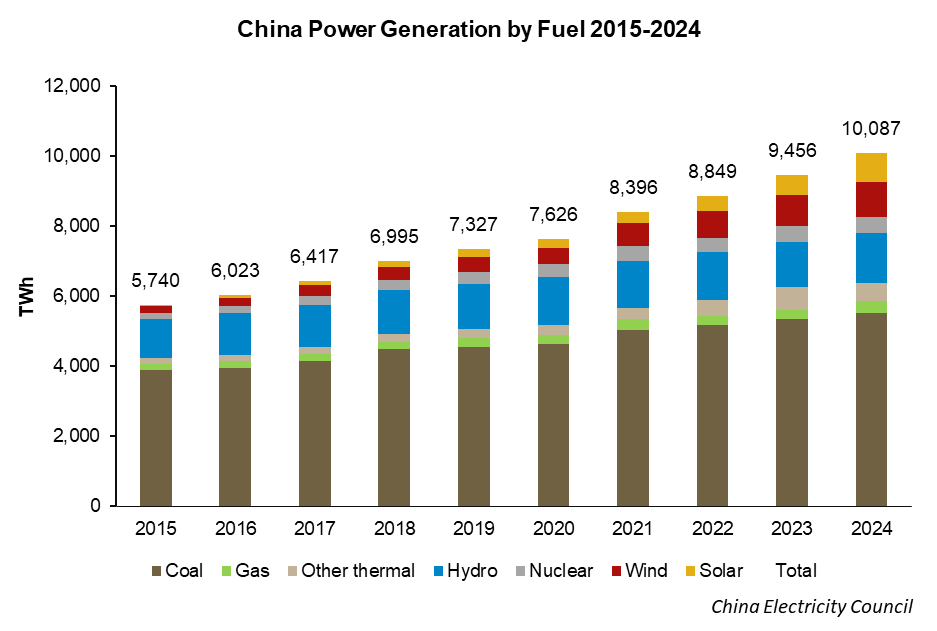

A big milestone for China's offshore wind that I missed a few weeks ago: Shandong's first GRID PARITY offshore wind project (500MW) was connected to the grid.

This means the offshore wind power is generated at a unit cost level competitive with coal-fired power.

Quick 🧵

This means the offshore wind power is generated at a unit cost level competitive with coal-fired power.

Quick 🧵

According to the news, the Shandong Bozhong project achieved an LCOE of 400 RMB/MWh, (USD 56.90) basically at the same level as the Shandong base coal price (394.9 RMB/MWh).

It represents a huge, HUGE decline in construction costs for offshore wind in the past few years.

It represents a huge, HUGE decline in construction costs for offshore wind in the past few years.

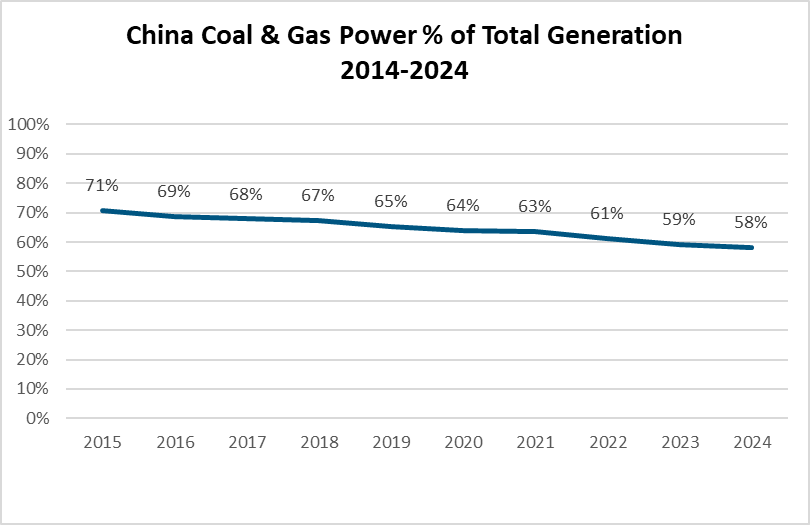

For contrast, the average LCOE of the already-existing offshore wind in China is around 790 RMB/MWh, nearly twice as much as this new project. These projects were built a few years ago, during the subsidy era.

In 2010, offshore wind cost per MWh in China was well over 1000 RMB.

In 2010, offshore wind cost per MWh in China was well over 1000 RMB.

Major factors for LCOE decline:

-Improvements in turbine blades, esp. length, allowing them to generate more power, more cost-effectively.

-Decrease in construction costs due to experience, economies of scale. Big cost drops for crane vessels, maritime labor, maritime cables.

-Improvements in turbine blades, esp. length, allowing them to generate more power, more cost-effectively.

-Decrease in construction costs due to experience, economies of scale. Big cost drops for crane vessels, maritime labor, maritime cables.

Offshore wind is particularly important for the long-term decarbonization plans of China's industrialized coastal provinces like Shandong, Jiangsu, Zhejiang, Guangdong precisely because they lack onshore land for deployment of solar or wind (or land usage fees are sky-high).

For now, some of these provinces have been able to keep their renewable capacity growth strong via mass deployment of rooftop solar (particularly Shandong, which leads the nation).

But the available rooftops will eventually run out, while the growth in demand will not.

But the available rooftops will eventually run out, while the growth in demand will not.

That's what makes control and mastery of offshore wind development costs so important for China.

It's major part of the equation for coastal provinces securing low-carbon power at reasonable prices (via their preferred in-province investment, not via cross-province imports).

It's major part of the equation for coastal provinces securing low-carbon power at reasonable prices (via their preferred in-province investment, not via cross-province imports).

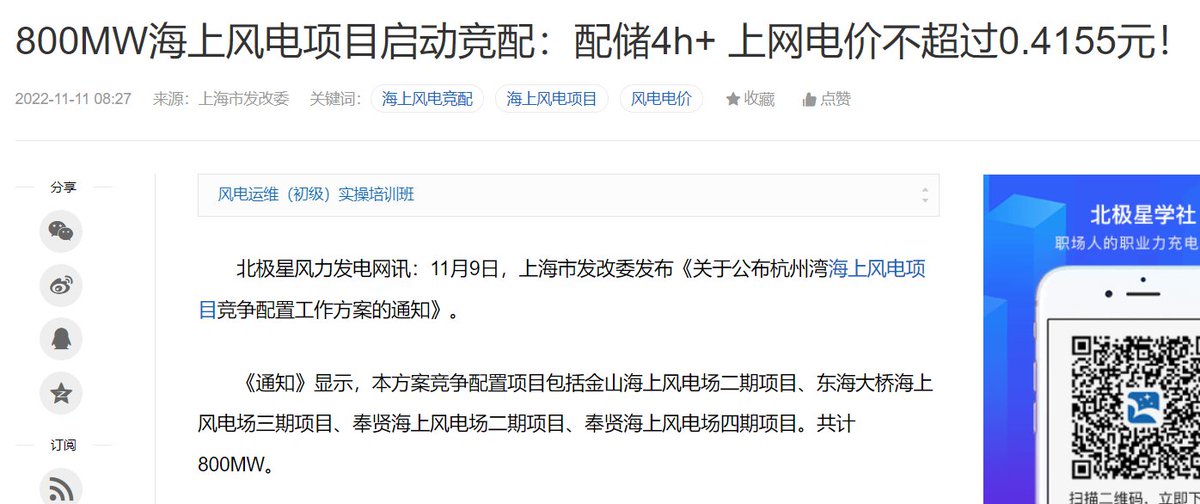

For instance, here's Shanghai a few days ago, soliciting tenders to build an 800 MW offshore wind farm PLUS STORAGE at an unit cost no higher than the Shanghai coal base price of 415.5 RMB/MWh.

This would have been impossible just a few years ago.

news.bjx.com.cn/html/20221111/…

This would have been impossible just a few years ago.

news.bjx.com.cn/html/20221111/…

Here's the link to the announcement from the Energy Administration of Shandong.

Lots of nerdy technical details about tons of carbon offset, # of turbines, etc.

nyj.shandong.gov.cn/art/2022/11/2/…

Lots of nerdy technical details about tons of carbon offset, # of turbines, etc.

nyj.shandong.gov.cn/art/2022/11/2/…

Well yes demand growth actually WILL run out someday, but way after the available rooftops do.

*Important note*

Although this project claims to have achieved an LCOE of 400 RMB/MWh, which is nearly level with the coal-fired base price in Shandong, I was unaware that Shandong offers a provincial capacity subsidy for offshore wind constructed from 2022-2024.

Although this project claims to have achieved an LCOE of 400 RMB/MWh, which is nearly level with the coal-fired base price in Shandong, I was unaware that Shandong offers a provincial capacity subsidy for offshore wind constructed from 2022-2024.

Thus, it should be inappropriate to refer to this project as "grid-parity". Although it will sell its power into the open markets with no subsidy on volume, it most likely had a one-off capacity subsidy at *construction* of 800CNY/kW.

hat tip to @MhehedZherting for the correction

hat tip to @MhehedZherting for the correction

• • •

Missing some Tweet in this thread? You can try to

force a refresh