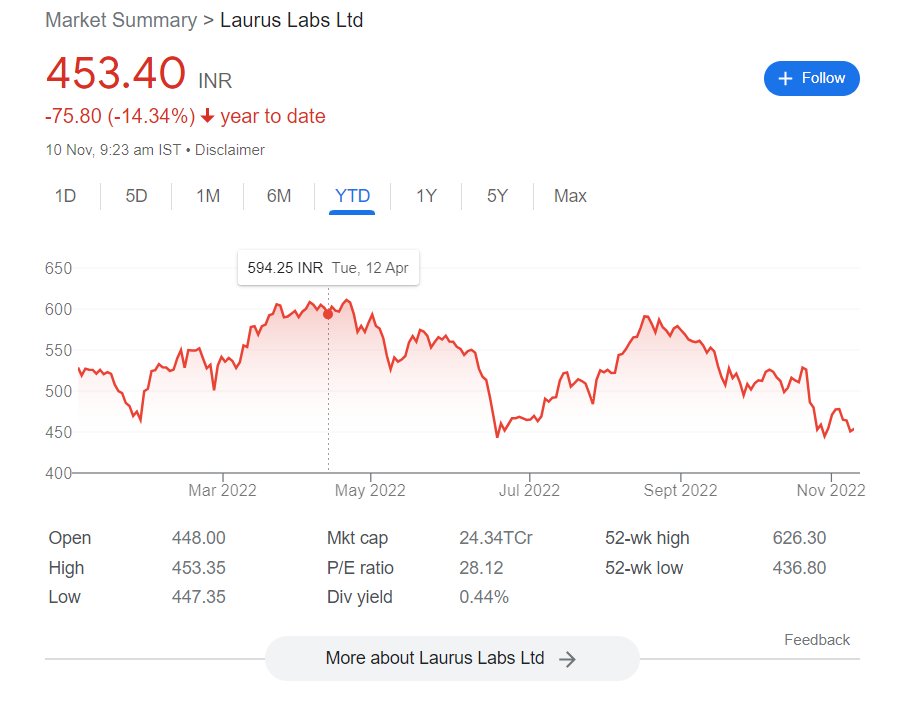

What has happened?

Over the last 1 year the Stock price has severely corrected

The stock has fallen over 25%

Lets find out the reasons here👇

(2/24)

Over the last 1 year the Stock price has severely corrected

The stock has fallen over 25%

Lets find out the reasons here👇

(2/24)

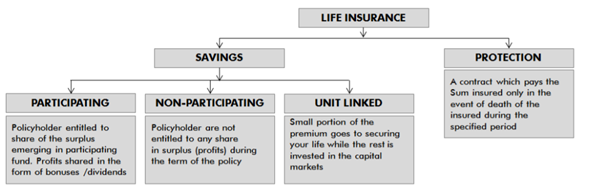

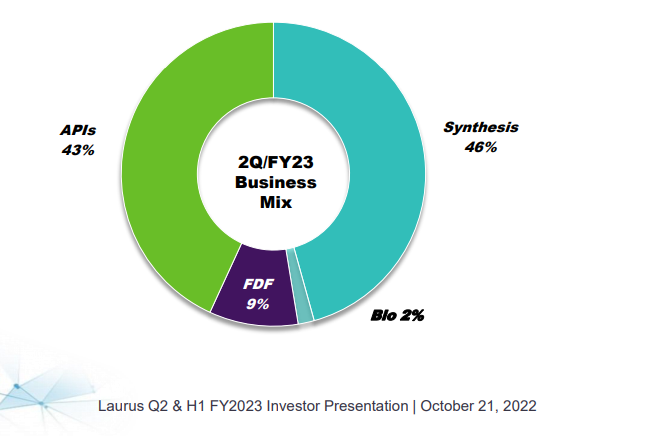

Business for Laurus Labs:-

Laurus Labs operates in the following areas:-

1. Active Pharmaceutical Ingredient(APIs)

2. Custom Synthesis

3. Formulations(FDF)

4. Biosynthesis

(3/24)

Laurus Labs operates in the following areas:-

1. Active Pharmaceutical Ingredient(APIs)

2. Custom Synthesis

3. Formulations(FDF)

4. Biosynthesis

(3/24)

Major focus in APIs is on ARV,oncology and other APIs.

It owns 11 manufacturing units (six FDA approved sites) with 74 DMFs, 32

ANDAs filed (15 Para IV, 11 first to file) and 192 patents granted

(4/24)

It owns 11 manufacturing units (six FDA approved sites) with 74 DMFs, 32

ANDAs filed (15 Para IV, 11 first to file) and 192 patents granted

(4/24)

China+1 playing out:-

Sourcing from China:-

Generic or big Pharma for custom synthesis+APIs is very difficult!

Big Pharma wants to reduce its dependency on China

India will have a lot of opportunities in custom synthesis and APIs

(5/24)

Sourcing from China:-

Generic or big Pharma for custom synthesis+APIs is very difficult!

Big Pharma wants to reduce its dependency on China

India will have a lot of opportunities in custom synthesis and APIs

(5/24)

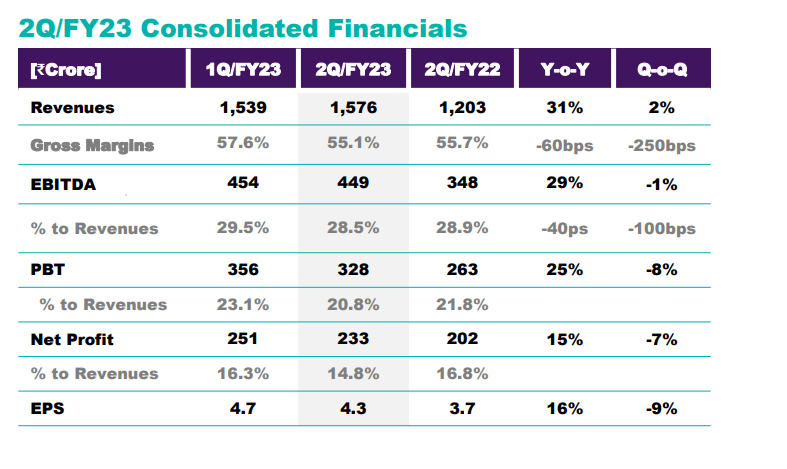

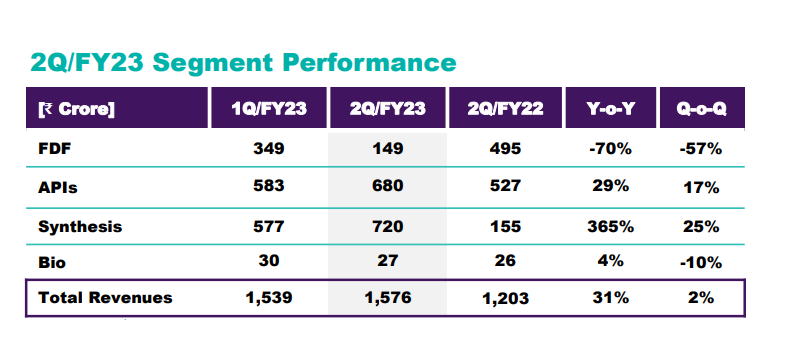

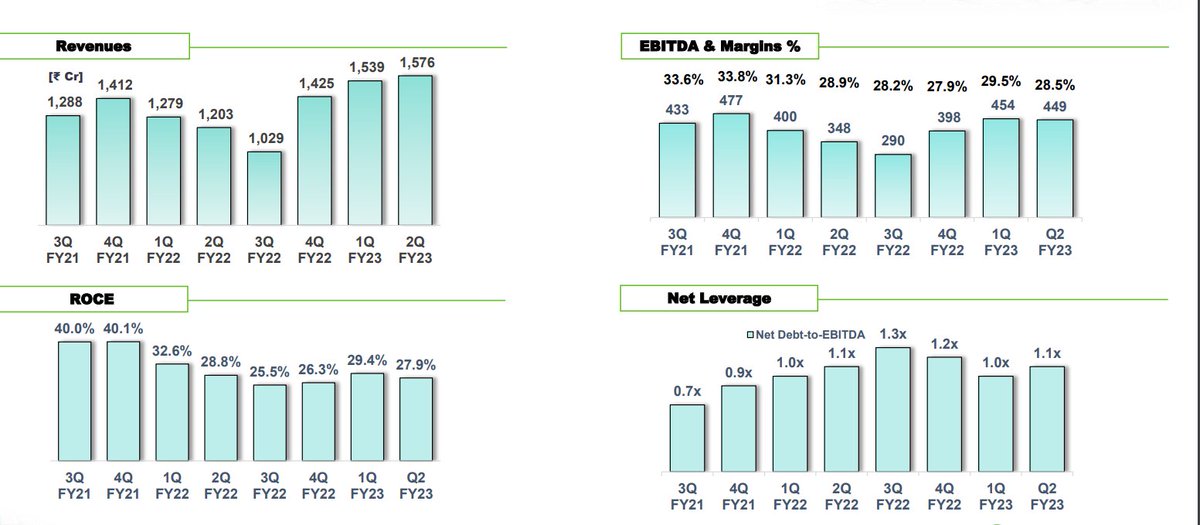

So how were the Q2FY23 results?

🧪Revenue increased by 31%

🧪Operating Margins remained at 23.1%

🧪Gross margins expanded to 57.6%

🧪Operating margins increased by 29%

The Custom Synthesis business has started to take lead!

(6/24)

🧪Revenue increased by 31%

🧪Operating Margins remained at 23.1%

🧪Gross margins expanded to 57.6%

🧪Operating margins increased by 29%

The Custom Synthesis business has started to take lead!

(6/24)

Fomulations business(FDF)-

Declined 70%, primarily impacted by softening

demand and excess inventory led to depressed pricing.

The management expects a recovery in this business during the second half of the year.

(7/24)

Declined 70%, primarily impacted by softening

demand and excess inventory led to depressed pricing.

The management expects a recovery in this business during the second half of the year.

(7/24)

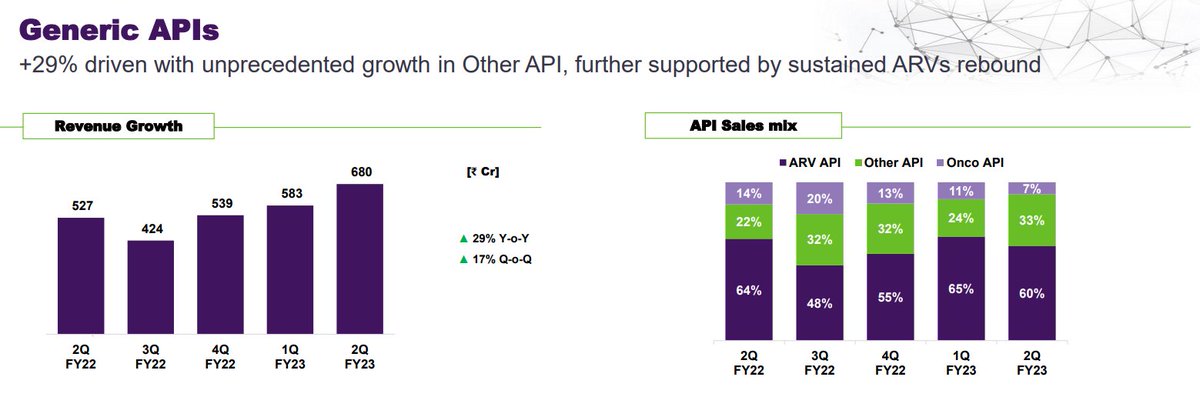

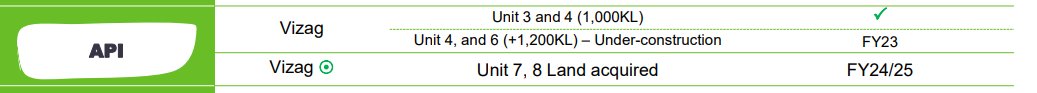

APIs:

Very strong growth trajectory of +29% overall.

Strong ramp-up in the Other API business (+93%) and continued volume based improvement in ARV APIs (+20%) more than offset decline in the Oncology (-30%);

(8/24)

Very strong growth trajectory of +29% overall.

Strong ramp-up in the Other API business (+93%) and continued volume based improvement in ARV APIs (+20%) more than offset decline in the Oncology (-30%);

(8/24)

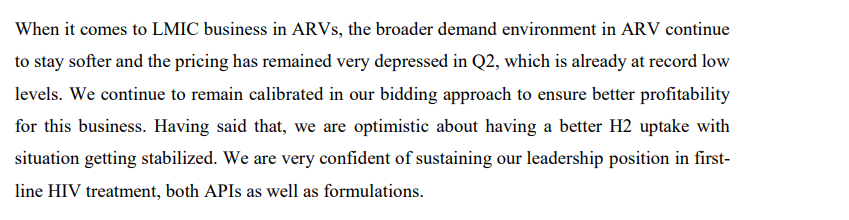

LMIC market for ARV was weak

Laurus is a key player in the Latin America MArket for Anti-Retroviral APIs.

The market was soft in H1 and

Should recover in H2

(9/24)

Laurus is a key player in the Latin America MArket for Anti-Retroviral APIs.

The market was soft in H1 and

Should recover in H2

(9/24)

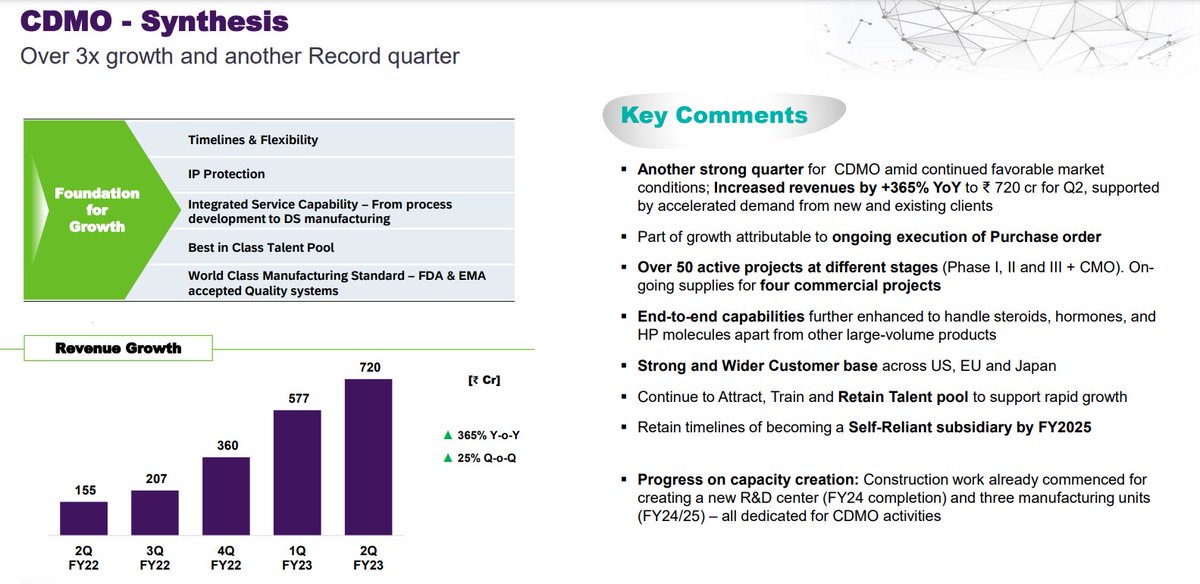

Custom Synthesis Business Leads:-

Significant growth momentum maintained (+365% YoY,+25% QoQ), led by business from existing customers and Increased

off-take.

Expansion in CDMO capabilities on track to capture new opportunities and accelerate growth

(10/24)

Significant growth momentum maintained (+365% YoY,+25% QoQ), led by business from existing customers and Increased

off-take.

Expansion in CDMO capabilities on track to capture new opportunities and accelerate growth

(10/24)

Management Commentary

🧪Saw continued pricing pressure and demand slowdown in ARVs

🧪Guides for 30% EBITDA margins for the full year

🧪Laurus will file ANDAs for complex generics products, which have lower competition, from FY25

(11/24)

🧪Saw continued pricing pressure and demand slowdown in ARVs

🧪Guides for 30% EBITDA margins for the full year

🧪Laurus will file ANDAs for complex generics products, which have lower competition, from FY25

(11/24)

🧪Capex guidance at 2,000 crore

(50%: custom synthesis,rest all is for non ARV APIs

🧪For FDF- Expects 75% utilization of capacity by the end of this fiscal year.

(12/24)

(50%: custom synthesis,rest all is for non ARV APIs

🧪For FDF- Expects 75% utilization of capacity by the end of this fiscal year.

(12/24)

Guidance downgrade:-

Laurus Labs has earlier guided for a US $1 Billion revenue by FY23.

However due to

1. Prolonged high inventory

2. Start-up costs relating to new projects

The company has pushed up the target to FY24.

(13/24)

Laurus Labs has earlier guided for a US $1 Billion revenue by FY23.

However due to

1. Prolonged high inventory

2. Start-up costs relating to new projects

The company has pushed up the target to FY24.

(13/24)

Business conditions are always dynamic

However, the scale-up Laurus has been able to do over the past few years has been mighty

Delays are part and parcel of life

(14/24)

However, the scale-up Laurus has been able to do over the past few years has been mighty

Delays are part and parcel of life

(14/24)

So what are the opportunities going forward for Laurus?

Custom Synthesis:-

Well-positioned to meet fast-growing global demand for NCE drugs with ongoing supplies for 7 commercial products.

Setting up dedicated R&D centre+ 3 new manufacturing units (FY24,FY25)

(15/24)

Custom Synthesis:-

Well-positioned to meet fast-growing global demand for NCE drugs with ongoing supplies for 7 commercial products.

Setting up dedicated R&D centre+ 3 new manufacturing units (FY24,FY25)

(15/24)

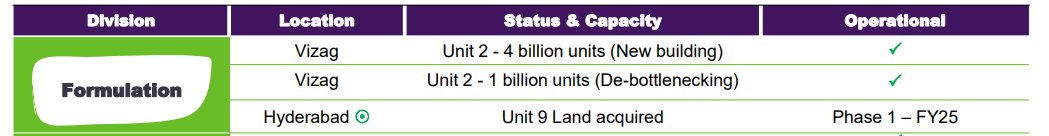

Formulations:

Product launches in anti-diabetic (FY23)

CV portfolio (FY24)in US & Europe with target opportunity at ~ US$40 billion.

Gradual traction from Unit-2 commissioned in Q1FY23 taking total capacity to 10 billion units

(16/24)

Product launches in anti-diabetic (FY23)

CV portfolio (FY24)in US & Europe with target opportunity at ~ US$40 billion.

Gradual traction from Unit-2 commissioned in Q1FY23 taking total capacity to 10 billion units

(16/24)

API:

Robust order book in anti-diabetic, CV & PPI amid capacity expansion in high growth therapeutics

(17/24)

Robust order book in anti-diabetic, CV & PPI amid capacity expansion in high growth therapeutics

(17/24)

Biologics:

Expanding the biologics CDMO at scale. Commercial scale-up of the new fermentation capacity (food proteins).

Plans to add 1 million litre capacity in Phase 1

(18/24)

Expanding the biologics CDMO at scale. Commercial scale-up of the new fermentation capacity (food proteins).

Plans to add 1 million litre capacity in Phase 1

(18/24)

Risks to the business:-

Most of Laurus's new failities come online in FY24 and FY25:-

Any Delay in commercialisation of new facility can be a material risk to the business

(19/24)

Most of Laurus's new failities come online in FY24 and FY25:-

Any Delay in commercialisation of new facility can be a material risk to the business

(19/24)

Core ARV API Business continues to see pricing pressure:-

Slower offtake and persisting pricing pressure in ARV space was pronounced

While the management has guided for the pricing pressure to ease....but this remains a key monitorable.

(20/24)

Slower offtake and persisting pricing pressure in ARV space was pronounced

While the management has guided for the pricing pressure to ease....but this remains a key monitorable.

(20/24)

Valuation:-

Given the strong pipeline of expansion in the coming two years

Laurus now trades at roughly 17-18x EV/EBIDTA

The Valuation is certainly not cheap

(21/24)

Given the strong pipeline of expansion in the coming two years

Laurus now trades at roughly 17-18x EV/EBIDTA

The Valuation is certainly not cheap

(21/24)

Conclusion:-

While core APIs do face demand and pricing pressure

The Custom synthesis business has helped the overall business grow well

While Laurus gave an aggressive guidance of $1Billion,

Due to adverse business conditions...they have had to push back the targets

(22/24)

While core APIs do face demand and pricing pressure

The Custom synthesis business has helped the overall business grow well

While Laurus gave an aggressive guidance of $1Billion,

Due to adverse business conditions...they have had to push back the targets

(22/24)

However, given the strong China+1 factor in APIs as well as the strong brand that is Laurus Labs

Business should slowly and steadily recover in ARV APIs

Custom Synthesis is already doing well

Scale-up of the Bio-Synthesis remains a positive optionality

(23/24)

Business should slowly and steadily recover in ARV APIs

Custom Synthesis is already doing well

Scale-up of the Bio-Synthesis remains a positive optionality

(23/24)

Disclaimer:-

This is my own study

Not an investment recommendation

Please consult your own financial advisor before making any investment decisions

(24/24)

This is my own study

Not an investment recommendation

Please consult your own financial advisor before making any investment decisions

(24/24)

• • •

Missing some Tweet in this thread? You can try to

force a refresh