People get this one wrong a lot because it is confusing as hell.

Does a token burn affect circulating supply or not?

What is circulating supply vs. total supply?

And what are the most common uses when evaluating tokenomics?

(This is post 3 in our BIM series)

Does a token burn affect circulating supply or not?

What is circulating supply vs. total supply?

And what are the most common uses when evaluating tokenomics?

(This is post 3 in our BIM series)

#Circulatingsupply measures the quantity of a token ALREADY in circulation, meaning tokens available in the open market.

These tokens are in wallets where they can be sold instantly without or only very short lockups.

These tokens are in wallets where they can be sold instantly without or only very short lockups.

A token burn is never done from these wallets (have you ever sent tokens to a 0-wallet on purpose?).

Note: Treasury tokens are NOT part of circulating supply!

Why? Because a treasury is governed and cannot dump on the market (unless it's a straight-up scam project).

Note: Treasury tokens are NOT part of circulating supply!

Why? Because a treasury is governed and cannot dump on the market (unless it's a straight-up scam project).

Total supply is easier to understand: it is literally the supply of all the tokens that exist at this point in time, regardless of where they sit.

Obviously, burned tokens are not part of the total supply since no one has the keys to the 0-wallet.

Obviously, burned tokens are not part of the total supply since no one has the keys to the 0-wallet.

When analyzing this, look for a gap between total and circulating supply.

Why? Because it guides you toward factors possibly impacting the price of your investment.

Why? Because it guides you toward factors possibly impacting the price of your investment.

Case study:

@AxieInfinity has a fixed supply token called AXS.

AXS has a total supply of 270 million.

However, all tokens have not yet been released. The amount of AXS tokens in circulation is about 83 million tokens today.

Notice the difference?

@AxieInfinity has a fixed supply token called AXS.

AXS has a total supply of 270 million.

However, all tokens have not yet been released. The amount of AXS tokens in circulation is about 83 million tokens today.

Notice the difference?

Once released the new tokens will increase the circulating supply.

This may lead to increased selling pressure (!) price may go down.

This may lead to increased selling pressure (!) price may go down.

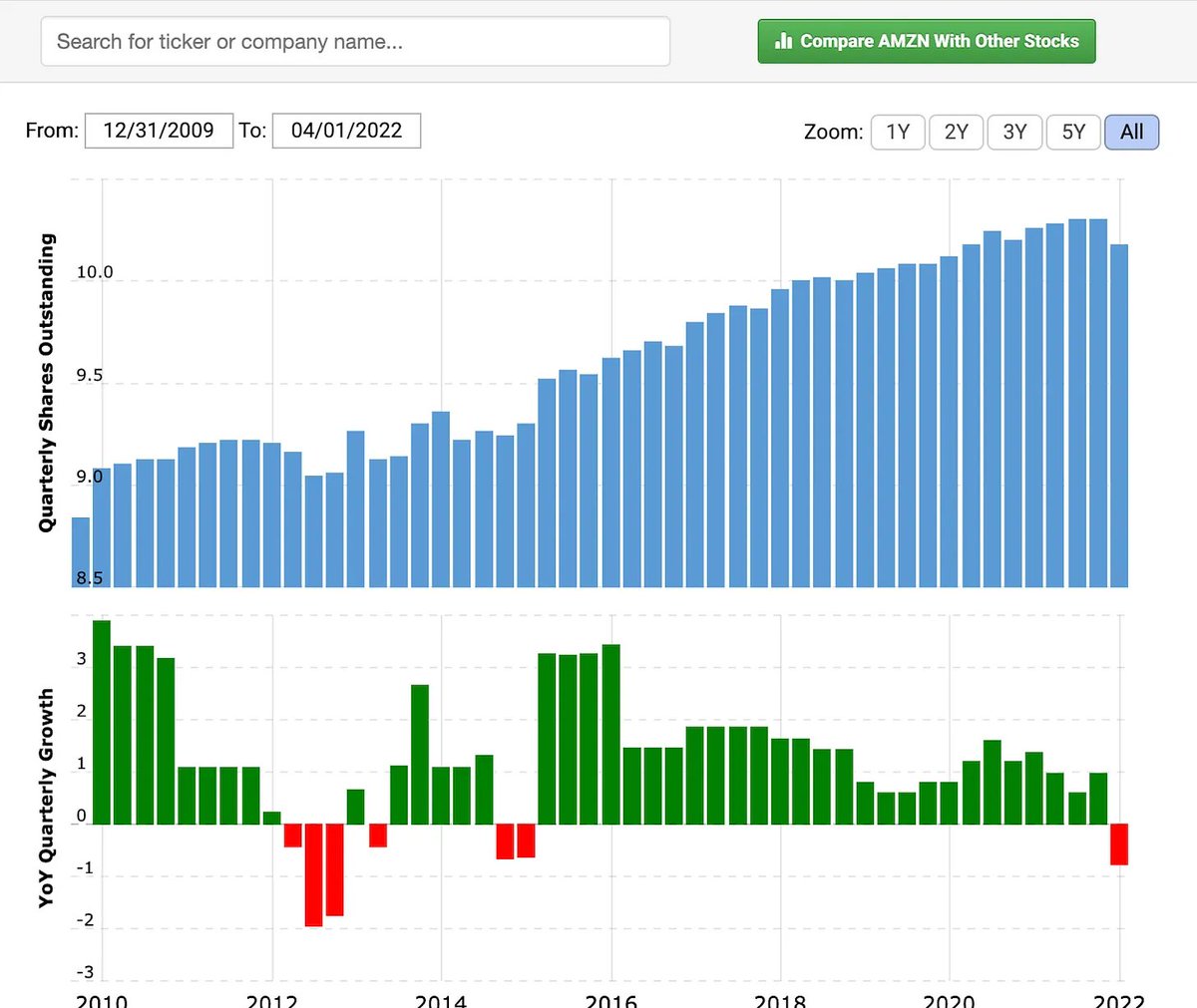

The ratio between token emissions and circulating supply provides the inflation metric.

This is a very important factor to determine selling pressure for a token.

To make up for inflation a project has to grow at least as fast as supply is increasing to keep price stable.

This is a very important factor to determine selling pressure for a token.

To make up for inflation a project has to grow at least as fast as supply is increasing to keep price stable.

In the case of Axie 270/83 = 3.25

This means that Axie has to increase its operation by a factor of 3 to have enough demand to keep pace with the supply that is coming online.

Draw your own conclusion from this.

This means that Axie has to increase its operation by a factor of 3 to have enough demand to keep pace with the supply that is coming online.

Draw your own conclusion from this.

Still reading?

Well, you should consider making it official and train yourself to become a mini-tokenomist!

tokenomicsdao.thinkific.com/courses/tokeno…

Well, you should consider making it official and train yourself to become a mini-tokenomist!

tokenomicsdao.thinkific.com/courses/tokeno…

• • •

Missing some Tweet in this thread? You can try to

force a refresh