1) What

2) H

3) A

4) P

5) P

6) E

7) N

8) E

9) D

10) [NOT LEGAL ADVICE. NOT FINANCIAL ADVICE. THIS IS ALL AS I REMEMBER IT, BUT MY MEMORY MIGHT BE FAULTY IN PARTS.]

11) I'll get to what happened. But for now, let's talk about where we are today.

12) To the best of my knowledge, as of post-11/7, with the potential for errors:

a) Alameda had more assets than liabilities M2M (but not liquid!)

b) Alameda had margin position on FTX Intl

c) FTX US had enough to repay all customers

Not everyone necessarily agrees with this

a) Alameda had more assets than liabilities M2M (but not liquid!)

b) Alameda had margin position on FTX Intl

c) FTX US had enough to repay all customers

Not everyone necessarily agrees with this

13) My goal—my one goal—is to do right by customers.

I’m contributing what I can to doing so. I’m meeting in-person with regulators and working with the teams to do what we can for customers.

And after that, investors. But first, customers.

I’m contributing what I can to doing so. I’m meeting in-person with regulators and working with the teams to do what we can for customers.

And after that, investors. But first, customers.

14) My goal:

a) Clean up and focus on transparency

b) Make customers whole

a) Clean up and focus on transparency

b) Make customers whole

15) A few weeks ago, FTX was handling ~$10b/day of volume and billions of transfers.

But there was too much leverage--more than I realized. A run on the bank and market crash exhausted liquidity.

So what can I try to do? Raise liquidity, make customers whole, and restart.

But there was too much leverage--more than I realized. A run on the bank and market crash exhausted liquidity.

So what can I try to do? Raise liquidity, make customers whole, and restart.

16) Maybe I'll fail. Maybe I won't get anything more for customers than what's already there.

I've certainly failed before. You all know that now, all too well.

But all I can do is to try. I've failed enough for the month.

And part of me thinks I might get somewhere.

I've certainly failed before. You all know that now, all too well.

But all I can do is to try. I've failed enough for the month.

And part of me thinks I might get somewhere.

17) I know you've all seen this, but here's where things stand today, roughly speaking. [LOTS OF CAVEATS, ETC.]

Liquid: -$8b

Semi: +$5.5b

Illiquid: +$3.5b

And yeah, maybe that $9b illiquid M2M isn't worth $9b (+$1b net).

OTOH--a month ago it was worth $18b; +$10b net.

---

Liquid: -$8b

Semi: +$5.5b

Illiquid: +$3.5b

And yeah, maybe that $9b illiquid M2M isn't worth $9b (+$1b net).

OTOH--a month ago it was worth $18b; +$10b net.

---

18) Truth and Beauty

19) Once upon a time--a month ago--FTX was a valuable enterprise.

FTX had ~$10-15b of daily volume, and roughly $1b of annual revenue. $40b of equity value.

And we were held as paragons of running an effective company.

FTX had ~$10-15b of daily volume, and roughly $1b of annual revenue. $40b of equity value.

And we were held as paragons of running an effective company.

20) I was on the cover of every magazine, and FTX was the darling of Silicon Valley.

We got overconfident and careless.

We got overconfident and careless.

21) And problems were brewing. Larger than I realized.

[AGAIN THESE NUMBERS ARE APPROXIMATE, TO THE BEST OF MY KNOWLEDGE, ETC.]

Leverage built up-- ~$5b of leverage, backed by ~$20b of assets which were....

Well, they had value. FTT had value, in EV! But they had risk.

[AGAIN THESE NUMBERS ARE APPROXIMATE, TO THE BEST OF MY KNOWLEDGE, ETC.]

Leverage built up-- ~$5b of leverage, backed by ~$20b of assets which were....

Well, they had value. FTT had value, in EV! But they had risk.

22) And that risk was correlated--with the other collateral, and with the platform.

And then the crash came.

In a few day period, there was a historic crash--over 50% in most correlated assets, with no bid side liquidity.

And at the same time there was a run on the bank.

And then the crash came.

In a few day period, there was a historic crash--over 50% in most correlated assets, with no bid side liquidity.

And at the same time there was a run on the bank.

23) Roughly 25% of customer assets were withdrawn each day--$4b.

As it turned out, I was wrong: leverage wasn't ~$5b, it was ~$13b.

$13b leverage, total run on the bank, total collapse in asset value, all at once.

Which is why you don't want that leverage.

---

As it turned out, I was wrong: leverage wasn't ~$5b, it was ~$13b.

$13b leverage, total run on the bank, total collapse in asset value, all at once.

Which is why you don't want that leverage.

---

24) Shrapnel

25) Last night I talked to a friend of mine.

They published my messages. Those were not intended to be public, but I guess they are now.

They published my messages. Those were not intended to be public, but I guess they are now.

26) Well, that gives some color, I guess.

It sucks. I'm really sorry that things ended up as they did. And as I said--I'm going to do everything I can to make it more right.

It sucks. I'm really sorry that things ended up as they did. And as I said--I'm going to do everything I can to make it more right.

27) A few thoughts:

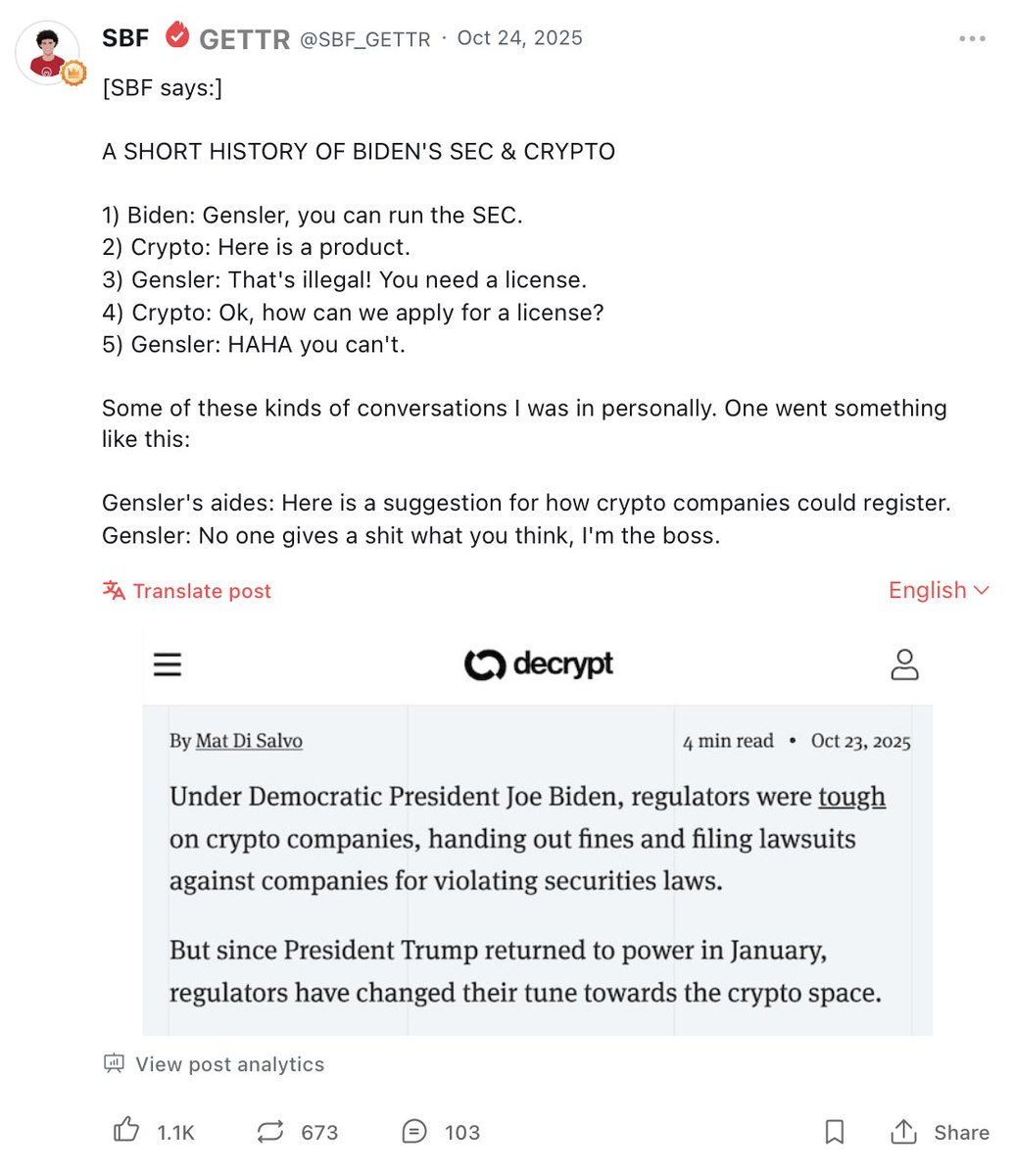

a) It's *really* hard to be a regulator. They have an impossible job: to regulate entire industries that grow faster than their mandate allows them to.

And so often they end up mostly unable to police as well as they ideally would.

a) It's *really* hard to be a regulator. They have an impossible job: to regulate entire industries that grow faster than their mandate allows them to.

And so often they end up mostly unable to police as well as they ideally would.

28) Even so, there are regulators who have deeply impressed me with their knowledge and thoughtfulness. The CFTC has; the SCB, and VARA, too. And others, scattered.

But most are overwhelmed.

But most are overwhelmed.

29) Which means that interacting with regulatory structures can be really frustrating: a *huge* amount of work--much of it arbitrary--and relatively little customer protection.

Fuck that. You all deserve frameworks that let regulators protect customers while allowing freedom.

Fuck that. You all deserve frameworks that let regulators protect customers while allowing freedom.

30) (Some of what I said was thoughtless or overly strong--I was venting and not intending that to be public. I guess at this point what I write leaks anyway.)

31) And in the future, I'm going to care less about the dumb, contentless, "good actor" framework.

What matters is what you do--is *actually* doing good or bad, not just *talking* about doing good or *using ESG language*.

What matters is what you do--is *actually* doing good or bad, not just *talking* about doing good or *using ESG language*.

32) Anyway -- none of that matters now.

What matters is doing the best I can.

And doing everything I can for FTX's customers.

What matters is doing the best I can.

And doing everything I can for FTX's customers.

• • •

Missing some Tweet in this thread? You can try to

force a refresh