🧵 Sequoia Capital 🧵 1/18

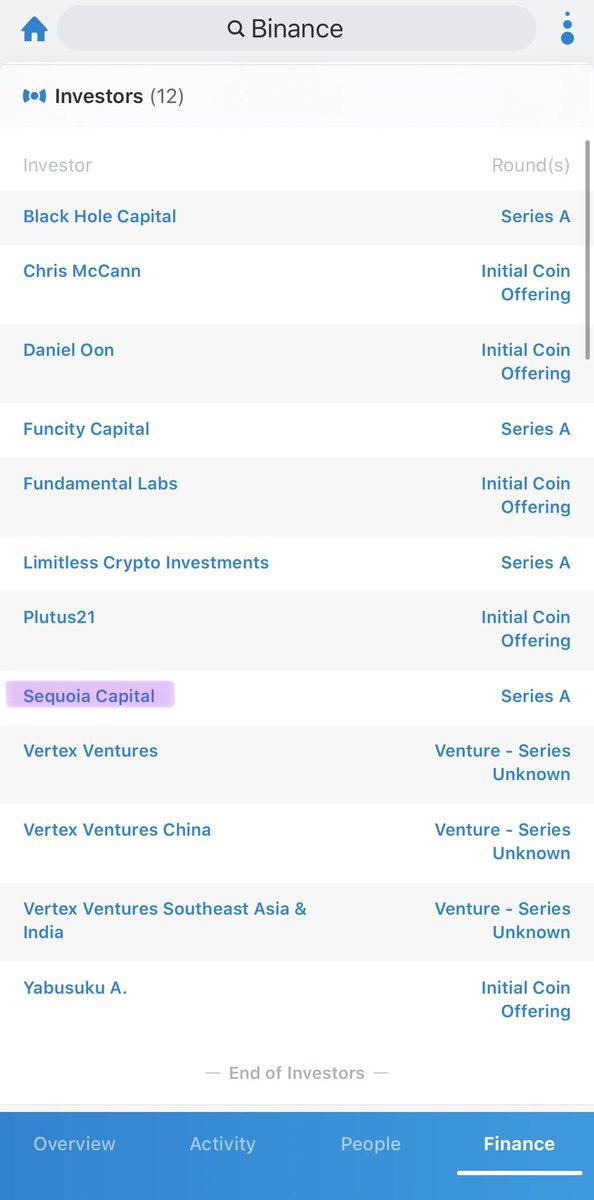

- Sequoia Capital was invested big in FTX EXCHANGE 👀

- Sequoia Capital is major investor in Citadel Securities.

- Sequoia invested in Fireblocks who hired Jay Clayton immediately following his departure from SEC after the Ripple law suit. #RETWEET

- Sequoia Capital was invested big in FTX EXCHANGE 👀

- Sequoia Capital is major investor in Citadel Securities.

- Sequoia invested in Fireblocks who hired Jay Clayton immediately following his departure from SEC after the Ripple law suit. #RETWEET

2/18 Mike Novogratz brokers a deal between Blockfolio & FTX 👀

https://twitter.com/gg_scaramanga/status/1526296265339719680

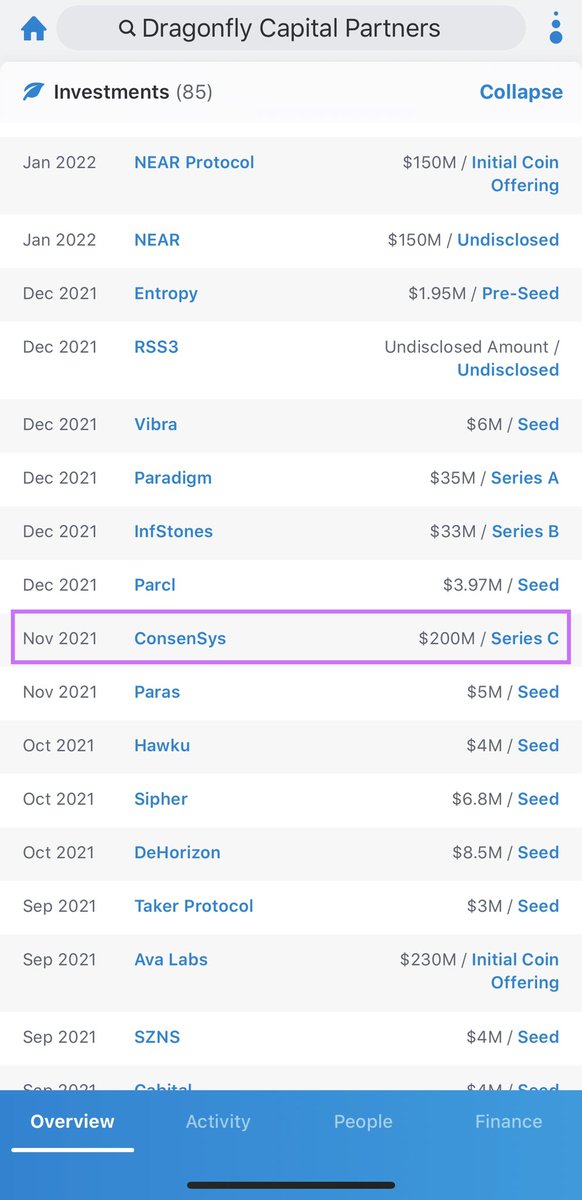

4/18 More loops.

https://twitter.com/cowboycrypto313/status/1529470243734753283

6/18 David Meister, who left the CFTC only a week after closing down the silver investigation after finding “no evidence of wrongdoing” just so happens to be ex SULLIVAN AND CROMWELL & COOLEY 👀💣

https://twitter.com/cowboycrypto313/status/1527718693748330499

7/18 Entire thread from above 👇🏼 @BlackberryXRP

https://twitter.com/blackberryxrp/status/1527687944953376769

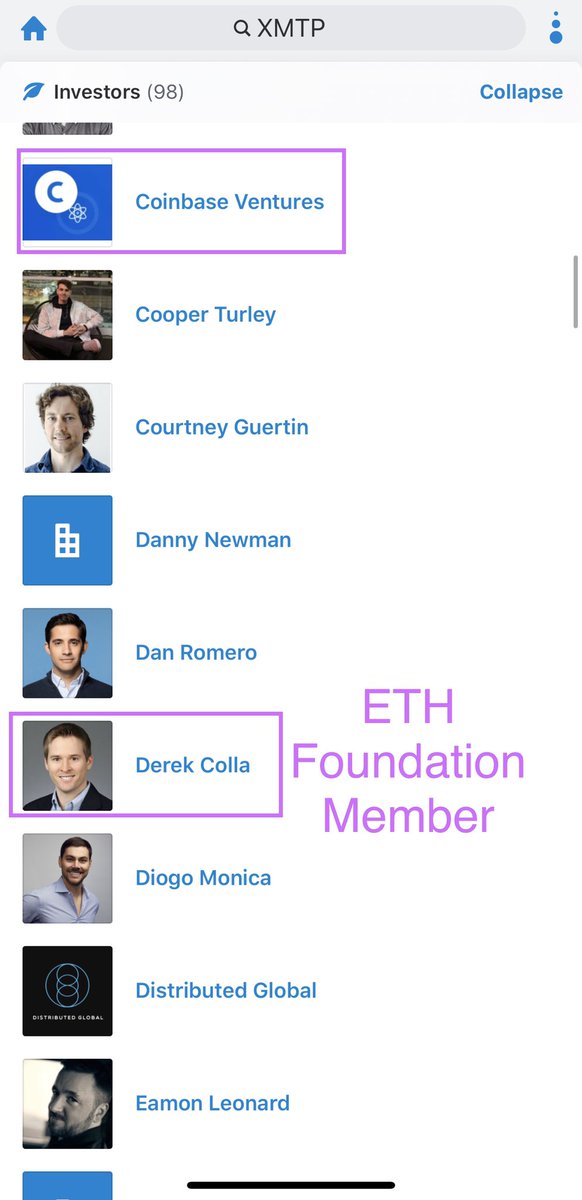

8/18 Where the F is Joe Lubin these days?

https://twitter.com/cowboycrypto313/status/1525281835776868353

9/18 PStake Investors

https://twitter.com/cowboycrypto313/status/1525098931893444610

12/18 Treehouse Finance

https://twitter.com/cowboycrypto313/status/1525098874045620227

13/18 Wanxiang & Nervous Network 👀

https://twitter.com/cowboycrypto313/status/1536008975975600128

14/18 🔥 GitHub Investors 🔥

https://twitter.com/cowboycrypto313/status/1535982996377030657

16/18 Sequoia quote...

https://twitter.com/unusual_whales/status/1591491263232151553

17/18 🔥 last but not least, make sure you watch 👀 this vid regarding Sequoia/FTX 🔥

https://twitter.com/LibertyBlitz/status/1591418251132932096

• • •

Missing some Tweet in this thread? You can try to

force a refresh