So, I doubt you have missed the MAYHEM unfolding in Crypto these past days

Are we witnessing a Bear Stearns / Lehman 2.0 in Crypto space in real-time here on Twitter?

Here is a boomers ‘executive summary’ if you will…

1/n

Are we witnessing a Bear Stearns / Lehman 2.0 in Crypto space in real-time here on Twitter?

Here is a boomers ‘executive summary’ if you will…

1/n

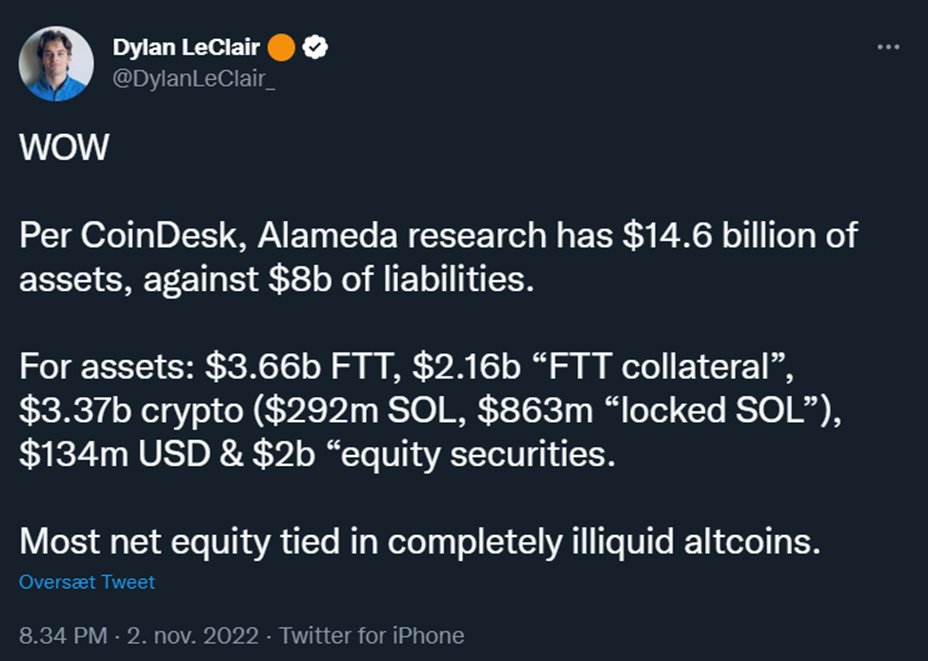

The saga took its beginning on Nov. 2nd after a leaked balance sheet from Alameda Research, the Sam Bankman-Fried founded trading firm, showed significant holdings of the FTX-native token FTT. This rightly concerned the crypto community.

2/n

2/n

Alameda's CEO tried to pour oil on troubled waters with the statement on Nov 6

“The BS breaks out a few of our biggest long positions; we obviously have hedges that aren’t listed … given the tightening in the crypto credit space this year we’ve returned most of our loans”

3/n

“The BS breaks out a few of our biggest long positions; we obviously have hedges that aren’t listed … given the tightening in the crypto credit space this year we’ve returned most of our loans”

3/n

On Nov 6th, Binance CEO Changpeng Zhao (CZ) said the exchange would liquidate its entire FTT holdings due to “recent revelations”. According to CZ Binance held 2.1 billion USD equivalent in BUSD and FTT due to its FTX divestment last year

4/n

4/n

The ‘revelations’ mentioned by CZ probably had to do with the CoinDesk report

h/t: @DylanLeClair_

5/n

h/t: @DylanLeClair_

5/n

The market was quick to react on the news, and the FTX-token (FTT) sold off more than 2.6 billion USD worth of market cap (88%)… OUCH!

6/n

6/n

Despite Sam Bankman-Fried claiming “A competitor is trying to go after us with false rumors … Assets are fine”, bridges were apparently built overnight…

7/n

7/n

I will refrain from guessing whether Binance and CZ ever intended on following through on their LOI.

I will leave this statement for you to judge

8/n

I will leave this statement for you to judge

8/n

This mayhem certainly is fuel on the fire for sceptics, and I imagine investors’ confidence and trust took a hit. While the total crypto market capitalization fell around 24%, some saw a decent entry and bid up the cap 10% from the bottom

9/n

9/n

So, where does this leave crypto as an asset class? *

Well, we definitely had what feels like a classic bank-run, and while major players in the space have absorbed ones in trouble before (FTX indeed did that), who will come to the rescue next? The Fed will certainly NOT

10/n

Well, we definitely had what feels like a classic bank-run, and while major players in the space have absorbed ones in trouble before (FTX indeed did that), who will come to the rescue next? The Fed will certainly NOT

10/n

So, did we just experience a Lehman 2.0?

Well, Lehman was trading at a price worth 60b USD in 2007. FTX was grim, but not as bad though. FTX was valued at 32b in January in a new round of funding – now it is worth 1 USD.

Not the end of the world, but it is a BIGGIE!

11/n

Well, Lehman was trading at a price worth 60b USD in 2007. FTX was grim, but not as bad though. FTX was valued at 32b in January in a new round of funding – now it is worth 1 USD.

Not the end of the world, but it is a BIGGIE!

11/n

Takeaway: To sustainably grow and constitute itself as a solid long-term play, the industry needs increased legislation and transparency

At least the crypto-sector has had a fast-track experience of why all of the banking regulation came in to place

12/n

At least the crypto-sector has had a fast-track experience of why all of the banking regulation came in to place

12/n

The Fed is not coming to the rescue. Stop trading Monkey JPGs as long as Powell and co WANT to bring so-called excessive risk taking down!

They are not done pursuing that - not even with todays milder CPI report

13/n

They are not done pursuing that - not even with todays milder CPI report

13/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh