About -

Fiem is one of the leading manufacturers of automotive lighting & signaling equipments & rear view mirrors.

Got inc. on Feb 6,1989 as private limited company with the name Rahul Auto Pvt Ltd.

They are in the business of manufacturing & suppliers of auto components mainly

Fiem is one of the leading manufacturers of automotive lighting & signaling equipments & rear view mirrors.

Got inc. on Feb 6,1989 as private limited company with the name Rahul Auto Pvt Ltd.

They are in the business of manufacturing & suppliers of auto components mainly

automotive lighting and signalling equipments, rearview mirror, prismatic mirror, steel metal parts & moulds, block & dies for two-wheeler and four wheeler applications.

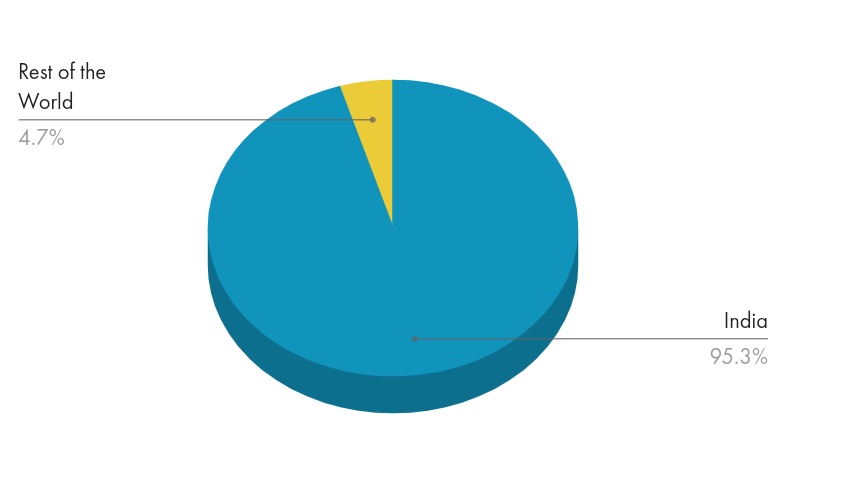

Location Wise Break-up -

Fiem earns 95.3% of it's revenue from India & 4.7% from the Rest of the World.

Fiem earns 95.3% of it's revenue from India & 4.7% from the Rest of the World.

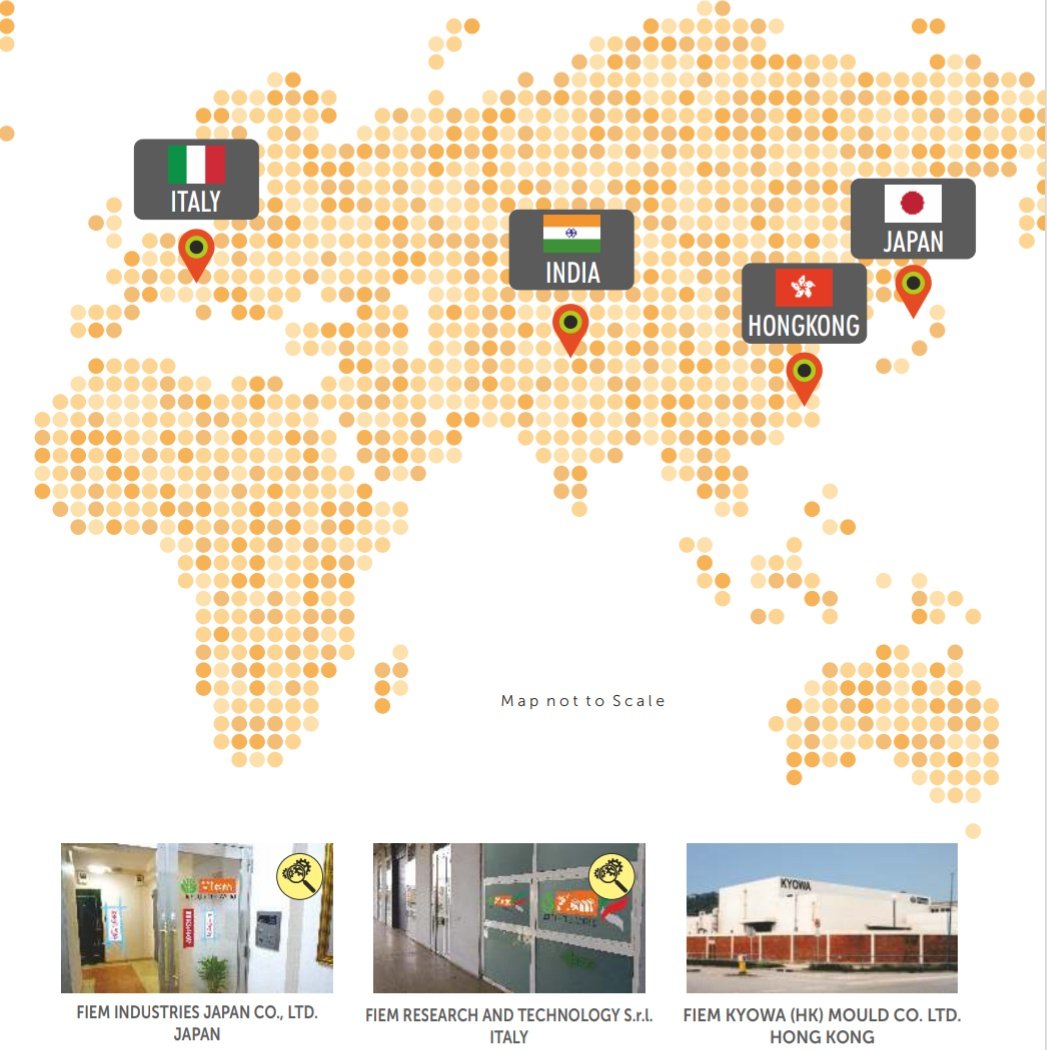

Manufacturing Facilities -

Fiem has 9 state-of-the-art manufacturing facilities located close to OEM customers, offering logistic cost savings and just-in-time delivery as well as the operational flexibility.

Fiem has 9 state-of-the-art manufacturing facilities located close to OEM customers, offering logistic cost savings and just-in-time delivery as well as the operational flexibility.

Company has Wholly owned Subsidiaries & J.V. Companies

• Wholly-owned Subsidiaries - Fiem Industries Japan Co., Ltd. (Japan)

• Fiem Research & Technology s.r.l (Italy)

• JV Company - Fiem Kyowa (HK) Mould Company Limited (Hong Kong)

• Wholly-owned Subsidiaries - Fiem Industries Japan Co., Ltd. (Japan)

• Fiem Research & Technology s.r.l (Italy)

• JV Company - Fiem Kyowa (HK) Mould Company Limited (Hong Kong)

Fiem has signed " Technical Assistance

Agreement" with TOYODENSO CO, Japan for manufacturing of "Bank (lean) Angle Sensor

".

Fiem has signed "Technical Assistance Agreement" with Aisan Industry Co, Japan. It manufactures "Canister" in its Tapukara Factory.

Agreement" with TOYODENSO CO, Japan for manufacturing of "Bank (lean) Angle Sensor

".

Fiem has signed "Technical Assistance Agreement" with Aisan Industry Co, Japan. It manufactures "Canister" in its Tapukara Factory.

Segment Wise Revenue Break-Up -

Fiem Industries earns (37.7%) from Auto LED Lamp, (30%) from Automotive Lamp, (11.3%) Rear View Mirrors, (10%) from Plastic Moulded parts & (10.9%) Others.

Fiem Industries earns (37.7%) from Auto LED Lamp, (30%) from Automotive Lamp, (11.3%) Rear View Mirrors, (10%) from Plastic Moulded parts & (10.9%) Others.

▪️Automotive Lights:

FIEM is one of the most renowned names in Automotive Lightings & Signalling Equipments with the history of around four decades. The company is associated with some of the most prestigious OEM customers in India.

FIEM is one of the most renowned names in Automotive Lightings & Signalling Equipments with the history of around four decades. The company is associated with some of the most prestigious OEM customers in India.

▪️Rear View Mirrors:

FIEM has 6 state-of-the-art mirror manufacturing plants in its different units

having all the processes in-house which includes:

Mirror Plate Making, Plastic Housing, Rod Making, Final Assembly.

FIEM has 6 state-of-the-art mirror manufacturing plants in its different units

having all the processes in-house which includes:

Mirror Plate Making, Plastic Housing, Rod Making, Final Assembly.

▪️Plastic Moulded Parts:

Plastic moulding is integral part of automotive lighting as well as rear view mirrors, as these parts are required to make final assembly of all the products.

Plastic moulding is integral part of automotive lighting as well as rear view mirrors, as these parts are required to make final assembly of all the products.

FIEM has installed world class more than 450 latest injection moulding machines in their six plants ranging from 50 tonnes to 1400 tonnes capable of making Plastic Moulded Parts weighing 20 gms to 2.5 kgs.

▪️Others:

Others Automotive Segment Include items contributing 10% of Total Sale, mainly includes Fabrication items (Sheet Metal Parts), Canister, Bank Angle Sensor etc.

Others Automotive Segment Include items contributing 10% of Total Sale, mainly includes Fabrication items (Sheet Metal Parts), Canister, Bank Angle Sensor etc.

▪️LED Segment (Other Segment):

LED Segment (non-automotive) represent products under two categories:

(i) LED luminaires for indoor & outdoor

applications & (ii) Integrated passenger information systems with LED displays for trains and buses.

LED Segment (non-automotive) represent products under two categories:

(i) LED luminaires for indoor & outdoor

applications & (ii) Integrated passenger information systems with LED displays for trains and buses.

Financials -

Q2FY23 (YoY)

Revenue at ₹ 527 Cr vs₹420 Cr ⬆️25.44%

PAT at ₹41 Cr vs ₹27 Cr ⬆️52.15%

EPS₹30.98 vs ₹20.01 ⬆️54.82%

Standalone EBITDA over last 5 years has grown at a CAGR of 13.38%

Q2FY23 (YoY)

Revenue at ₹ 527 Cr vs₹420 Cr ⬆️25.44%

PAT at ₹41 Cr vs ₹27 Cr ⬆️52.15%

EPS₹30.98 vs ₹20.01 ⬆️54.82%

Standalone EBITDA over last 5 years has grown at a CAGR of 13.38%

Indian Two-wheeler Industry -

It primarily include Motorcycles, Mopeds, Scooters & Electric 2W.

Indian Two-wheeler industry has evolved many folds in terms of technology & total no of two wheelers being manufactured & produced.

It primarily include Motorcycles, Mopeds, Scooters & Electric 2W.

Indian Two-wheeler industry has evolved many folds in terms of technology & total no of two wheelers being manufactured & produced.

Rising fuel price is one of the primary growth drives for two-wheelers due to their higher fuel efficiency.

Furthermore, rising urbanization, improving road infrastructure & increasing no of women consumers are also catalyzing the demand of two wheelers in India.

Furthermore, rising urbanization, improving road infrastructure & increasing no of women consumers are also catalyzing the demand of two wheelers in India.

Electric Two-wheeler (Electric 2W) -

Company strongly believe that Electric 2W is the future of Two-wheeler Industry.

The speed of transformation is really encouraging.

The E-2W ecosystem is developing at a fast pace in India & it has got unprecedented support from the Govt.

Company strongly believe that Electric 2W is the future of Two-wheeler Industry.

The speed of transformation is really encouraging.

The E-2W ecosystem is developing at a fast pace in India & it has got unprecedented support from the Govt.

Two largest existing customers announcing EV plans

TVS Motors and Yamaha Motors India have now announced new rounds of fund raising & extensive plans for ramping up Electric vehicle & battery infrastructure to ramp up its EV production. While TVS is expected to raise

TVS Motors and Yamaha Motors India have now announced new rounds of fund raising & extensive plans for ramping up Electric vehicle & battery infrastructure to ramp up its EV production. While TVS is expected to raise

Rs 4000-5000 Cr for the same purpose, Yamaha’s new EV prototype is ready & is expected to enter into production soon. With the current state of robust loyalty showed by these customers, it is very likely that FIEM will be manufacturing lightings for these two OEM’s.

Research & Development -

FIEM’s in-house R&D Centre has various kinds of testing facilities such as Product Testing, Photometry Testing, Environmental Testing, Thermal Tests,

Electronic Test, Vibration Test, Chemical Test, Mechanical Tests etc.

FIEM’s in-house R&D Centre has various kinds of testing facilities such as Product Testing, Photometry Testing, Environmental Testing, Thermal Tests,

Electronic Test, Vibration Test, Chemical Test, Mechanical Tests etc.

Advantages of in-house R&D unit:

• Diversified and large portfolio of lighting products developed.

• New generation LED technology in automotive & home lighting segments developed.

• Reduction in development time and cost savings to clients.

• Diversified and large portfolio of lighting products developed.

• New generation LED technology in automotive & home lighting segments developed.

• Reduction in development time and cost savings to clients.

Key Risks -

• 95% of the company’s revenue is derived from two wheelers segment, leading to high segment concentration risk.

• Auto industries are discretionary which makes it cycle in nature. Therefore, any slow-down can dampen their revenue growth.

• 95% of the company’s revenue is derived from two wheelers segment, leading to high segment concentration risk.

• Auto industries are discretionary which makes it cycle in nature. Therefore, any slow-down can dampen their revenue growth.

Fundamentals -

Market Cap : ₹2,396 Cr

P/E (Stock): 21.32

P/E (Industry): 39.17

P/B : 3.27

Debt to equity : 0.05

ROE : 15.5 %

ROCE : 20.6 %

EV/EBITDA : 9.4

Market Cap : ₹2,396 Cr

P/E (Stock): 21.32

P/E (Industry): 39.17

P/B : 3.27

Debt to equity : 0.05

ROE : 15.5 %

ROCE : 20.6 %

EV/EBITDA : 9.4

Conclusion -

FIEM industries is a market leader in automotive lighting segment & is one of the preferred supplier for LED 2W lighting solutions.

FIEM industries is a market leader in automotive lighting segment & is one of the preferred supplier for LED 2W lighting solutions.

We expect the company to deliver healthy growth & outperform on the back of diverse product & client portfolio, healthy balance sheet and strong R&D capabilities.

Please 🙏 like 👍,comment, retweet ♻️ if you find this 🧵 useful.

And follow us on @LnprCapital for more information like this.

@nid_rockz @AnishA_Moonka @AdeptMarket

And follow us on @LnprCapital for more information like this.

@nid_rockz @AnishA_Moonka @AdeptMarket

https://twitter.com/LnprCapital/status/1592051281182740480?t=mSxFASHwLmQESFU7JORlDg&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh