About -

Radico Khaitan Limited (RKL) is one of the oldest and the largest manufacturers of Indian Made Foreign Liquor in India. Formerly known as Rampur Distillery, RKL commenced its operations in 1943 & over the years, emerged as a major bulk spirits supplier today.

Radico Khaitan Limited (RKL) is one of the oldest and the largest manufacturers of Indian Made Foreign Liquor in India. Formerly known as Rampur Distillery, RKL commenced its operations in 1943 & over the years, emerged as a major bulk spirits supplier today.

Manufacturing Facilities -

Radico has 2 distilleries- Rampur Distillery in Rampur (Uttar Pradesh) & Radico NV Distilleries Maharashtra Ltd, a joint venture with RNV in Aurangabad (Maharashtra).

Establishing a new facility in Sitapur (U.P)

Radico has 2 distilleries- Rampur Distillery in Rampur (Uttar Pradesh) & Radico NV Distilleries Maharashtra Ltd, a joint venture with RNV in Aurangabad (Maharashtra).

Establishing a new facility in Sitapur (U.P)

The company has a total capacity of over 160 million litres & operates 33 bottling units, spread across the country.

Customer Segments -

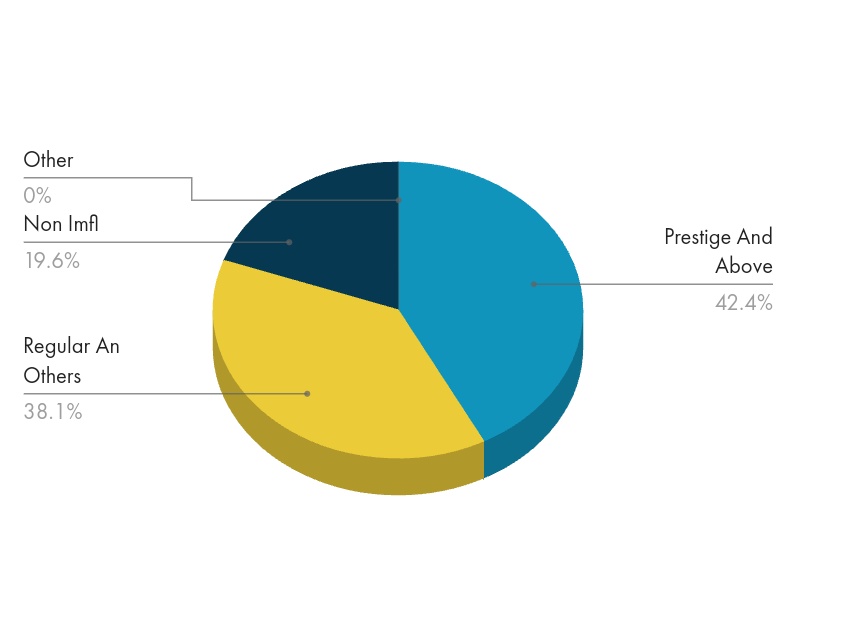

In IMFL Radico earns (42.2%) from Prestige products, (38.1%) from Regular products & (19.6%) from Non IMFL.

In IMFL Radico earns (42.2%) from Prestige products, (38.1%) from Regular products & (19.6%) from Non IMFL.

Investment in Building Capabilities -

Radico has invested in augmentation of the grain ENA production at the Rampur distillery & have also decided to set up a 330 KLPD greenfield grain-based distillery in Sitapur.

Radico has invested in augmentation of the grain ENA production at the Rampur distillery & have also decided to set up a 330 KLPD greenfield grain-based distillery in Sitapur.

These backward integration initiatives helping Radico to leverage the strong brand equity they have created over the years, to enable them to move into the next phase of growth.

Financials -

Q1FY22 (YoY)

Rev ₹757.4 Cr vs 597.6 Cr ⬆️27%

PBT ₹77.2 Cr vs 77.6 Cr ⬇️(0.06%)

PAT ₹58.3 Cr vs 59.8 Cr ⬇️(2.6%)

Q1FY22 (YoY)

Rev ₹757.4 Cr vs 597.6 Cr ⬆️27%

PBT ₹77.2 Cr vs 77.6 Cr ⬇️(0.06%)

PAT ₹58.3 Cr vs 59.8 Cr ⬇️(2.6%)

Indian Spirits Industry -

According to Euromonitor International, Indian Made Foreign Liquor (IMFL) volumes are expected to touch 369 million cases in CY2026.

During the CY2022-2026 period, IMFL sales volume is expected to grow at a CAGR of 5.3%.

According to Euromonitor International, Indian Made Foreign Liquor (IMFL) volumes are expected to touch 369 million cases in CY2026.

During the CY2022-2026 period, IMFL sales volume is expected to grow at a CAGR of 5.3%.

Indian consumers have become more willing to spend on high-value products, especially premium brands & experiences.

Consumers are experimenting with experiences beyond functional social benefits of alcohol. This trend likely accelerate social acceptance of alcoholic beverages.

Consumers are experimenting with experiences beyond functional social benefits of alcohol. This trend likely accelerate social acceptance of alcoholic beverages.

Pan India Presence -

Radico Khaitan has a robust sales & distribution network, with over 75,000 retail & 8,000 on-premises shops in key alcohol categories throughout 🇮🇳.

Radico Khaitan is one of the major supplier of branded IMFL to Canteen stores department in Defence segment.

Radico Khaitan has a robust sales & distribution network, with over 75,000 retail & 8,000 on-premises shops in key alcohol categories throughout 🇮🇳.

Radico Khaitan is one of the major supplier of branded IMFL to Canteen stores department in Defence segment.

International Presence -

The company's brands are well recognised and has built a brand equity for itself in international markets.

Radico has presence in 85

International markets, including Middle East, North & South America, Africa, Asia & Europe.

The company's brands are well recognised and has built a brand equity for itself in international markets.

Radico has presence in 85

International markets, including Middle East, North & South America, Africa, Asia & Europe.

Growth Drivers -

• India’s favourable demographics, growing middle class, rising levels of disposable income, rising acceptance of alcohol will contribute to an increase in alcohol consumption.

• India’s favourable demographics, growing middle class, rising levels of disposable income, rising acceptance of alcohol will contribute to an increase in alcohol consumption.

• Favourable Excise Policies being developed by several states are expected to improve customer satisfaction.

• New options for Online ordering & home delivery.

• COVID has influenced a change in consumer drinking behaviour, with drinks being more frequently consumed at home

• New options for Online ordering & home delivery.

• COVID has influenced a change in consumer drinking behaviour, with drinks being more frequently consumed at home

Capital Expenditure -

During FY2022, Radico has undertaken two capex projects:

₹185 Cr for the conversion of the existing 140 KLPD molasses plant in Rampur to dual-

feed & a greenfield project of ₹555Cr spread over 100 acres to establish a 330 KLPD grain based distillery

During FY2022, Radico has undertaken two capex projects:

₹185 Cr for the conversion of the existing 140 KLPD molasses plant in Rampur to dual-

feed & a greenfield project of ₹555Cr spread over 100 acres to establish a 330 KLPD grain based distillery

along with bottling facilities for IMFL & country liquor and a malt maturation facility. This will be funded 50% through internal accrual and rest from borrowing.

Risks -

• Any policy change by Central/State Govt in areas of production, marketing, taxation, distribution can have an adverse impact on companies performance.

• Any policy change by Central/State Govt in areas of production, marketing, taxation, distribution can have an adverse impact on companies performance.

• ENA & packaging materials are the two key components of the raw materials required for the Company’s product portfolio & hence commodity price volatility remains one of the key considerations.

Fundamentals -

Market Cap : ₹ 13,485 Cr

P/E (Stock): 52.64

P/E (Industry): 31

P/B : 6.87

Debt to equity : 0.10

ROE : 13.78%

ROCE : 16.4

EV/EBITDA : 32.9

Market Cap : ₹ 13,485 Cr

P/E (Stock): 52.64

P/E (Industry): 31

P/B : 6.87

Debt to equity : 0.10

ROE : 13.78%

ROCE : 16.4

EV/EBITDA : 32.9

Conclusion -

India represents one of the largest global

consumption hubs and there is no doubt about the significant growth opportunities that the country presents due its current low per capita consumption, middle class is expanding rapidly.

India represents one of the largest global

consumption hubs and there is no doubt about the significant growth opportunities that the country presents due its current low per capita consumption, middle class is expanding rapidly.

These are all perfect ingredients for the long term growth of a consumer products company like Radico Khaitan.

Please 🙏 like 👍,comment, retweet ♻️ if you find this 🧵 useful.

And follow us on @LnprCapital for more information like this.

@nid_rockz @VVVStockAnalyst

And follow us on @LnprCapital for more information like this.

@nid_rockz @VVVStockAnalyst

https://twitter.com/LnprCapital/status/1590933931838537729?t=xClU1LCGaq0dii1TqfSHag&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh